Author: Jon Charbonneau Source: X, @jon_charb Translation: Shan Ouba, Golden Finance

Summary

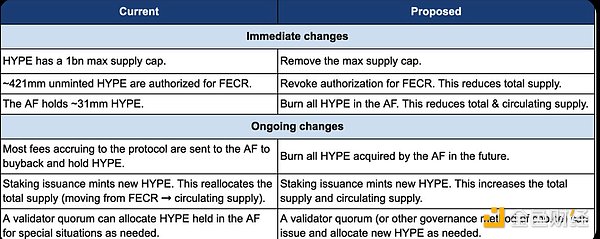

We propose the following changes to Hyperliquid's economic model:

Future Emission and Community Rewards (FECR) - Revoke the authorization of all unminted HYPE currently allocated to FECR.

Assistance Fund (AF) - Destroy all HYPE currently held by AF. Continuously destroy all HYPE acquired by AF.

Maximum Supply - Remove the maximum supply cap of 1 billion HYPE. Future token issuance (e.g., for staking rewards or community rewards) will increase the total supply.

These changes would immediately result in a reduction in the total HYPE supply by over 45%.

Hyperliquid currently has a significant authorized but uncirculated supply between AF (~31M HYPE) and FECR (~421M HYPE). This is a problem because the market penalizes this excess supply when assessing the value of the protocol, and pre-allocating these tokens could unduly influence future capital allocation decisions. Our proposal addresses these issues by better aligning Hyperliquid's financial accounting with its underlying strategy.

Importantly, this proposal does not impact existing HYPE token holders' relative ownership of the protocol's economics, Hyperliquid's ability to fund value-enhancing initiatives, or how these decisions are made.

The Problem

HYPE Has Excess Authorized But Uncirculated Supply

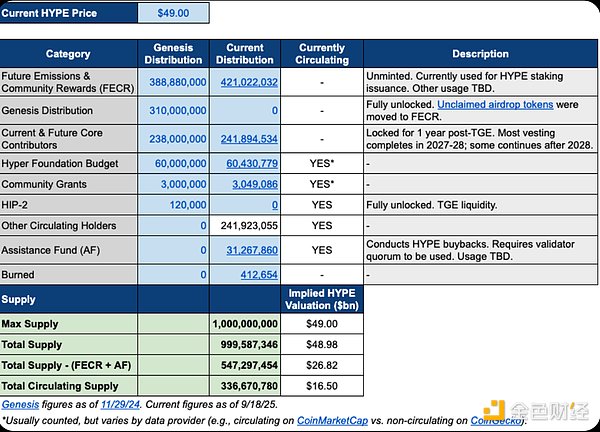

For background, HYPE’s genesis and current token distribution are as follows:

The Market Punishes Excess Supply

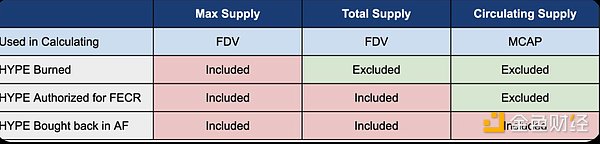

Cryptocurrency valuation metrics are a mess. They are inconsistent with traditional finance’s equity accounting standards and are even inconsistently measured across different data providers. The most popular metrics, Market Cap (MCAP) and Fully Diluted Valuation (FDV), are often misleading, with the most relevant numbers falling somewhere in between:

MCAP is too low because it excludes team and investor tokens with a known float (i.e., scheduled unlock).

FDV is too high because it includes tokens that have been vested but have no float plan.

There are many articles online describing this issue and proposing new metrics, so we'll keep it brief here and focus on the immediate issue facing Hyperliquid. The standard FDV calculation significantly overstates what we believe is a reasonable valuation and supply for HYPE. Most platforms, such as CoinMarketCap, default to calculating FDV using maximum supply:

"If the maximum supply is circulating, the market cap is fully diluted valuation (FDV) = price × maximum supply. If the maximum supply is zero, FDV = price × total supply." Even if HYPE is burned (e.g., from HYPE spot trading fees), this FDV always uses HYPE's maximum supply of 1 billion tokens. Other providers, such as Coingecko, default to calculating FDV based on total supply, so burned tokens at least reduce the FDV there. Providers also always count HYPE repurchases held in AF towards the circulating supply, so they do not reduce FDV or circulating MCAP. Furthermore, they always count FECR towards the total supply, so this always increases FDV.

In general, crypto data providers consistently show the following:

We personally model the uncirculated token supply very differently in our valuations:

Include tokens with known distribution and unlocking schedules (e.g., vesting insider allocations).

Exclude tokens with no circulation schedule. This includes tokens held in treasury (e.g., AF) or other authorized but unissued tokens (e.g., FECR). In equity terminology, these are similar to treasury shares and authorized but unissued shares, which are not counted towards uncirculated supply.

In addition, we project forward and calculate the tokens we estimate will enter circulation, even with some uncertainty (e.g., HYPE staking issuance and possible community rewards). We then project the offsetting value you receive directly as a holder (i.e., if you stake to access issuance, you will no longer be diluted), as well as other value created for the protocol (i.e., the issued tokens should generate proportional or greater value in the expectation, such as users paying more in fees).

There are many excellent investors who use similar supply modeling and valuation processes. However, the reality is that many (perhaps even most) do not. We frequently have these conversations with other investors, and many (including some of the largest and most sophisticated funds) often only use the headline FDV for HYPE and other tokens. We believe this is misleading, and we hope that industry standards will improve over time, but this is the reality.

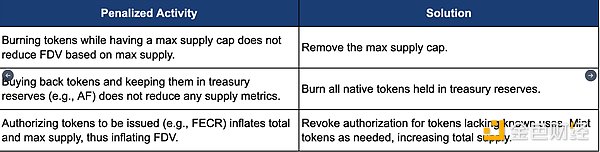

The widespread use of these misleading valuation metrics directly leads to tokens being misvalued. In particular, they penalize protocols that:

Buy back tokens and deposit them into a treasury (e.g., AF).

Include a large number of pre-authorized, unissued tokens in the token economy (e.g., FECR).

Given HYPE’s current supply dynamics, it is one of the most unfairly penalized tokens in the market today. It would benefit greatly from correcting this issue.

Proposal

Therefore, we propose to modify Hyperliquid’s economic model as follows:

Our motivation is two-fold:

Improve the readability of the protocol’s economics for outsiders considering participating. This allows the market to more accurately assess the value of the protocol (e.g., misleadingly high FDV metrics discourage many investors). This also helps expand the Hyperliquid ecosystem by attracting new participants (many of whom first enter as investors) and increasing the resources available to grow the ecosystem (i.e., more investors deploying capital). Improve the legibility of the protocol's economics to community members, enabling them to make more informed capital allocation decisions. Pre-allocating tokens into specific "buckets" creates a psychological bias in favor of using those funds, rather than evaluating all uses of incremental capital purely based on direct economic benefit (e.g., will diluting and issuing $X worth of tokens create $Y > $X worth of value in the future?). These changes do not impact the relative ownership of the protocol's economics by existing HYPE token holders, Hyperliquid's ability to fund value-add initiatives, or how those decisions are made. They are simply changes to the ledger to better align Hyperliquid's financial accounting with its underlying strategy and goals. Therefore, we consider these changes to be strictly positively optional. For example, consider a scenario where the proposal passes and it has a positive impact on HYPE's market value. If Hyperliquid subsequently uses newly issued HYPE rewards for incentivized activity, it will now need to distribute less HYPE to achieve the same economic impact as before.

We generally see two counterarguments to this proposal:

The responsibility lies with the market and governance; they should be smarter about understanding Hyperliquid's economics, so no changes are necessary.

Hyperliquid is in early growth mode and should freely use funds to fuel growth, not burn them.

Regarding the first point, we believe the protocol's responsibility is always to accurately communicate its story to the market. Outsiders have limited time and resources to evaluate them. They will always be tempted to use broad metrics that allow for easy direct comparisons (e.g., comparing price-to-earnings ratios). The reality is that industry standards are penalizing Hyperliquid's current economic model, and this is unlikely to change in the near future. Markets are never completely rational.

Regarding the second point, this is a false dichotomy. This proposal is by no means mutually exclusive with future growth plans. New HYPE could equally well come from newly approved issuances, rather than from allocations of AF or FECR. The proposal here simply provides a more accurate accounting for this reality. Maximum supply caps are mostly a relic of Bitcoin's famous 21 million cap. However, this cap doesn't reflect reality in most other contexts. Supply caps simply represent current social consensus and expectations. If everyone decided tomorrow that Bitcoin should have a 22 million cap and HYPE should have a 2 billion cap, both would fork. Bitcoin's 21 million cap makes sense because there's a strong social contract that it will never change. This isn't the case with HYPE (and almost every other token). If, after many years, FECR were depleted, but there was an opportunity for additional HYPE issuance to increase value, the community would likely support it. There's no religious imperative to an arbitrary supply cap. This is why large tokens like ETH and SOL don't have supply caps. They simply issue new tokens and increase supply over time. Even leaving Hyperliquid aside, we believe this is a trend we'll see increasingly across the industry. Several other protocols have recently destroyed excess treasury reserves and migrated tokens to achieve issuance beyond their initial hard cap (note that Hyperliquid can avoid the complex manual migration because it's a fork-capable L1). This is just rational calculation. They're turning a market disadvantage into an advantage. Overall, we believe this proposal provides significant economic benefits to Hyperliquid with virtually no downside risk.

Appendix - Hyperliquid Current Fee Model

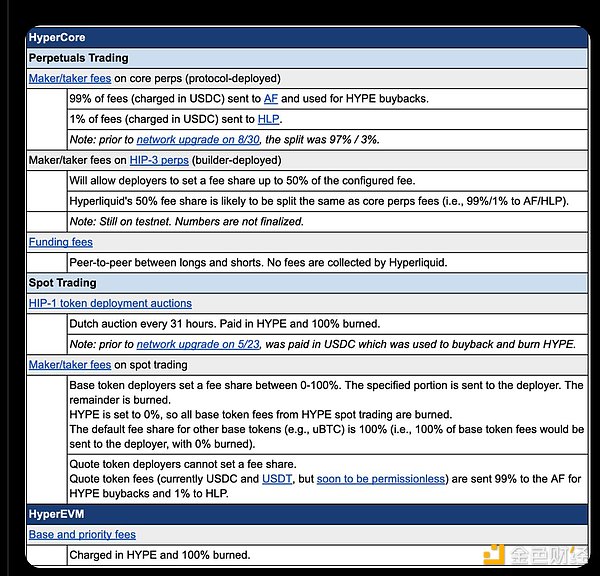

All Hyperliquid fees are currently allocated to the community as follows:

HyperCore Transaction Fees - All used to buy back and burn HYPE.

HYPE Spot Trading Fees - All used to buy back and burn HYPE.

Token Auction Fees - 90% used to buy back and burn HYPE, 10% used by the project. HyperEVM Revenue - 100% of it is used to buy back and burn HYPE. Today, HyperCore transaction fees provide nearly all of the protocol's revenue. Perpetual swap fees account for the vast majority (>90%), spot fees, while significant, contribute significantly less (<10%), and token auction fees contribute a negligible amount (averaging tens of thousands of dollars per day). HyperEVM revenue is also relatively small. This revenue mix will evolve over time, with potential new revenue streams including revenue sharing from permissionless aligned stablecoins (e.g., USDH), HIP-3 perpetual contract fees, and HIP-4 event markets.

Davin

Davin

Davin

Davin YouQuan

YouQuan YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan Brian

Brian