Author: David Lawant, Vivek Chauhan, CoinDesk; Compiled by: Deng Tong, Golden Finance

One of the key factors in the success of Bitcoin is the emergence of new trading infrastructure and investment methods, and opening them up to New investors. This trend is accelerating with the recent launch of spot BTC ETFs.

With the exception of liquidity providers and trading platforms, we don’t yet know much about how these massive changes will alter the Bitcoin market structure.

As market structures mature, we canexpect inherent volatility to decrease. Here, we explore how several key shifts associated with the launch of spot ETFs are contributing to this change.

Revise ETFs to market price references

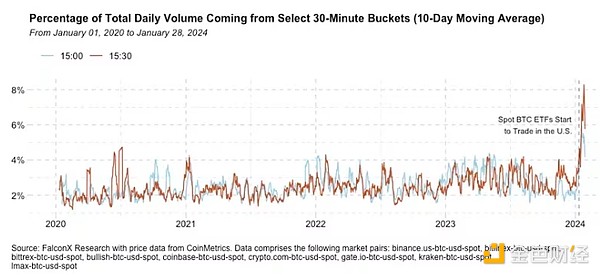

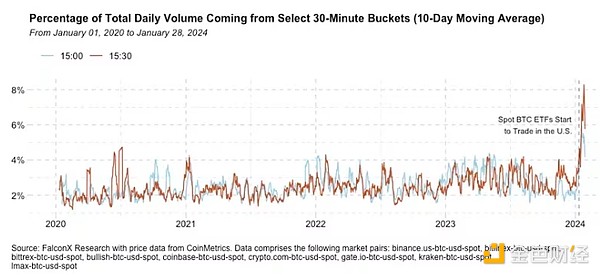

The recent launch of ETFs has apparently resulted in underlying spot Bitcoin trading Significant increase in volume. It’s worth noting that a disproportionate share of thisincrease in trading volume occurs primarily between 3pm and 4pm ET, or close to ETF pricing time.

The chart below shows the daily Bitcoin trading volume percentage starting from 3:00 to 3:30 PM ET, for major trading pairs. Trading activity in these two time periods, which generally account for less than 5% of total trading volume, now accounts for 10-13%.

By providing more and more The more transparent and consistent a reference point recognized by more market participants, ETF fixing allows investors to aggregate large trades at the same time, thereby reducing their market impact and overall market volatility.

A new options market surrounding ETFs?

Three exchanges currently listing spot Bitcoin ETFs have asked the U.S. Securities and Exchange Commission (SEC) to allow them to list options on these ETFs. These applications can take anywhere from one to eight months to be evaluated by the SEC, and there are some complexities related to their clearing and settlement processes.

If this new class of options is approved, the Bitcoin options market could get a significant boost. The Bitcoin options market is currently divided between investors who trade on offshore exchanges that are inaccessible to Americans or on platforms used only by large institutions. Allowing options based on spot Bitcoin ETFs could significantly expand the options market beyond these two markets.

Overall, the Bitcoin options market should continue to increase in importance in 2024, even after last year’s huge growth. A moremature options market can reduce volatility because it allows investors to express a broader range of investment strategies and allows even the most liquid ETFs to become more liquid. It also amplifies the importance of events such as options expiration and trader positioning as drivers of price action.

ETF brings Bitcoin revolution

It is exciting to see the ETF revolution now having a positive impact on the Bitcoin market. The launch of spot Bitcoin ETFs is here and will likely continue to increase investor participation, perhaps similar to the launch of gold ETFs in the early 2000s.

In just over two weeks since its launch, the daily trading volume of the spot Bitcoin ETF has exceeded $1.5 billion. To put it into perspective, this volume is roughly equivalent to 20% of Bitcoin’s volume on a good trading day in the spot market.

As innovation in cryptocurrency ETFs continues, we expect ETF-related trading activity to continue, which should dampen Bitcoin volatility and aid the maturation of this emerging asset class.

JinseFinance

JinseFinance