Author: David C, Bankless author; translation: Jinse Finance xiaozou

Over the past week, Crypto Twitter has been heatedly discussing a new popular metric: Real Economic Value (REV). This metric was launched by Blockworks Research to track the actual costs paid by users for using the blockchain - including basic transaction fees and MEV tips.

REV (Real Economic Value) is a standardized metric for measuring the accumulation of blockchain value generated by user activities. It includes in-protocol transaction fees and out-of-protocol tips paid by users for transaction execution, so it can reflect the monetization demand of on-chain transactions. - Blockworks

The metric has quickly become popular as a signal of block space demand and a tool for evaluating real on-chain usage, and recently highlighted Solana's status as a high-value creation platform. Although people generally recognize its value, no one regards it as the only key metric.

The core of the debate is extremely subtle: how much weight should REV have in blockchain valuation? Should it be a core value signal or one of many indicators? Is it being abused by certain groups that promote a particular narrative?

We explored the Twitter discussion in depth and extracted the most representative views below.

The most popular REV insights are as follows:

▪️ REVis a strong starting point for analysis

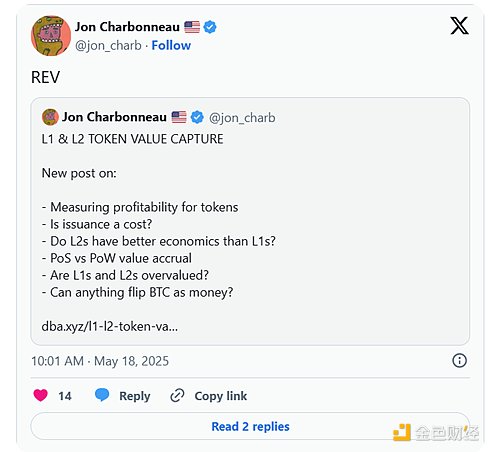

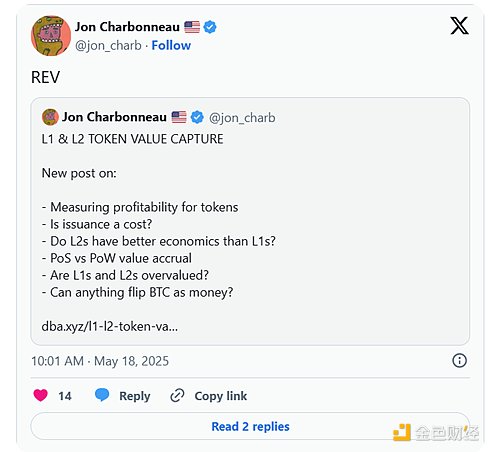

DBA Crypto co-founder Jon Charbonneau (who first proposed REV as a valuation framework for L1/L2 tokens in November last year) believes that REV is similar to the role of revenue in stock valuation in traditional finance, providing a specific benchmark for blockchain evaluation. He emphasized that although a single data cannot cover all information, as the market matures, REV can develop into a more sophisticated valuation model.

It is particularly important to pay attention not only to the current REV value, but also to its long-term quality and sustainability. A chain that generates competitive fees consistently due to high transaction volume (Hyperliquid and Ethereum as examples) should receive a higher valuation multiple than a temporary congestion fee because it implies greater future earnings potential.

▪️ REVis a clear but incomplete signal

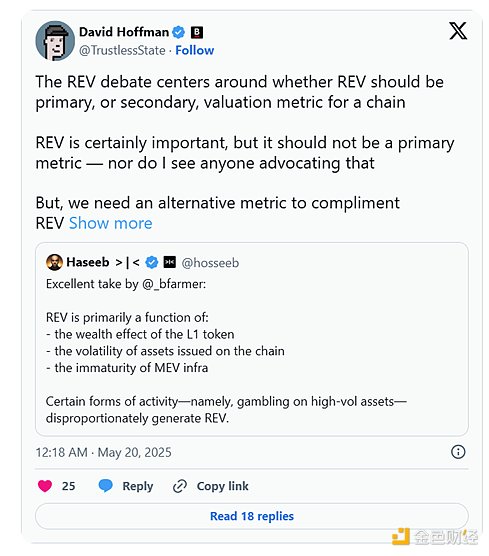

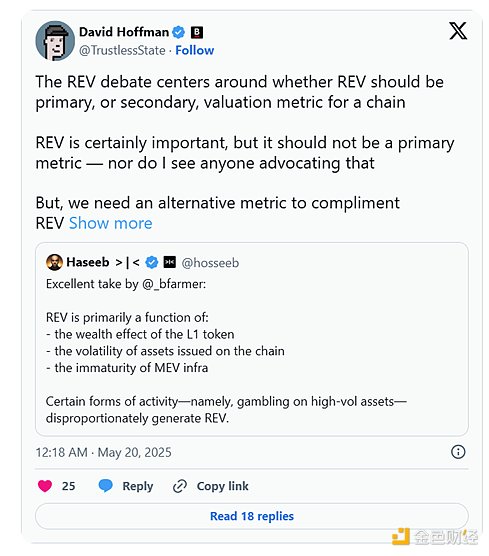

David Hoffman puts it simply: REV is useful—but not a panacea. It directly shows users’ willingness to pay for on-chain services, and even if it is not perfect, it is still an effective demand measurement tool.

He is puzzled by the recent resistance to REV in the Ethereum community. The core narrative of Ethereum is that it has the most valuable block space, and if users pay the highest fees for it, REV should reflect this. When REV verifies this narrative and is denied, it is obviously contradictory.

David proposed an explanatory framework: chains such as Solana that optimize fast state transitions (high-frequency trading) will naturally produce higher REV; Ethereum focuses on state storage, and its value cannot be equally reflected through REV. He still regards REV as a secondary indicator, similar to a simplified discounted cash flow model (DCF), which needs to be used in conjunction with other indicators. As for what specific supplementary indicators are, Ryan is exploring the answer.

▪️ REV’s value is beyond imagination

▪️ REV’s value is beyond imagination

Spire founder Mteam.eth defends REV: Although it is not perfect, it is extremely practical.

His point of view is very pragmatic: the problem is not REV itself, but people’s misunderstanding. "All models are not the right one, but some are useful." He believes that REV is one of the useful ones. Blockchain is not a business, and REV is not revenue - but it does reveal the intensity of demand for on-chain services and reflects users' valuation of block space, and should be included in a broader evaluation toolbox.

But this is by no means a shortcut to blockchain valuation. Solana's REV may be 2-4 times that of Ethereum, but the token value may not be higher. Judging the value of the chain based on REV alone is like evaluating a company based on revenue alone - completely ignoring the dimensions of profit and growth.

▪️ REVextremism ignores the overall picture

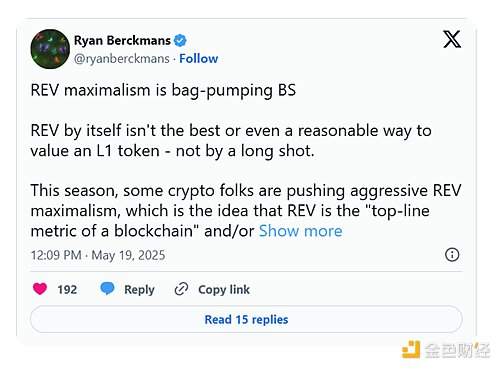

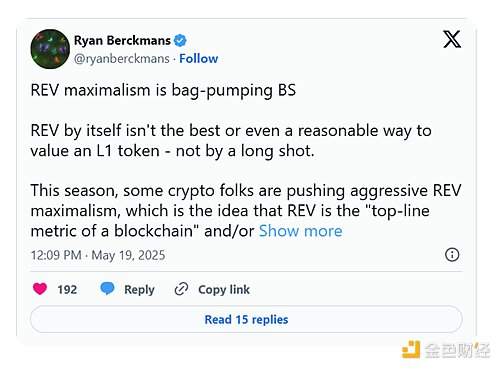

Ryan Berckmans, a member of the Ethereum community, disagrees with the REV craze, pointing out that while REV may have its uses, it is overrated by some people to be the core indicator of L1 token valuation.

He emphasized that L1 is a confidence asset (like gold or currency), not a company. Valuation should be a combination of multi-dimensional indicators and market confidence. If REV determines everything, Tron's market value should reach 290 billion US dollars - this is obviously contrary to reality.

▪️ Short-term REV cannot predict long-term value

▪️ Short-term REV cannot predict long-term value

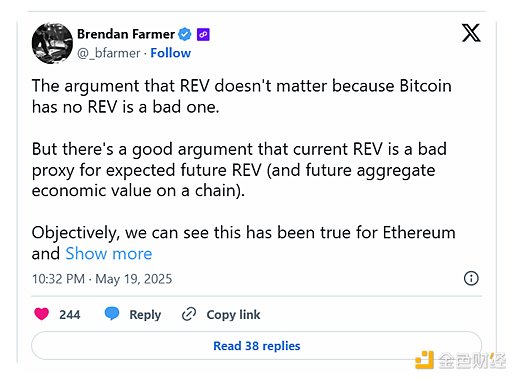

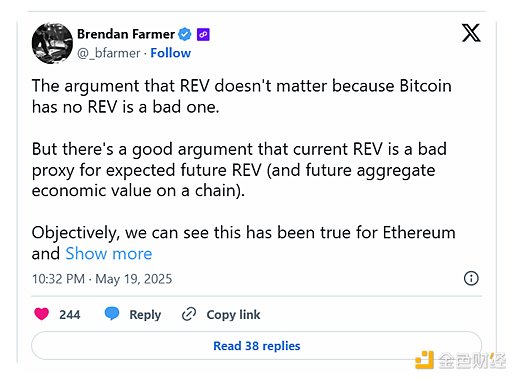

Polygon co-founder Brendan Farmer did not completely deny REV, but believed that it was often misused, especially in the short-term framework.

For example, Ethereum's annualized REV peaked at $21.6 billion and Solana reached $6.6 billion, but both have fallen sharply. If REV can strongly predict long-term value, these peaks should have been more accurately mapped to price or activity.

He believes that short-term REV mainly reflects the wealth level of users, the volatility of network-issued assets, and the immaturity of the MEV market. Over-optimizing REV may sacrifice affordability and user growth, and ultimately backfire.

▪️ REVis a proxy for on-chain GDP

▪️ REVis a proxy for on-chain GDP

Paradigm co-founder Matt Huang interprets REV from a more macro perspective of blockchain valuation. He believes that the ultimate goal of smart contract platforms is to become a truly non-custodial currency - decentralized like Bitcoin but programmable. This means not only storing value, but also supporting a wide range of financial activities without intermediaries.

From this perspective, REV is not a goal itself, but a proxy for estimating real on-chain GDP. The ultimate measure of platform utility should be GDP rather than token speculation. REV reflects GDP by capturing pricing activity (which is harder to fake), but it can still be manipulated, and overly narrow optimization can backfire.

It’s not just the size of on-chain GDP that matters, but its relative share. If ETH or SOL ultimately fail to become a platform for large-scale storage and use of value, Huang believes that its long-term value will be difficult to maintain. REV helps us observe this trajectory, but it is not the end in itself.

Consensus Zone:

There’s more to actual consensus than it seems: No one considers REV the only metric, but few people advocate ignoring it entirely. Supporters affirm that it captures the true dimension of users' willingness to pay; skeptics warn that it is easily abused and cannot independently support judgment.

What is the compromise position? REV is a useful supplementary tool - but it is by no means complete. The best use is to analyze it together with indicators such as stablecoin trading volume, TVL, developer activity and long-term user retention.

In a rapidly iterating ecosystem like the crypto field, there will never be a single indicator that is the final word. REV is undoubtedly an important part of the puzzle of many indicators - but don't mistake it for the whole picture.

Weatherly

Weatherly

▪️ REV’s value is beyond imagination

▪️ REV’s value is beyond imagination ▪️ Short-term REV cannot predict long-term value

▪️ Short-term REV cannot predict long-term value ▪️ REVis a proxy for on-chain GDP

▪️ REVis a proxy for on-chain GDP