Author: Aiying; Source: Aiying Payment Compliance

Southeast Asia is gradually becoming an emerging force in the global crypto asset market. For details, please read [2024 Q3 Web3 Asian Market Research Report: Regulatory Policies and Development Trends] But behind the brilliant growth, this land has gradually evolved into a "testing ground" for money laundering and cyber fraud by transnational criminal groups.

According to the latest report released by the United Nations Office on Drugs and Crime (UNODC), virtual asset service providers (VASPs) and online casinos in Southeast Asia have been widely used by transnational criminal groups for illegal financial activities such as money laundering and fraud. In the context of crypto assets attracting a large number of investors, the lack of supervision has undoubtedly exacerbated the instability of the market. This article aims to explore the current regulatory challenges in depth, analyze their impact on Web3 payment companies, and provide suggestions for companies to deal with this situation. The following are specific cases in the report:

1. Cambodian underground casinos: secret capital flow and money laundering operations

Cambodia has become one of the centers of money laundering activities in underground casinos and crypto assets in recent years. Although the Cambodian government legally prohibits online gambling, the underground casino network is still thriving in reality, and unregulated VASPs have become a key channel for these casinos to launder money. A raid in 2023 revealed how criminal groups use these underground casinos to launder money on a large scale - after the casinos accept cash gambling funds, they will quickly convert them into cryptocurrencies, and then through a series of on-chain transactions and multi-level wallet operations, the funds are gradually "laundered" in the process of cross-border circulation.

In this process, the criminal groups use multi-layered encrypted wallets and anonymous accounts to convert the cash obtained by the casinos into mainstream encrypted assets such as Bitcoin or Ethereum. Subsequently, these encrypted assets are transferred multiple times on the chain and split into several small transactions to evade the review of single large funds. These funds cross multiple jurisdictions and eventually flow into bank accounts controlled overseas, making it almost impossible to track their final destination. By packaging illegal proceeds as high-return crypto investment projects, casinos can disguise their revenues as legal gains, thereby attracting new capital inflows.

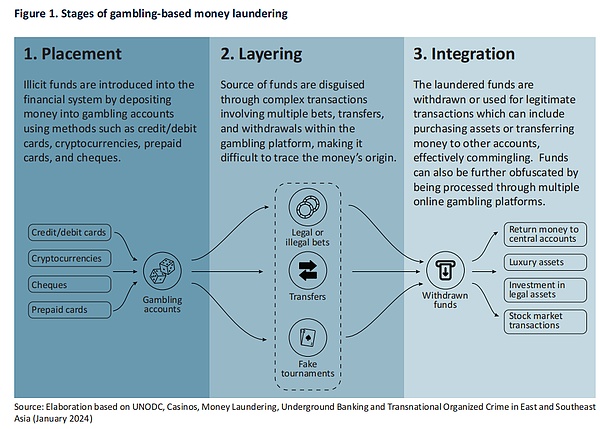

For example, in an enforcement operation in Cambodia, the police found that criminal groups widely advertised on social media in the name of "investment opportunities" to attract the public to invest in these fake high-return projects. According to the report, gambling-based money laundering operations are usually divided into three stages - placement, layering and integration. During the placement stage, criminal groups introduce illegal funds into gambling accounts and deposit them through credit cards, cryptocurrencies, checks, etc., so that the funds enter the formal financial system. In the layering stage, funds are obscured through multiple complex transactions, including multiple bets on gambling platforms, transfers, and fake matches, making them more difficult to track. Finally, in the integration stage, the laundered funds are withdrawn or used for legal investments, such as buying luxury goods, investing in legal assets or the stock market. Through these links, criminals are able to transform illegal funds into seemingly legal wealth, thereby evading regulation. This systematic operation makes the flow of funds obscured layer by layer, becoming an important means for transnational criminal groups to launder money.

Aiying Ai Ying has also written about a huge Chinese ecosystem and market in Cambodia before, called HuioneGuarantee. This market consists of thousands of instant messaging application channels, each operated by different merchants. Huione is responsible for managing the platform and acts as a guarantee or escrow provider for all transactions to help prevent fraud. [Huione in Cambodia: Billions of dollars of money laundering platform for online fraudsters].

Capital Chain and Operation Mode of Illegal Online Gambling

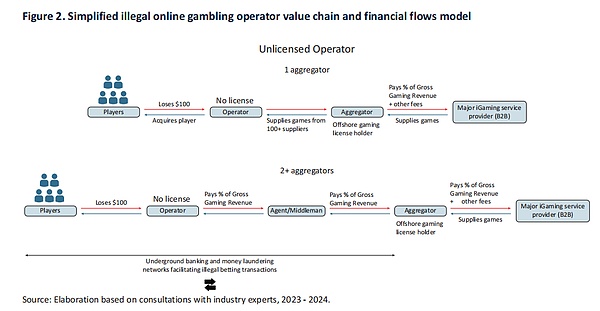

The operation of illegal online gambling usually relies on a complex multi-layer capital chain. Unlicensed gambling operators obtain gambling game resources through aggregators and process betting funds through underground banks and money laundering networks. For example, the gambling funds lost by players are eventually obtained by unlicensed operators and then paid to large gambling service providers through aggregators. The flow of funds in this process not only involves multiple roles, including agents and aggregators, but is also accompanied by the payment of high fees. All of these funds may be used for money laundering during the cross-border flow. By taking advantage of this model, criminal groups have achieved efficient transfer and "whitewashing" of illegal funds, and the assistance of underground banks has further aggravated the concealment of capital flows. This operating model allows illegal funds to circulate secretly in the global financial system, providing financial support for the continuation of criminal activities.

Second, money laundering operations under OTC and "motorcade" models

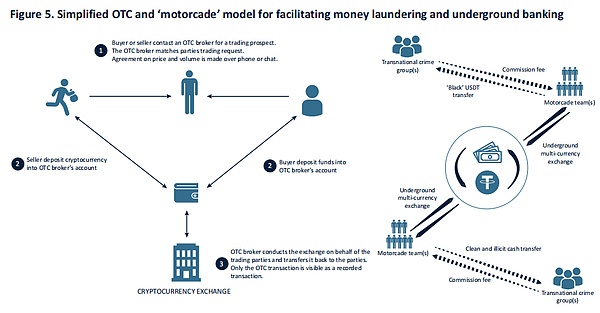

The report also revealed a method of money laundering and underground banking operations through over-the-counter (OTC) and so-called "motorcade" models. Specifically, buyers and sellers will contact through OTC brokers to negotiate the price and quantity of the transaction, and the transaction is usually completed by phone or chat software. The seller deposits the cryptocurrency into the OTC broker's account, and the buyer transfers the funds to the broker's account. The OTC broker then completes the exchange on the cryptocurrency exchange on behalf of both parties and transfers the funds back to the accounts of both parties. In this form, transactions are only visible as records on the OTC platform, but there may be a deeper money laundering network behind it, such as using "black" USDT (cryptocurrency of illegal origin) to further launder funds through underground multi-currency exchange institutions. These underground exchanges and "caravans" assist in completing the multi-level transfer of funds by accepting commissions, making transactions more difficult to track. This model reflects the complexity of Southeast Asia's underground financial system and provides strong support for the illegal flow of funds by transnational criminal groups.

Three. From "pig killing" to cross-border money laundering: the transnational operation model of the scam

The "pig killing" scam has become a landmark operation model for crypto asset crimes in the Mekong region in recent years. Through carefully designed social engineering methods, criminal groups use social networks and dating websites to target individuals who are easily manipulated, gradually build trust, and induce them to invest in fake crypto asset projects. These scams are not simply online fraud, but a whole set of multi-level, cross-border money laundering schemes that ultimately leave victims penniless.

In-depth deconstruction of "pig killing"

Take a "pig killing" case seized in Vietnam in 2022 as an example. The criminal group disguised itself as wealthy and attractive individuals on social platforms and won the trust of victims through long-term communication. Once the victim took the bait, the criminals recommended that they join a high-return cryptocurrency investment platform. These platforms appear to be legally operated, but are actually completely controlled by the criminal group.

After the victim puts fiat currency into these platforms, he is first asked to convert the funds into crypto assets such as Bitcoin or Ethereum. Subsequently, these cryptocurrencies are quickly transferred to multiple fake crypto wallets and transferred across borders multiple times through VASPs in different countries. Each transfer further splits the funds, making it exponentially difficult to track their flow. Through multiple conversions, criminal groups ensure that the flow of funds at each link is hidden in layers of encryption and fake identities, ultimately making the funds completely "laundered".

These scams are often accompanied by fake investment platforms, which carefully produce various false income reports to attract victims to continue to invest. In the cases seized in Cambodia, these fake platforms cooperated with underground VASPs, and the funds were split and transferred across borders through layers of encrypted wallets, and finally entered bank accounts in multiple countries. These operations make the flow of funds as complicated as a maze, and regulators often find it difficult to find out the full picture of this multi-layered disguised fund network.

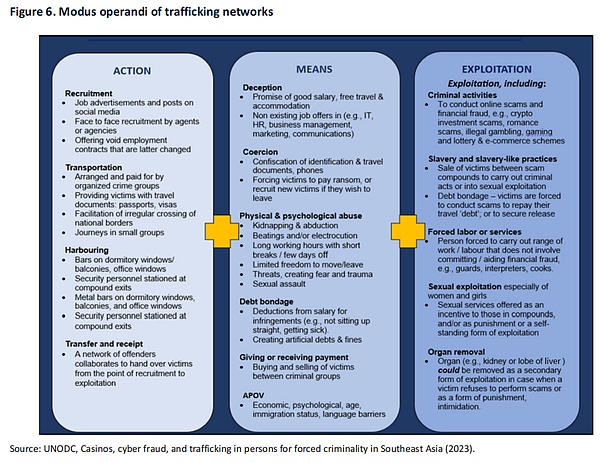

Fourth, the operation mode of the trafficking network: from recruitment to exploitation

According to the research of the United Nations Office on Drugs and Crime, the operation mode of the trafficking network is extremely complex and systematic, involving a complete chain from recruitment to exploitation. First, the criminal groups recruit victims through social media and fake job advertisements, usually promising high salaries, free travel and accommodation as bait. Then, the victims are transported to the target location, and these trips are fully arranged by the criminal groups, including providing forged travel documents and facilitating illegal border crossing. Once arrived, the victims will be trapped in the facilities, under strict control and supervision, and often unable to escape. The criminal groups use means including threats of violence, kidnapping, sexual assault, debt bondage, etc. to coerce victims and force them to participate in various criminal activities, such as online fraud, illegal gambling and even sexual exploitation.

The activities these victims were forced to engage in involved multiple forms of exploitation, including forced labor, financial fraud, sexual exploitation, and cruel practices such as organ removal. The systematization and efficiency of these criminal networks allow them to quickly transfer illegal proceeds to different financial institutions around the world through multi-level transfers and money laundering, thereby evading regulation and legal sanctions. This cruel means of exploitation and the high degree of concealment of the entire network make it a huge challenge for law enforcement agencies to track down and destroy these criminal chains.

V. The deep connection between fake investment platforms and cross-border money laundering

In illegal activities in Cambodia, Laos, Vietnam and other places, fake investment platforms have become a key tool for money laundering. These platforms appear to have legitimate investment projects, but in fact they are an important link in the money laundering chain. After the victims are lured, the funds are immediately converted into crypto assets and transferred through multiple crypto wallets and cross-border exchanges. Behind these criminal methods, the lack of law enforcement and supervision in Southeast Asia is exploited to hide the ultimate source of funds through multiple jurisdictions.

The criminal groups carefully designed these fake platforms to make them extremely confusing. For example, the "small profits" of the victims in the early stage are actually paid with the funds of new investors to maintain the surface stability and profitability. When the victims' trust deepens, the criminal groups will induce them to increase their investment, and eventually all the funds will be transferred to offshore accounts controlled by the criminal groups, and the platforms will be closed, leaving the victims with nothing.

In investigations in Vietnam and Cambodia, the police found that there are complex transnational operating networks behind these platforms. Using unregulated VASPs, funds are quickly transferred across borders, and the secrecy of each link makes any pursuit difficult. This feature of transnational fund transfer makes financial crimes more complicated, and traditional financial supervision and judicial cooperation seem powerless in the face of such challenges.

The complexity of cross-border money laundering lies not only in the fact that it involves multiple jurisdictions, but also in the high flexibility and anonymity of the money laundering process. A case investigated by the Vietnamese police showed that criminals transferred funds from Vietnam to Hong Kong through unregulated VASPs, and then converted them through European exchanges and finally entered offshore financial accounts. In this process, criminal groups took advantage of the anonymity of cryptocurrencies, global liquidity and inconsistencies in national regulations to quickly launder illegal proceeds and flow into the legal financial system.

For Southeast Asian countries, this complex cross-border criminal activity undoubtedly poses a huge challenge to the existing regulatory system. The lack of cross-border cooperation and instant information sharing makes these funds like mercury pouring out, and it is difficult to effectively block them. The lack of law enforcement capabilities in the region also gives criminals more room for operation.

VI. Compliance challenges and solutions for Web3 payment companies

For Web3 payment companies, the complex and unregulated environment in Southeast Asia is both an opportunity and a challenge. On the one hand, the relaxed regulatory environment has lowered the threshold for market entry and attracted many companies to enter this market; but on the other hand, the lack of a compliance framework also means that companies need to bear higher operational risks, especially in anti-money laundering and knowing your customer, the importance of compliance cannot be underestimated.

The challenges faced by Web3 payment companies in AML and KYC are particularly obvious. High-risk VASPs and unregulated online casinos, transactions using crypto assets are easily used by criminals for money laundering activities. In order to meet these compliance challenges, companies must continuously improve internal compliance standards and establish a strong risk control system to reduce possible legal and reputational risks.

In addition, Southeast Asia's rapid development in the field of financial technology has brought unique opportunities for Web3 companies. Despite the compliance challenges, the potential of the Southeast Asian market cannot be ignored. Compared with mature markets such as Europe and the United States, the crypto asset market in Southeast Asia is still in its early stages of development. Market demand and growth rate provide huge room for growth for Web3 payment companies. Therefore, how to balance risks and opportunities is the key to the success of Web3 companies in Southeast Asia.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance 铭文老幺

铭文老幺 JinseFinance

JinseFinance Financial Times

Financial Times Cointelegraph

Cointelegraph Ftftx

Ftftx