Author: Aiying Compliance

On June 30, 2025, Robinhood's stock price soared more than 12% during the trading session, setting a record high. The market's frenzy is not just due to a brilliant financial report, but from a series of blockbuster news released in Cannes, France: launching stock tokenization products, building its own Layer 2 blockchain based on Arbitrum, and providing perpetual contracts for EU users... This series of actions marks a fundamental change in the market's perception of it-Robinhood is no longer just a "retail trading app" serving young people, it is trying to become a potential "financial infrastructure disruptor."

Aiying's team members are a compliance consulting team that has been in both A and B legal affairs and operations, and are well versed in the golden mean of balancing industry regulatory compliance and actual business models. This article mainly studies what kind of evolution has Robinhood's business model undergone? How will its current strategic core - especially the deep layout of RWA (Real World Assets) and encryption technology - reshape its own value and what far-reaching impact will it have on the traditional financial market and the encryption industry? This article will analyze the evolution of Robinhood's business model and the logic of its core strategy from the three dimensions of Robinhood's "Yesterday, Today, and Tomorrow", and deduce its future influence on the industry market.

1. Yesterday: Wild Growth and Transformation Pains from "Zero Commission" to "Diversification"

This section aims to quickly review Robinhood's rise and the initial construction of its business model to provide a background for understanding its current strategic transformation.

1. Entrepreneurial Intentions and User Positioning

The story of Robinhood began with two founders with physics and mathematics backgrounds from Stanford University - Baiju Bhatt and Vladimir Tenev. Their experience in developing low-latency trading systems for hedge funds made them realize that the technology that serves institutions can also serve retail investors. As symbolized by their company name "Robin Hood", their original intention is "financial democratization", aiming to provide ordinary people with the same investment opportunities as institutions. This concept precisely resonated with the millennials' distrust of big banks after the 2008 financial crisis. They seized the wave of mobile Internet and launched an App designed specifically for mobile terminals in 2014. Its two major disruptive innovations are: Zero commission trading: It completely breaks the charging model of traditional brokerages and greatly reduces the investment threshold. The ultimate user experience: The simple and even "addictive" interface design, such as the ribbon animation after the transaction is completed, gamifies complex financial transactions and attracts a large number of young people with no investment experience.

With this precise positioning, when Robinhood was officially launched in 2015, there were already 800,000 users on the waiting list, which quickly achieved viral growth and ushered in an era for young investors.

2. Establishment and controversy of the core business model

"Zero commission" is not a free lunch. Behind it is the diversified income model carefully constructed by Robinhood, among which the most representative and controversial is PFOF.

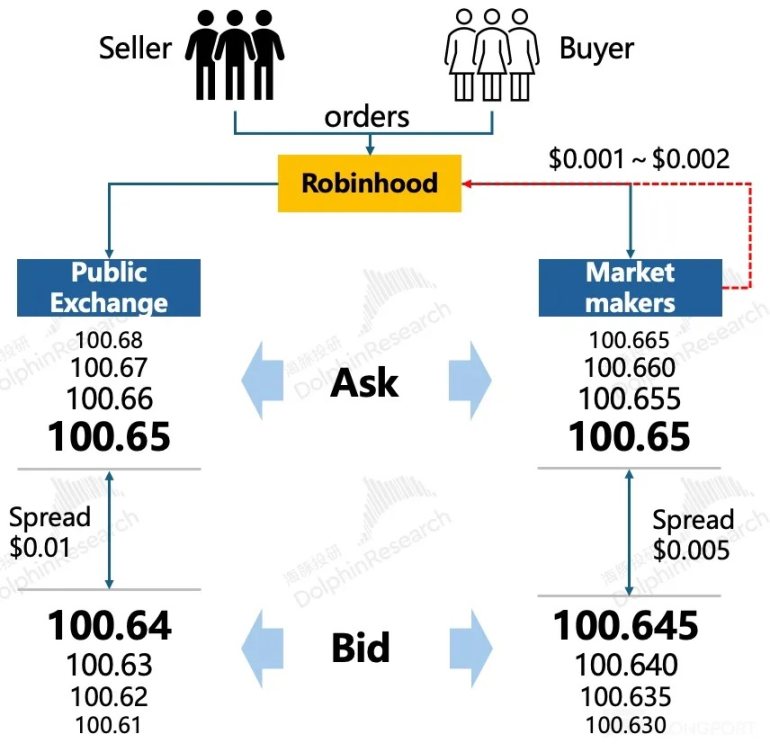

PFOF (Payment for Order Flow)

PFOF is the cornerstone of Robinhood's "zero commission". In short, Robinhood does not send users' orders directly to the exchange, but packages and sells them to high-frequency trading market makers such as Citadel Securities. Market makers make a small profit from the bid-ask spread and pay Robinhood a portion in return. According to research report data, in the second quarter of 2024, Robinhood accounted for about 20% of the stock PFOF market and an absolute advantage of 35% in the option PFOF market. This model has brought it lucrative income, but it has also triggered long-term regulatory disputes, the core of which is whether it has sacrificed the best execution price of users for its own benefit.

Exploration of business diversification

Based on PFOF, Robinhood continues to expand its business territory and build three major revenue pillars:

Trading business: From the initial stock trading, it quickly expanded to options (2017) and cryptocurrencies (2018). Data shows that options and cryptocurrencies, two highly volatile assets, contribute far more trading revenue than stocks, reflecting the preference of its user groups for high risk and high returns.

Interest income: By launching margin loans and cash management services (Cash Management), Robinhood has transformed users' idle funds and leverage needs into stable interest income in a high-interest environment, becoming its second largest source of income.

Subscription service: Robinhood Gold subscription service launched in 2016 provides value-added functions such as instant deposits, pre-market and after-market trading. By the first quarter of 2025, the number of Gold users has exceeded 3.2 million. This marks that Robinhood is initially transforming from a pure trading platform to a "financial SaaS" model that enhances user stickiness and income stability.

3. Growing pains: crisis and reflection

Wild growth is inevitably accompanied by pain. Robinhood's development history is full of various crisis events:

Technology and risk control crisis: In March 2020, on the day of the historic rise of the US stock market, the Robinhood platform was down all day, triggering a class action lawsuit from users. In the same year, a 20-year-old user committed suicide due to a misunderstanding of the balance of his options account, exposing the serious lack of user education and risk warnings behind its "gamified" interface.

GME incident and trust crisis: The GameStop incident in early 2021 was a turning point in its reputation. At the climax of the battle between retail investors and Wall Street, Robinhood suddenly restricted users from buying hot stocks such as GME and was accused of "pulling the plug" and betraying retail investors. Although the official explanation was to meet the margin requirements of the clearing house, the label of "stealing from the poor to help the rich" has been deeply engraved on its brand, shaking its original intention of "financial democratization."

Continued regulatory pressure: From the fine issued by FINRA for PFOF issues to the SEC's investigation into its crypto business, regulation has always been the sword of Damocles hanging over Robinhornod's head.

These crises have collectively exposed Robinhood's weaknesses: unstable technical platforms, flawed risk control mechanisms, and potential conflicts between business models and user interests. It is these profound pains that have forced Robinhood to find new growth stories and strategic directions to get rid of the label of "Meme Stock Paradise" and rebuild market trust.

2. Today: All in Crypto——Robinhood's Strategic Ambition and Business Logic

This section is the core of the full text, and will deeply analyze Robinhood's current strategic layout with RWA and crypto technology as the core, and dismantle the business logic and competitive advantages behind it.

1. The core of the strategic shift: Why RWA and stock tokenization?

Robinhood's future bet on RWA and encryption technology is not a whim, but based on profound financial drivers and strategic considerations.

"We have the opportunity to prove to the world what we have always believed, that cryptocurrency is far more than a speculative asset. It has the potential to become the backbone of the global financial community." —— Vladimir Tenev, Robinhood CEO

Financial drive: the core engine of profit

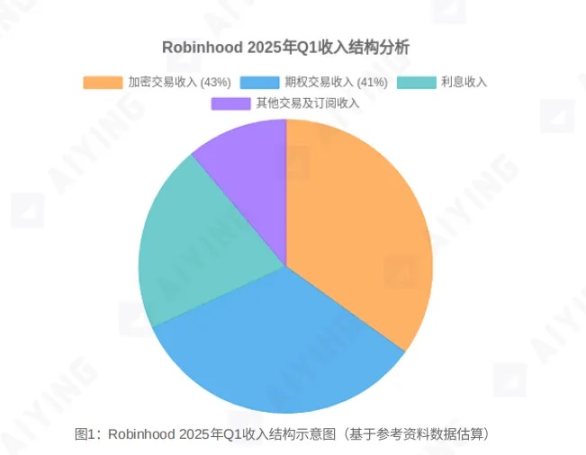

According to financial report data, the encryption business has become Robinhood's most profitable business. In the first quarter of 2025, encryption transactions contributed $252 million in revenue, accounting for 43% of total trading revenue, surpassing options for the first time to become the largest source of trading revenue. More importantly, its amazing profit margin. According to analysis, the market-making rebate rate of crypto order flow is 45 times that of stocks and 4.5 times that of options. Driven by both growth and profitability, All in Crypto has become an inevitable choice.

Narrative Upgrade: From Broker to "Bridge"

This move helped Robinhood upgrade from a controversial "retail broker" to a "bridge connecting traditional finance (TradFi) and the on-chain world." This can not only effectively get rid of the regulatory shadow of PFOF and the cyclical label of "Meme stock", but also cut into a trillion-level market that is far larger than the existing business - digitizing and tokenizing huge assets in the real world.

Core goal: subverting traditional financial infrastructure

In a letter submitted to the U.S. Securities and Exchange Commission (SEC), Robinhood clearly stated its vision for RWA tokenization. They believe that blockchain technology can be used to achieve: This vision aims to fundamentally subvert the inefficiency, high cost and entry barriers of the existing securities trading system.

24/7 all-weather trading: breaking the time barrier of traditional exchanges.

Near-instant settlement: from T+2 to T+0, significantly reducing counterparty risk and operating costs.

Unlimited division of ownership: Allow high-priced assets (such as real estate and artworks) to be fragmented and lower the investment threshold.

Improve liquidity: Create a broader market for traditionally illiquid assets (such as private equity).

Automated compliance: Embed regulatory rules through smart contracts to reduce compliance costs.

2. "Trinity" strategic combination: How to achieve the goal?

In order to achieve this grand goal, Robinhood has launched a "Trinity" strategic combination, from the application layer to the infrastructure layer.

Stock Tokenization

This is the "stepping stone" of its RWA strategy. By launching US stock tokens in the EU market, allowing users to trade 24/5 and receive dividend support, Robinhood is conducting a large-scale market education and technical verification. This move aims to open up the interface between traditional assets and the on-chain world, allowing users accustomed to traditional investments to enter the crypto ecosystem "smoothly".

Self-built L2 public chain (Robinhood Chain)

This is its most strategically ambitious step. By building its own Layer 2 public chain optimized for RWA based on the Arbitrum Orbit technology stack, Robinhood is sinking from an "application" to an "infrastructure provider". Owning your own public chain means mastering the right to make rules and the dominance of the ecosystem. In the future, the issuance, trading, and settlement of all tokenized assets will be completed in a closed loop within this ecosystem, thus building a strong technical and commercial moat.

Broker-as-a-Platform

Through a series of acquisitions (such as Bitstamp, WonderFi) and product launches (such as perpetual contracts, staking services, AI investment advisor Cortex, and credit card cashback for coin purchases), Robinhood is building an "all-around investment platform driven by encryption." This platform integrates trading, payment, asset management, and infrastructure, covering the entire life cycle of users from deposits, transactions to asset appreciation, aiming to maximize the lifetime value (LTV) of a single user.

3. Comparative analysis: Robinhood vs. Coinbase & traditional brokerages

Robinhood's strategic positioning puts it in a unique position in the competitive landscape.

vs. Coinbase

Path differences: Coinbase is an "exchange on the chain", whose core is to serve crypto-native assets and win the trust of institutions through compliance paths. Robinhood is a "broker on the chain", whose goal is to "change the old world with the chain" and introduce huge traditional assets on the chain.

Advantage comparison: Coinbase's advantages lie in its deep crypto industry roots, compliance depth and institutional customer base. Robinhood's advantages lie in its huge retail user base, ultimate product experience and more radical and focused RWA strategy.

vs. Traditional brokerages (Schwab, IBKR)

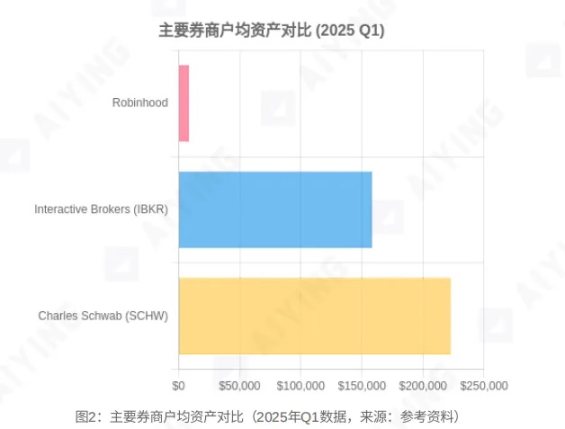

Model differences: Traditional brokerages such as Schwab and Interactive Brokers (IBKR) mainly serve high-net-worth and institutional clients, and their income is more dependent on interest and advisory services. Robinhood serves younger and more active retail traders, and its income is more dependent on trading commissions (especially cryptocurrencies).

Data comparison: According to third-party statistics, Robinhood has exceeded Schwab in terms of account number by 2/3, but its average assets per household (AUC) is only about 2% of the latter. This is both its shortcoming and its future growth space. Its current IRA retirement accounts, credit cards and other products are precisely to increase the scale and stickiness of user assets and attack the hinterland of traditional brokerages. In terms of the growth rate of trading revenue, especially crypto trading revenue, Robinhood has far surpassed traditional brokerages.

3. Tomorrow: The "first entrance" to reshape the financial order? Opportunities and risks coexist

Based on the previous analysis, Aiying Aiying deduces the future of Robinhood and evaluates its possible market impact and the challenges it faces.

1. Potential impact on the financial market structure

Squeeze the liquidity of altcoins: When investors can trade blue-chip tokens (such as OpenAI and SpaceX) with real value support on a compliant and convenient platform, the demand for high-risk, non-fundamental altcoins and meme coins may be diverted in large quantities. In the future, the crypto market may further differentiate into "mainstream coins through ETFs" and "infrastructure coins that can link traditional finance", and a large number of altcoins may not have much presence.

Reshaping stock trading rules: 24/7 trading will completely break the pre-market and post-market restrictions of traditional exchanges, and will have a profound impact on global liquidity allocation, price discovery mechanisms and even market maker strategies. In the future, "Do you look at Nasdaq or Robinhood before the market?" may change from a joke to a real question.

Accelerate the entry of TradFi giants: Robinhood's aggressive layout will become a "catfish" that will stir up the entire traditional financial industry. Its exploration will force traditional giants such as JPMorgan Chase and Goldman Sachs to accelerate their layout in the field of asset tokenization, thus triggering a new round of financial technology arms race.

2. Robinhood's own opportunities and valuation reconstruction

If the strategy is successful, Robinhood will usher in huge development opportunities.

Become the "first entrance" of RWA: With its huge user scale and leading product experience, Robinhood has the potential to become the core hub connecting trillions of dollars of real-world assets with the crypto ecosystem. It will capture the dual era dividends of "intergenerational wealth transfer" (84 trillion dollars of assets will be transferred from baby boomers to millennials) and "Crypto Adoption" (popularization of crypto technology) at the same time.

Valuation anchor point shift: Its valuation logic is undergoing a qualitative change. It is no longer a cyclical brokerage that is simply affected by trading volume and interest rates, but a composite company with SaaS (Gold subscription), financial technology (platform effect) and infrastructure (public chain value) attributes. This multi-dimensional business model will greatly open up its growth ceiling, and the market will also adopt a new model for its valuation.

3. Lingering risks and challenges

Robinhood's grand blueprint is not a smooth road, and it still faces three core challenges:

Regulatory uncertainty: This is the biggest bottleneck for the realization of its strategy. In its letter to the SEC, it clearly pointed out many obstacles under the current regulatory framework, such as: How to define the legal attributes of RWA tokens? How do brokers meet the custody rules for digital assets (such as Rule 15c3-3)? How to calculate the capital requirement for digital assets (Rule 15c3-1)? Although the current political winds in the United States seem to be more friendly to the crypto industry, any changes in regulatory policies may be a fatal blow to its business.

Execution and competition risks: Plans such as building its own L2 public chain, integrating Bitstamp, and achieving global expansion, each step tests Robinhood's strong project management and execution capabilities. At the same time, competition from crypto-native rivals such as Coinbase and Kraken, as well as awakened traditional financial giants such as Goldman Sachs and JPMorgan Chase will be extremely fierce. "Who does it is the key to life and death", Robinhood must prove that it not only has good ideas, but also has the ability to realize ideas.

The inherent fragility of the business model: Despite the increasing diversification of its business, its revenue structure will still be highly dependent on the highly volatile trading business in the short term, especially cryptocurrencies. This means that its performance will still be greatly affected by market cycles. How to establish a more robust and predictable source of income while pursuing disruptive innovation is the key to its long-term healthy development.

Summary: A new and old financial derivatives blueprint being drawn

Looking back on Robinhood's history, it is no longer the "retail toy" that only relies on "zero commission" and "gamification" to attract attention. It is trying to move from the edge of the financial system to the center through a gamble centered on RWA and encryption technology, and become a "system designer" and "infrastructure provider" at the junction of the old and new financial order.

It is no longer aiming at the surface functions such as 24-hour trading and instant settlement, but the underlying reconstruction of the entire asset issuance, trading, and settlement system - transforming the closed, expensive, and inefficient rules in traditional finance into an open, programmable, and composable new financial logic.

The success or failure of this transformation will not only determine the fate of Robinhood itself, but will also largely affect the evolution of the global financial market in the next decade. For investors and market observers, Robinhood is no longer just a stock code, but a "derivative blueprint" full of infinite possibilities for observing the future financial form. Volatility will continue to exist, and the space for institutional arbitrage has just opened up.

Clement

Clement

Clement

Clement Kikyo

Kikyo Jixu

Jixu Clement

Clement Hui Xin

Hui Xin Catherine

Catherine Clement

Clement Aaron

Aaron Jasper

Jasper Jixu

Jixu