Author:Token Dispatch, Nishil

Foreword

Last week, my social media was flooded with Monad boxes. Anyone else like me, unable to resist logging in every day to open one? It felt like going back to childhood, opening blind boxes, cricket cards, Pokémon card packs—all that excitement condensed into a few clicks of the mouse. We've grown up, but some habits never disappear.

Speaking of old things, I often think that if people from the 2000s tried using payment apps and banking services now, they would hardly feel any difference. Why is it that instant messaging has evolved to the point where anyone can send a message to anyone in the world with a simple click, but when I try to send money, the internet suddenly seems outdated?

Besides the commonly used and well-known codes, the HTTP standard also includes some other defined but rarely used codes, one of which is HTTP 402: Payment Required.

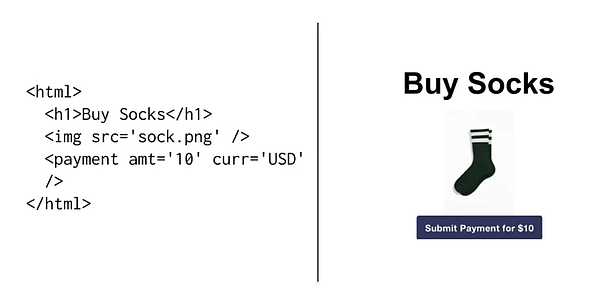

The 402 standard itself is very simple and straightforward. It opens up space for web pages to convey payment-related information via the HTTP standard, much like the ![]() tag tells the browser where to find the image.

tag tells the browser where to find the image.

Incredibly, this idea has been dormant for decades. I believe it simply needs the right financial tool to scale with the internet, namely blockchain.

But the real question is: what actually happens after you click to pay?

According to the standard, the server will return "HTTP 402: Payment Required". This seems insignificant on its own, but when combined with infrastructure that allows funds to be transferred as quickly and easily as internet data transfer, it could be revolutionary.

Wait, isn't that what Stripe and PayPal are doing? Making online payments possible?

Wait, isn't that what Stripe and PayPal are doing? Making online payments possible?

Kikyo

Kikyo