Golden State Warrior Quietly Announced Partnership With Coinbase. Exclusive gifts for NBA Fans!

Golden State Warriors is partnering with Coinbase, who is in the middle of a legal war with the SEC.

XingChi

XingChi

Author: Jimmie from 10K Ventures

CKB stablecoin payment is a decentralized stablecoin payment solution based on the CKB network, allowing users to generate and manage the US dollar-pegged stablecoin RUSD through the joint network of CKB and Bitcoin, leveraging Layer 2 extensions such as RGB++ and Fiber Network, to achieve fast, low-cost and secure cross-chain stablecoin payments.

2.1.1 What is CKB

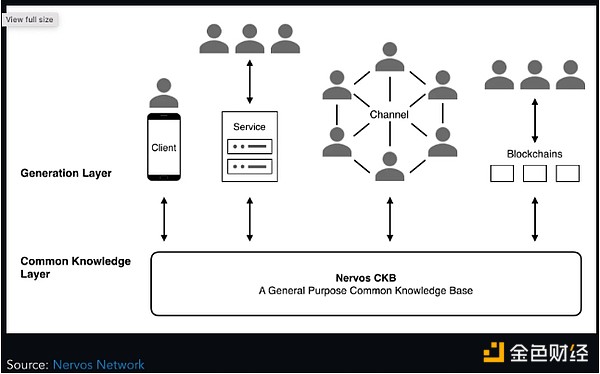

CKB is the Layer 1 blockchain of Nervos Network. Its main functions can be summarized as consensus and execution and data availability. The scalability is improved through the payment channels and RGB++ built on it.

It is based on the PoW consensus mechanism, similar to BTC, and uses an upgraded version of the BTC algorithm NC-MAX, which improves the efficiency and responsiveness of the network by speeding up transaction confirmation time and reducing the orphan block rate. Unlike BTC's fixed interval of one block every 10 minutes, CKB dynamically adjusts the block interval (approximately every four hours) based on network activity to optimize performance.

CKB uses the Eaglesong hash function, a hash function specially customized for the Nervos Network, as an alternative to SHA-256, it provides the same security.

CKB uses the Cell model as the core of its data structure, which is an improved version of BTC's UTXO accounting model:

Through the dual script system, it allows more flexible data storage and verification, supports asset issuance and smart contract execution. Provides data storage and state management functions to ensure the long-term availability of all on-chain assets and data.

2.1.2 Cell Model

Cell Model and Its Features:

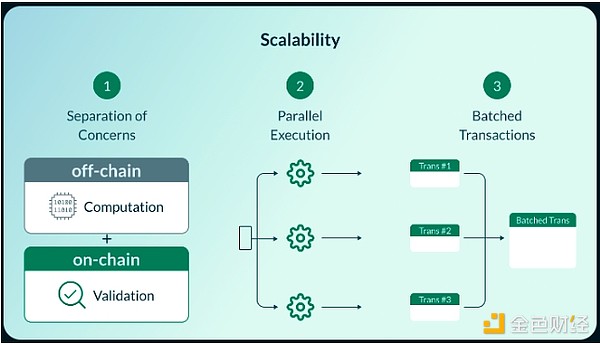

The Cell Model is similar to the UTXO model of BTC, but it implements on-chain data storage and verification of smart contract scripts by introducing dual scripts. Store any type of data or assets: In the UTXO model of BTC, each transaction output can only contain simple amount information and ownership; while each Cell of CKB can store smart contract code) and trigger the execution of these scripts through external calls in transactions, which means that each Cell can independently execute the smart contract logic related to it and has programmability. Separation of state and calculation: Because the Cell stores the code and state of the smart contract, each Cell is allowed to independently execute the contract logic. Complex computing tasks can be executed on Layer 2 or off-chain, and the execution results are synchronized back to Layer 1 through transactions to ensure the security of the network and the consistency of data. Parallel execution and packaged transactions: Through the Cell model, smart contracts in different Cells can be executed in parallel, and at the same time, the transaction results of different Cells can be packaged and updated on the chain, which makes the calculation more efficient and reduces transaction costs.

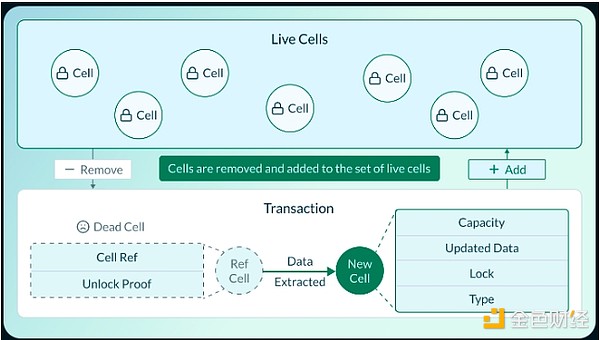

How the Cell model works:

Cell is composed of inputs and outputs: Similar to BTC's UTXO model, Cell performs transactions and status updates through inputs and outputs. Each Cell can be spent as an input for a transaction, and generates new outputs to create new Cells. Cell components: Each Cell contains Capacity, Updated Data, Lock Script, and Type Script. Capacity: Capacity records the size of the Cell storage space and also represents the storage value of the CKB token. Cells created by users need to allocate a certain Capacity based on the amount of data to ensure that the storage space on the chain is effectively utilized. Data: It is one of the core features of the Cell model. It can store any information from simple numbers to complex smart contract states, allowing diverse data to be stored on the blockchain. Dual script system: Lock Script is used for identity authentication, similar to the signature mechanism of BTC, to prevent unauthorized users from accessing or modifying data in the Cell. Users must provide the correct signature or multi-signature to unlock and use the Cell; Type Script defines the data verification logic of the Cell, which is used to set rules for how to use or change the Cell in future transactions, and determine the legitimacy of the transaction or state by executing smart contracts or rule verification. Live Cell & Dead Cell: Live Cell refers to a Cell that has not been spent yet and can still be used as input for the next transaction or state update; when a Cell is spent, it becomes a Dead Cell and can no longer be used, but its history is retained on the chain to ensure traceability. State rental mechanism: Users need to pay CKB tokens to rent storage space on the chain to ensure long-term data storage and prevent state bloat.

2.1.3 Programmability & CKB-VM

2.1.3 Programmability & CKB-VM

The Cell model is the foundation of CKB programmability: it supports storing the state of smart contracts and executing scripts in each Cell, so that the execution of contracts and the management of assets are closely integrated

Through the Turing-complete RISC-V virtual machine (CKB-VM), developers can execute custom smart contracts on the chain. The flexibility of the RISC-V instruction set gives developers more freedom to write contracts, allowing CKB to support complex contract logic.

CKB-VM supports multiple languages: including popular languages such as C and Rust. This broad compatibility sets CKB-VM apart from other blockchain virtual machines that are usually limited to specific languages, and makes it open to a wider developer community. The CKB network also supports SDKs for mainstream languages such as JavaScript, Rust, Go, and Java, making it easy for developers to develop with familiar tools.

Compatibility and Scalability: The design of CKB-VM ensures compatibility with BTC's UTXO model and other blockchains, while supporting highly scalable smart contracts and complex applications.

2.1.4 PoW Consensus Mechanism

CKB uses a PoW consensus mechanism similar to BTC to ensure the security and decentralization of the network. Similar to BTC, miners pack blocks by competing to calculate hash values, thereby ensuring the network's immutability and censorship resistance.

NC-MAX Algorithm: Compared to BTC, CKB introduces an improved NC-MAX algorithm. This improvement allows higher throughput and optimizes block packaging efficiency, reduces the orphan block rate, and increases transaction confirmation speed, making it suitable for large-scale application scenarios such as asset storage and payment settlement.

Eaglesong hash function: The custom design of the Eaglesong hash function provides performance and security advantages to the Nervos CKB network through ASIC neutrality, efficiency, security and network fairness, ensuring decentralization while improving mining efficiency and network scalability.

2.1.5 Multi-layered security architecture

CKB adopts a multi-layered security architecture: Layer 1 focuses on the final settlement of data and the secure preservation of status, while Layer 2 is used to expand transaction processing capabilities.

The separated architecture ensures the security of the main chain (Layer 1): reducing the load when processing transactions and improving the stability of the overall network

2.1.6 Connection and orthodoxy with BTC

Cross-chain interoperability of the UTXO model:

CKB's Cell model is an extension of the BTC UTXO model. BTC users can map their assets to the CKB network, and use the flexibility of the CKB network for storage, smart contract operations, and decentralized finance (DeFi) applications. Since Cell is similar in structure to BTC UTXO, and CKB is compatible with the BTC signature algorithm, users can use BTC wallets to manipulate CKB chain assets, and the same is true for other UTXO public chains.

Legitimacy: CKB maintains ideological consistency with BTC by adopting NC-Max (Nakamoto Consensus Max), which is an improved version of the Nakamoto consensus that provides better security and performance.

Community support: The Nervos community is composed of many blockchain technology enthusiasts, developers, and miners, and has received support from some BTC communities. The orthodoxy lies in that it inherits the decentralized thinking of BTC and meets a wider range of needs through extended functions.

2.1.7 CKB's role in stablecoin payments

Storing and managing stablecoin balances: CKB's Cell model is the basis for stablecoin storage. The user's stablecoin balances such as RUSD are stored in the Cell on the chain. Each Cell contains complete balance information, ensuring the security and traceability of assets.

Recording transaction status: CKB supports recording every state change of transactions on the chain, and all payment processes can be transparently recorded and tracked through the Cell model. This mechanism is crucial in stablecoin payments, ensuring the security and verifiability of transactions.

Execution of smart contracts: Complex operations such as conditional payments and locking in the stablecoin payment process can be implemented through smart contracts supported by CKB-VM.

2.2.1 What is RGB++

RGB++ is a decentralized asset issuance and smart contract protocol that is applicable to the Bitcoin UTXO model and other UTXO public chains.

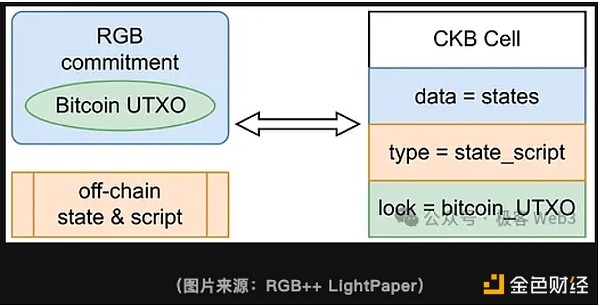

RGB++ protocol inherits the idea of creating a transaction on the chain and off the chain and binding them separately. The difference is that RGB uses client verification to move more data that cannot be stored and smart contracts that cannot be implemented on the BTC network to the off-chain, and creates corresponding transactions to bind to the chain, while RGB++ moves these data that cannot be stored and smart contracts that cannot be implemented to CKB, making CKB the smart contract settlement layer of BTC.

2.2.2 Basic functions

Through RGB++, CKB is used as the shadow chain of BTC: as a supplementary chain of BTC, it undertakes complex logic and smart contract operations including Turing machines that BTC cannot handle natively.

Interaction with BTC network:

Transaction occurs: In the BTC network, users complete transactions through the conventional UTXO model, and the part involving smart contract execution uses RGB++ to bind the contract status and data to CKB. Verification logic: The transaction records on the BTC network will be synchronized with the contract status stored on CKB through RGB++, and the legitimacy of the transaction will be ensured through specific verification logic. Whenever a transaction occurs on the network, RGB++ will trigger the execution of the contract on CKB, and check whether the transaction complies with the predetermined rules through the on-chain contract logic, such as whether the balance is sufficient, whether the signature is valid, whether the contract conditions are met, etc.

RGB++ uses the client-side validation mode to ensure the privacy and integrity of off-chain data. Only when the off-chain verification is passed will the data be submitted to CKB for final settlement.

Asset issuance and management: RGB++ allows users to issue assets (such as stablecoins, tokens, etc.) through off-chain protocols, and use CKB to manage the life cycle of these assets (including not only the issuance and circulation of assets, but also more complex operations, such as time locks, conditional payments, etc.).

RGB++ combines the high security of BTC with the programmability of CKB.

2.2.3 Isomorphic Binding

2.2.3 Isomorphic Binding

Cross-chain synchronization of assets and status: Isomorphic binding refers to synchronizing assets and status between BTC and CKB (or other UTXO public chains, such as Cardano) through a binding mechanism. Whenever an asset transaction occurs on the BTC chain, RGB++ will map the corresponding contract status or asset changes on CKB.

Extended UTXO: In isomorphic binding, each UTXO on the BTC chain will have a corresponding Cell (UTXO container) on CKB, and record the corresponding asset status and smart contract conditions.

Asset Binding: When a user holds a certain RGB++ asset on the BTC chain, the Cell on CKB will store the corresponding asset status, and the consistency of these asset information is ensured by isomorphic binding between the two chains.

Transaction Synchronization: When an RGB++ token transaction occurs, the isomorphic binding mechanism will generate a Commitment on the BTC network. On the CKB chain, the corresponding Cell will be consumed, and a new Cell will be generated to allocate assets.

Advantages of Isomorphic Binding - Empowering BTCFi

Smart Contract Support: BTC cannot natively support Turing-complete smart contracts, and through isomorphic binding, CKB can serve as the execution layer of smart contracts to manage complex transaction conditions of BTC assets, such as time locks, conditional payments, etc. Flexibility of Asset Management: Isomorphic binding allows the management of assets circulating in the BTC network on CKB, and users can perform complex financial operations through CKB's flexible programming capabilities without changing the underlying protocol of BTC.

2.2.4 Leap

RGB++ Layer upgrade proposes: Extend the binding relationship between CKB and BTC to all UTXO chains, and realize cross-chain assets through "binding swap".

Bridgeless cross-chain between BTC and other UTXO chains: Its core purpose is to enable RGB++ assets on the BTC chain to be seamlessly transferred to other UTXO chains. It supports the management and transfer of assets on multiple blockchains by switching the UTXO bound to the assets.

Bridgeless technology: Leap realizes cross-chain transfer of assets through isomorphic binding technology and switching UTXOs on different chains without relying on the traditional Lock-Mint cross-chain bridge.

Operation process: For example, users can control RGB++ assets originally on the BTC chain through the Cardano chain, and split and transfer assets on the Cardano chain.

Publish Commitment: First, users need to publish a Commitment on the BTC chain, stating that they want to unbind the assets bound to BTC UTXO. Cardano chain binding: Next, publish a new Commitment on the Cardano chain to bind the RGB++ asset to Cardano's eUTXO. Modify the locking script: Then, modify the locking script of the RGB++ asset on the CKB chain, switching the unlocking condition from BTC UTXO to eUTXO on the Cardano chain. This step allows asset holders to control assets originally on the BTC chain through the Cardano chain.

The role of CKB in Leap:

CKB plays a role similar to an indexer and data availability (DA) layer. All RGB++ asset data is still stored on the CKB chain, and CKB acts as a third-party witness to process Leap requests and ensure the security of cross-chain assets. CKB provides security and credibility: Compared with the multi-signature or MPC (multi-party computation) mechanism commonly used in traditional cross-chain bridges, CKB's security and decentralized properties are more reliable.

2.2.5 RGB++'s role in stablecoin payments

Issuance and circulation of stablecoins: Stablecoins are issued on the BTC chain through RGB++, and smart asset management is achieved with the help of CKB.

Cross-chain asset management: Through the combination of RGB++ Layer and CKB, stablecoin payments are ensured to operate seamlessly on different UTXO chains.

Smart contract support: Provide complex payment conditions, time locks and other functions for stablecoin payments to enhance the flexibility and security of payments.

Bridge role: RGB++ Layer acts as a bridge between BTC (and other UTXO chains) and CKB, expanding BTC's programmability and asset management capabilities, making BTC's stablecoin payment function more diverse and flexible.

2.3.1 Introduction to Fiber Network

Fiber Network is a Layer 2 extension solution on CKB similar to BTC Lightning Network: it is specially designed to improve CKB's off-chain payment capabilities, allowing users to make fast and low-cost payments off-chain. Off-chain transactions are realized through payment channels, reducing the pressure on the main chain and increasing transaction speed.

Features of off-chain payment: Fiber Network realizes fast off-chain transfers through payment channels, reduces dependence on the CKB main chain, and increases transaction throughput.

Current situation: As of September 2024, according to mempool data, more than 300 million US dollars of funds are currently placed in the BTC Lightning Network, the number of nodes is about 12,000, and nearly 50,000 payment channels have been built between each other. The Fiber Network based on Nervos CKB has been launched on the test network.

2.3.2 Technical Highlights

Off-chain Payment Channels: Fiber Network allows users to exchange assets directly off-chain by creating payment channels, and the final state is not submitted to the CKB main chain for settlement until the channel is closed.

On-chain Contracts (HTLC):

Similar to the BTC Lightning Network, Fiber Network now also uses Hash Time Lock Contracts (HTLC) to ensure the security of off-chain transactions; if the off-chain transaction is not confirmed within the agreed time, the assets can be automatically returned through HTLC. PTLC: Fiber Network improves on HTLC to avoid using the same encrypted value for the entire payment path graph, and will use PTLC to prevent privacy leakage of transaction associations.

Multi-Hop Routing: Like the BTC Lightning Network, Fiber Network supports payment path jumps through multiple nodes, and searches for payment paths based on the Dijkstra algorithm, thereby reducing routing costs and increasing the success rate of multi-hop path payments.

Monitoring Service - Watchtower Service: Users can use the 24/7 monitoring service to monitor the status of payment channels to prevent malicious nodes from attempting double payments or cheating (preventing transaction participants from submitting expired Commits to the chain). The service can automatically track transactions and alarm.

2.3.3 Differences between Fiber Network and BTC Lightning Network

Multi-asset support:

The BTC Lightning Network previously only supported off-chain payments for BTC, but now it can support other assets through Taproot Asset upgrades. Fiber Network supports a variety of assets, including CKB, BTC, RGB++ stablecoins, etc.

Fees and transaction speed:

Since the BTC Lightning Network runs on the BTC chain, it needs to pay higher BTC fees when opening and closing channels. Especially when BTC transaction fees rise, the cost of channel operations increases significantly. Due to its reliance on CKB, Fiber Network has higher TPS and lower transaction fees, which makes the cost of opening and closing channels lower and provides a better user experience.

Cross-chain interoperability:

BTC Lightning Network is mainly used for payments within the BTC network, and does not yet support cross-chain payments from other UTXO chains. Fiber Network supports the circulation of multiple assets including: BTC native assets (including inscriptions, runes, etc.), CKB, RGB++ native assets (including RUSD, etc.). Cross-chain asset off-chain payment: With the help of RGB++ Layer, all UTXO chain assets can enter the Lightning Network. Fiber Network and BTC Lightning Network can be interconnected: cross-chain payment is realized (only Fiber Network can send, BTC Lightning Network can receive), users can use CKB or RGB++ assets through Fiber Network to purchase assets on the BTC Lightning Network, and ensure the atomicity of cross-chain transactions (there will be no successful/failed cross-chain of some assets).

2.3.4 The role of Fiber Network in stablecoin payments

Fiber Network is used to support off-chain stablecoin transfers to ensure the immediacy and low cost of payment.

Fiber Network creates off-chain payment channels, allowing users to conduct high-frequency transactions off-chain and reduce pressure on the main chain.

Fiber Network supports cross-chain atomic payments, allowing stablecoin payments to safely cross multiple chains.

2.4.1 Introduction to Stable++

2.4.1 Introduction to Stable++

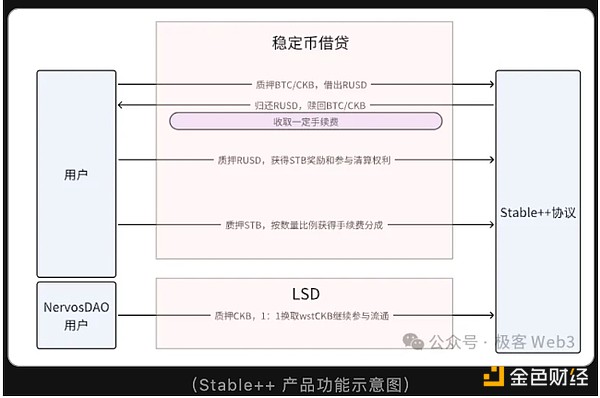

Stable++ is a decentralized over-collateralized stablecoin protocol for the CKB ecosystem, allowing users to mint RUSD pegged to the US dollar by pledging BTC or CKB.

RUSD is theoretically the first stablecoin issued directly on the Bitcoin network based on the RGB++ protocol, leveraging the capabilities of CKB to provide a more localized and efficient solution.

Service fees: Users are required to pay service fees for pledging BTC/CKB to mint RUSD and returning RUSD to redeem BTC/CKB.

RUSD staking: Users can obtain governance tokens STB through the lent and pledged RUSD.

Governance tokens STB: Users can participate in the liquidation of collateral by staking STB to obtain income; users can participate in the fee sharing by staking STB.

Cross-chain interoperability: RUSD can realize transfers between UTXO chain accounts through RGB++'s isomorphic binding and Leap functions.

Lower minimum collateral ratio (MCR): Thanks to efficient liquidation, the risk of potential losses faced by protocols and stability providers is reduced, thereby reducing the demand for collateral value

Decentralization: Stable++ is a fully decentralized, independently operated protocol that does not require control or permission from any entity, and users can interact with the system freely and securely.

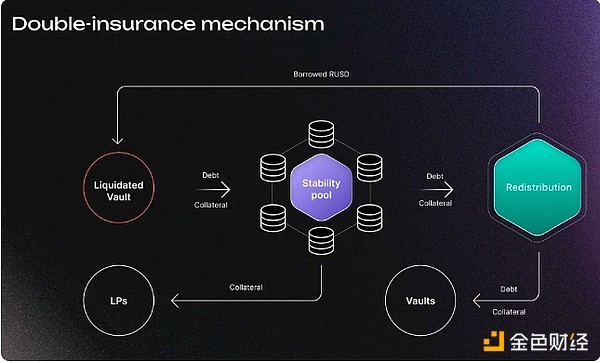

2.4.2 Liquidation Mechanism - Double Insurance

Overview: The liquidation mechanism is a protection measure triggered when the value of the collateral drops to a certain critical point (the minimum pledge ratio to borrow RUSD), ensuring that the generated RUSD stablecoin always has sufficient collateral support. The system will automatically liquidate those users with insufficient collateral to maintain the stability of the overall system

Overview: The liquidation mechanism is a protection measure triggered when the value of the collateral drops to a certain critical point (the minimum pledge ratio to borrow RUSD), ensuring that the generated RUSD stablecoin always has sufficient collateral support. The system will automatically liquidate those users with insufficient collateral to maintain the stability of the overall system

Stability Pool:

To solve the problem of inefficiency when large-scale liquidations occur, Stable++ uses a stability pool instead of the auction method commonly used in most lending protocols for liquidation, without the need to find liquidators in the market. Automatic liquidation: The stable pool requires LPs (users) to deposit RUSD in advance as reserves. When liquidation occurs, the RUSD in the stable pool equal to the bad debt will be directly destroyed, and the collateral will be directly allocated to the LP. Through the ability of automatic liquidation of the stable pool, the traditional auction is replaced by the direct allocation of excess collateral, which improves the operating efficiency and stability of stablecoins in the event of large-scale liquidation.

Redistribution:

Overview: When the stable pool does not have enough reserves to complete the liquidation of bad debts, the bad debts and collateral will be distributed among borrowers through the full allocation mechanism. Debt redistribution: When the liquidation pool cannot cover all bad debts, the remaining debt will be redistributed proportionally among all borrowers. Collateral distribution: While all borrowers jointly digest the bad debts, they will also receive a proportional allocation of excess collateral as a reward. By allowing all borrowers to jointly bear the bad debts, this mechanism ensures that there is no uncovered debt in the system and avoids the accumulation of systemic risks. 2.4.3 The role of Stable++ in stablecoin payments

The Stable++ protocol generates the stablecoin RUSD as the main stablecoin used in payments.

Stable++ improves the traditional over-collateralization method through an innovative liquidation mechanism and ensures the stability of the RUSD price.

With the help of RBG++'s isomorphic binding and Leap capabilities, Stable++ makes RUSD the first stablecoin that can truly circulate freely on any chain that supports UTXO, further broadening the liquidity of stablecoins.

2.5.1 What is JoyID

The JoyID Passkey wallet is a crypto wallet combined with Passkey key management.

In the Nervos ecosystem, JoyID is designed as a cross-chain, decentralized identity authentication and management tool that allows users to securely store and use cryptocurrencies and other decentralized applications.

2.5.2 Main Features

No password or mnemonic required: Access the wallet through biometrics, and log in without a private key.

Support for BTC and Fiber Network: Users can trade faster and more efficiently, and can help expand the application scenarios of CKB.

Multi-chain support: In addition to supporting BTC and Nervos CKB, JoyID also supports ETH and a series of EVM chains.

Additional security through Passkey: Passkey generates the secp256k1 signature required for blockchain transactions through the secp256r1 signature associated with the hardware device. Because the secp256r1 signature will not be exposed in the transaction and will only be generated through biometric information, it adds additional security to the wallet.

Combination of security and ease of use:

Security: Hard wallet > Passkey wallet > Software non-custodial wallet > Custodial walletEase of use: Passkey wallet > Custodial wallet > Software non-custodial wallet > Hardware wallet

2.5.3 JoyID's role in stablecoin payments

JoyID, as a user interface, allows users to make stablecoin payments in the CKB network and manage their RUSD assets and payment channels.

JoyID can further enable stablecoin payments and other transactions based on CKB through its excellent combination of capabilities (security, ease of use, multi-chain support).

Payment initiation and acceptance: Users can open payment channels through the JoyID wallet and make stablecoin payments. Stablecoin issuance: RGB++ and Stable++ work together. Stable++ generates RUSD by over-collateralizing BTC or CKB, and then issues it on the chain through RGB++. Cross-chain transactions and circulation: RGB++ seamlessly connects the BTC chain (and other UTXO chains) and the CKB chain through isomorphic binding and Leap, allowing RUSD and other assets to perform cross-chain operations on multiple UTXO chains, expanding the scope of asset circulation and ensuring data synchronization. Transaction records and settlements: The combination of Fiber Network and CKB supports the rapid processing of off-chain payments, and CKB as an L1 chain guarantees the final settlement of transactions and ensures the security of all transaction status and assets. The basis for complex transactions: CKB's virtual machine and Cell model provide an execution environment for smart contracts, support complex payment conditions and custom contract logic, and also ensure the decentralization of the Stable++ protocol.

Golden State Warriors is partnering with Coinbase, who is in the middle of a legal war with the SEC.

XingChi

XingChiState Street’s partnership with Taurus aims to enhance its digital asset services, integrating advanced technologies to meet institutional clients’ needs, with full implementation pending regulatory approval.

Dante

DanteThis article succinctly but to the point points out how to make Bitcoin support ZK verification function.

JinseFinance

JinseFinanceState Street's strategic move into blockchain settlement technology, including the potential creation of a stablecoin and deposit tokens, aligns with its ongoing involvement in digital finance and crypto ETFs. This initiative positions State Street to potentially leverage blockchain for more efficient and secure financial transactions, following the trail blazed by other major financial institutions.

Cheng Yuan

Cheng YuanETF, Cryptocurrency, State Street Bank and Galaxy Digital have reached a cooperation to launch Crypto ETF in addition to BTC. Golden Finance, this move aims to provide investment options other than pure spot BTC

JinseFinance

JinseFinanceLearn how AO’s holographic state revolutionizes blockchain scalability, leveraging Arweave’s immutable log to achieve consensus without compromise.

JinseFinance

JinseFinanceState Street Corporation's Q4 2023 showcases resilience with $501B new mandates, $0.55 EPS, and record $103B net inflows. Surpasses expectations, plans $5.0B share repurchase, and emphasizes operational efficiency in future outlook.

Edmund

EdmundMoving rigs from New York to Texas was part of Riot's effort to reduce the firm’s operating expenses through lower power costs and eliminate “all third-party hosting fees.”

Cointelegraph

Cointelegraph“Ethereum’s overwhelming mindshare helps explain why its users have been willing to pay more than $15 million in fees per day on average just to use the blockchain,” a16z stated.

Cointelegraph

CointelegraphThe “anti-technology” bill could accelerate mining operators' switch to renewable energy, experts say.

Cointelegraph

Cointelegraph