Author: Alex O’Donnell, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Based on historical market performance data in US election years, the bullish momentum in the cryptocurrency market may slow down after the inauguration of US President-elect Donald Trump on January 20, 2025.

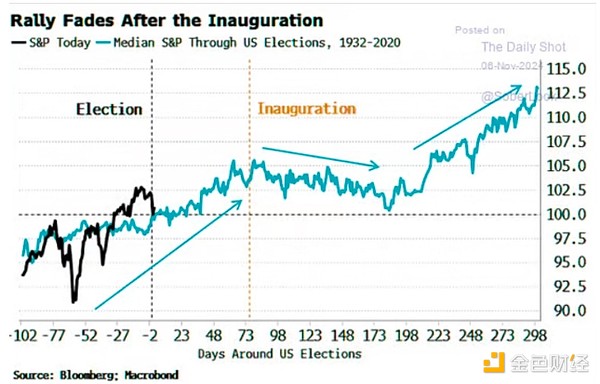

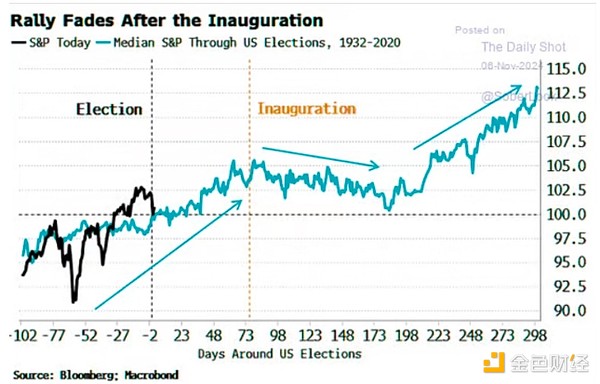

In the United States, stocks and cryptocurrencies such as Bitcoin perform well in the weeks after the presidential election, and then cool down after the president-elect takes office, according to data from Bloomberg and researcher Macrobond Financial.

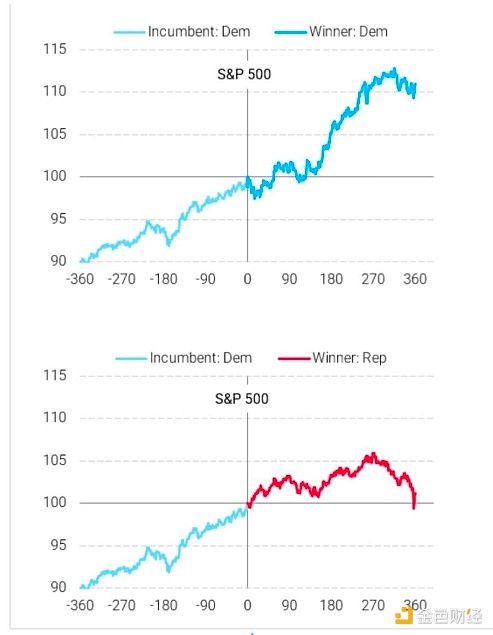

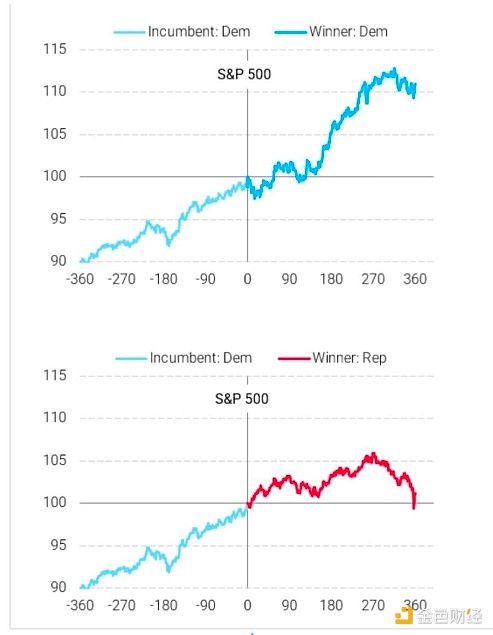

This is particularly evident when the incumbent president is a Republican, according to data from research group TS Lombard. Republicans are generally seen as more business-friendly, sparking greater market excitement after the election.

According to reports, Citigroup U.S. equity strategist Scott Kronert wrote in a November research note: "Investors should strategically retreat from the post-election rally if the S&P 500 exceeds our year-end bull market target of 6,100, which is roughly consistent with the 5% increase in the index since Election Day."

Data shows that market performance rebounded after the initial correction after the inauguration.

Post-election rally

As of December 2, the S&P 500 was 6,047, up nearly 4.5% since November 5, according to Google Finance.

Cointelegraph Research said that cryptocurrencies surged after Trump's election, with many saying his victory would benefit the industry.

Bitcoin's price gains were particularly pronounced, with the world's most popular cryptocurrency up more than 30% after the election. Solana has also seen similar gains.

Other analysts believe that Bitcoin's rally will continue after the inauguration, although there will be bumps along the way. Ryan Lee, chief analyst at Bitget Research, said that BTC prices could pull back 30% before resuming their bullish trend.

“Historical data trends show that Bitcoin could still correct by as much as 30% before reaching a cyclical high,” the analyst noted on November 27.

Such a correction would hypothetically bring Bitcoin prices down to around $70,000 per coin.

Web3 investment firm MV Global noted that investors expect the cryptocurrency bull run to continue until 2025 and peak in the second half of the year.

Weakened correlation?

Binance Research said that historically, Bitcoin has been "considered a risk-on asset that is closely correlated with the U.S. stock market" — particularly the Nasdaq, an American tech index — but that relationship has weakened in recent months.

"Since March 2024, the 30-day rolling correlation between Bitcoin and the Nasdaq has fallen to 0.46, one of the lowest levels in five years," Binance said.

Still, a nearly 50% correlation with U.S. stocks means BTC faces significant risk from a broader market downturn.

According to MacroAxis.com, Ethereum (ETH) has an even higher correlation with the Nasdaq, at around 0.66.

JinseFinance

JinseFinance