Author: 0xkyle0xkyle, Researcher Source: X, @0xkyle Translation: Shan Ouba, Golden Finance

As you can see, the market is in a stalemate. Narrative themes are nothing more than the result of local outperformance during uptrends, driven by liquidity shifts - but in a downtrend like now? These themes will disappear throughout the day, leaving people like me with nothing to do!

I don't care too much though - to be honest, I'm quite happy. The price drop means this is a perfect time to relax and research the token, and buy in when liquidity inevitably flows back - but will it?

So today, I just wanted to write down my thoughts.

Long-Term Crypto View

I remain very bullish on crypto from a generational timeframe perspective; I don’t want to repeat the old “it’s revolutionizing finance” clichés, but I did write a great tweet explaining my thinking - and yes, I think it’s important to be optimistic not only from a “market cap” perspective, but also from a career perspective if you’re in the industry.

Limitations of Short-Term Market Predictions

Narrowing down a bit, I’m on the fence about where the market continues to go in 2025. This is where my macroeconomic knowledge is weak, because I can’t really understand the big picture. I know the basics, but I don’t have any concrete data on whether a rate cut is bullish or bearish (my initial thinking is bullish in the long term, bearish in the short term), nor do I have any real-world experience with similar macroeconomic situations to refer to.

I’d like to say I’m optimistic, but to be honest that’s more of a prayer than a statement. 2025 looks like it’s going to be a good year - given the current odds for a Republican president, we can assume Trump will be president - if we follow that line of thought, that seems to mean easier credit policy, a more risk-taking environment, and most importantly, easier cryptocurrency policy (Trump recently said he wants “Bitcoin to be made in the USA!”)

Well, the risks here are:

1) If the Democratic candidate wins - they don’t seem to be that bullish on cryptocurrencies;

2) If Trump wins, that doesn’t mean all is well either - we’ll likely have a bad macroeconomic situation as stocks are at all-time highs right now and some very, very bad indicators are flashing that haven’t been seen since 2008 (check out “The Game of Trading”).

Unfortunately, this long story has only one conclusion: I don’t know! My base case is bullish for 2025, which is what I laid out - a Republican president, looser monetary policy, and a continuation of the overall upward trend, with some hiccups in between.

Bitcoin in the Short Term (LTF)

Now that we’ve set the overall bullish tone for 2025, what is my view on Bitcoin in the short term (monthly and weekly?)? I think Q4 2025 through 2026 will be very good for risk assets, meaning cryptocurrencies - but I don’t think cryptocurrencies will continue to do well now.

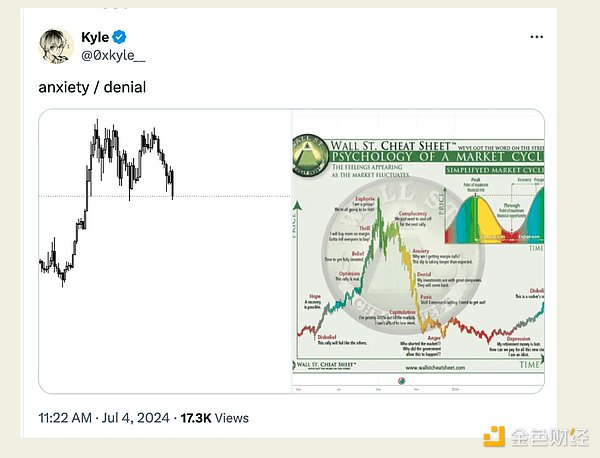

In fact, despite Bitcoin’s run from $53,000 to $58,000, I’m still very bearish. I have been extremely bearish since the FOMC policy meeting a few weeks ago when Bitcoin failed to break $72k while stocks continued to rise. Clearly, it is past time to be overly bearish, as the old GCR saying goes: Extremely bearish at the top, a little less bearish at the bottom.

I am still bearish, but cautious - I have bought a fair amount of spot at $53k as these are generally good levels to get spot exposure. On the perpetual account, I am still short some of the higher market cap tokens and hedged with some long Ethereum positions.

Where do you think this move will end? Well, I'm more inclined to think we're closer to the "angry" phase now (the tweet above was written before Bitcoin hit $53k); $53k is where people started getting angry, so another drop to around $40k makes more sense to me.

I do think we'll see a rally between $53k and $60k, but I think any sign of hitting $60k should be sold; I can see people getting extremely optimistic and saying "I told you so" and "it was just a blip" when $60k is reclaimed.

Could I be wrong?

Of course, I'd be wrong if Bitcoin goes up. But I'm just kidding. If Bitcoin can reclaim the $60-62 range lows and hold, I’ll turn technically bullish; but more importantly how altcoins react to that - I want to feel the urge to take risk before I go all bullish. So far, these rallies (e.g. $53k → $57k) haven’t been like the “risk on” scenarios of January/March, but more like classic bear market rallies/forced liquidation buying.

Still, even if I’m wrong, I have nothing to worry about - again, that’s why I bought spot at $53k! I’m probably a little smaller than I thought, but that could easily change; I’d rather miss the bottom and buy later than be right and be long here.

So, what’s next?

To summarize:

Long term: Bullish

Now: Bearish

I don’t know where it will end, but I’d be more inclined to say Q3/Q4, simply because of the “slow market season” in the summer (it has some credibility, I won’t go into details); in short, summer is slow market season, trading is light, a lot of sell orders (Mt. Gox/German government), but in Q3/Q4 - FTX asset return (said to be 16 billion?), ETH ETF listing, and a potential bullish Q4 (like we see in 2023).

So what’s next? Well, in order to welcome the risk-on conditions, we need to be ready! I’m not going to beat around the bush and just tell you the themes that I think will do very well once risk-on conditions return again:

1. ETH ETFs and DeFi

Spend 5 minutes on Twitter and you’re bound to see a post trying to assess the “impact of the ETH ETF”; therefore, I don’t think I need to explain to you why the ETH ETF is bullish. Some people think the ETH ETF will be bearish because of Ethereum’s overall performance this year - I don’t think past performance is indicative of future returns.

If we get risk-on conditions again, the tailwinds for ETFs seem very positive to me - it’s as simple as that.

2. Real World Asset Tokenization (RWA)

Coupled with the ETH narrative is the narrative that “institutions are entering the market” - therefore, tokens associated with this narrative will do well. Expect speculators to rush in with enthusiasm, asking about the next “RWA with ties to BlackRock”.

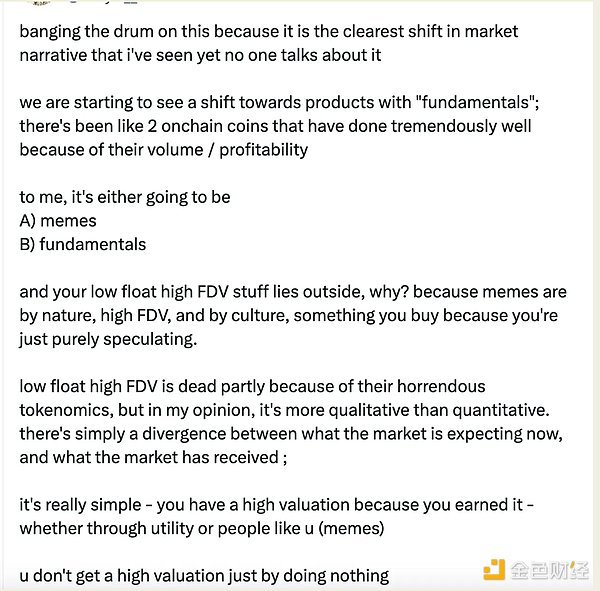

3. Fundamentals

I’ll spare you my long thoughts on this subject again - but I do tweet about it frequently. Essentially, I think coins that can do things will be the hardest to send. We already have some on-chain coins (BANANA and ACX); we haven’t seen the rest of the market move yet;

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Others

Others

Beincrypto

Beincrypto Future

Future Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph