On September 12, Coinbase launched the wrapped Bitcoin token Coinbase Wrapped BTC (cbBTC), which has been running on Ethereum and Base; a month later, on October 17, Kraken also launched the wrapped Bitcoin product kBTC, which runs on Ethereum and OP Mainnet.

The two global leading exchanges have launched similar new businesses in a short period of time, and cbBTC's data performance in the past month is also impressive. What does this series of actions mean? What kind of deep-level considerations may be hidden behind it?

"Wrapped Bitcoin + EVM" DeFi Summer

Old guns who have experienced the DeFi Summer in 2020 must be familiar with WBTC, renBTC and other wrapped Bitcoins. At that time, there were many attempts to release the liquidity of Bitcoin assets during the summer of on-chain liquidity. The most important one was to cross the chain to the Ethereum (EVM) ecosystem through the form of ERC-20 wrapped tokens:

For example, the most popular renBTC, WBTC, and tBTC at that time, users could pledge BTC to obtain the corresponding wrapped tokens, thereby bridging to the Ethereum ecosystem as liquidity, and participating in DeFi and other on-chain scenarios by coupling with the Ethereum ecosystem, playing the role of the flag bearer of bringing Bitcoin liquidity into the DeFi and Ethereum ecosystem.

It's just that after rounds of bull and bear markets, most of the former star projects have failed one after another.

The "trust crisis" of veteran player WBTC

WBTC is a veteran player in the packaged Bitcoin track. With the explosive development of the Ethereum DeFi ecosystem in 2020, the demand for Bitcoin as the most valuable asset in the circle has also begun to emerge, especially for "whales" and "classic players". The initial batch of packaged Bitcoins such as WBTC have made the BTC in the hands of Holder no longer a "non-interest-bearing asset". On the contrary, it can participate in various DeFi usage scenarios under certain risk trade-offs.

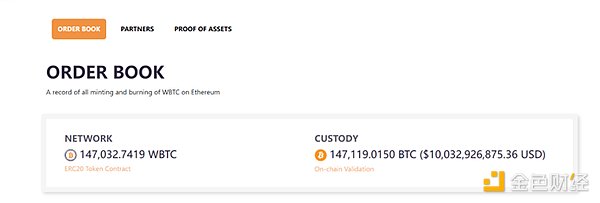

To some extent, WBTC has also withstood the test of the market and time during the bull and bear cycles. From the data dimension, the entire network has issued more than 147,000 WBTC, with a total value of more than 10 billion US dollars, which also shows the market's trust in and demand for WBTC.

Source: WBTC official website

However, WBTC has also encountered a round of trust crisis recently. On August 9, WBTC custodian BitGo officially announced the establishment of a joint venture with Hong Kong company BiT Global, and plans to migrate WBTC’s BTC management address to the multi-signature of this joint venture. What’s interesting is that behind this Hong Kong company BiT Global is Justin Sun.

This has also triggered a heated debate in the market about the security of the subsequent actual control of WBTC. Although Sun Yuchen responded that WBTC has not changed compared with the previous one, the audit is conducted in real time and is completely managed by the custodians Bit Global and BitGo according to the same procedures as before.

But for crypto investors, the market still has doubts. Within a week of the first exposure of the news, Crypto.com and Galaxy alone redeemed more than $27 million in Bitcoin, and WBTC's reserves have decreased by nearly 7,000 Bitcoins in the past two months.

In the final analysis, it is because the multi-signature authority of WBTC's reserve assets has to be transferred from BitGo to a joint venture controlled by Sun Yuchen, and under the centralized mechanism that only looks at whether the custodian is reliable, the market has extremely no trust in Sun Yuchen, which has triggered this crisis of trust.

"Brain-dead" renBTC

In 2020, renBTC and WBTC are the leading representatives of decentralized and centralized BTC stablecoin solutions. Its entire issuance process is relatively decentralized, that is, users deposit native BTC into the designated RenBridge gateway as collateral, and RenVM issues the corresponding renBTC in the Ethereum network through smart contracts.

The project has a close relationship with Alameda Research, which once became its biggest highlight label, but good and bad are interdependent. After the FTX crisis, Ren was not surprisingly affected, not only did its operating funds break, but also funds fled on a large scale.

Although it also tried to save itself later, as of the time of posting, the latest public disclosure progress is still the Ren Foundation announcement in September 2023. Now it is almost equivalent to brain death.

Source: X

tBTC 's decentralized practice

The most interesting project practice that is still in operation should be the tBTC product of Threshold Network, in which tBTC replaces centralized intermediaries with a randomly selected group of operators who run nodes on the network. These operators jointly use Threshold encryption technology to protect users' deposited bitcoins. In short, user funds are controlled by the majority consensus of the operators.

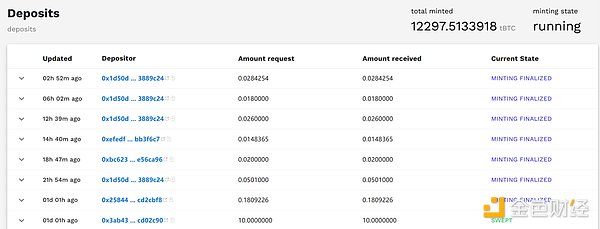

As of the time of writing, the total supply of tBTC exceeds 12,000 pieces, with a total value of nearly US$800 million. Six months ago, there were only about 1,500 pieces, which is still a very rapid growth.

Source: Threshold Network

In short, the competition among various solutions is essentially centered around the core of asset security. With this turmoil, WBTC has unveiled the market demand for decentralized stablecoins. In the future, whether it is tBTC or other similar projects, they will need to continuously improve their decentralized design on the basis of ensuring asset security to meet the needs of the market and users.

cbBTC and kBTC “Old Wine in New Bottles”

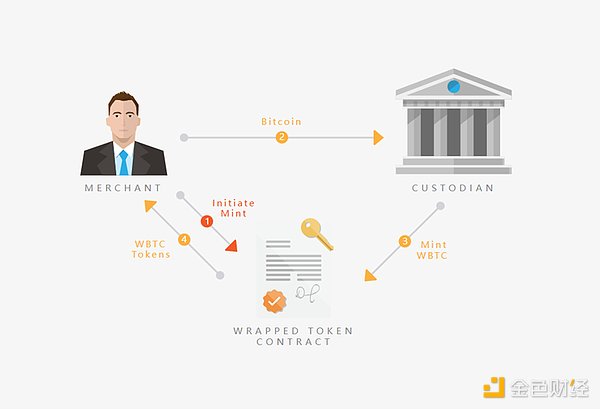

According to the official description, the minting/destruction mechanism of cbBTC and kBTC is similar to that of WBTC, except that the fund custody of the former is directly backed by Coinbase and Kraken exchanges, while the latter is backed by BitGo and the latest Justin Sun.

In addition, the biggest difference is that the threshold for ordinary users to participate is greatly reduced - users do not need to hold Bitcoin on the chain first, and then transfer BTC to the acceptor to complete the WBTC exchange, but can complete the operation directly in the exchange account.

Source: WBTC official website

Take cbBTC as an example, when a user transfers BTC stored in Coinbase to Base or Ethereum network, it will automatically trigger a 1:1 exchange between BTC and cbBTC, and mint corresponding tokens at the target address; conversely, the system will destroy these tokens and release an equal amount of BTC from the Coinbase reserve to the user's Bitcoin account.

The minting/destruction process of kBTC is also completely closed in the exchange account. Users must hold BTC in their Kraken account to exchange it. If they want to exchange kBTC back to Bitcoin, they need to deposit kBTC into their Kraken account.

To put it bluntly, Coinbase/Kraken assumes the responsibility of the routing node for the two-way exchange of BTC and the corresponding packaged tokens, which also facilitates them to coordinate their own user resources and liquidity.

At the same time, Coinbase also hired OpenZeppelin to audit the cbETH smart contract (link), and kBTC chose to be audited by the external security audit company Trail of Bits. Both emphasize their custody process and transparency.

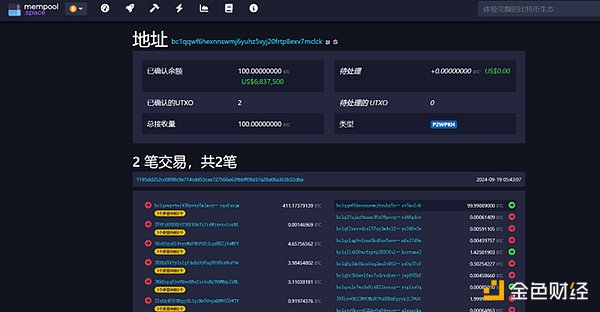

Even Kraken stated that each kBTC token is backed 1:1 by an equal amount of Bitcoin held by Kraken Financial, a Wyoming-chartered SPDI (special purpose depository institution), and users can verify the reserves of kBTC on the chain at any time - as of the time of writing, its custodial address holds 100 BTC, which should be a test transaction.

Source: mempool

However, compared to WBTC, which caught up with the DeFi Summer in 2020 and went through several rounds of bull and bear markets before it secured its place in the ecosystem, cbBTC and kBTC were born with a "golden spoon":

As soon as Coinbase launched cbBTC, it established close cooperative relationships with many mainstream DeFi protocols and platforms, including mainstream DEX (Uniswap, Curve, Aerodrome, etc.), lending protocols (Aave, Compound, Spark, etc.), yield vaults, etc., not only provide extensive ecological support for cbBTC, but also provide users with more diverse ways to use Bitcoin on the chain;

The first batch of partners of kBTC also include deBridge, Definitive, Gauntlet, ParaSwap and Yearn, and holders can use it for various on-chain activities on Ethereum and OP Mainnet;

Interestingly, as of the time of writing, in the fee structure, neither Coinbase nor Kraken charges any fees for minting/destruction operations - Users only need to pay the withdrawal fee when withdrawing cbBTC from Coinbase, while kBTC charges an additional 0.05% 0.00001 on deposits and withdrawals respectively ETH (OP Mainnet).

A trick to revitalize the BTC stock on exchanges?

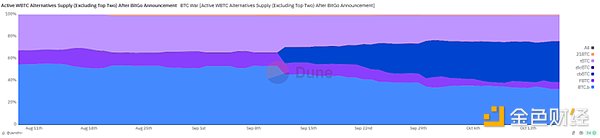

Dune data shows that as of October 20, WBTC has an absolute advantage in the entire packaged Bitcoin track with a market share of 63.7%, while cbBTC, which has just been launched for one month, accounts for only 3%.

But it cannot be ignored that the situation has changed since the WBTC trust crisis - among the active WBTC substitutes, cbBTC accounts for as high as 37%, with an extremely fierce momentum, showing strong development potential, and injecting new vitality into the originally conventional packaged Bitcoin track.

Source: Dune

At the same time, according to data disclosed by IntoTheBlock, two weeks after the release of cbBTC, its trading volume accounted for 49% of the total trading volume of packaged Bitcoin.

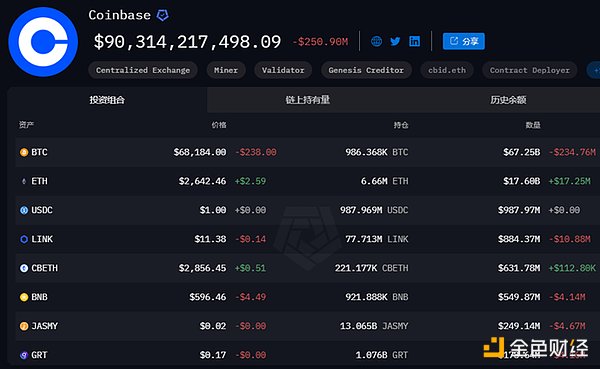

Overall, the launch of cbBTC has indeed effectively activated the huge stock of BTC in Coinbase - Arkham data shows that the current Bitcoin balance of Coinbase exchange is as high as more than 980,000, worth more than 67 billion US dollars, and these BTC have been idle:

Due to its lower price volatility than other altcoin assets, it has sufficient safety margin, and the minting/destruction process requires multiple steps of on-chain operations. Therefore, compared with complex on-chain Lego combination gameplay such as DeFi, many ordinary users have no motivation and dare not take the risk of transferring too much BTC across chains to the Ethereum ecosystem for unknown returns.

Source: Arkham

Therefore, since 2020, the form of packaged tokens + EVM has not grown, and the overall BTC capital inflow attracted is limited, while Coinbase/kraken The new gameplay is equivalent to greatly simplifying the threshold for ordinary users to mint/destroy. At the same time, for users, the daily exchanges can also provide more intuitive brand endorsement.

Therefore, combined with the trust crisis of WBTC, cbBTC naturally revitalized the deposited assets of these exchanges, providing BTC, a "non-interest-bearing asset", with a higher return that is almost native and stable, and converting it into an interest-bearing asset. On this basis, it is introduced into a wider range of on-chain usage scenarios, thereby revitalizing BTC, the highest quality and largest crypto native asset in the hands of Holders.

In addition, there is another observation angle that has been overlooked by the market: as early as July 16, three months ago, as a cryptocurrency exchange that participated in the repayment of Mt. Gox creditors, Kraken received creditor funds (BTC and BCH) from the Mt. Gox trustee.

Arkham on-chain data showed that Kraken-associated addresses received a total of approximately 48,641 BTC (currently worth approximately US$3.3 billion), which were subsequently split into deposit addresses of other exchanges. This means that no matter whether the creditor users who receive BTC allocations choose to continue holding or directly (all/partially) sell them, Kraken faces a huge challenge and opportunity that other exchanges do not have - how to attract this BTC worth US$3.3 billion through an effective business form, directly convert it into deposited funds retained in Kraken, and even attract a wider range of BTC holders.

Therefore, the launch of kBTC is likely to be a strategic business test based on this idea by Kraken - by providing ERC-20 EVM-compatible packaged Bitcoin, giving BTC liquidity and a wider range of on-chain trading scenarios, thereby attracting creditor users to keep their BTC in Kraken and convert it into deposited funds.

cbBTCWill they be the new main battlefield for exchange business?

In a sense, the $1.34 trillion Bitcoin (the latest CoinGecko data on October 20, 2024) is the largest "sleeping fund pool" in the crypto world.

So since the demand for BTC to enter various DeFi scenarios has emerged, a safe and reliable cross-chain bridge has become the core factor that bears the brunt, especially for the vast number of Bitcoin "Holders" who hold a lot of money, and security concerns are the first reason for being on the sidelines.

Therefore, whoever can guarantee an absolutely safe and convenient BTC cross-chain solution may become the next "Tether" in the ERC-20 Bitcoin market, which may be worth at least 100 billion yuan in the future. In this context, Coinbase and Kraken, as the first exchange players to test the waters, have indeed provided users with a more convenient BTC liquidity service to a certain extent by relying on their own business foundation and market influence. It is also a new format to further expand the product line by leveraging existing advantages. It is just curious why large exchanges such as Binance and OKX have not launched similar packaged Bitcoin products? In fact, compliance issues may be an important obstacle - both Coinbase and Kraken have a strong foundation in compliance, which enables them to launch new products in a strictly regulated environment.

For exchanges such as Binance, although they have a huge user base and market share worldwide, regulatory issues in some regions are still a big challenge. From this perspective, Hong Kong licensed trading platforms such as HashKey, due to their strict compliance with regulatory requirements, are expected to become the core variable in the reshuffle of the digital asset trading platform landscape under the background of increasingly stringent supervision:

Take HashKey as an example. As one of the first exchanges in Hong Kong to obtain a virtual asset trading license, it must strictly comply with the regulatory requirements of the Hong Kong Securities Regulatory Commission - adopting the method of separating hot and cold wallets, 98% of assets are stored in cold wallets and 2% in hot wallets, and introducing professional insurance institutions to insure user assets, providing users with more protection in terms of compliance.

In addition, based on the licenses of Hong Kong and other jurisdictions, licensed exchanges such as HashKey can also combine their own regulatory advantages and market demand to develop innovative products that meet market expectations, just like the newly launched crypto ETF business on April 30 this year, which not only provides an entry point for business upgrades, but also provides users with more liquidity and usage scenarios.

In general, by learning from the Coinbase model, other exchanges can consider launching similar products. However, in today's increasingly important compliance, licensed and compliant exchanges like HashKey have strict compliance review and risk management in asset custody and customer asset protection, and have greater development potential and market competitiveness.

Note

With 1.34 trillion dormant assets, capital efficiency is undoubtedly the core issue throughout the Bitcoin ecosystem.

And cbBTC, kBTC and other exchange-based packaged Bitcoin solutions can be likened to "infrastructure projects" to further release Bitcoin liquidity to some extent - enabling exchanges to become intelligent routers connecting the Bitcoin ecosystem and the multi-chain application ecosystem on the basis of giving Bitcoin liquidity.

This is also a new exchange competition around the Bitcoin ecosystem. Currently, Coinbase and Kraken are leading the way. Mainstream offshore exchanges are relatively cautious due to compliance considerations. This may also become a microcosm of compliant and non-compliant exchanges in the expansion of new businesses:

With the strengthening of global supervision, the market may undergo a new reshuffle around compliance in the future. Whether it is packaged Bitcoin or new businesses such as stablecoins and RWA, strictly regulated licensed trading platforms like HashKey Exchange may play an increasingly critical role and deserve attention.

Huang Bo

Huang Bo

Huang Bo

Huang Bo Alex

Alex Miyuki

Miyuki Xu Lin

Xu Lin Coinlive

Coinlive  cryptopotato

cryptopotato Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist