Author: Klein Labs; Translation: Golden Finance xiaozou

As Web3 enters a new adjustment cycle, TGE (token generation event) is no longer a financing tool, but has become a battlefield for dynamic game between projects and the market. At a time when liquidity is shrinking and investor confidence is weak, how and in what form TGE is launched has become a core proposition that project teams must think deeply about.

As one of the mainstream TGE mechanisms, IDO has written a glorious history. Platforms such as CoinList have nurtured countless star projects through IDO. However, with the surge in the number of projects, the wealth effect of IDO is gradually declining. At the same time, Binance's every move has always affected the market. Since 2025, Binance Wallet IDO has become the preferred release platform for many projects-low entry barriers, high exposure and strong traffic effects have made it quickly become the focus of the market, attracting a large number of early projects and community attention. But under the spotlight, the market structure, valuation system and narrative logic of new assets are undergoing drastic changes.

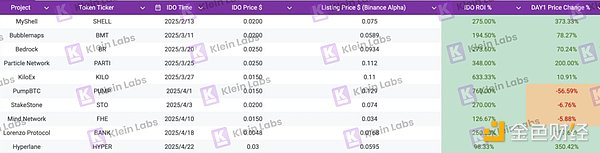

Is this model applicable everywhere? Which projects can use this to amplify the narrative and achieve a cold start, and which will fall into the dilemma of "opening high and closing low" after the heat fades? The Klein Labs research team systematically analyzed the data and structure of 10 Binance Wallet IDO projects that have been launched, aiming to provide strategic references for project parties and help them make more informed decisions.

1. What market cycle are we in?

In the past few months, the market investment preferences have shown a clear evolution trajectory:

Early preference:High valuation + low circulation model (VC driven, short-term speculation)

Mid-term frenzy:Fully circulated MEME coin model (zero threshold speculation)

Current stage shift:Return to projects with solid fundamentals and strong sustainability

At the same time, the TGE model structure has also experienced three distinct stages:

Early model:Low valuation issuance + market value discovery mechanism (narrative driven)

Mid-term model:High valuation issuance + insider arbitrage (through OTC or immediate selling)

Current Status:Return to low-valuation issuance (scarce buying orders, unwilling to "catch the flying knife")

This market status is most directly reflected in the continued decline in the issuance valuation of Binance Wallet IDO projects. Project parties have to exchange ultra-low valuations and release ratios for the scraps of market attention. The core insight behind this is:

TGE valuation does not reflect the "future value" of the project, but a real-time synthetic indicator of market liquidity, expectations of listed exchanges, narrative strength and market-making system.

2. The traffic effect of Binance Wallet IDO is still strong, but timing is everything

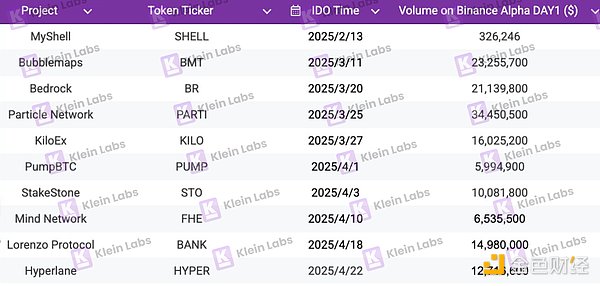

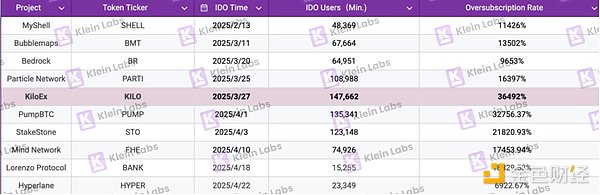

Data proves that Binance Wallet IDO can bring considerable market attention and brand exposure to the project:

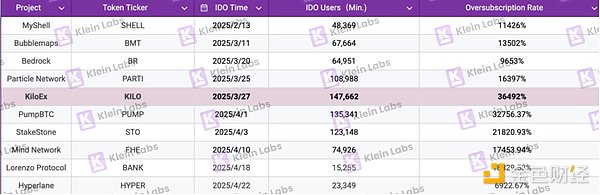

Average number of participants:80,965 users

Single fundraising range:60,000–443,000 BNB

Oversubscription multiple:6,900%–36,500% (KiloEx even reached an astonishing 36,492%)

Binance Wallet IDO can easily leverage six-digit user participation, and can still attract tens of millions of dollars in equivalent assets even in an overall sluggish market. Although the mechanism optimization has raised the participation threshold, it has screened out high-quality users with more long-term value and stickiness, forming a healthier community structure and facilitating subsequent operations and user conversion.

Relying on the lightweight access model of Binance Wallet, the project still maintains a strong cold start potential, greatly reducing the time and cost of user acquisition.

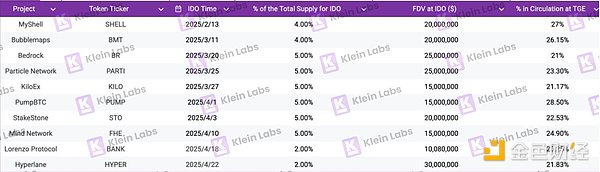

3. TGE model deleveraging, wallet IDO projects start with low valuations

Data analysis shows that Binance Wallet IDO projects show amazing consistency in token economic models:

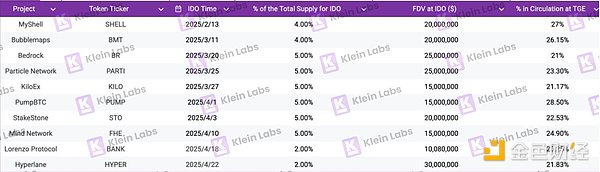

IDO token release:Generally low (2%-5% of total supply, 4.44% on average)

TGE circulation:Usually controlled at 20%–30% to avoid excessive dilution of initial liquidity.

IDO fully diluted valuation (FDV):Concentrated in the reasonable low range of 10 million to 30 million US dollars

Three major reasons why project parties still choose Binance Wallet IDO at this stage:

The product is mature and needs tokens to support use cases/incentives/settlement systems.

Low-cost access to community and transaction support, similar to large-scale market roadshows + liquidity seeding.

Adhere to long-termism and accept low valuations, small releases, and slow growth models.

Currently, Binance Wallet IDO projects must withstand the valuation squeeze caused by the collapse of market confidence, but this also reserves huge room for growth for truly excellent teams.

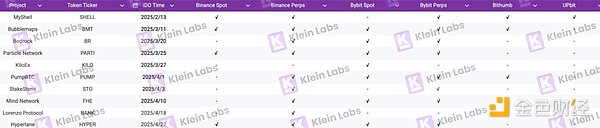

4. Exchange performance: Binance Wallet IDO is an entry ticket rather than a finish line

Many teams mistakenly regard wallet IDO as a guarantee of Binance listing, but data shows:

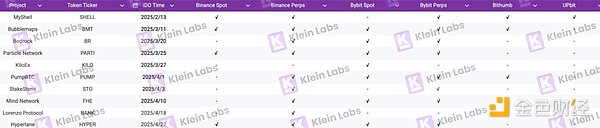

Binance spot listing rate:40% (SHELL, BMT, PARTI, HYPER)

Binance contract adoption rate:About 90% of projects

Bybit listing:70% spot, 80% perpetual contract.

South Korean Exchange:Low and irregular listing rate

Binance Wallet IDO is not a pass to Binance spot market, but more like a trial field to enter Binance traffic ecology. Whether the full amount of spot listing can be obtained depends on the data after the project is launched, user feedback and the evaluation of Binance internal trading team. The project party should regard it as a rehearsal for listing, and prepare for the subsequent acceptance and secondary liquidity support.

5. Price trend: strong start, long-term victory depends on operation strategy

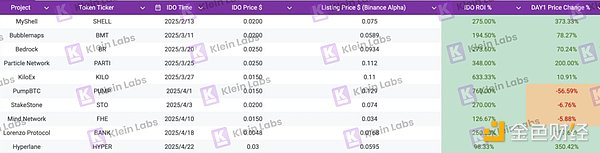

Most Binance Wallet IDO projects performed well on the first day, with amazing return on investment (ROI):

Star case:PumpBTC soared 760% on the first day, and KiloEx also performed well.

Volatility characteristics:The price fluctuation on the first day was drastic, but the medium- and long-term performance depends on continuous operation, market strategy and clear roadmap.

Regional gameplay:MyShell, Bubblemaps, PumpBTC and other projects focused on the Korean market after IDO to promote development.

Although Binance Wallet IDO projects can often ignite market enthusiasm, projects without long-term planning are difficult to cope with current challenges: weak buyer power, investors are averse to chasing high short-term selling pressure, insufficient fundamental support or narrative overdraft. This has led to an increase in performance differentiation between projects.

Short-term enthusiasm is easy to ignite, and long-term victory requires internal operation. The team must plan the rhythm of the secondary market and investor relations in advance to avoid price collapse and achieve long-term steady-state value release.

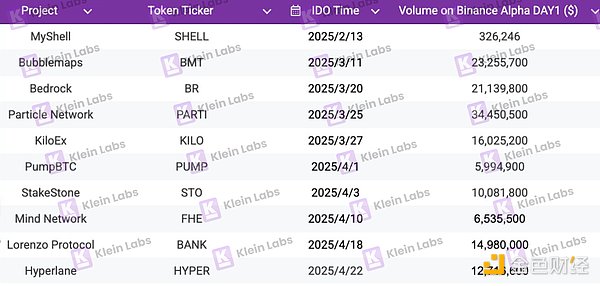

6. Trading heat: the real yardstick of market attention and capital flow

The market response of Binance Wallet IDO projects varies, but the overall trading activity remains strong:

Head projects:PARTI, BMT, BR's first-day trading volume exceeded 20 million US dollars.

Factors driving heat:High activity not only comes from initial traffic, but also depends on narrative tension, token economic design and expectation management.

IDO is just a spark of enthusiasm. Whether it can be continued and amplified in the secondary market depends on execution and rhythm control. Projects with poor performance often become silent after TGE, either because of the lack of continuous content to stimulate discussion or because of the loss of confidence due to improper market operation.

Conclusion: Binance Wallet IDO is a value filter and narrative testing ground

Binance Wallet IDO is a structured high-leverage tool for Web3 projects to cold-start narratives, build consensus, and amplify voice. It provides teams with a script that converts limited investment into huge potential energy, but requires extreme execution, planning, and market acumen.

Its data reflects the deep evolution of market valuation logic and issuance paradigms. It is neither a terminal nor a pass, but a low-cost window to verify product vision and test market mechanisms.

At the end of the current cycle of "low confidence + low liquidity + high vigilance", projects that insist on long-term construction should take the initiative to use Binance Wallet IDO to demonstrate their value thickness, narrative rhythm and operational skills.

It is not suitable for everyone. But for those teams with clear narratives, restrained rhythm and long-term intentions, this is an important springboard to enter the Binance ecosystem and mainstream vision. The market after the bubble recedes is returning to the source of value-this is undoubtedly a positive signal for those who are truly focused on long-termists.

Like all platform IDOs, the online carnival is fleeting-how can the feast continue? This is a proposition that Binance Wallet needs to answer. If the positioning of the high-quality asset release platform can be consolidated, its life cycle will far exceed expectations. And what is a high-quality asset? What kind of project does the industry really need? Which projects have a future? These are worth our joint consideration.

Kikyo

Kikyo