Author: flowie, ChainCatcher

Today, the price of XRP broke through $3 for the first time since 2018. As of press time, the price of XRP is now $3.17, with a 24-hour increase of 9.2% and an increase of more than 30% in the past week. The overall increase is far higher than the overall crypto market. In addition, the price of XRP is very close to its historical high of $3.4 in January 2018.

On January 15, local time in the United States, the last day of the appeal submission deadline, the U.S. Securities and Exchange Commission decided to appeal the Ripple case and asked the appellate court to review the relevant ruling. However, the market generally believes that the SEC is "wasting time" and the new SEC under the Trump administration will take a more friendly attitude towards encryption, especially such a typical case as Ripple.

In addition, expectations for the XRP ETF remain strong. In a recent interview, Ripple President Monica Long said that XRP is likely to be the next crypto spot ETF after Bitcoin and Ethereum. Especially with the change of government, the approval of these applications will accelerate.

In addition, last night, the CPI and PPI data were released one after another, and the core PCE inflation was lower than expected, which boosted the confidence of investors in the crypto market. The crypto market also ushered in a general rise.

The price of XRP also took this opportunity to rise again. As in its previous style.

XRP was issued in March 2013 and began trading in April 2014. The total issuance was 100 billion pieces and the issue price was 0.0000007 yuan.

XRP has been unique since its birth. In a simple summary, it has been sideways for several years in a bear market, and it has been rising for half a year in a bull market, and it has been "Optimus Prime" once it has risen, and it has risen by more than 3 times or even more than 10 times in more than ten days.

The first surge in XRP dates back to the bull market in 2017. XRP has been sideways for more than 700 days. Starting from the beginning of March 2017, it rose from about US$0.005 to US$0.054 in one month, an increase of more than 10 times.

After a short-term decline of about 50%, it went sideways again for about a month. Starting from the end of April 2017, it rose from about $0.37 to $0.4 in half a month, an increase of 11 times.

Then it fell by 60% again, and then went sideways for nearly 200 days, until it continued to rise from $0.24 on December 12, 2017, and broke through the historical high of $3.4 on January 8, 2018. In less than a month, XRP rose again by 14 times.

That is to say, from March 2017 to January 2018, XRP experienced three short-term bursts of more than 10 times in more than half a year.

However, with the end of the bull market that started in 2017, XRP also fell sharply, falling 80% from a high of $3.4 to around $0.7. After several rounds of shocks, it fell to a low of $0.14 and remained sideways at around $0.2 for 2 and a half years.

Until the start of a new bull market in 2020, XRP began to show signs of recovery at the end of 2020. Starting from the beginning of November 2020, it rose from around $0.25 to $0.69 in about 20 days, an increase of nearly 3 times.

Then it fell back 60% again to around $0.21, and after 2 months of continuous pull-ups, it returned to $0.62 on February 14, 2021, an increase of 3 times.

It was sideways at $0.4-0.6 for 1 month. Starting from March 2021, it rose from $0.41 to $1.84, rising more than 3 times again. After rising 3 times, it fell back and rebounded repeatedly, and there were many 1-2 times rises, but XRP failed to break through $1.84.

In summary, in this round of bull market that started in 2020, XRP rose 3 times in a short period of time 3 times, and rose 1-2 times in a short period of time many times.

With the end of this round of bull market in 2020, in June 2022, XRP fell to around $0.3, returning to the state at the beginning of this round of bull market. Subsequently, XRP continued to trade sideways around $0.4 for more than a year and a half, until July 12, 2023, when XRP rose from $0.47 to around $0.81 in two days, an increase of nearly 1 times, but then fell sharply and traded sideways for more than a year.

It was not until November 2024 that the real explosion began, rising from around $0.5 to $3.17, an increase of nearly 6 times in more than two months.

Ripple's dealer method: attracting institutions to ship and cooperate with favorable factors

In the bear market, the price of XRP is stable at $0.2-0.5. Each bull market has risen several times, and the multiples are also relatively regular. It is difficult to say that it is a normal market phenomenon. It is almost a clear result of dealer manipulation.

In 2020, the SEC's lawsuit against Ripple revealed Ripple's method of attracting institutions to sell and cooperating with favorable market conditions.

XRP's chips are very concentrated, and Ripple and its team hold most of the XRP, so it is very easy to control the market.

The total supply of XRP is 100 billion. In the initial distribution of tokens, 80% was given to Ripple Labs, and 20% was allocated to the three founders Jed McCaleb, Chris Larsen: Arthur Britto, who received 9 billion, 7 billion, and 4 billion respectively.

Over time, Ripple Labs reduced most of its XRP holdings, selling them to institutional investors through over-the-counter transactions and to retail investors through cryptocurrency exchanges. The founders also sold XRP for cash many times.

Currently, 57% of XRP is actually in circulation (the total supply is 100 billion, and the number of XRPs in circulation on the market is about 57 billion). According to the quarterly report released by Ripple, the XRP currently held by Ripple is divided into two parts, one part is directly held through the wallet, and the other part is locked in the ledger escrow and released monthly.

According to the top 100 XRP holding addresses counted by coincarp.

The top 10 addresses hold more than 40% of the total, and 6 of them are Ripple wallet addresses, with a total of 30% of the total;

The top 20 addresses hold more than 50% of the total;

The top 50 addresses hold about 63.83% of the total.

The top 100 addresses hold as much as 71.82% of the total.

Among the top 100 addresses, Chris Larsen, executive chairman of the board, has 6 wallets holding more than 2.8 billion in total, accounting for more than 2.8%. Another co-founder, Arthur Britto, has 7 wallets holding more than 1.3 billion coins in total, accounting for more than 1.3%.

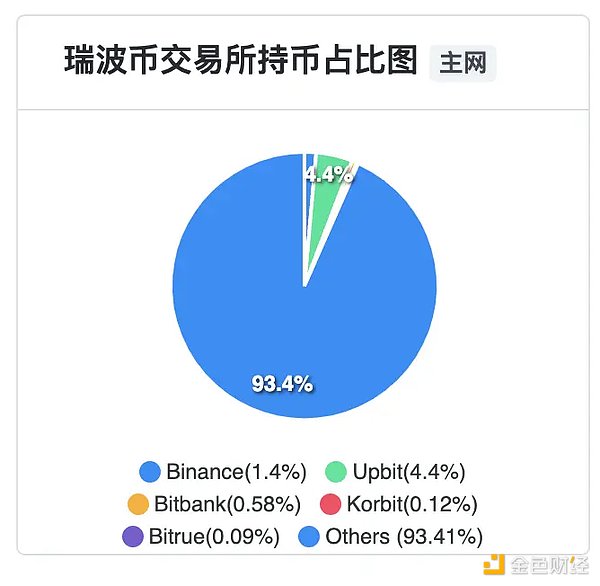

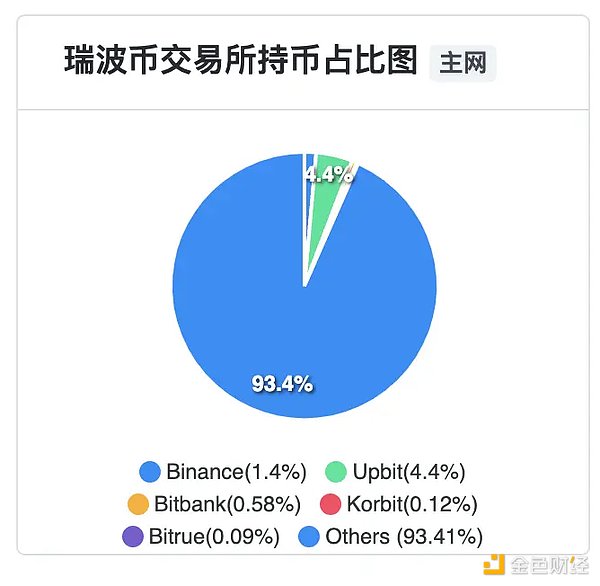

Except for Ripple, most of the wallet addresses in the top 100 currency holding addresses are exchanges. Upbit, Binance, Uphold, and Bithumb, the crypto exchanges with the highest number of XRP, hold 5.9 billion, 2.05 billion, 2.02 billion, and 1.45 billion, respectively, accounting for 5.9%, 2.5%, 2%, and 1.45%, respectively.

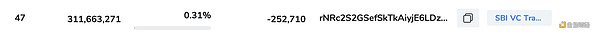

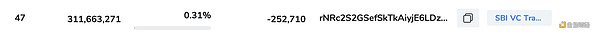

SBI Holding, a Japanese consortium closely linked to Ripple, also owns more than 310 million XRP, accounting for more than 0.31%.

XRP transactions on Upbit, the exchange with the most XRP, are also an important driving force for the recent surge in XRP.

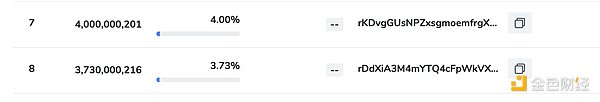

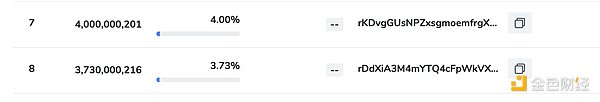

In addition, there are two unknown addresses rDdXiA3M4mYTQ4cFpWkVXfc2UaAXCFWeCK and rKDvgGUsNPZxsgmoemfrgXPS2Not4co2op, each holding more than 3.5 billion XRP, accounting for more than 3.5%.

In addition to Ripple, the crypto exchanges that hold the most XRP are an important force driving XRP prices.

SEC lawsuit Ripple documents show that in July 2019, a senior vice president of Ripple cooperated with a US cryptocurrency exchange company to allow XRP to be traded on the exchange. In an email sent to the other party, he said, "The main use case of XRP today is speculation, and exchanges are the main promoters of this use case."

Recommended reading: "SEC decrypts Ripple's market manipulation techniques: attracting institutions to sell, cooperating with favorable factors to pull the market"

Ripple not only uses XRP to pay fees to these exchanges, but also provides rewards for reaching trading volume indicators.

Ripple has spent a lot of energy to control XRP prices and trading volumes. For example, it uses algorithms to determine the amount and price of XRP sold to the market; and pays certain market makers rewards for reaching trading volume targets.

Ripple also has an "XRP market team" to monitor XRP prices and trading volumes. They will regularly communicate with Ripple's XRP market makers about XRP sales strategies to ensure that the amount of XRP sold does not exceed a certain percentage of XRP's daily trading volume.

Ripple co-founders Larsen and Garlinghouse will also soon join the "XRP market team" to make various control instructions.

Ripple's common market-making method is to pull the market with good news. For example, on September 20, 2016, Ripple's vice president of finance sent an email to the market maker, saying that all $300,000 should be used to buy XRP within 24 hours of the announcement.

In June 2020, Ripple employees provided reports such as Garlinghouse and Larsen that due to Ripple's sales of XRP, XRP began to perform lower than Bitcoin, and hoped that Ripple would buy back XRP.

Garlinghouse then approved the repurchase plan, and Ripple disclosed in its third quarter 2020 market report in November 2024 that Ripple had purchased $45 million worth of XRP.

This is also the first surge in XRP in this bull market that started in 2020. As mentioned earlier, XRP rose from around $0.25 to $0.69 in about 20 days, an increase of nearly 3 times.

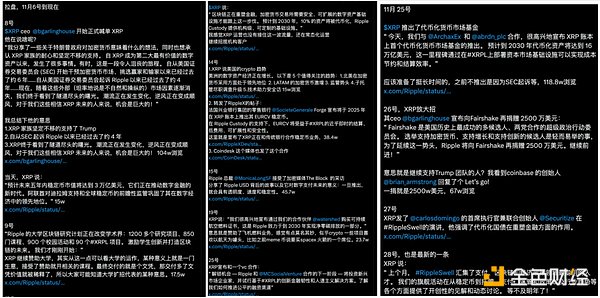

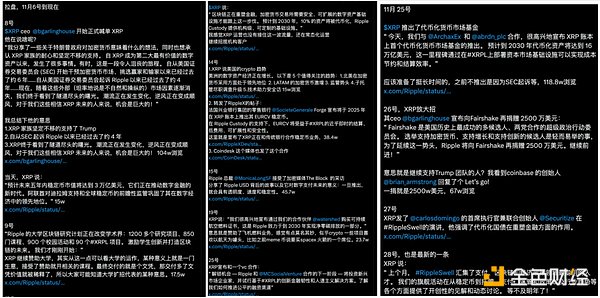

The rhythm of XRP's surge in this bull market is also in line with the news. Crypto KOL @sky_gpt has sorted out the whole process in detail.

During the two-week sideways period before November 2024, Ripple intensively outputted news related to the business outlook of XRP through interviews with CEO Ggarling House, reports, and various news, and the weight of the news seemed to be gradually upgraded from light to heavy.

During the pull-up period from November 6 to early December, compared with some of the more vague industry outlooks issued during the sideways period, Ripple began to announce a confirmed new project landing plan and kept up with the hot spots. For example, it announced a tokenized market fund and multiple partners, indicating that XRP supported the Trump administration and really donated funds.

The pace is also more compact than the sideways period. Not only did many Ripple executives accept interviews, but Ripple also steadily output news almost every day or two.

XRP lacks practical use

Although Ripple has repeatedly emphasized the various benefits in payment, stablecoins, and tokenized funds, in fact, XRP has no practical use in past businesses, and the future role of XRP in its ecosystem is still unclear.

Among Ripple's three major products, xCurrent, ODL cross-border payment platform and xVia, the only product that can use XRP is OLD, which was launched in 2018. XRP is equivalent to the medium of funds conversion in cross-border payments. The payer exchanges the legal currency for XRP and sends it. The recipient who receives XRP can then exchange XRP for the legal currency of the region.

Although Ripple tried to promote the platform and the use of XRP through official subsidies, it did not receive much attention due to the high cost.

Ripple has never disclosed the revenue of cross-border software. Compared with the software business, what really makes Ripple a lot of money is selling coins. In 2019, a foreign media website Owler analyzed Ripple's total revenue, of which 80% came from selling coins.

In the past year, Ripple has been selling XRP almost every quarter. As mentioned above, as of September 30, 2024, the total number of XRP it holds is 4,436,713,796. The number of accounts in custody is 38,900,000,005. In the same period last year, on September 30, 2023, the total number of XRP was 5,258,162,324, and the number of accounts in custody was 41,300,000,005.

In the past year, XRP has been reduced by almost 3.22 billion pieces. Calculated at a price of about $0.5 per piece during the period, Ripple has earned more than $1.6 billion from selling coins in the past year. XRP CEO Garlinghouse and Executive Chairman Larsen were also disclosed by the SEC that they had sold XRP before 2020 and made a total profit of about $600 million.

Weatherly

Weatherly