Author: Zixi.eth Source: X, @Zixi41620514

We have recently made a macro-oriented material. Recently, in the blockchain industry, it is time to decide the overall primary and secondary investment direction, similar to the end of December 22. At present, all tokens except BTC and solana have performed relatively averagely, and the market has responded coldly, thinking that the bull market may be over. But we are still optimistic about the market in the second half of this year and next year. This kind of market with the most serious long-short divergence, whether it is primary or secondary, as long as the right direction is made, it is the most profitable time.

Therefore, I will first put out our core views on the market and give some opinions on the four mainstream tokens.

TL:DR:

Whether it is the interest rate cut in September, the regulatory policy of the SEC, or Trump's support for crypto, from the perspective of the US economy and politics, it is a big boon to the crypto market.

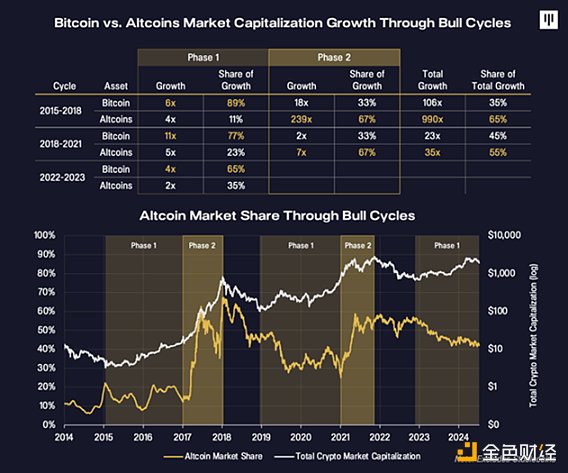

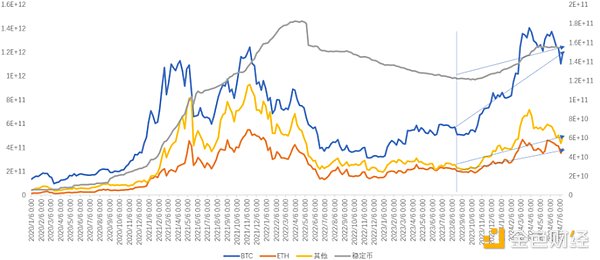

Analogous to the past two cycles, the current bull market is Stage 1, that is, Bitcoin leads the rise, Bitcoin's market share rises, and the market share of Shansai Coin drops sharply. This period may continue for a few months. Next year will be the bull market Stage 2 led by altcoins. (See Figure)

Holding BTC in the past six months is still the best choice, but in the second half of this year, you can consider replacing it with ETH or Solana. Since the ETF was approved, the ETF has increased its holdings by 303,000 BTC in half a year, holding a total of 950,000 BTC, accounting for 4.5% of all BTC. In addition, for BTOEcosystem, in the past six months, we believe that the only way to focus on developing how to provide BTC Holder trustless with financial management and liberate the liquidity of large households is correct, which can be seen in the data of SolvProtocol.

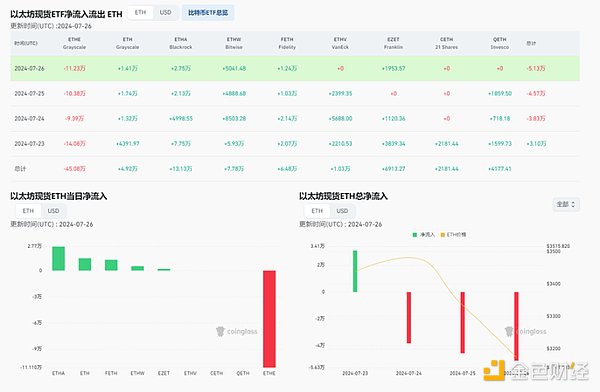

ETH is very suitable for building positions in the second half of this year. After ETH began trading on Nasdaq on July 23 this year, it will repeat the process of Grayscale selling BTC at the beginning of this year. The selling process may last for half a month to one month until the market can catch Grayscale's selling. Once this critical point is reached, it is a very good time to build a position. We suggest paying attention to the BTC/ETH exchange rate in the second half of this year. Once the Grayscale net outflow ends, it is time to build a position (the logic refers to the process of Grayscale BTC net outflow ending in February this year and BTC rising 20%-30% in one month).

Solana We are still optimistic about it in the long term. There are hot products every quarter. Those who have goods still hold firmly and do not sell them. Those who don’t have goods can consider building a position at a low price. Their 2C ecological construction capabilities are really strong. FTXLiquidation solved it perfectly in the first half of this year. The cost price is 80, and the current price is 170-180. It has now begun to unlock. It is the most correct decision we made in the second-level OTC in the first half of the year. In addition, SolanaETF has also been submitted, and it is expected to make progress next year. The SEC also cancelled the judgment that Solana is a security. Following the hit product DePIN at the end of last year, Solanaecosystem has launched another hit product this year, Pump.fun (one-stop meme coin + casino), which earns one million US dollars a day and 80 million US dollars in half a year.

Ton We are bullish in the short and medium term, but we need to observe in the long term. At the current price, I am still very cautious about OTC, but you can consider buying directly in spot. We have a chance to make money with Ton, but our chances with Tonecosystem are relatively small

1. The money in the currency circle comes from the capital pool of the financial market

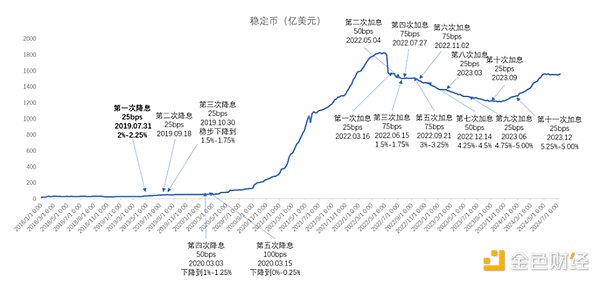

Under macroeconomic regulation, such as when interest rates are cut and money is printed in large quantities, these funds will naturally flow to the trading market. Since 2020, the crypto market has begun to be highly positively correlated with US stocks. Since the beginning of 2021, when the crypto industry has grown into a trillion-dollar track, it has been closely related to macroeconomic interest rates. In the 17-20 cycle, it is not related to interest rates because the volume is too small. The amount of hot money in the market can be measured by the amount of stablecoins minted. At the end of 2021, the total number of stablecoins in the market reached an ATH of 162 billion US dollars. Even after half a year of rising momentum, the number is still only 150 billion US dollars.

Second, the annual rate of the unadjusted CPI in the United States in June was 3.0%, far below the market expectation of 3.1%, and fell sharply to the lowest level since June last year.

The annual rate of the US unadjusted CPI in June was 3.0%, far below the market expectation of 3.1%, and fell sharply to the lowest level since June last year. The monthly rate of CPI after seasonal adjustment in June was -0.1%, the first negative value since May 2020. The market is betting on the possibility of a rate cut in September, which has reached 90%+. According to CICC's macro materials, this round of rate cuts is mainly to return interest rates to a neutral level. Macro analysts believe that the reasonable US Treasury bond interest rate is 4%, corresponding to a rate cut of 100-125bps. The time for this round of benchmarking should be 2019.

Third, after the shooting, Trump's probability of being elected president on Polymarket has reached 60%+.

Trump's monetary policy in his second term is still to pursue a substantial interest rate cut and balance sheet expansion, which in turn will lead to an increase in inflation, which is usually a major positive for the crypto market and the U.S. stock market. In addition, Trump opposes the new energy industry and advocates boosting the traditional energy industry. At present, mining is a major consumer of traditional energy, which is why he is very concerned about Bitcoin production capacity-he wants all future bitcoin to be minted in the U.S.

Trump was quite contemptuous of crypto in 2019 and had little understanding of the industry. In December 2022, he issued his own NFT card. In 2024, he began to hold crypto, with assets exceeding $10m, including $3.5m of TRUMP (meme), $3m of ETH and some meme coins. At the Bitcoin Conference in Nashville, Trump had a very wonderful speech (odaily.news/post/5197170). How much of the content can be cashed out is still a matter of opinion.

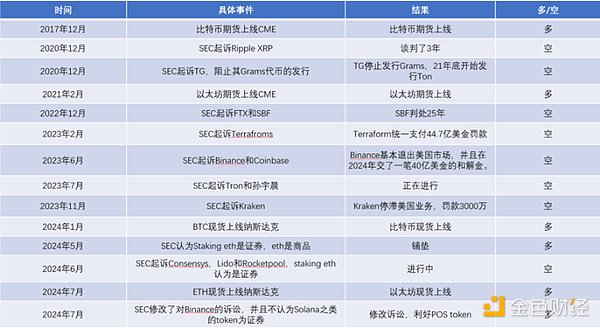

In addition, you can look at the recent series of attitudes of the SEC, which are generally optimistic.

Fourth, the market value of stablecoins reached the lowest circulating market value of 121.1 billion US dollars in this cycle on October 2, 2023

Now it has rebounded to 155.8 billion US dollars, a year-on-year increase of 28%, which means that 34.7 billion US dollars have actually flowed into the market. The inflow of only 34.7 billion US dollars led to: BTC grew from 545 billion US dollars to 1.2 trillion US dollars today, an increase of 120% (not only the inflow of stablecoins, but also a large amount of buying from ETFs.) ETH performed the weakest, growing from 208 billion to 390 billion US dollars, an increase of 87% Altcoins performed second, growing from 235.6 billion to 490.1 billion US dollars, an increase of 108% (new projects were launched, so the growth here is somewhat exaggerated)

V. The performance of the above tokens is very consistent with the reservoir model we talked about before, and the liquidity is gradually decreasing. The reason why Ethereum has not performed as well as Bitcoin in the past six months is:

From the perspective of the new narrative, this year, apart from staking (Lido) + restaking (Eigenlayer) + LRT, Ethereum has no substantial innovation in infra and business model, and it is more about constantly nesting dolls.

Ethereum's technical expectations are gradually coming to an end. In the ETH/BTC growth phase from 2021 to 2022, everyone was optimistic about Ethereum because with the continuous growth of users, Ethereum Gas was extremely expensive (GWEI was usually above 70 at the beginning of 21-22, a transfer tx was 2-3 u, and an NFT interaction was at least 50-100 u). Therefore, everyone started to do op/zk L2. After two or three years, although L2 has shared a large part of the interaction pressure for the main network, the massadoption that everyone hoped for at the time did not appear. On the contrary, doing L2 is no longer a technical problem, which caused the L2 with a high valuation in 22/23 to fall continuously after the issuance of the coin.

BTC passed the ETF and had Nasdaq's buying, while ETH had not passed the ETF six months ago.

Liquidity is not enough, and it is far from the process of liquidity overflow.

Sixth, for BTC (and its ecosystem), although the macro-economic outlook is optimistic in the long term, it can be considered to be converted into ETH/Solana in the second half of this year:

From the timeline of half a year, the inflow of BTC ETF is still quite healthy. ETF holds about 950,000 BTC, and increased its holdings by 303,000 BTC in half a year. ETF holders account for 4.5% of the total BTC.

Trump pays great attention to BTC. This can be seen from Trump's attitude towards mining, energy, interest rate cuts and regulation at the Nashville Conference.

The interest rate cut should have the greatest impact on BTC, and funds will flow into BTC first.

The BTC Ecosystem has stalled slightly, but Trustless provides U-based/Sansai Coin-based financial management for BTOHolder. Ecological projects are all clinging to Babylon's thighs. If Babylon can cooperate with traditional ETFs and bring BTcSecuritysharing to other POS chains to provide security services, it will be a great benefit to Babylon's ecological projects.

Seventh, for ETH (and its ecosystem), the short-term bearish outlook is that the ecosystem innovation is stagnant, but the medium- and long-term macro outlook is optimistic.

SEC believes that ETH is not a security but a commodity, but STETH is a security, which is not a good thing for StakingFi related projects (such as Lido).

If Grayscale repeats the process of selling BTC in the early stage, the growth rate of ETH in the first half of the month will most likely not look good. Grayscale sold 600,000 BTC to only 300,000 BTC in half a year, and sold 18 billion US dollars at an average price of 60,000. Grayscale still has 7.4 billion US dollars of Ethereum, which needs to wait for the market to digest.

All (asset) innovations of Ethereum in this round are based on Eigenlayer. The staking ratio of Ethereum in the past four years has reached 28.21%, and the restaking ratio in half a year has reached 4.8%. Eigenlayer is all asset innovation, which is a typical self-entertainment style.

Appchain-type RAAS is still built on Ethereum, and infra has been very well done. The future hit may be Ethereum's appchain.

Eighth, Solana is optimistic in the long term, and there will be hot products every quarter.

FTXLiquidation has been successfully resolved, and linear release has begun in July. The average daily market selling pressure is 3.6-4 million US dollars (180-190 prices).

Solana ETF has submitted an application and is expected to be approved in 2025.

The 2C ecosystem is getting better and better, and the user experience is very smooth. It once surpassed Ethereum to become the largest on-chain casino. Pumpfun has become the most successful application product in the past six months (pump.fun/board), with a cumulative revenue of 80 million US dollars and a daily profit of one million US dollars.

Ninth, Ton is bullish in the short and medium term, but it is limited by the liquidity of chips and whether the ecosystem is sustainable, and it needs to be observed in the long term.

1. Continuing from our previous point of view on Ton, Ton has the opportunity to grow, but the Ton ecosystem may not have the opportunity. The Ton ecosystem can be seen as a wilder and less regulated WeChat applet ecosystem. Most of the games currently developed are brainless games, such as tap 2 earn, and most of the users are airdrop hunters. Limited by the product game model, the actual on-chain interaction conversion of web2 users does not exceed 10%. Although there are phenomenal game products, they are not sustainable. After one day of airdrop distribution, the project is basically over.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Beincrypto

Beincrypto Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist