Author: Mu Mu, Source: Vernacular Blockchain

"The price has risen again! The price of gold has soared to over 700 yuan per gram." People from all walks of life around the world have been discussing the "madness" of the gold price since this year.But many people may not know that Bitcoin, also known as "digital gold", has exceeded 500,000 yuan per coin. Some people may say that it is difficult to compare because of the different units. Then you can refer to the following set of figures:

10 years ago (2014), gold was 250 yuan per gram, 10 years later, 700 yuan per gram, 2.8 times in 10 years

10 years ago (2014), Bitcoin was 500 US dollars per coin, 10 years later, 70,000 US dollars per coin, 140 times in 10 years

Several years ago, when the concept of "digital gold" was first proposed, almost everyone would look at it as a liar whenever someone talked about it. However, 10 years have passed in the blink of an eye, and Bitcoin is growing at an astonishing rate, so that today's Bitcoin has finally begun to shake the unbreakable position of gold for thousands of years...

01 Gold VS Digital Gold Bitcoin

Bitcoin is called digital gold because some of its characteristics are very similar to gold, but many people still find it difficult to associate physical objects with virtual assets. Perhaps this should start with the background of Bitcoin's birth...

1) Background of Bitcoin's Birth

Thousands of years ago (the specific date is not accurate), gold was already a "hard currency". In fact, it was first recorded as a currency in the Spring and Autumn Period and the Warring States Period more than 2,000 years ago, and it has been used ever since. People's holding and use of gold is not restricted by any person, institution, or even country, and they truly achieve "private property is inviolable."

Historical records show that in 1717, Newton of Britain first proposed the gold standard (a monetary system based on gold, in which the amount of gold held by a country determines the amount of currency issued and the exchange value), and subsequently, countries around the world adopted it one after another. Until 1971, US Secretary of State Kissinger announced a plan to leave the gold standard, and the currencies of the United States and other countries were no longer dominated by gold, making the value of currency no longer limited by gold reserves. This means that the modern monetary system can regulate depreciation and inflation as needed.

Later, during the global financial crisis in 2008, the United States printed a large amount of money to rescue banks, and people found that the money in their pockets was forced to be diluted, which caused strong dissatisfaction and distrust of the financial system, leaving some text clues for Satoshi Nakamoto to express his original intention of creating Bitcoin.

That’s why Satoshi Nakamoto left this sentence on the genesis block of Bitcoin, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The message trail left by Satoshi Nakamoto before his sudden disappearance has led many to believe that Bitcoin is a response to the events of the 2007-2008 financial crisis. On a message board for the P2P Foundation, Satoshi Nakamoto wrote an article in February 2009 introducing Bitcoin.

In the article, they expressed their distrust of the reserve banks and concerns about assets:

“Banks must be trusted to hold our money and transfer it electronically, but they will transfer it out in waves of credit bubble, with little reserves. We must trust them with our privacy and not let identity thieves drain our accounts. Their huge intermediary fees make small payments impossible.”

2) What are the specific similarities between gold and Bitcoin?

A. Decentralization

Gold: A natural resource spread all over the earth. Anyone can dig out gold from a corner

Bitcoin: A public blockchain with network nodes spread all over the world, making it a resource that anyone can participate in mining

B. Mining

Gold: Mining gold requires workers, mines, equipment, and electricity

Bitcoin: Bitcoin mining also requires block producers, mines, equipment, and electricity

C. Scarcity

Gold: Non-renewable natural resources

Bitcoin: Upper limit of 21 million

D. Durability

Gold: Stable physical properties, never rust

Bitcoin: Strong and secure network, data on the chain is indelible

E. Anti-counterfeiting

Gold: Real gold is not afraid of fire

Bitcoin: Even if you invest a lot of money, it cannot be tampered with

Having said that, in some aspects, they are very similar, but digital gold still has many impressive features. Physical gold has advantages that cannot be matched, such as: Bitcoin is very convenient to carry, you only need to remember a string of words, while physical gold is particularly heavy; Bitcoin can be verified for anti-counterfeiting anytime and anywhere, while physical gold is easy to counterfeit with metals of similar specific gravity (there have been many cases of adulteration of gold jewelry in recent years); Bitcoin is easier to split and trade, while gold is the opposite; Even if Bitcoin transfers on the chain often reach hundreds of millions of dollars, the handling fee is only tens of dollars, while gold and even the modern banking system find it difficult to achieve such a low and fast transfer of assets. 02 Bitcoin has opened up the corner of gold 1) Grayscale has repeatedly placed advertisements to remind people that Bitcoin replaces gold Grayscale launched its first Drop Gold campaign on May 1, 2019, and placed advertisements with the theme of "Drop Gold" to remind people that it is time to replace gold with Bitcoin.

In 2020, Barry Silbert, founder of Grayscale and blockchain venture capital firm DCG, tweeted that Grayscale had re-launched the anti-gold ad "Drop Gold", which is now running on all major US networks. This is a marketing campaign for Bitcoin. The video states that "digital currencies like Bitcoin are the trend of the future" and aims to make Bitcoin a tool for storing value in the 21st century.

In fact, most people, including some financial institutions, have never taken Grayscale ads a few years ago seriously. At that time, some financial tycoons sneered at it, such as the famous BlackRock CEO Larry Fink, who once said that Bitcoin was worthless! However, not long ago, Larry Fink changed his mind and said: BTC will subvert traditional finance.

Today, BlackRock has become a Bitcoin whale holding nearly 30,000 BTC.

2) Rapid inflow of funds into spot ETFs

As early as 2020, JPMorgan Chase, the bank with the largest balance sheet in the United States, published a report studying the success of Grayscale Bitcoin Trust (GBTC). The bank was once one of the biggest critics of Bitcoin, but the report acknowledged that the demand for Bitcoin even affects mature markets.

JPMorgan Chase pointed out that the demand for Bitcoin may erode the demand for gold ETFs.According to the study, the number of people flowing into the Grayscale Bitcoin Trust in October 2023 was significantly higher than that of the gold ETF. Therefore, the US bank concluded that GBTC may be able to capture some share of the gold ETF market.

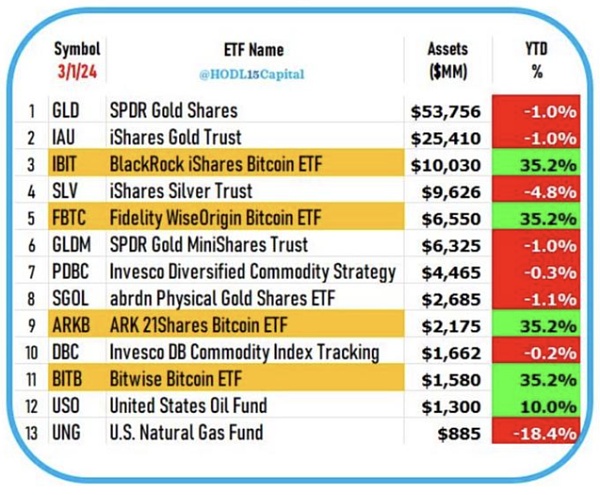

List of changes in holdings of US stock Bitcoin spot ETFs, source: https://www.hellobtc.com/etf/

List of changes in holdings of US stock Bitcoin spot ETFs, source: https://www.hellobtc.com/etf/

As expected, after the launch of Bitcoin spot ETFs, a large amount of funds have flowed in, while gold ETF funds have flowed out significantly.Many financial commentators have pointed out that this is not a coincidence. Bitcoin spot ETFs have attracted a lot of money, and a large part of the money comes from gold ETFs.

Some time ago, some media reported that BlackRock IBIT's asset management scale has surpassed the largest silver ETF and ranked third among all commodity ETFs (the figure below is historical data). Currently, 11 US stock spot Bitcoin ETFs hold a total of about 840,000 Bitcoins, with a market value of nearly US$60 billion.

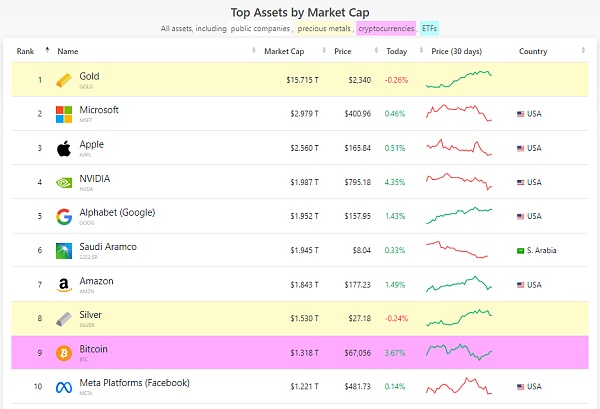

3) Bitcoin ranks among the top 10 global asset market capitalization

As of April 23, on the global asset ranking list from Companiesmarketcap, Bitcoin ranks 9th in global asset market capitalization with a market capitalization of 1.35 trillion, second only to silver. Currently, the market value of Bitcoin has surpassed the total market value of the world's four largest banks.

Top 10 global asset rankings, source: Companiesmarketcap

Top 10 global asset rankings, source: Companiesmarketcap

Bitcoin is still more than 10 times away from the market value of more than 15 trillion US dollars of gold. Perhaps in the eyes of many people in the crypto asset circle, this may not be a very difficult thing for Bitcoin, which has grown 140 times in 10 years.

Recently, Anthony Scaramucci, CEO of SkyBridge Capital/senior hedge fund manager, said that the market value of Bitcoin will eventually exceed the market value of 16 trillion US dollars of gold.In an interview with CNBC, the founder of SkyBridge Capital called Bitcoin a high-quality asset that has never been seen in the past 5,000 years of human history.

Scaramucci said that Bitcoin still has a long way to go from the market value of 16 trillion US dollars of gold, but he believes that the distance will narrow over time as regulators approve BTC ETFs.

4) Bitcoin is playing a "safe haven" value

Most of the time, gold is actually used as a risk hedge against inflation in many people's portfolios, which can also be used as a safe haven asset. However, the fact is that gold has not outperformed inflation most of the time. But Bitcoin, which has been breaking new highs, has a fixed upper limit for the supply chain, and has halved every four years, seems to have never let anyone down in this regard.

Due to the general consensus, gold has very low volatility, while Bitcoin is just the opposite. Therefore, while Bitcoin has higher growth, it also has to bear higher risks accordingly, but Bitcoin's volatility is gradually decreasing. At the same time, Bitcoin is really on the road to becoming an optional "safe haven tool" for countries with high inflation...

Recently, a new report from the International Monetary Fund (IMF), "A Primer on Bitcoin Cross-Border Flows", pointed out that BTC has become a necessary financial tool for preserving wealth in the face of financial instability. The analysis also pointed out that on-chain Bitcoin transactions, which are recorded on the blockchain and provide higher security, are often larger than off-chain transactions. This shows that the powerful security features of blockchain technology usually protect greater financial interests.

The report authors said that Bitcoin trading provides individuals in high-inflation countries with a way to stabilize savings and participate in global commerce in a way that local currencies cannot.

From another perspective, when missing out is also seen as a "risk" and "alternative assets" such as Bitcoin are added to the portfolios of many investors, in many cases, the consideration is to hedge the risk of not being able to get on board with future Web3 technology in time and missing out on crypto assets.

When the crypto market deteriorates, some people will choose to exchange high-risk altcoins for more stable and lower-risk Bitcoin, which not only stops losses in time to reduce risks but also does not have the risk of leaving the market and missing out. Therefore, Bitcoin is often used to hedge the high risks brought by altcoin assets.

03 Summary

In fact, it is not surprising that Bitcoin is gradually eroding the market share of gold. The relationship between "digital gold" and "gold" is like "digital payment" and "paper money". As time goes by, the usage rate of paper money is getting less and less, and old gold may not be able to meet the needs of everyone, so Bitcoin fills this gap. As for whether Bitcoin can gradually surpass gold, it will take time to verify.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund 贝壳君

贝壳君 JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance 链向资讯

链向资讯