Author: He Yi, co-founder of Binance; Source: Binance Square

I generally don't like to be someone's father, unless someone else comes to be my father.

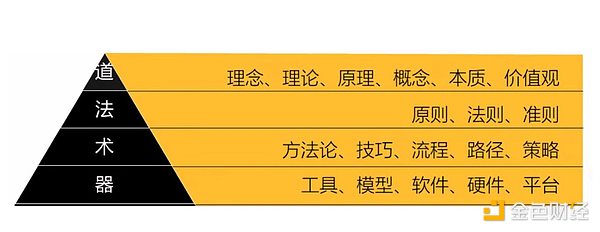

Looking back, Bitcoin was born against the backdrop of the 2008 financial crisis. At that time, no one would have thought that a white paper and open source code would become the best asset of the past 17 years. Times are changing, the concept of money is changing, the concept of assets is changing, and policies are shifting. On a road untraveled, we practitioners have gone from being called "MLMs" to calling ourselves "honored Wall Street traders." Along this path, our community has grown, facing repeated forks. Every choice is a process of screening, with some drawing closer while others drifting further away. As an entrepreneur who believes in "value investing" and "long-termism," I believe that only businesses that solve user problems and generate revenue can be considered entrepreneurial and constructive. My long-term holdings of Bitcoin and BNB stem from my optimism about the entire industry. Within this industry, BTC is the leading decentralized asset, and Binance boasts the largest user base and strongest team. If this team isn't already world-class, then I'll make it so. Binance has never been a pretentious, perfect team. We've stumbled along the way, flying and repairing planes simultaneously. We've paid a heavy price, so now we prioritize compliance. Binance has invested enormous resources in compliance. Even third-party auditors have rated us as the industry's top compliance authority. Our compliance resources are over five times the size of our product, surpassing those of traditional finance. Binance isn't the first to enter many businesses. When you're first, following is the better strategy. In a sailing race, if you're in the lead, you can easily follow the others. I'm not the first to build an exchange, we're not the first to offer contracts, we're not the first to do C2C, and we're not the first to include an on-chain wallet in our product. But we are the first to require KYC for even that on-chain wallet. Our products all started with "nothing." We grew up in an African village, walked with our users through the Darien Pass in Latin America, and enjoyed a relaxing coffee in a small Australian shop. We also share the typical East Asian involution. We don't have the grand feasts of F1, but we are with nearly 300 million users. We take small steps forward, guided by the criticism and suggestions of our community and users. In other industries, when times abandon you, there's no word of farewell. Fortunately, in this industry, if we don't keep up, the community will teach us how to behave, and we'll "know shame and then be brave." I used to believe that adding leverage to contracts would magnify human weaknesses, and I vowed not to trade. It wasn't until the 2019 bear market, when all cryptocurrencies plummeted and users were wailing, that I brushed up on my financial knowledge and learned about hedging and margin trading. Later, we forced two contract teams into a horse race, but we didn't forget to test contract users before trading, and we didn't forget to set a cooling-off period for users who repeatedly went all-in. My moment of self-deprecation was also caused by me. I used to think MEME was a conspiracy disguised as a subculture, and that only serious projects that took responsibility for their stakeholders were the right path. That was until I saw that those prominent, well-regarded projects, openly talking about their dreams and passions, were simply using Binance as a last resort for liquidity withdrawal, where they were simply poured money into it. Facing professional players, retail investors are defenseless, facing either spot market dumps or contract price crashes. I understand their anger, but I feel powerless to address the structural changes in the industry. I once choked up during a six-hour AMA because I didn't know how to ensure both retail and professional players could profit. What if we wanted our users to be our first stop? This is the starting point of Alpha. Until I came to terms with myself, most users don't expect perpetual profits. What they want is fairness, fairness, and damn fairness. Users aren't hyping "Binance Life" or "Customer Service Xiao He," but the tiny bits of fairness, opportunity, and consensus that accumulate under these "Contract Owners." At this point, I'd like to remind everyone: MEME has no one responsible for the project, no long-term value support, and there are no lack of conspiracy groups. Be aware of the investment risks. The inclusion of Binance and my self-proclaimed "Binance" or my tweets on the "Contract Owners" does not mean that Binance or I endorse it. For MEME players, Binance and I are in the same quadrant as dogs, pigs, frogs, and emojis; there's no difference. I've opposed MEME, understood MEME, and finally become MEME. The clown is me. Compared to the entire financial market, the cryptocurrency world is still a tiny fraction. The market is large enough to accommodate many giants, so we don't attack competitors. We learn from other entrepreneurs and project owners. If we don't understand, we can still invest or buy. Because the ultimate goal of a straightforward business war is who satisfies user needs, not hair-pulling or spitting. YZi Labs plans to invest $1 billion to support the ecosystem and developers, incubating a number of top projects. This is true business competition. Over the years, we've been bombarded with countless bullshit, which we've used to cultivate vibrant flowers. If our wallet wasn't good, we'd fix it until it was better. We never understood the purpose of MEME. As soon as we saw a CA associated with Binance, we started to refute rumors, strictly guard against it, and distance ourselves from MEME, returning to our own business. It's not without a few broken hearts. As a new-age entrepreneur and cultivator, I thank you for taking the time to read this long, uninformative article. After much deliberation, I can only offer some valuable insights, as this aligns with our consistent altruistic approach. Entrepreneurship, trading, making money, and cultivating immortality are essentially the same thing, requiring principles, methods, techniques, and tools. Before you understand them, if you make money blindly, you'll also lose it blindly. After all, you can only make money within your own understanding. Tao is the law governing the world. Only those who adhere to these laws can achieve long-term success. Just like our industry thrives because it conforms to the laws of the world, not because of the brilliance of any particular individual. Law is a principle, the cultural values of every company and organization, and Binance's user-centric approach. It represents freedom, collaboration, a hard-core approach, and, above all, humility. Techniques: People are easily drawn to tactics, political schemes, and marketing, but these are often trivial. Tools: Products and tools. Tools are the most easily replaced in mobile internet products. Every individual, company, and organization has their strengths. Doing well in any one area can yield significant results. Everyone can identify their strengths. Ultimately, Binance is still short on talent, so this is still a recruitment post. Join us and cultivate together. PS: None of the above information is intended as investment advice. I apologize that English-speaking players can only see AI-translated content. I will find time to learn English.

Brian

Brian

Brian

Brian Joy

Joy Weiliang

Weiliang Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Joy

Joy Brian

Brian Weiliang

Weiliang