Original title: "On Alpha and Edges in Crypto" Original author: Tyrogue Original compilation: Luccy, BlockBeatsThe difference between Alpha and Edge

What is Alpha and how to use it

How to cultivate Edge, and how to build your own intuition in crypto

When to buy the dip

When to short haram

In CT (cryptocurrency community), the words Alpha and Edge are often mentioned, but they actually mean What are you wearing?

Simply put, Alpha is information that you can use to make money. There are different types of Alpha, and different Edges required to make money with it. Edge refers to the ability to profit from a market due to an understanding or skill set that a participant has that others do not. Edge and Alpha are different sides of the same coin.

Alpha = actionable information

Edge = ability to take advantage of this information

There are many variations of this, let’s break it down.

3 basic types of "alpha"

Time-sensitive alpha

This would be news trading and speculation, being able to take risky positions where the likelihood of success is high. Examples of this include leaving cryptocurrencies short Cronje in 2022, or going long FTT, which has recently exploded.

Alpha based on mass psychology

Whether you are familiar with technical analysis such as icons, or know a certain Some fractals related to airdrops are a good example. Despite poor fundamentals, it is profitable to buy hacked or bankrupt projects, SOL, FTT, CEL, SRM are all good examples.

Look, LUNC provided great returns in the final bear market. This can also be extended to GCR making large purchases at 10 SOL and 1,000 ETH and 15,700 BTC bottoms. Popular psyche screams contagion and worse is coming, but it still isn’t coming (at least not yet).

Intuition

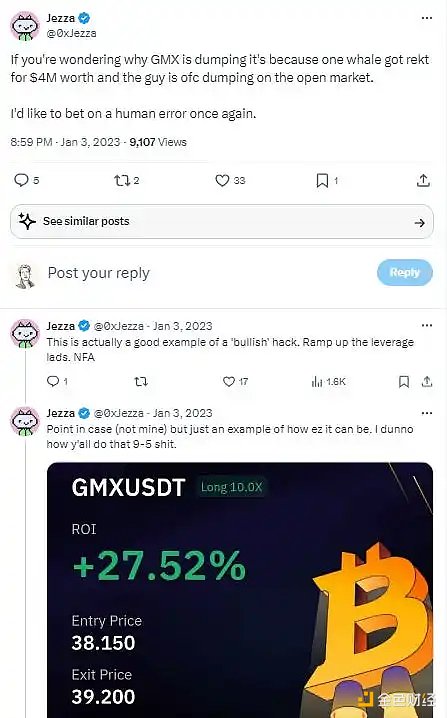

The ability to know, feel, and accurately predict what will happen. This is the hardest to develop, and many people don’t have it. I've seen this with multiple CT (cryptocurrency community) members like @outpxce and his ability to understand the game; @0xJezza and his ability to accumulate, sell and enter on-chain transactions with low risk; @smileycapital Get ahead of the crowd with predictions on price, gains, and market trends; @ZoomerOracle discovers new bright coins that are outperforming the market (TIA, ZETA, BEAM); and @GCRClassic's killer views and predictions on the market.

Analyzing GCR's views on the market, you can begin to understand how his intuitions are formed: he combines Schelling points with unit bias and market Combined with human psychology, it reaches the level of genius. He has instincts built from a background in political forecasting, and best of all, it comes easily to him.

If you have the right intuition, making money should be easy. If you've been in this business long enough, the best strategy may be the simplest strategy. Whether you buy FTT when the market starts to rise in 2023, buy APT when you see SOL starting to recover, buy when BEAM rebrands, nodemonke goes public, or PANDORA starts to have escape velocity, being able to quickly change strong beliefs to win is the right way to win . Let’s illustrate with an example:

Example 1: Buying any hacks or exploits when they are not a fatal blow to the protocol - GMX A whale was exploited for 400 on GMX million, this is a bullish sell signal.

Example 2: Go short or long based on the market trend and use this to make a profit. Hands down, the easiest trade of the last year was the announcement of the Blackrock ETF and noticing the market's reaction to the intern's fake tweet (may his soul rest in peace).

Example 3: Waiting for a push from the team or a scam pump (not all projects are scams, but you know what I mean). If you can find projects that won't go to zero and simply spot buy when volume decreases and selling slows, the team will use announcements and drivers to stimulate positive price action when market conditions are right.

Doing research on AVAX before it announced the Cultural Incentive Grant, researching Pengus and how they slowly evolved into the pfp of choice, researching MC's reinvention into BEAM, There are many more examples.

However, the most important principle behind all of this is to be flexible and adapt to whatever the market has to offer, that is, to participate in currently booming market sectors. NFTs, Leverage, Onchain and DeFi, you just go where the money is. Know how to go short/long on CEX, have funds there ready for capitalization, have an ETH or a few bands on each semi-qualified chain and L2 to grab new opportunities as they arise. Having a close friend who can invest in you when you're not at your computer and more.

To summarize the posts so far:

Alpha is the information that makes you money< /p>

Edge is your ability to make money with this information

Alpha can be found in many ways, Everyone has different advantages in this market. Find your strengths, build on them, and win.

The methods for success will change with the seasons. So the key to winning is to always adapt and never forget to turn off your mid-brain and either become a stupid ape or a giant brain. There is no second place in the market.

Some quick thoughts on cycles, phases, beliefs, and profiting from the markets

< img src="https://img.jinse.cn/7182176_watermarknone.png">

Nowadays, most people in the cryptocurrency field have various Minor coins and mainstream coins, which can be worth six to seven figures in the future, will sell prematurely due to a lack of cycle belief.

If you don't have belief that some form of crazy high is coming (maybe a distribution, double top, single top, etc.), you will sell too much morning. In order to capture the crazy multiples found only in cryptocurrencies, you must be able to:

Know when to take risks

Know when to take profits to re-buy at a lower price

Know when to hold firm and expect huge moves to the upside< /p>

And knowing when to run away

Imagine buying ETH for single digits and then Selling after the DAO hack because there was no belief in ETH at the time, or hearing about Vitalik's false death. Imagine buying AVAX at a double digit low price and then selling before the second FTX and 3AC double top of 2021. Or selling LUNA in the single digits after its first crazy high while it was over $100 at its peak.

I know a guy who sold 20 Boring Apes for a few ETH before the 2021 NFT season really started.

The easiest way to truly get ruined in this space is to borrow other people's beliefs and not understand what you are actually doing in this space. When you buy a token, you should know:

What is its potential appreciation, that is, how high it can rise, its token economics , FDV, what factors can make it rise sharply.

Is this technology any good? Good technology may become a good meme, it may be a new L1 technology, or it may be a new consensus, but try to understand it after entering the market so that you know what you are getting.

Are you an early or late participant in the story? If you get involved early, you can go all-in and hold a large spot or leveraged position and just monitor the position. If you participate late, you may only be able to seize the opportunity of the decline. If you get there early, you might be able to give it your all before the crowd arrives, but leave much sooner than you think.

You should also know about the competitors and holders of the token, they are:

A follower who will never sell because of his true beliefs? Such as TAO, KAS.

Are you a meme coin trader who sells on -70% candles to invest in other coins? Such as the recent meme coin sell-off.

Are institutions and VCs waiting to dump on retail investors after unlocking, or driving the rally before then? Like the cycles before TIA, SOL

Will retail investors keep bidding until they have no savings whatsoever?

Token economics, holders, and storylines, study the combination of all three to find out if you can make money with the token you just discovered. What is the market cap of this token? How does it compare to other coins? What is the likely cap market cap of this token?

Some coins will never exceed $100 million. Others are destined to become multi-billion dollar tokens. Others, despite having great PMFs, are destined to only reach $10 million because people will only bid on storylines. You have to be realistic about the multiple your token can provide, but optimistic enough to see if it can outperform. It's a tricky balance.

Next, what is the liquidity and purchase process of this token? When RLB was only pennies, SOL seemed to be dead, but as long as you see the revenue and users of the product, and then hold on to it like a diamond, ignoring the panic and volatility, you can capture this A sweet 20-50x return per coin. Typically, the earlier a token is purchased, the more difficult it is to purchase.

TAO At that time, the OTC market was between $10 and $25. The purchase process was quite complicated and only true believers could enter. It now trades for many times its original price, with early buyers being rewarded.

In a bull market, there are countless ways to make huge gains, and there are countless ways to lose everything when the market falls. Your job is to follow the bull market, watch for the moment when almost everyone is already in, and then quickly start exiting before the liquidity disappears, the charts turn red, and people turn on each other like hungry demons, eager to get their money back.

Stop thinking about how to win the next market move and start thinking about how to succeed throughout the cycle. There will be countless tokens to invest in the crypto market, countless NFTs, and new innovations will emerge, all you need to do is listen to the market and pay close attention. Even now, the next unicorns in crypto are being born, and you have to be ready when their tokens launch. But you have to have a deep understanding of yourself and your knowledge of the market to take the right actions to win. Some people will make millions trading with leverage, some will do it with tokens held on-chain, some people will just have the right spot tokens, the right NFT mints, etc. Find the path that works for you, but also know how to succeed using other paths in the market.

If history repeats itself, we are now about 18 months into a bull market, but it will be difficult. You may want to sell early, or, at the top, you may believe that this time is different and that we have finally created the future of finance. You'll want to quit before the party is over, but you probably won't squeeze enough juice out of that orange before it's over.

No cycle is truly different. The drivers of bubbles may be different from inflation, apocalypse, and modernization, but the behavior is the same. A group of people believe a new asset, stock, or commodity is the next big thing, and credit expands to keep prices climbing until the bubble bursts and the market moves money from the hands of the many to the hands of the few. Just as there will be another bull market cycle, there will be another bear market.

There will come a time to call it all smoke and mirrors again, but in this current moment, for the crypto natives who are here to stay, it's all are shiny new objects.

You have to be prepared, you have to believe.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Coindesk

Coindesk Tristan

Tristan Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph