Author: Michael Nadeau, The DeFi Report; Compiler: Tao Zhu, Golden Finance

The cryptocurrency market is at a turning point.

Just as many market participants did not fully appreciate the impact of rate hikes on risk assets in early 22, we believe the market may underestimate the impact of rate cuts in 24/25.

For most of this year, our view has been that the market will continue to climb to the wall of worry before peaking in 25.

In this week's report, we share our views on how this situation may develop and how you can position yourself in the risk environment.

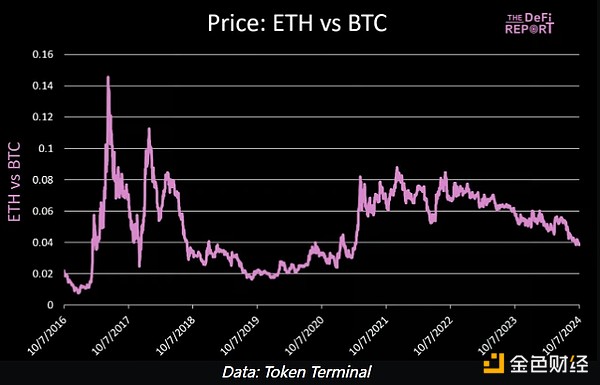

Has ETH/BTC bottomed out?

We believe ETH/BTC may have hit a cycle bottom.

6 reasons:

ETH/BTC has been making higher lows since 2016. The ratio bottomed out in early 2017, just below 0.01. In late 2019, the ratio bottomed out, just below 0.02, and then bottomed out again during the March 2020 crash. Fast forward to September 2024, and ETH has just broken below 0.04.

To me, this suggests that market confidence in ETH is growing over time. Let's see if it can sustain at 0.04.

In previous cycles, when ETH/BTC capitulated, it would make a low shortly thereafter. Over the past few months, the ratio appears to have capitulated, falling from 0.057 to 0.038.

In past cycles, ETH bottomed after rate cuts. The Fed started cutting rates a few weeks ago.

The same is true for the Fed's balance sheet - last cycle we moved from a net contraction to a net expansion, and ETH/BTC bottomed. We expect similar dynamics in this cycle as liquidity conditions improve.

Historically, Bitcoin dominance declines as liquidity conditions improve. Currently at 57% (near cycle highs).

From a sentiment perspective, ETH just went through a period of disillusionment that we haven’t seen in a long time (fees dropping due to EIP4844, “roadmap is a mess”). It’s market psychology and crypto Twitter’s impatience. The reality is that Ethereum continues to execute on its roadmap. Kyle Samani’s “Why SOL Flipped ETH” talk at Token2049 appears to have marked the bottom for ETH/BTC.

If we are correct that ETH/BTC has bottomed, it means that altcoin season has officially begun.

Catalysts

It’s been interesting to watch sentiment on crypto Twitter over the past few months. It seems like crypto natives are trying to get ahead of the liquidity cycle by jumping to the far end of the risk curve (meme coins).

I’m sure many did well in the Oct-March period, but most were late and early to the alt season. After all, historically alt seasons have started after rate cuts. So my sense is that most markets gave back their gains in Q4 2023/Q1 2024. Many sold as the market fell. Others are reallocating.

“Retail will never come back.”

This is exactly what we need to see from a sentiment perspective. Now that the Fed has started a rate cutting cycle, there are several catalysts pointing to another breakout top in the market:

Allowing easing. The Fed cutting rates is effectively giving permission for all other central banks in the world to cut rates. We’re already seeing the ripple effect from this in China – which is currently stimulating its economy heavily. It looks like they’re waiting for the green light from the Fed. To be clear, when the Fed cuts rates, the dollar weakens, reducing the risk of Chinese capital flowing into the dollar — giving China more flexibility to cut rates while keeping its currency stable. This dynamic can apply to all central banks around the world.

Politics. I hate talking about politics. But we have to address this because it really is important. At least in the short term. The key point here is that I believe Democrats have realized that crypto is not going away. Just look at what happened in ’23. The year started with Operation Choke Point — the Biden administration’s unconstitutional attempt to cut off access to banks for crypto businesses. It failed. And Bitcoin was up 187% for the year.

What happens if we elect a pro-crypto president? What happens if banks are allowed to custody crypto? What happens if we get a stablecoin bill? What happens if the CFTC becomes the lead regulator of digital commodity crypto assets?

Is the market priced in this yet? Probably not yet. We’d like to see progress on these fronts even if Trump loses.

It might have sounded ridiculous at the time. But my question is: how many coping cycles does one need to watch before capitulating? If you consider yourself a serious investor, you’ve seen BTC/cryptocurrency rise in 2013, 2017, 2021, and now in 2024 (into 2025?).

Bitcoin is starting to become more like Ethereum, and the DeFi and L2 ecosystems are showing some promise.

Ethereum is scaling and executing on its roadmap. BlackRock has an on-chain money market fund, and Visa just announced a tokenization platform on Ethereum.

Solana’s Firedancer is now on testnet. Citigroup and Franklin Templeton announced plans to tokenize assets on Solana on Breakpoint. Paypal and Societe Generale have launched stablecoins on Solana.

Speaking of stablecoins – the issuer is now the 16th largest holder of US Treasuries. We now have permissionless, yield-generating stablecoins.

Altcoin Season?

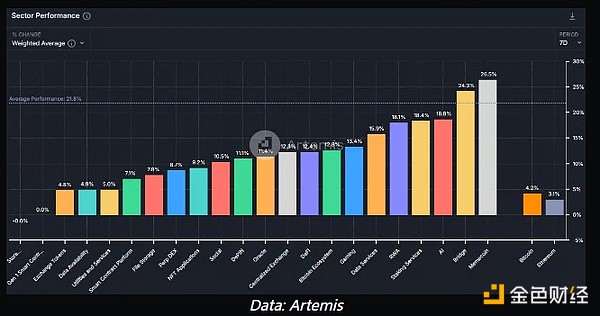

As mentioned earlier, we believe ETH/BTC may have bottomed. This means that altcoin season may have officially begun – when long-tail risk assets outperform the main assets.

Markets have shown strength. Below is the 7-day sector performance provided by Artemis, with memecoins leading the way.

Some thoughts and/or predictions on how the cycle might play out:

ETH is clearly outperforming BTC, with BTC dominance well below 50%.

SOL is clearly outperforming ETH, with SOL infrastructure outperforming ETH infrastructure + Solana memecoins outperforming Ethereum memecoins.

TIA and SUI become the best performing “new L1s” on the market right now (keep an eye on Berrachain and Monad — expected to launch later this year).

Over 10 memecoins will reach $10B+ valuations (2 today). In fact, we may see $100B+ memecoins this cycle. *I will share my full in-depth view of memecoins in November.

AI Coins and DePINs may perform like NFTs did in the last cycle.

Supply of stablecoins grows to $500B ($160B today).

It goes without saying, but I will say it anyway: I don’t have a crystal ball. I am just using pattern recognition as someone who has been watching these markets for a while. Risk on = Central Bank Easing = USD flows into risk assets. If this happens, then outperformance should be at the far end of the risk curve (crypto). Everything else is instinct for identifying sectors, teams, communities, cycle dynamics, risks, etc.

Conclusion

Is it possible that the market has strayed away from the idea that we are in a mania like the one we had in '21 again?

This is the question I keep asking myself right now. Why? Because crypto is truly a unique asset class, and bull markets can be just as volatile as big declines.

Bear markets tend to leave a psychological shadow on market participants. As a result, it's easy to forget how volatile a potential bull market can be.

Sure, there are a lot of bears out there. They're calling for a recession. But we don't see that in the data. Credit spreads are low. Banks are lending. Central banks are easing. Inflation is falling. The Treasury is spending. Unemployment fell last month.

Catherine

Catherine

Catherine

Catherine Alex

Alex Hui Xin

Hui Xin Alex

Alex Aaron

Aaron Davin

Davin Aaron

Aaron Aaron

Aaron Jixu

Jixu Jasper

Jasper