Author: Luke, Mars Finance

While Deepseek and Grok3 continue to set off a craze in the Web2 world, the AI ecosystem of Web3 is experiencing its largest retracement in history. Many AI tokens have retreated at least 80% from their highs a month ago. The Virtual Protocol (VIRTUAL) ecosystem has also seen a sharp drop - the VIRTUAL platform coin plummeted 8.6% in a single day, and its incubated tokens such as GAME and LUNA fell by more than 10%.

Previously, Virtuals' deployment on Solana was seen as a positive by the market, but now it reminds people of the new recruits who had just joined the army in 1949, with great ambitions, but found themselves pushed onto the retreating train at the first moment of the battlefield.

But all this was not without signs. From the peak in January to the trough in February, Virtuals' experience is just like a crypto version of "The Big Short", revealing the cruel game between speculative bubbles, technological ideals and market cycles. As the largest AI agent platform on Ethereum's Base ecosystem, Virtuals had planned to expand its business to Solana, trying to replicate the success of AI agents in Solana's ecosystem. However, Solana's recent scandals, especially the turmoil surrounding Meme coins and conspiracy groups, have plunged Solana's ecosystem into a crisis of trust. Although Virtuals seems to be looking for new opportunities, the plunge in the entire AI agent track and the entire altcoin market shows that the market winter seems to be accelerating for both Solana and Ethereum ecosystems.

1. Solana branch opening was cold: multi-chain expansion "not suitable"

On January 25, Virtuals announced its entry into the Solana ecosystem, and the market once regarded this move as an important step in the "AI agent empire". The team plans to replicate the successful model on the Base chain through five major plans, including the Meteora trading pool and the SOL Strategic Reserve (SSR). However, the data from Solana’s debut on February 12 burst all these bubbles:

The AI agent graduation rate is only 8.3%: In the Solana ecosystem, only 13 of the 156 new projects have reached the graduation standard, of which more than half of the projects are close to zero, and only 5 have a market value of over one million US dollars;

Liquidity dilemma: User participation on the Solana chain is sluggish, and the number of holding addresses of most projects is less than 100, which is in sharp contrast to the 222,000 active wallets on the Base chain.

This situation is like a popular restaurant blindly expanding its branches - it originally thought that it could conquer new markets with its signature dishes (AI agents), but it was found that Solana users prefer local characteristics (such as Meme coin $TRUMP and local projects such as ai16z). What’s even more ironic is that Virtuals’ “inter-chain abstract exchange” solution designed for cross-chain is still at the white paper stage. Users can only use SOL to purchase AI agents on Base, or use ETH to purchase Solana agents. The operation threshold is comparable to asking Sichuan chefs to make sushi.

2. AI agent retreat: from “technological revolution” to “leek toys”

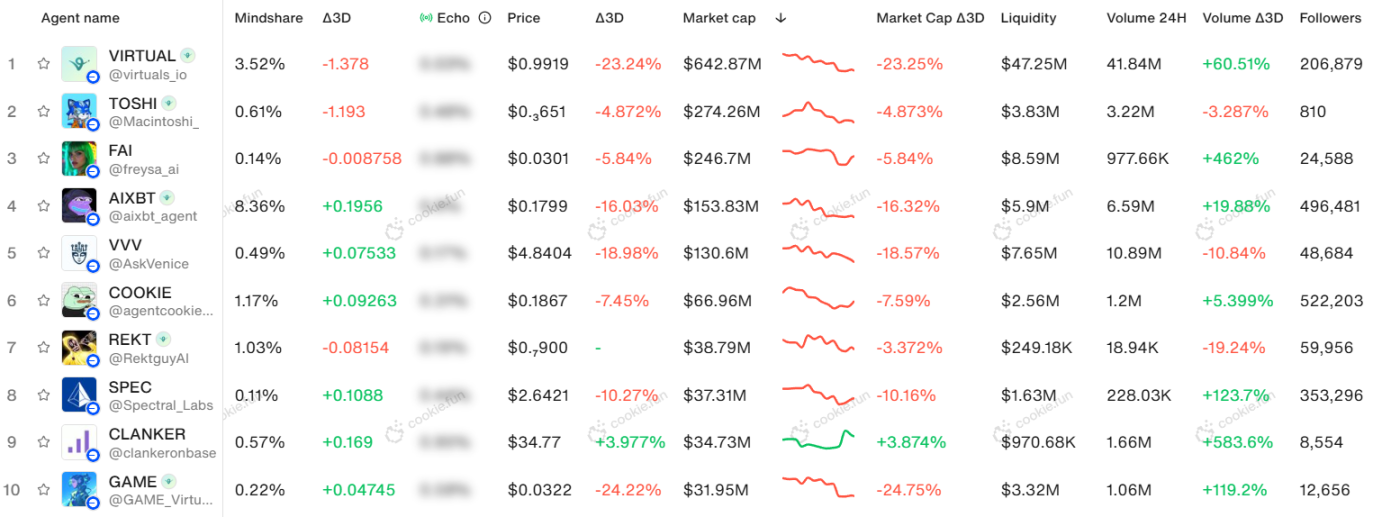

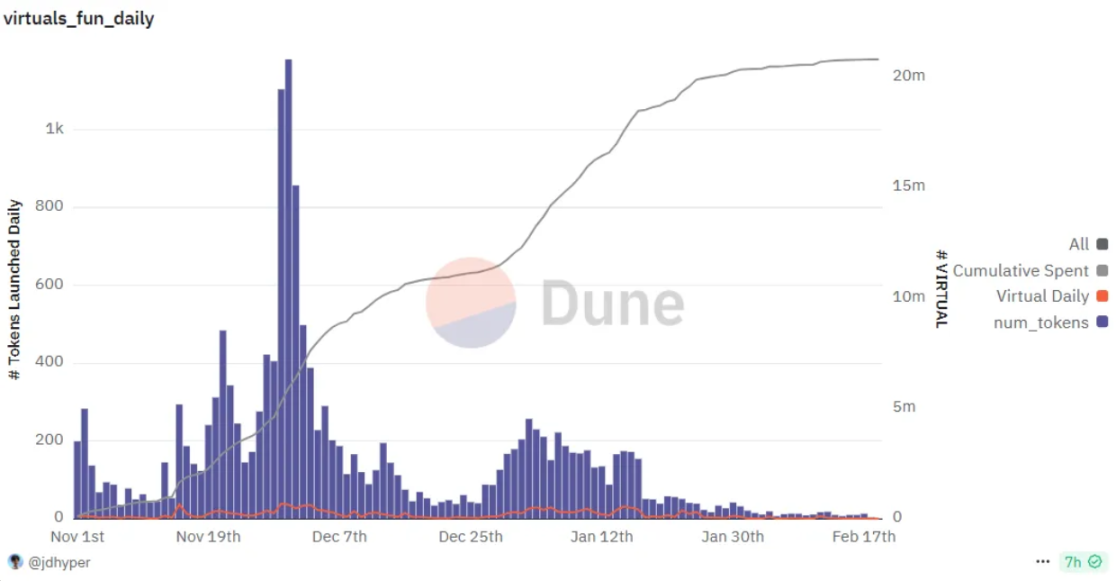

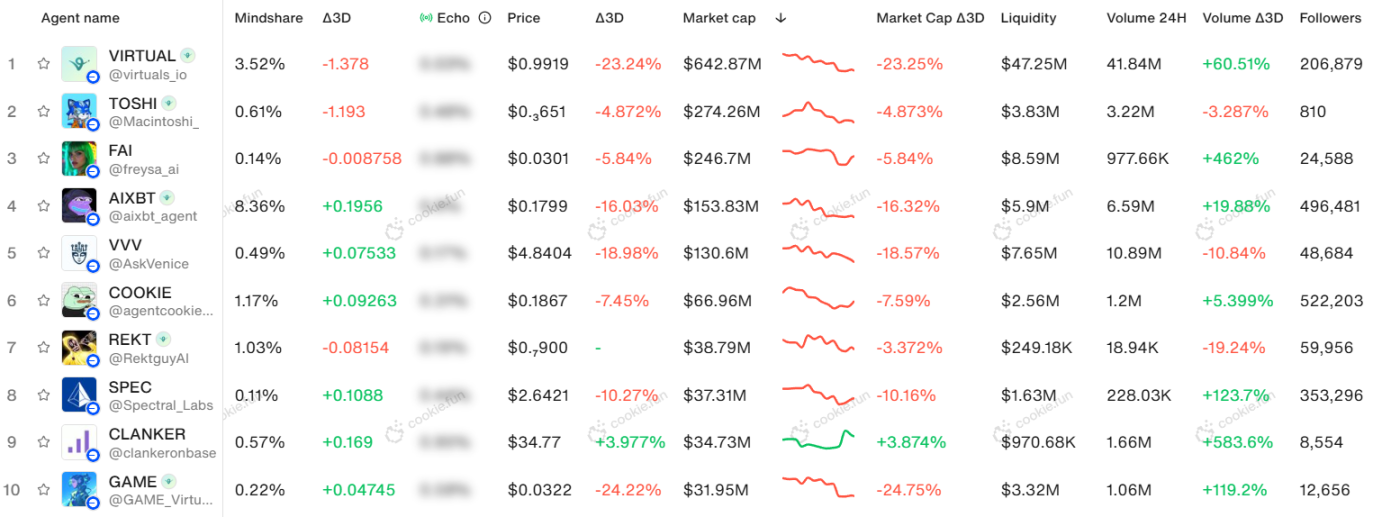

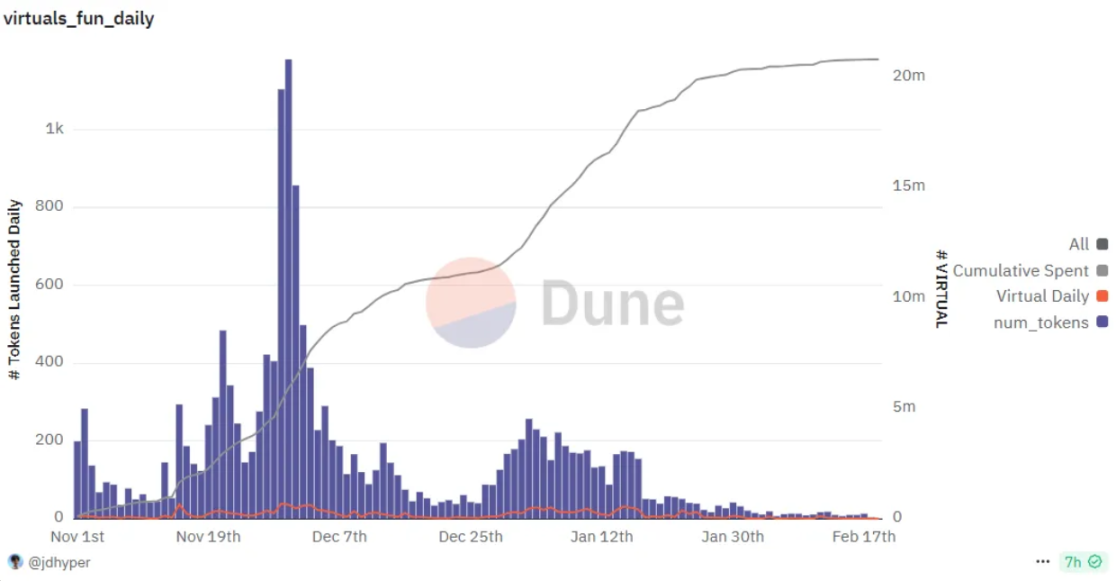

Virtuals’ dilemma is essentially a microcosm of the bursting of the bubble in the AI agent track. According to Cookie.fun, the market value of the entire AI agent track has shrunk by 65.3% in the past month. This trend is consistent with Messari's earlier prediction: "The prosperity of AI agent frameworks will peak in Q1 2025 due to the lack of real demand support." During the boom period, the madness of the AI agent track was like the "Trump pump" in the stock market. In December 2024, thanks to the AI narrative and the "Trump pump", the VIRTUAL token soared 500% in 30 days, and its market value once exceeded US$5 billion, becoming the "Nasdaq of AI agents." At the same time, the platform's cumulative revenue exceeded $37.76 million, and its trading volume reached $6.74 billion, as if it had become a star in the crypto industry overnight.

However, as the bubble burst, the cost of swimming naked began to emerge:

Token economy involution: The $48 million buyback plan launched in January did raise the price of the currency in the short term, but it also exposed the vulnerability of relying on the commission sharing - when the trading volume plummeted, the destruction mechanism became a "blood pump" instead;

Agent homogeneity: Most of the 16,000 AI agents on the platform are social KOL tokens (such as AIXBT) or "virtual idols" who are riding on the hot spots. Their functions are limited to forwarding tweets or generating earthy love words, and they are still a long way from "disruptive AI". At the same time, the number of new agents is also shrinking rapidly, with only 4 new agents online on February 18.

This situation reminds people of the craze for NFT avatars in 2021 - when speculators find that the "digital monkeys" in their hands can neither chat nor move bricks, a sell-off becomes inevitable.

3. Ethereum to the left, Solana to the right: Prisoner’s dilemma under ecological internal friction

Virtuals’ cross-chain strategy was originally intended to simultaneously deploy Base (Ethereum L2) and Solana, two major public chains, but this plan exposed its dilemma of being caught in a two-sided trap in the competition among public chains, like a sandwich.

The embarrassment of the Base chain: As an “excellent student” in the Ethereum ecosystem, Virtuals’ expansion to Solana was instead seen by the Ethereum community as a “betrayal” of the parent chain. This multi-chain layout has exacerbated the Ethereum community’s anxiety about the “blood-sucking effect” of L2, especially at a time when Ethereum itself is struggling to deal with scalability and cost issues.

Solana’s cold reception: Although Virtuals incentivizes the Solana ecosystem by converting 1% of the handling fee into SOL, Solana users clearly prefer local projects, especially homegrown competitors such as ai16z (market value of $2.55 billion). As an "outsider", Virtuals has always found it difficult to gain widespread recognition in the Solana community and has almost become an "airborne soldier."

This situation reminds people of a son-in-law who tries to please both his mother-in-law and his mother-in-law at the same time. In the end, no matter which side is dissatisfied, there is only one possible result: being kicked out.

Fourth, the Revelation of Retail Investors: The "Cognitive Folding" of Speculation and Value

For ordinary investors, the roller coaster market of Virtuals provides the market with several profound warnings:

Narrative ≠ Value: The grand vision of AI agency must be supported by actual landing scenarios. If the token economy relies solely on the circulation of transaction fees, it will eventually become a "casino on the chain" and cannot develop sustainably.

Multi-chain ≠ Security: Although cross-chain expansion seems to be able to open up the market, it will actually disperse the team's resources, especially in the downturn of the market. Excessive layout will only increase the risk of capital chain rupture-the more branches, the greater the crisis.

Whales ≠ Allies: Although VIRTUAL has been favored by large whale investments, these whales often sell more quickly than retail investors. In the past month, VIRTUAL has fallen by as much as 46.3%, and it is the rapid shipments of these whales that have exacerbated the panic in the market.

From this, we can see that there is often a huge cognitive gap between market speculation and the value of virtual assets. In the world of virtual assets, many investors have fallen into a "value illusion", thinking that the bubble will continue to expand, but eventually ushered in a ruthless "fission".

Anais

Anais