Author: Charles Source: HFAResearch Translation: Shan Ouba, Golden Finance

We are in an era that many call the "memecoin cycle", and some even boldly call it the "memecoin super cycle". We have witnessed emerging memecoins like WIF soar from zero to billions of dollars in market value in just a few months. With the popularity of the memecoin phenomenon, products such as pump.fun have also emerged. Whether you like it or not, memecoins are a force that cannot be ignored.

For most active crypto players, the overall performance of memecoins has been astounding so far, with gains as a sector far outstripping any other sector. When we see news about traders making huge returns on a particular memecoin, one question always lingers in our minds: "How did they identify this specific memecoin?" Sure, there is a certain survivorship bias, but are there other factors at play besides this?

At HFAResearch, we generally focus on fundamentals-based investing, trading, and mining ideas. This makes it difficult for us to cover the memecoin space - similar to NFTs, the investment logic for memecoins tends to be a little more fuzzy and relies more on the "vibe" and the meme itself, making fundamental analysis more difficult. At least that's what we thought until we discovered what we call the "memecoin TVL surge theory".

The memecoin TVL surge theory posits that the top memecoin or a basket of the top memecoins will act as a leveraged bet on the TVL of a blockchain. Before we go through various examples we've seen in the past, let's first understand why this is the case.

We know that as a blockchain's TVL grows, a portion of the money flows to certain applications or "destinations" on that chain... X% goes to the money markets, Y% goes to the top DEXs to provide liquidity, etc. Therefore, it's logical to assume that a small portion of the money (albeit a small portion) will go looking for a way to bet on the blockchain in question with the highest exposure. How do they do that? Well, it can be done by buying the leading memecoin or a basket of the leading memecoins. Perhaps to some of you this may seem obvious and need not be specifically pointed out, but we believe it provides a valuable and potentially reduced risk way to participate in memecoins as it provides a fundamental method of assessing future memecoin performance (up or down).

Let's take a look at several examples of this happening in history:

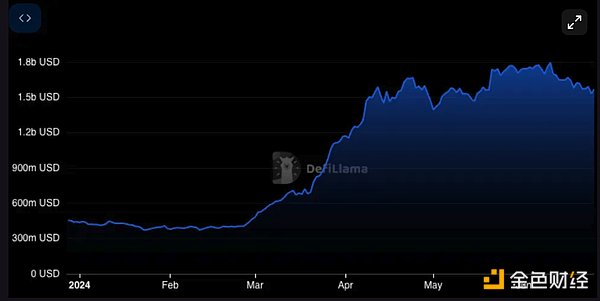

Base

If you can predict TVL growth, then you can make a convex bet on its TVL forecast by holding the leading memecoin on that chain.

If you can predict TVL growth, then you can make a convex bet on its TVL forecast by holding the leading memecoin on that chain.

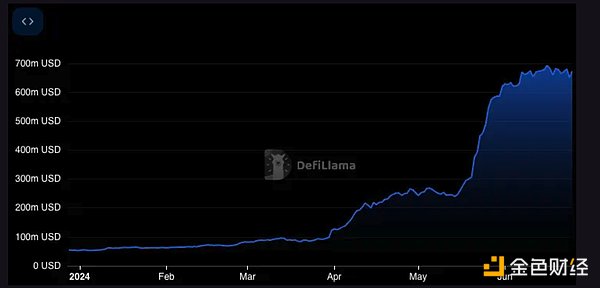

Critics of this strategy will say that since the strategy needs to know which is the leading memecoin in order to identify where TVL is flowing, it will have low returns by design. This is a fair criticism, and this strategy certainly won’t allow you to buy a memecoin at a $100k market cap and then soar 1000x all the way to $100m. But it can be very effective for finding some slightly larger, more mature projects and then starting to accumulate gains from there. For example, during the parabolic TVL growth that Base experienced from late February to early April, Toshi soared from a $40m market cap to over $300m, achieving such an impressive return in less than 2 months.

There are two ways to predict TVL growth: long-term and short-term. Long-term forecasts are really about predicting where TVL will flow in the coming months. For example, we might point to Base having Coinbase as a channel to onboard retail users as a reason why TVL growth will remain strong. We might look at the tight relationship between TON and Telegram to see the TVL impact that all 900 million Telegram monthly active users might have if they joined the blockchain. We might also point to Solana having a great on-chain UX and mobile wallet as a reason why TVL will flow there. You get the idea? Long-term forecasts look at the deeper distribution fundamentals of a blockchain in an effort to predict TVL growth over a longer timeframe. You would then look at the leading memecoins on that chain and bet accordingly.

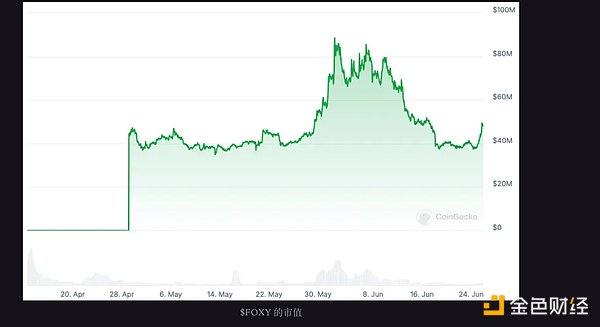

Short-term strategies look at near-term catalysts, such as points programs or airdrops, as reasons for TVL growth. For example, $FOXY, the leading memecoin on Linea, performed very well during the ensuing TVL inflow after announcing its Surge Points program.

Short-term strategies require a more active focus on the market and where capital may flow based on incentive plans. This is relatively similar to the game some of us played in the last cycle; entering the liquidity pool 2 of the major DEX on the new chain as a way to bet that TVL will increase through incentive plans.

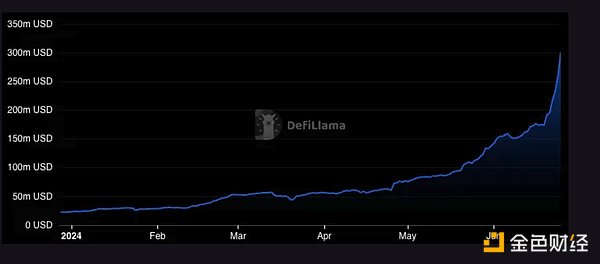

A more actionable example might be Scroll, where we’ve seen TVL grow parabolicly since their recent launch of the “marks” program. Will Scroll become the next prime hunting ground for short-term strategies?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Clement

Clement Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist