CoinFLEX CEO Mark Lamb Sued By Exchange's Creditors Over OPNX

Aside from Mark Lamb, the case also names Roger Ver as a defendant.

Clement

Clement

Author: Naly Source: MoneyVerse Translation: Shan Ouba, Jinse Finance

Zcash (ZEC) is like Bitcoin that no one can see.

The same supply cap, the same halving model, the same deflationary architecture; the only difference is its anonymity.

As institutions, governments, and cryptocurrency natives begin to view Bitcoin as a sovereign store of value, the world is gradually realizing the need for a second dimension of money—a money that is not only scarce and self-custodial, but also permissionless and privacy-preserving.

In a world where AI surveillance, programmable money, account freezes, and cashless control systems are rapidly developing, Zcash offers a second dimension of monetary freedom. It is not only scarce, but also cryptographically protected.

This report will delve into the investment logic of Zcash as a "stealth Bitcoin" and why it may be the investment target with the greatest potential for asymmetric returns in the current cryptocurrency space. Key Highlights: It adopts a Bitcoin-style hard-top supply currency system, lagging behind by two halving cycles in maturity. It has deep cypherpunk roots, with participants including Edward Snowden in its encryption setup. The concept is easy to understand, even for those without a technical background: the idea of stealth currency needs little explanation. Renewed interest from institutions and academia, including prominent figures like Navarre Lavikant, is driven not by hype but by the growing importance of financial privacy. This report breaks down Zcash's investment logic into eight key parts: Core Concepts, Origin Story, Technical Architecture, Competitive Landscape, Token Economy, Macroeconomic Relevance, Risks and Challenges, Investment Value. style="text-align:center">

Satoshi Nakamoto, the founder of Bitcoin, once explored the compatibility of zero-knowledge proofs with Bitcoin.

Zcash was not created to compete with Bitcoin, but to improve it. Bitcoin achieved monetary sovereignty, while Zcash endowed monetary privacy. It extended Satoshi Nakamoto's design to a realm that Bitcoin could never reach—anonymity.

From the very beginning of Bitcoin's existence, privacy has been considered its fundamental flaw.

Hal Finney, one of the earliest adopters of Bitcoin and the recipient of Satoshi Nakamoto's first Bitcoin transaction, had a clear understanding of this. He warned that while Bitcoin's transparent ledger offered significant advantages in verification, it inevitably compromised the token's fungibility because its historical trajectory could be traced and distinguished. For Finney and early cypherpunks, this contradicted the core principles of digital cash. Finney was active in the cypherpunk mailing list community in the 1990s, where concepts such as zero-knowledge proofs and cryptographic anonymity were initially discussed as tools for achieving individual autonomy. He firmly believed that the future of digital currency required both verifiability and privacy. Years later, another cypherpunk pioneer and early Bitcoin contributor, Zuko Wilcox, set out to address this issue. He collaborated with a group of world-class cryptographers to co-author the Zerocoin academic proposal, aiming to add full transaction privacy features to Bitcoin. When Bitcoin Core developers rejected the proposal, the team decided to launch a completely new protocol. This protocol was Zcash, officially launched in 2016. Its founding principle was simple yet radical: privacy is the norm. It is not a privilege or optional feature, but a fundamental attribute of robust money. For a long time, privacy has been misunderstood as a secret that needs to be hidden. In fact, privacy is about dignity, autonomy, and the freedom to choose who to disclose what information to. It is the silent cornerstone of self-sovereignty. Bitcoin achieves censorship resistance through decentralization, while Zcash adds a deeper value: financial anonymity. Using zero-knowledge proofs, Zcash allows users to verify transactions without disclosing the sender, receiver, or transaction amount. For the first time ever, people can transfer value on a public blockchain without exposing their identity or transaction activity. This innovation made Zcash the first project to actually deploy zero-knowledge proofs in a permissionless blockchain, a milestone that profoundly impacted the entire field of zero-knowledge cryptography. Even today, Zcash remains one of the few layer-one protocols that treats privacy as an underlying property (rather than an added feature). Zcash's origin story connects two eras: the cypherpunk beginnings of Bitcoin and the forefront of modern encryption. It represents the maturation of the initial vision of Satoshi Nakamoto, Finney, and the early internet builders—privacy is not a vulnerability to be fixed, but a right to be protected.

In its early days, Zcash needed to generate cryptographic parameters to enable encrypted transactions. If these parameters were compromised, it could theoretically lead to undetectable token inflation. To mitigate this risk, the Zcash team designed one of the most compelling launch events in cryptocurrency history, aptly named the "Rite."

This Rite was a globally distributed multi-party computation conducted under extremely high operational security standards.

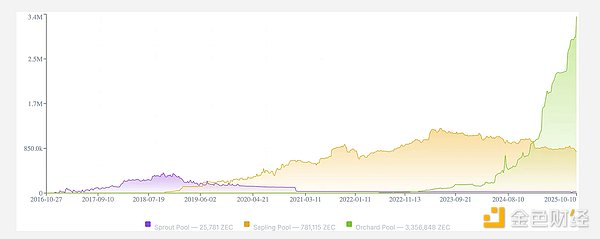

Each participant operated in a physically isolated environment, using offline devices, and destroyed all encrypted materials after completing their role. The goal was to ensure that no single participant, or even collusion between participants, could reconstruct the keys. Among the participants was Edward Snowden, who participated under a pseudonym; his participation was made public in 2022. Given Snowden's symbolic status in the digital privacy movement, his participation helped this ceremony leave a profound mark on cryptocurrency history. The Radiolab podcast's coverage of the event reads like science fiction: Wearing a wizard's hat; using paper maps instead of GPS; burning hardware in a campfire; randomly selecting hotels and removing televisions; storing laptops under pillows; removing phone batteries mid-conversation. Bitcoin has a genesis block, while Zcash has this ritual. One etches history, the other encrypts it. If you believe privacy is a collective right, then Zcash is the starting point for that right. This is crucial in narrative-driven markets. Memes and origin stories are not distractions from the fundamentals, but rather carriers of belief, and belief is the fuel for network effects. 3. Technical Architecture Zcash is the first blockchain to implement zero-knowledge concise non-interactive knowledge arguments (zk-SNARKs) in a real-time, permissionless environment. While zero-knowledge rollups have gained popularity in recent years, Zcash deployed zero-knowledge cryptography in production as early as 2016. The core of zero-knowledge cryptography is that one party can prove something is true without disclosing any underlying data. In traditional blockchains like Bitcoin and Ethereum, verifying a transaction requires exposing the sender, receiver, and transaction amount, all of which are permanently recorded on a transparent public ledger. Zcash offers a fundamentally different model. Through zero-knowledge proofs, users can prove a transaction is valid without disclosing any of these details. This is not a layer of obfuscation or optional privacy tools, but a fundamental function enforced cryptographically and built into the protocol itself. Zcash supports two address types: transparent addresses (t addresses), which function similarly to Bitcoin addresses; and encrypted addresses (z addresses), which provide complete privacy protection. Funds can be freely transferred between the two pools. This flexibility and the integrated nature of crypto liquidity pools structurally distinguish Zcash from almost all other blockchains. The relative privacy of the ZEC network is directly related to the liquidity in the crypto liquidity pools: it's like a crowd—the more people there are, the harder it is to identify an individual. Despite its strong technical capabilities, critics rightly point out that historically, crypto transactions have only accounted for a small portion of overall network activity, forcing crypto users to remain "hidden among a small group." This is partly due to insufficient wallet support, friction in the user experience, and the high computational resource requirements for generating zero-knowledge proofs. At one point, less than 5% of all ZEC transfers were fully encrypted. However, this trend has begun to reverse. Recent updates to the proof-of-stake system and the emergence of new tools like the Zashi wallet have made encryption much easier to use. According to the Zcash Foundation, over 70% of active wallets now support crypto transactions, and the number of daily crypto transactions is growing rapidly. Today, over 25% of circulating ZEC is in crypto liquidity pools, and this number is still rising significantly. This distinction is crucial. Privacy alone is not enough; for widespread adoption, privacy must be usable. Zcash has built the foundation for encryption over the past decade, but only now is it beginning to develop the user interface that will propel it into the mainstream.

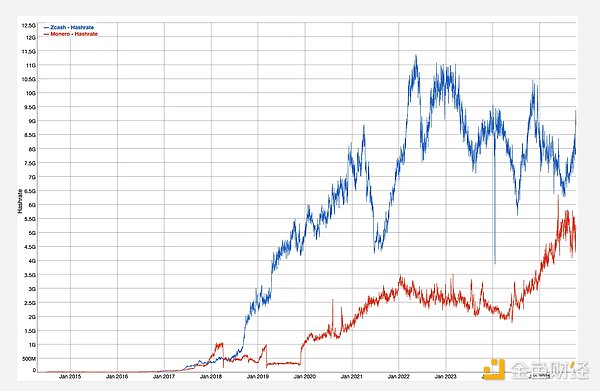

Analyzing Zcash Before delving into the token economy, it's essential to clarify Zcash's uniqueness within the broader realm of digital asset privacy. In today's market, Zcash has virtually no real competitors. While widely used, Monero relies on ring signature technology—a powerful but statistically and heuristically vulnerable technology. Even Monero's developers acknowledge these limitations and are exploring the integration of zero-knowledge systems to enhance privacy. Its model also carries a reputational burden, long associated with darknet markets and unregulated activities. This is why Monero is no longer listed on major exchanges like Coinbase, Binance, or Kraken, while Zcash can be freely traded on all of them. Monero's privacy is absolute, thus unregulated; Zcash's privacy is optional, allowing users to choose between transparent and crypto trading. As Helius's Mert observed: Zcash is two-mode—users can choose to encrypt or not encrypt their assets. For privacy to truly become widespread, a system that can be grounded in reality is needed. This balance between privacy and compliance is key to Zcash's sustainable development. Its architecture allows for selective disclosure by viewing keys, enabling users to share transaction data with auditors, regulators, or trusted third parties when necessary. In short, the privacy it provides operates within existing systems, rather than outside of them, a necessary prerequisite for wider adoption. However, viewing Zcash and Monero as competitors misses the point. The real challenge isn't which privacy asset will prevail, but whether privacy can remain a viable pillar of the digital economy. Both ecosystems are driving this cutting-edge field forward. However, from a design and application perspective, Zcash's hybrid model of confidentiality and compliance makes it a more likely candidate for mainstream and institutional integration. Tornado Cash, once a promising privacy protocol on Ethereum, demonstrated the limitations of a system completely incapable of adapting to regulation. The protocol was sanctioned and dismantled by authorities, its developers are currently facing prosecution, and its contracts remain under intense scrutiny. The message is clear: privacy lacking resilience and adaptability cannot last. In contrast, Zcash achieves privacy at the protocol level through zero-knowledge proofs, a cryptographic technique more robust than methods based on ring signatures or mixers. It combines rigorous mathematical principles with practical flexibility, providing confidentiality that can coexist with transparency when necessary. This combination of technological robustness and legal sustainability is what sets it apart. Its concept is also highly intuitive: Zcash is an invisible Bitcoin—the same supply cap, the same halving model, the same deflationary architecture, but with cryptographic protection. This concise narrative is crucial from both an application and investment perspective. Initially a cryptographic experiment, Zcash is now maturing into a sovereign, private, and programmable financial system. In an era characterized by surveillance, programmable money, and geopolitical instability, it occupies a unique position. 5. Token Economics In the era following the popularization of ETFs, institutions are familiar with Bitcoin's halving cycle and fixed supply mechanism. Zcash's design has now become a high-quality asset with the potential for asymmetric returns. The Bitcoin model—fixed supply, halving every four years, and predictable scarcity—has been incorporated into institutional investment systems. An asset that replicates this model and adds privacy features represents a logical evolution of this concept. Zcash is a verbatim replica of Bitcoin's monetary structure: Maximum supply of 21 million coins; halving approximately every four years; centralized early emission; no ICO, no pre-mining, no venture capital allocations. It perfectly matches Bitcoin's scarcity model, the only difference being its anonymity. However, a key difference exists: ZEC lags behind by two halving cycles. This means it follows the same monetary curve, just at an earlier stage of maturity. The difference in this cycle lies in the scale of market buying power. Today, those accumulating Bitcoin are no longer retail speculators or crypto-native funds, but rather trillion-dollar asset management firms, pension fund allocators, and sovereign entities seeking to position themselves in high-quality digital assets. The launch of spot ETFs has institutionalized the Bitcoin narrative, opening the floodgates for traditional capital—capital now recognizing programmable scarcity as a legitimate asset class. Many of these allocators missed Bitcoin's growth phase and are unlikely to repeat that mistake. As institutional investment expands beyond Bitcoin, the supply mechanism, regulatory accessibility, and clear narrative of Bitcoin-like ZECs make them a natural secondary allocation target. It offers the same mathematical scarcity as Bitcoin, plus the added dimension of anonymity. For large asset management firms today, who recognize both the advantages of transparency and the risks involved, even a small allocation to ZEC means having options in the next phase of the digital asset cycle. Zcash, launched in 2016, saw its early market dynamics influenced by a steep emission curve and the absence of pre-sales and risk-free investment quotas. Selling pressure was extremely heavy due to the large supply skewed towards miners. Prices plummeted from their initial speculative peak, ownership gradually dispersed, and assets entered a long accumulation phase.

Now, this dynamic has reversed:

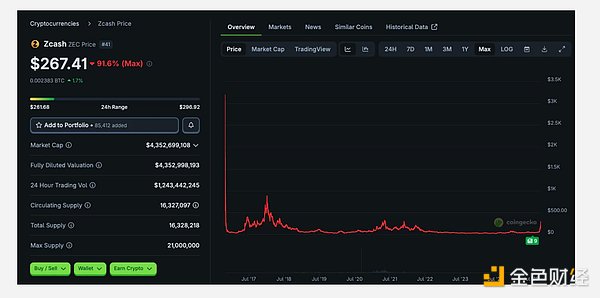

Circulating Supply: Approximately 16.3 million ZEC

Maximum Supply: 21 million

Market Cap: Approximately $4.46 billion (all-time high), although the price per unit ($272) is still lower than in 2017, 2018, and 2021.

Market Cap: Approximately $4.46 billion (all-time high), although the price per unit ($272) is still lower than in 2017, 2018, and 2021.

Zcash is not an application chain, L2, or DeFi toolkit. It is money—pure, cryptographic, programmable money. This simplicity gives it a clear position and endurance in a market rife with complexity. Its narrative is understandable to both institutions and individuals: the architecture of Bitcoin, the hidden functionality.

Market Asymmetry and Portfolio Allocation

This section draws on the analysis of Frank Braun, whose research on the intersection of offshore wealth and digital privacy assets provides an excellent quantitative context for understanding Zcash's opportunities.

Global assets are estimated at $1,000 trillion. Gold has a market capitalization of $27 trillion, while Bitcoin has a market capitalization of $2.3 trillion—approximately 8.5% of the value of gold and only 0.2% of global assets.

Global assets are estimated at $1,000 trillion. Gold has a market capitalization of $27 trillion, while Bitcoin has a market capitalization of $2.3 trillion—approximately 8.5% of the value of gold and only 0.2% of global assets.

In comparison, the total market capitalization of the entire privacy coin sector is only $12.6 billion. This gap is even more significant compared to the estimated $10 trillion in unreported offshore wealth (approximately 1% of global assets). The market value of all privacy coins represents less than 0.1% of this offshore pool. Historically, real estate has been a primary tool for storing hidden wealth, offering both anonymity and profitability. However, this channel is gradually closing. Global anti-money laundering regimes, stricter reporting standards, and digital regulations are increasing the transparency of cross-border real estate and corporate structures. As capital seeks new self-custodial, censorship-resistant forms of storage, programmable privacy networks like Zcash may become their digital equivalent. From a portfolio construction perspective, ZEC can play two distinct roles. It serves as a hedge against central bank digital currencies (CBDCs), capital controls, and the pervasive data collection in modern finance. At the same time, it is also a high-beta asymmetric target reflecting the founding principles of cryptocurrencies—regarding self-custody and privacy as the core of sovereignty. The potential demand is enormous. If privacy-oriented assets capture only 1% of global offshore wealth, ZEC's implied valuation could approach $6,000 per coin; capturing 5% would exceed $30,000; and capturing 10% would surpass $60,000. These are not predictions, but rather an analytical framework—revealing the structural asymmetric potential of ZEC in a world where financial anonymity is gradually disappearing. Institutional funding inflows are still in their early stages, but attention has begun to shift. After years of being overlooked, Zcash is once again in the spotlight among influential investors and builders. Figures like Navarre Lavikant and Balaj Srinivasan have publicly emphasized its importance as a “stealth Bitcoin”—a scarce crypto asset for an age of surveillance finance. Zcash won’t appeal to everyone, nor does it need to. Its purpose is not to compete with Bitcoin, but to complement it; to act as a stealth asset within portfolios characterized by transparency. In a digital world moving towards full traceability, the most contrarian investment stance may no longer be leverage or returns, but simply privacy. Conclusion: Zcash is more than just another digital asset. It doesn't compete on transaction volume, modularity, or total value locked, nor does it position itself as a general infrastructure layer for decentralized finance. What it's doing is more focused and more disruptive. It safeguards financial autonomy in an era of full transparency. In a world where data has become currency, surveillance is embedded in infrastructure, and financial transparency is inevitable, Zcash offers an alternative. It provides the digital age with crypto cash—an asset whose value transcends its codebase, issuance curve, or cryptographic design. Its true value lies in what it defends: individual autonomy in an increasingly transparent financial system. For years, Zcash has been overlooked. Not because it failed, but because it refused to compromise. It steadfastly upheld principles the market wasn't yet ready to embrace. Now, that's changing. Demand for private currencies is rising, tools are maturing, and threat models are expanding. It doesn't need widespread adoption to succeed. It only needs to resonate with those who value privacy in a world where privacy is no longer the default. This includes not only activists or dissidents, but also a growing number of ordinary citizens who recognize that financial surveillance is no longer a myth, but an infrastructure. For them, Zcash isn't a speculative asset, but a safeguard against the recording and analysis of every future transaction, action, and connection. Perhaps one day, stealth currencies will become indispensable. When that day comes, Zcash won't need to evolve to fit the times. It will already be what the world needs.Aside from Mark Lamb, the case also names Roger Ver as a defendant.

Clement

ClementTraditional UK banks have recently tightened their stance on cryptocurrency-related activities, resulting in numerous account closures and stricter policies. This shift in the financial landscape has prompted around 38% of crypto investors in the UK to switch banks.

Jasper

JasperMicrosoft's AI advancements surpass Google's, shaping technological landscape.

Hui Xin

Hui XinWhile the crypto market is basking in its most fruitful week in over a year, the SocialFi app seems to be encountering headwinds.

Kikyo

KikyoIn November 2022, Input Output Global (IOG) announced a new project known as Midnight. Midnight is a sidechain solution for Cardano, designed to address various limitations and open up new possibilities for users and developers

Aaron

AaronMore than 200 companies have received alerts for violating the new advertising rules since their inception on October 8.

Clement

ClementThe groundbreaking collaboration between Christian Louboutin and Marvel, offering exclusive NFT collectibles as complimentary treasures to investors in their limited-edition fashion collection, seamlessly merging haute couture and comic book extravagance.

Jixu

JixuThe demonstration focused on enabling the seamless exchange of vital trade documents across diverse platforms and blockchains.

Alex

AlexThe 100 Digitally Native Note issued by the IBRD was listed on the Luxembourg Stock Exchange.

Alex

AlexAs AI technologies continue to progress, the importance of AI global governance is growing significantly.

Hui Xin

Hui Xin