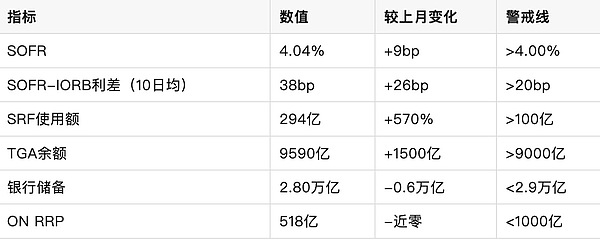

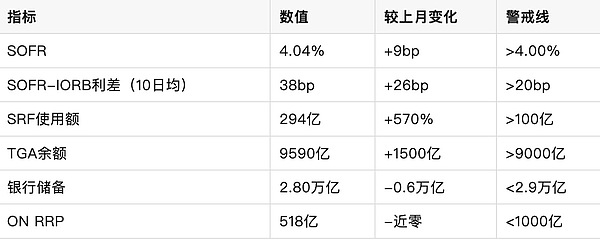

On November 5, 2025, the US federal government shutdown entered its 35th day, tying the longest shutdown in history. This deadlock stems from the disagreement between Republicans and Democrats in Congress over the budget bill. Democrats demanded an extension of the Affordable Care Act subsidies, while Republicans refused to compromise, leading the Senate to reject the temporary funding bill passed by the House of Representatives 14 times. During the shutdown, taxes continued to be collected, but federal spending was largely frozen. Approximately 700,000 employees were furloughed without pay, airport security delays affected 3.2 million passengers, the SNAP food assistance program only disbursed 50% of its benefits, and the Head Start children's program was partially closed. The economic impact is already evident: the Congressional Budget Office estimates a weekly loss of approximately $1.4 billion in GDP. If the shutdown continues, a liquidity crisis will become the biggest concern. The financial system's "pipelines" are showing signs of strain. The U.S. financial system's short-term funding market relies on approximately $3 trillion in overnight repurchase agreements (repo) transactions. These transactions are secured by Treasury bonds, with banks, money market funds (MMFs), and primary dealers lending dollars to each other daily to ensure smooth payment and settlement. A key metric is the Secured Overnight Financing Rate (SOFR), which reflects actual borrowing costs. On November 3, 2025, the SOFR was 4.04%, 4 basis points higher than the Federal Reserve's interest rate on outstanding reserves (IORB, upper limit 4.00%), marking the sixth consecutive day it had exceeded the upper limit, with the 10-day moving average spread reaching 38 basis points. The Federal Reserve does not set a single interest rate, but rather a corridor: the lower limit is the ON RRP rate (4.00%), and the upper limit is the IORB and the Standing Repurchase Facility (SRF) rate (4.25%). Normally, the SOFR should fluctuate below the upper limit. However, since September 2025, the SOFR has repeatedly exceeded the upper limit. On October 31, the single-day SRF usage reached a record $50.35 billion, and on November 3, it reached another $29.4 billion, indicating that the private market was unwilling to lend, forcing institutions to seek assistance from the Federal Reserve. The unsecured side is also under pressure. The Federal Funds Rate (EFFR) is trading at an average of $8-9 billion per day, with the October moving average 12 basis points higher than the ON RRP. Dallas Fed President Logan warned on October 31 that "if the recent rise in repo rates is not temporary, the Fed will need to launch asset purchases (QE)." Chairman Powell also specifically mentioned "pipeline strain" in his November speech. The Treasury General Account (TGA) has become a liquidity "black hole." The TGA is the Treasury's "checking account" at the Fed. In a normal year, the target balance for TGA is $850 billion, with tax revenue flowing in and being quickly spent to replenish bank reserves. Before the shutdown in 2025, the Treasury Secretary had increased TGA from $300 billion to $850 billion, exhausting the ON RRP buffer (leaving only $15 billion). After the shutdown, tax revenue continued to flow in at an average daily rate of tens of billions, while spending was almost zero, causing TGA to surge to $959 billion (weekly average as of October 29), an increase of $150 billion compared to before the shutdown. Every $1 increase in TGA means $1 is withdrawn from the banking system's reserves. From July to October 2025, bank reserves fell from $3.4 trillion to $2.8 trillion, and the proportion of M2 fell to 13%—the last time this level was reached was when three large banks, including Silicon Valley Bank, collapsed in 2023. ON RRP is nearly exhausted (only $51.8 billion on November 3rd), and can no longer serve as a "shock absorber." The triple squeeze: QT + new debt + shutdown. The Fed is reducing its holdings by $95 billion monthly, resulting in a continuous drain on reserves. On October 29th, the FOMC announced the end of QT on December 1st, but it was too late. The massive bond issuance will necessitate a $2.1 trillion deficit in fiscal year 2025, requiring the daily issuance of tens of billions of dollars in government bonds. Buyers will need to prepare US dollars in advance, further draining reserves. If TGA (Tax Payments) increases by another $50 billion per week, $200 billion in reserves will be depleted in a month. The tax season (January-April) will exacerbate the situation. The Fed's net liquidity indicator (balance sheet - ON RRP - TGA, inverted) has surged in two months, the DXY dollar index has risen to 108 during the same period, and the 10-year US Treasury yield is approaching 4.8%. Bitcoin and the S&P 500 fell 1.1% and 0.8% respectively this week, and the VIX rose to 21. **Crisis Transmission Path** **Phase 1: Repurchase Out of Control** **If SOFR rises to 4.30% (SRF cap + 5bp), primary dealers will flock to SRF, with daily usage potentially exceeding 100 billion yuan, exposing reliance on the "lender of last resort." **Phase 2: Reserve Shortage** **If the reserve/GDP ratio falls below 11%, banks will reduce on-balance-sheet leverage and decrease government bond underwriting. Regional banks bear the brunt of the pressure—by 2025, three small and medium-sized banks already had non-performing loan ratios exceeding 5%. Phase Three: Credit Freeze Money market fund redemptions → Private repurchase halt → Payment chain disruption. The probability of a repeat of the SVB event in March 2023 rises to 30% (Goldman Sachs model). Phase Four: Systemic Shock The Federal Reserve is forced to restart QE, purchasing $200 billion in bonds monthly, causing the 10-year yield to plummet by 50 basis points, the dollar index to collapse below 100, and triggering a loss of inflation expectations.

Latest data overview (2025.11.4)

Fed Contingency Plan

Suspension of new debt issuance

The Treasury Department has implemented special measures (partially implemented in October).

Congressional breakdown path

Most optimistic: On November 6, Senate Majority Leaders Thune and Schumer reached a compromise, the House of Representatives reconvened on November 10, and temporary funding was allocated until January 2026. Most pessimistic scenario: Market closure delayed until December, TGA exceeding 1.1 trillion, SOFR surging to 4.50%, triggering a "flash crash". Investor Response: Increase holdings of 3-month Treasury bills (yield 4.15%). Hedging Tail Risk Buy VIX call options and gold ETFs. Focus on Trigger Points If SOFR breaks below 4.10% or SRF exceeds 50 billion in a single day, reduce holdings of risky assets. The government shutdown, initially a political farce, has escalated into a systemic threat against the backdrop of a liquidity crunch. The Fed has raised red flags: SRF usage on November 3rd hit a new high since the pandemic. If Congress delays for another week, TGA will drain another $100 billion in reserves, and SOFR could spiral out of control. History tells us that the 35-day shutdown in 2018 only caused a 0.1% loss in GDP, but today reserves are only 70% of what they were then, and the ON RRP buffer is exhausted; any slight disturbance could ignite the powder keg. Reopening the government is the only key to stopping the crisis.

Hafiz

Hafiz