Solana Development Series 1 — Understanding Solana

Solana is a high-performance blockchain platform that achieves high throughput and low latency through a unique consensus mechanism and account model.

JinseFinance

JinseFinance

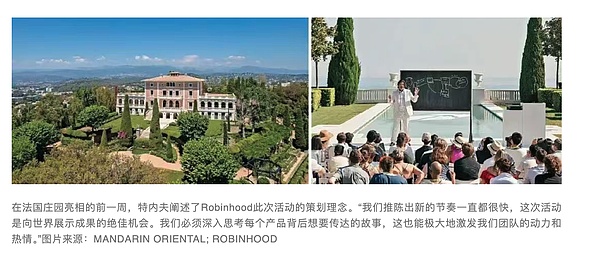

This Castle event marked Robinhood's first global product launch centered around cryptocurrency, and several major announcements were made.

Starting in July, European users will be able to trade blockchain-based "stock tokens" on Robinhood. These non-voting financial derivatives track the prices of hundreds of U.S. stocks and ETFs, including unlisted tech giants like SpaceX and OpenAI. Trading is commission-free and available 24 hours a day, five days a week. Meanwhile, cryptocurrency staking services for US users—locking digital assets in blockchain networks like Ethereum and Solana to earn returns—are finally being licensed. Following Robinhood's $200 million acquisition of the Luxembourg-based crypto exchange Bitstamp in June, users across Europe can now trade perpetual contracts on Bitcoin and Ethereum. To support this entire system, Robinhood is building its own blockchain. "Our entire industry is at a critical juncture," Tenev told the VIPs fanning themselves in the southern French heat. "This is the perfect time to prove to the world that cryptocurrency is more than just a speculative asset; it has the potential to become the cornerstone of the global financial system. Our mission is to make that possibility a certainty." To understand the revolution Tenev aims to unleash, it's helpful to review Robinhood's tumultuous past. In 2013, Tenev and co-founder Baiju Bhatt, both Stanford physics and mathematics graduates, sensed the time had come to disrupt the world of traditional finance. After graduation, they developed software for the top hedge funds that dominated Wall Street with their high-frequency trading. This experience exposed them firsthand to these funds' voracious appetite for trading volume, and their willingness to pay for it. The vast base of retail investors, accustomed to paying $10 or $25 per trade on traditional brokerage platforms like Charles Schwab, Fidelity, and Merrill Lynch, offered a valuable source of trading volume. So, Tenev and Bhatt developed a mobile app designed for novice investors. It was simple and engaging, with no minimum account balance requirements or trading commissions, knowing that hedge funds would be willing to pay to execute these retail trades. They then promoted their zero-commission platform, embracing the slogan "Democratizing investing," with the swagger of launching a blockbuster video game. Before Robinhood even officially launched, pre-registrations on the Apple App Store soared to nearly one million. By September 2019, established brokerages like Charles Schwab, E-Trade, Fidelity, and TD Ameritrade (later acquired by Schwab in 2020) had eliminated trading commissions, establishing Robinhood's "zero commission" model as the new industry standard. However, the good times didn't last. In early 2021, spurred by pandemic lockdowns and millions in government stimulus checks, Robinhood's trading volume surged. However, the platform also became the focus of a regulatory storm during the GameStop "meme stock" trading frenzy. Driven by the WallStreetBets community on the Reddit forum, GameStop's stock price soared, completely ignoring its dire fundamentals. This unprecedented volatility prompted clearing houses to impose massive margin calls on Robinhood, forcing Tenev to suspend buying of GameStop shares on the platform. This sparked widespread user outrage, and the platform subsequently faced public criticism, congressional scrutiny, and even the suicide of a young Robinhood options trader. However, the controversy did not deter Tenev. Instead, it made him more aware of the backward, closed, and inefficient nature of the US stock trading system, and it further solidified a long-held idea. "Seriously, is it possible to put stocks on a blockchain? I've always believed that the real value lies in enabling 24/7 trading," he said. Initially, Robinhood attempted to extend trading hours by partnering with Blue Ocean, an alternative trading platform based in West Palm Beach, but the effort was ultimately unsuccessful. "I didn't anticipate how difficult it would be to change this core infrastructure, given how much depends on it. I was definitely overthinking it," Tenev admitted. Meanwhile, Kobrat, the company's head of crypto, was exploring other avenues to realize Tenev's vision. Under the Biden administration, US regulators remained cautious about digital assets, so Kobrat's team chose to conduct experiments in Europe, where the regulatory framework was more defined. "Sometimes, it's easier to build new infrastructure from scratch," Tenev said. "We believe this technology can scale to any jurisdiction in the world, and we believe we can bring it to every corner of the world in the future." He knew that as millions of investors around the world began trading US stocks like memecoins, Robinhood's trading volume would grow exponentially, generating a steady stream of profits. While Kobrat was immersed in research on asset tokenization in Europe, Robinhood was quietly reinventing itself elsewhere. In March 2024, co-founder Bart, now worth $6.7 billion, departed the company (having previously stepped down as co-CEO in 2020) to pursue a new venture in space solar power. While user lawsuits stemming from the GameStop incident remain lingering, Tenev has been hard at work launching a series of new products—including individual retirement accounts (IRAs), high-yield savings accounts, a credit card offering 3% cash back (with 3 million subscribers already), a private banking service with on-demand cash delivery, and complex options tools once reserved for institutional investors. As Brett Knoblauch, managing director at Cantor Fitzgerald, put it, Robinhood is transforming into "a universal device for capturing all trading opportunities." This rapid-fire series of product launches mirrors the pace of Tenev's own life. After a moment of contemplation, the Bulgarian-born founder threw up his hands, revealing a hint of resignation: "My daily routine is to get up, work, eat, work out, and go to bed. My wife doesn't like me saying this, but I do like to integrate work into my life and make the two one." Tenev admitted that during Robinhood's explosive growth, he did not fully anticipate that this "zero-barrier" trading method would resonate so deeply with the entrepreneurial spirit. Last year, the company held a private event in Miami. The top users in attendance included not only self-taught day traders, but also small business owners and startup founders - when facing the market, they also adhered to the same "do it yourself, make a living" mentality as when they started their business. He believes this strong sense of autonomy is Robinhood's true competitive advantage: "Entrepreneurs don't like to delegate. They prefer to do it themselves." Robinhood's products are tailor-made for this group of people who crave control over their own wealth. Tenev plans to capture this new generation of investors in three phases. The first phase is to capture the active trader market, an area where investment returns are immediate, as evidenced by Robinhood's current impressive performance. In the medium term (approximately five years), the goal is to fully encompass the user's asset management ecosystem, from credit cards and cryptocurrencies to mortgages and individual retirement accounts. The third phase is to build a world-class financial ecosystem, with Robinhood's proprietary blockchain as the core pillar. "The scale of this third phase will far exceed the first two," Tenev said in preparation for the next day's shareholder meeting. "Opportunities will initially progress slowly, but over time, the effects will compound and amplify." Tokenization may be Robinhood's ultimate goal, but its core cryptocurrency business is already unstoppable. In 2024, Robinhood's cryptocurrency business revenue reached $626 million, a significant increase from $135 million a year earlier, accounting for more than a third of its total trading revenue. By the first quarter of 2025, its crypto revenue had reached $252 million. Rob Hadick, general partner at the crypto venture capital firm Dragonfly, said, "They're eating Coinbase's lunch in the US market." Cantor Fitzgerald analyst Knoblauch noted that in May 2025, Robinhood's crypto trading volume increased by 36% month-over-month, while Coinbase's declined. He acknowledged that while Coinbase still dominates the institutional client market ("they have a wider range of services and custodial capabilities"), Robinhood's acquisition of Bitstamp in June gained 5,000 institutional accounts and additional licenses in Europe and Asia. Tenev and Kobrat insist that Robinhood's operating model is fundamentally different from that of crypto exchanges like Coinbase. Kobrat said: "In this industry, people always talk about how this layer of technology (blockchain) is superior to that layer, but in the end, they completely ignore the end user. We don't build technology for the sake of flashy technology. We want to build something that people can use every day and let them feel the advantages it has over the traditional financial system." Micky Malka, founder of Ribbit Capital and an early investor in Robinhood, Coinbase and its European competitor Revolut, said that focusing too much on the competitive landscape between Coinbase and Robinhood is short-sighted. He said bluntly, "In my opinion, the core issue over the next decade will be how much market share they can take from traditional financial institutions, rather than a battle between the two companies." Knoblauch estimates that Robinhood's current $255 billion in managed assets will be comparable to Interactive Brokers (currently with $665 billion in client assets) within seven years. The next target will be Charles Schwab. According to the analyst's calculations, Robinhood has taken market share from the established brokerage for 14 consecutive months. Fourth, Tenev is equally committed to business diversification. Robinhood was once criticized for its overreliance on payment for order flow (PFOF), a model heavily reliant on high-frequency trading and Wall Street's most aggressive hedge funds. While trading still accounts for 56% of its revenue (down from 77% in 2021), John Todaro, managing director of Needham & Company, noted that Robinhood now has ten business lines, each expected to generate over $100 million in revenue within two years. Take Robinhood Gold, for example. Initially a $5 per month or $50 per year membership offering margin trading access, professional research, and a small balance return, it has evolved into the core of Tenev's robust subscription model. Current membership benefits include a 4% yield on cash in brokerage accounts, interest-free margin loans of up to $1,000, and a 3% contribution subsidy on individual retirement accounts. The newly launched Robinhood Gold service is available for purchase at a discounted price. The Gold credit card offers 3% cash back on all purchases and has already been issued to its first 200,000 customers. Knoblauch stated, "If Gold reaches 15 million users, annual subscription revenue will approach $1 billion. This marks a shift in the company's business model from highly cyclical to stable recurring revenue, thereby diversifying its overall revenue structure." ”

In addition, Robinhood has launched "Robinhood Strategies." This is a new product of human-machine collaborative intelligent investment advisory developed under the leadership of Tenev, targeting the $60 trillion US wealth management market dominated by traditional giants such as Morgan Stanley and Merrill Lynch. The service has an annual management fee of only 0.25%, and the annual fee for Robinhood Gold members is capped at $250. Users can obtain a customized portfolio of stocks and ETFs managed by algorithms and manually supervised. Since its launch in March, this disruptive platform has attracted $350 million in funding.

Tennev likens the company's new product development model to scientific experiments - empowering small teams within Robinhood to test hypotheses and obtaining real-time feedback from users on innovative solutions directly through social media channels.

Tennev said: "Many companies just follow external trends, copy them, and do some competitive tricks. We launch new products or new features because we like to explore and solve problems on our own. " Robinhood's recently launched home mortgage business—currently offering a 30-year fixed rate of 6.1% and a $500 closing fee subsidy—developed from a secret online pilot launched in June. "After the news leaked, it instantly took social media by storm, and later I tweeted out that we were doing a pilot. That tweet was probably my most popular tweet this year."

Tennev's tokenization strategy has a bit of a "moonshot" color.

Many crypto regulations are still under discussion in the U.S. Congress, but have already been implemented in Europe, making Europe a testing ground for Robinhood. He explained, "The experiment we are conducting in Europe is to see what Robinhood would look like if it were completely rebuilt on a crypto infrastructure. We will then evaluate the pros and cons and introduce the essence of the EU version of the application to the U.S. and other global markets. ”

Currently, the scale of stock tokenization is still small. xStocks, an emerging platform under Switzerland's Backed Finance, is still a new thing, but it is already in a leading position in the industry. It has tokenized the stocks of more than 60 well-known listed companies such as Apple and Amazon, and listed them for trading on major crypto exchanges such as Kraken and Bybit. However, xStocks' average daily trading volume is still less than US$10 million. This model has many structural risks: these tokens are actually derivatives backed by off-chain assets, which means that when regular corporate actions such as dividends and stock splits occur, or when other events occur when the market is closed on weekends, it may cause confusion in collateral calculations and even lead to involuntary liquidation risks.

Dragonfly's Hardik pointed out: "Market makers must bear this risk, but how can they hedge the risk when the market is closed? If they want to bear this risk, they can only significantly widen the bid-ask spread and charge high fees. Currently, the off-chain infrastructure is not yet perfect, and the on-chain products are not yet mature... I am worried that these early-stage products will eventually become useless. ”

Despite this, this has not prevented other participants from joining the game.

In June of this year, Gemini, owned by the Winklevoss brothers, cryptocurrency investors, launched a tokenized trading service for MicroStrategy shares for EU customers. It is reported that Coinbase is seeking approval from the U.S. Securities and Exchange Commission (SEC) to conduct tokenized stock business. Even Larry Fink, CEO of BlackRock (with assets under management of $12.5 trillion), has urged the SEC to approve the tokenization of stocks and bonds. Robinhood is more radical - in addition to stocks of listed companies, its tokenization map has extended to non-listed companies. It recently announced the launch of tokenized stocks of OpenAI and SpaceX, two companies with valuations of more than $300 billion. OpenAI immediately issued a statement to draw a line, emphasizing that the company has never authorized or recognized such tokens. Hardick warned, "No founder wants to see their equity circulating on the chain, and it is in the hands of people they don't know at all. ”

He admitted that “the system is still a bit cluttered,” using a derogatory jargon in the programmer community, referring to the software that has too much unnecessary or outdated code. “The major brokerages don’t want us to take away their stock resources easily. But what if self-custody is achieved in the future? Once you can tokenize stocks and keep them yourself, you are completely free from the constraints of the brokerage system—just like loading a crypto wallet on MetaMask, Robinhood, or Coinbase, in almost all scenarios in the future, you will be able to seamlessly hold and buy and sell stocks through any trading interface. ”

This is why Tenev is so determined to make Robinhood the “only tool” for young users to handle all financial affairs. In the field of retail financial services, the power of user inertia is second only to the compound interest effect. Customers themselves are sticky, but Tenev knows that as the “baby boomers” transfer trillions of assets to the descendants of digital natives, traditional financial giants such as Fidelity, Charles Schwab and Merrill Lynch are showing defensive disadvantages. In fact, he believes that the biggest competitors are not institutions such as Coinbase or Fidelity, but technology companies such as Anthropic and OpenAI: “These companies move the fastest and do the most interesting things. But it is too early to assert that ChatGPT will subvert the financial industry. ”

As an early investor in Robinhood, Malka is revered by Tenev as a mentor. Forbes estimates that his company has made more than $5 billion in profits from its holdings. The investor made no secret of his admiration for Tenev: “Robinhood has a leader under the age of 40 who is born with AI thinking, is well versed in AI development trends, and is proficient in tokenization technology. He can use these two strategies to perfection - there are very few people who can do this. We have just built the infrastructure and are about to usher in the 'Internet moment' in the field of money, when anyone in the world will be able to save using the same financial product. As the credit assessment system becomes more accurate and efficient, the cost of borrowing will also decrease. All of this will become a reality. Tenev is convinced that Robinhood will eventually replicate and enhance the services of high-net-worth family offices through AI agents, realizing its vision of a “family office in your pocket.” AI is at the core of Tenev’s vision, and the former mathematics PhD candidate recently co-founded the AI startup Harmonic and serves as its chairman. He co-leads the company with computer scientist Tudor Achim, who previously led the autonomous driving startup Helm.ai. In July, Harmonic completed a $100 million Series B funding round with participation from Kleiner Perkins, Paradigm, and Sequoia, valuing the company at $875 million. The lab, which specializes in “mathematical superintelligence,” is developing an advanced reasoning engine that it claims can “ensure accuracy and eliminate illusions”—undoubtedly a useful feature in an era of deep integration of AI and finance. "It would be huge if an app could solve the Riemann hypothesis or one of those millennium puzzles," Tenev mused, referring to some of mathematics' deepest unsolved mysteries. "I don't want to be just a spectator. I want to be a part of it." Jamie Dimon, Larry Fink, Ken Griffin—Wall Street bosses, take note.

Solana is a high-performance blockchain platform that achieves high throughput and low latency through a unique consensus mechanism and account model.

JinseFinance

JinseFinancePUMP.FUN is a phenomenal performance application in the track, which is worth studying and discussing repeatedly. PUMP.FUN Dune can explain the new track business model from the aspects of platform, user, product behavior, activity, growth trend, etc., which is worth tracking.

JinseFinance

JinseFinanceNigerian court delays bail for Binance exec amid new legal submissions and ongoing financial scrutiny.

Alex

AlexFrax Bonds are similar to traditional bonds but operate on the blockchain, providing returns comparable to short-term U.S. Treasuries in traditional finance.

JinseFinance

JinseFinanceThe FTX/Alameda saga continues to keep the crypto industry on its toes.

Bitcoinist

Bitcoinist Beincrypto

Beincrypto Finbold

FinboldOn day three of El Salvador’s financial inclusion and funding for SMEs conference, Bitcoin has stolen the show.

Cointelegraph

CointelegraphGAM Investments has called fake news on a fabricated announcement claiming it would invest $3 billion to help Luna/UST recovery efforts.

Cointelegraph

CointelegraphSharyn Alfonsi, journalist and 60 Minutes correspondent, interviewed Mike Peterson, one of the people who funded the Bitcoin Beach project and encouraged crypto adoption.

Cointelegraph

Cointelegraph