Author: Xiao Lizi Source: mirror

In the crypto market, in addition to participating in primary and secondary transactions, users can also participate in airdrops with a low threshold. Since DeFi became mainstream in 2021, airdrops have always been an opportunity to "win big with small investments". In recent years, airdrops have become a popular way to participate in small investments by participating in early on-chain interactions and tasks in projects to obtain airdrop rewards.

However, this strategy has gradually led to a large dilution of rewards for ordinary users due to the entry of a large number of studios. In addition, due to the increasingly complex rules of airdrops, even if you work hard, you may not necessarily get a reward. What is more important is the strength of the selected project and the prosperity of the public chain ecosystem it relies on.

Therefore, when deciding which projects to participate in, users need to not only evaluate the potential of the project itself, but also pay attention to whether the public chain ecosystem in which it is located has a foundation for long-term development. Blindly interacting may not even be rewarding. This is what many people say, airdrops are 20% effort and 80% investment research.

A high-quality public chain ecosystem can provide multi-faceted support for projects, including sufficient liquidity, diverse application scenarios, and a large user base. These factors together constitute a fertile ground for project development, enabling it to stand out in a highly competitive market. However, if the public chain ecosystem is underdeveloped, even if the project has cutting-edge technology or unique creativity, it may gradually fade away due to lack of sufficient resources and user attention.

Take Starknet as an example. As a Layer 2 solution based on ZK-Rollup technology, its technical strength is unquestionable, but the ecological construction has failed to match its technical advantages, resulting in scarce on-chain applications, low user participation, and slow growth in total TVL. The situation of Scroll is similar. Although it relies on the Ethereum ecosystem, its development is limited by the dispersion of liquidity and lack of innovation, and it has failed to form a strong user appeal. The experience of these public chains shows that the lag in ecological construction will significantly weaken the potential of ecological projects.

Berachain, which focuses on ecological development

In contrast, some emerging public chains have learned lessons and attach great importance to ecological development. Take Berachain as an example. Since its mainnet was launched on February 6, 2025, Berachain has quickly become a highlight in the DeFi field. Its total locked value (TVL) has reached 5.3 billion US dollars, an increase of more than 200% from the initial launch, with more than 100,000 daily active addresses and an average monthly increase of 150% in transaction volume.

This achievement is mainly due to its innovative Proof of Liquidity (PoL) consensus mechanism. Unlike traditional PoW (proof of work) and PoS (proof of stake), POL emphasizes the liquidity and utilization efficiency of assets, closely combines the provision of liquidity with network security, and avoids resource waste and high energy consumption. Its core advantage is that it can attract more users to participate in network maintenance, enhance decentralization and anti-attack capabilities, and improve the stability and scalability of the network.

By incentivizing users to provide liquidity, this mechanism not only improves the efficiency of funds on the chain, but also builds an economic system with liquidity as the core. For example, users can earn block rewards and "bribes" by staking BERA or providing liquidity to ecological projects, thus forming a positive feedback loop and attracting more users to participate. In addition, Berachain's EVM compatibility enables it to seamlessly integrate the development tools and services of the Ethereum ecosystem, further lowering the threshold for dApp development.

Infrared Finance: The Pillar of Berachain Ecological Liquidity

As of April 2025, the number of projects in the Berachain ecosystem has exceeded 50, covering decentralized exchanges (DEX), lending platforms, yield aggregators and other fields, forming a variety of application scenarios. The project that occupies the core of the Berachain ecosystem is Infrared Finance, which is also the first project of the Berachain Foundation's "Build-A-Bera" incubation program.

Its founding team is composed of a group of experienced professionals with both deep technical skills and ecological insights. Team members are not only core participants in the Berachain project, but have also held important positions in top institutions and projects such as Apple, NASA, Kraken, and Ethereum Layer 2 solution Optimism.

Infrared focuses on liquid staking services. Improve the ease of use, efficiency, and composability of the PoL consensus mechanism in the Berachain ecosystem. Make it easier for users to participate in network security and governance while optimizing capital efficiency. After users pledge their assets, they can obtain liquid tokens such as iBERA and iBGT. These tokens retain the pledge rights and can circulate freely in DeFi, avoiding the lock-up restrictions of traditional pledges. This design lowers the technical threshold and enhances asset liquidity and the degree of decentralization of the ecosystem.

However, the POL consensus mechanism has its advantages and troubles. For example, users need to understand the strategies of LPs, participate in BGT delegation, study the cost-effectiveness of the vault, and interact with validators. This is a bit like users in 2020 facing a bunch of DeFi pools and not knowing where to start. At that time, the machine gun pool automatically participated in the pool with higher returns by sniffing from the chain.

The core goal of Infrared is to promote the sustainable development of Berachain and create greater value for users and developers by simplifying processes and improving flexibility. Make PoL easier to use, more efficient, and seamlessly combine with other financial scenarios to help the prosperity of the ecosystem.

Infrared Points Program

On April 24, 2025, Infrared launched the Infrared Points program, which provides early participants with the opportunity to obtain future token airdrops by recording users' pledges and liquidity contributions.

Combined with its native tokens scheduled to be issued in the third quarter of 2025, this points mechanism effectively reduces the time cost of users, and they will not have to worry about PUA for several years like other projects. At the same time, it creates a clear path for them to share the growth dividends of the Berachain ecosystem. For users who are looking for high-potential opportunities in the crypto market, Infrared Points is undoubtedly a worthy entry point.

Users can stake Berachain's native token BERA or governance token BGT to Infrared's PoL vault to obtain liquid staked tokens iBERA or iBGT and earn points at the same time. WBRA can also provide liquidity to iBERA and iBGT group LPs to obtain higher points multiples.

Moreover, compared to most of the "backstabbing" of old users after launching a points activity, the previous points are not counted or the points are greatly diluted. Infrared's points have a retroactive mechanism, which will trace back the user's participation records since March 21, 2025, such as users who have participated in providing liquidity in Kodiak and BEX, to ensure that the contributions of early users are recognized.

Tutorial for Beginners on the Points Program

How to participate in Infrared Points? There are actually many strategies, such as providing liquidity, staking iBERA or iBGT, and even arbitrage strategies. For those who want to participate, I propose the simplest two or three methods for reference.

1.Convert BERA to iBERA or iBGT and stake it to earn income and points.

2.Form LP in vaults, and the recommended one is WBERA-iBERA pool.

3.Convert BERA to iBERA for staking, and then hedge for lossless arbitrage, but the APR is only about 5%, which is more suitable for large funds to participate.

First, you need to buy BERA and withdraw it to Berachain, then enter the infrared vaults page.

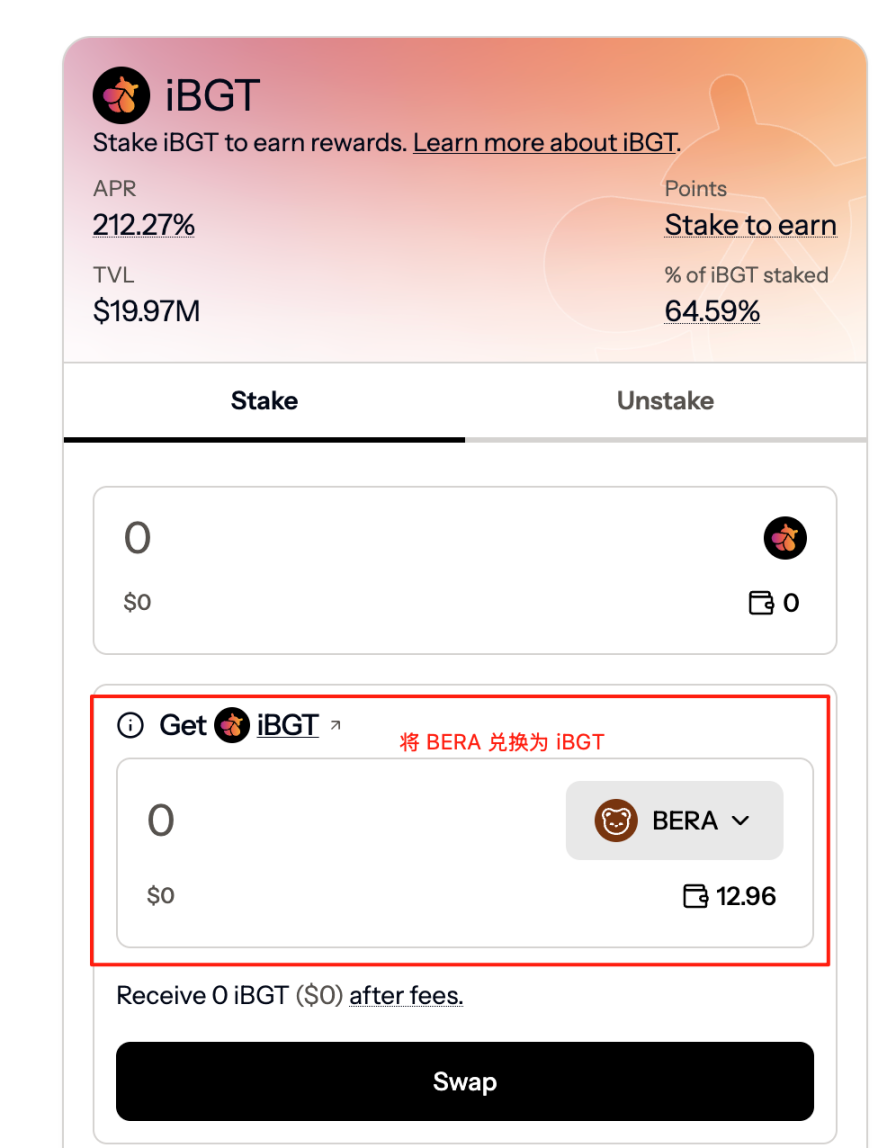

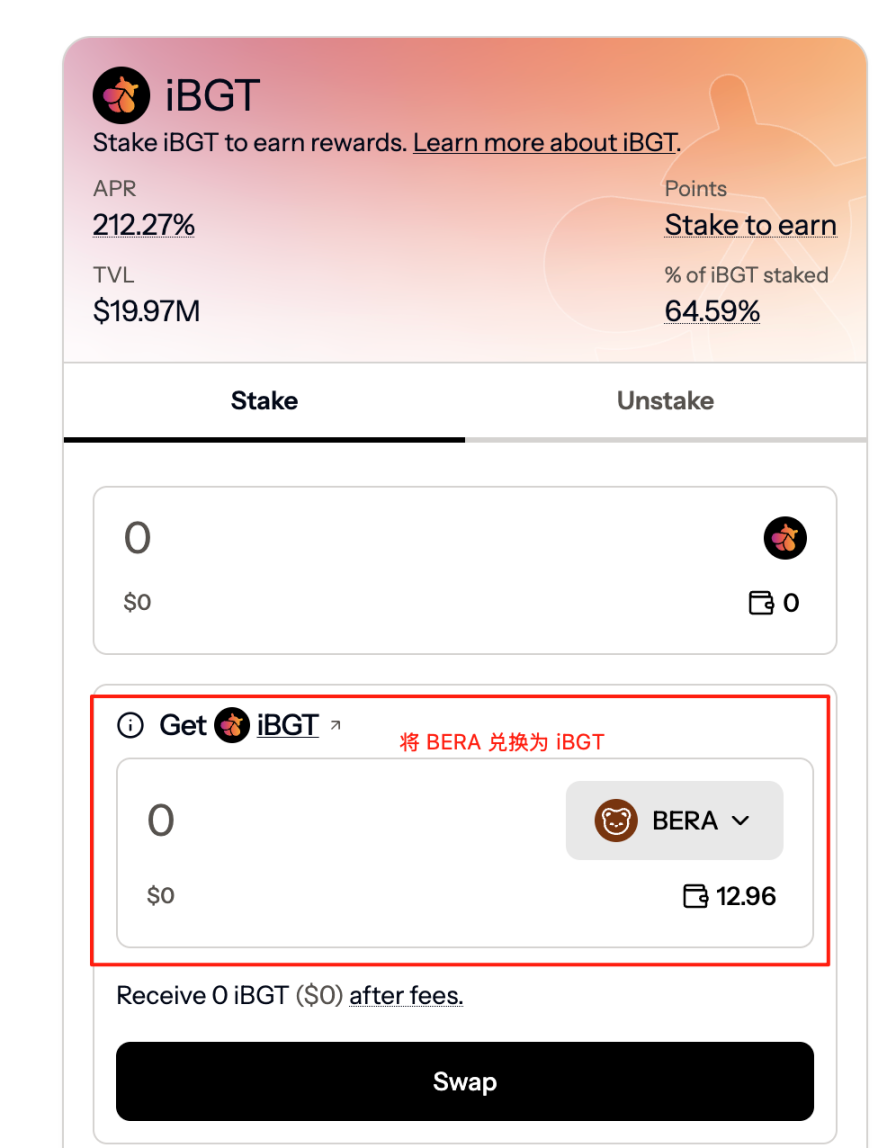

First exchange BERA for iBGT, then stake iBGT, which currently has 212% APR (will fluctuate between 100-300 at any time) and earn points.

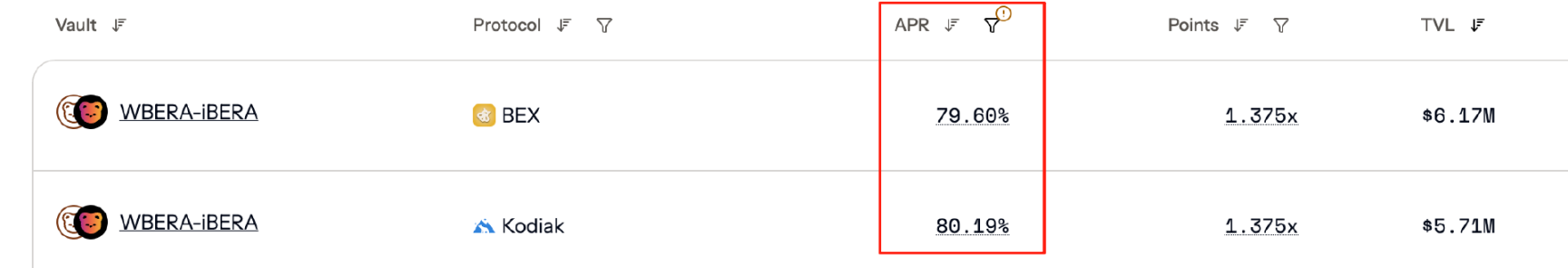

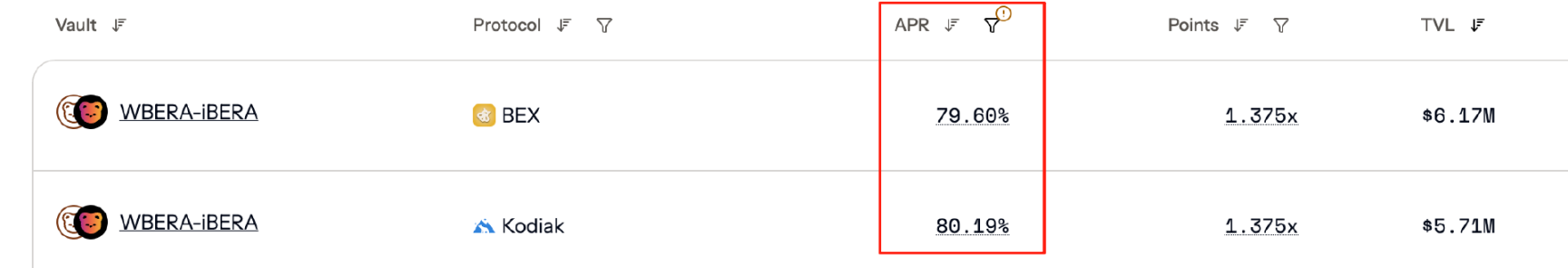

Form WBERA-iBERA LP in vaults. Currently has 80% APR and earns 1.375 times points.

Why choose iBGT staking and WBERA-iBERA pool, we must understand the relationship between these coins.

BGT is the governance token of Berachain, and users can earn BGT by participating in dApps in the ecosystem (such as BEX, Berps, etc.). BGT can be burned and exchanged for BERA at a ratio of 1:1, so the value of BGT is theoretically equal to BERA. iBGT is pegged to BGT at a 1:1 ratio, and each iBGT is backed by one BGT.

Do you understand? BGT can be exchanged for BERA at a 1:1 ratio, and iBGT is linked to BGT at a 1:1 ratio, so theoretically the value of iBGT should be exchanged for BERA at a 1:1 ratio.

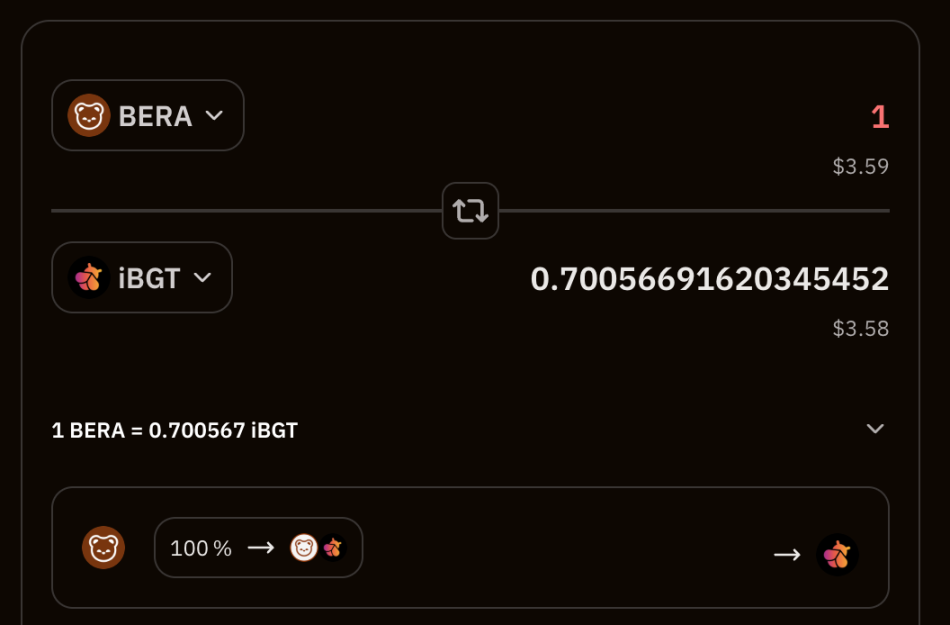

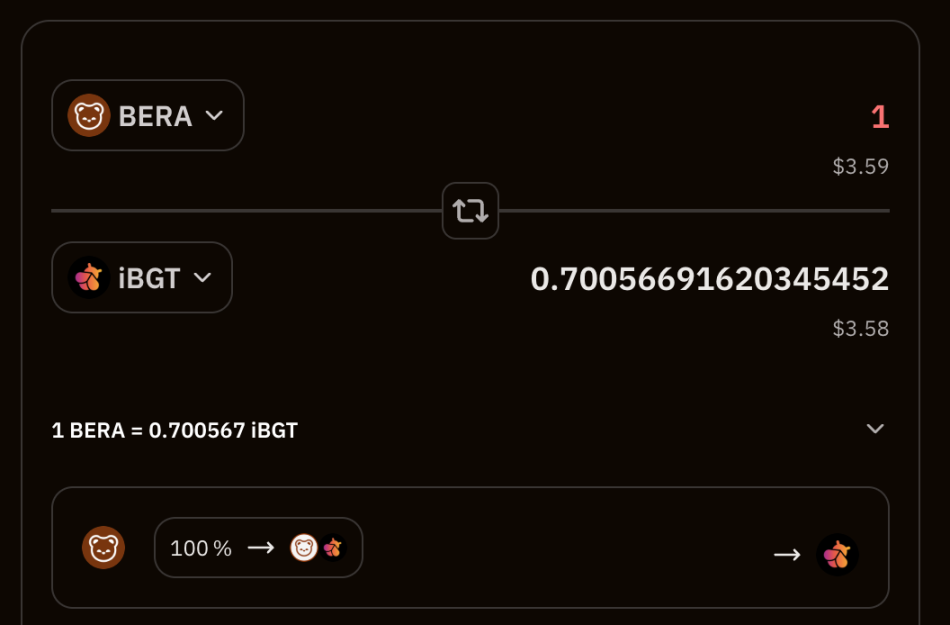

However, the current high return on iBGT staking has led to a very high premium of iBGT to BERA in the secondary market. Currently, 1 BERA can only be exchanged for 0.7 iBGT.

Since iBGT can be pegged to BERA at a 1:1 ratio in theory, while participating in staking iBGT can enjoy high APR, it is also necessary to consider that iBGT will be sold off and the exchange rate will be sharply adjusted due to the decline in yield in the later period.

The risk of participating in WBERA-iBERA is relatively small. WBERA is a wrapped version of BERA, similar to WETH on Ethereum. iBERA is a liquid staking token provided by Infrared Finance, and its value increases with the staking income (that is, the price will increase slowly over time than BERA).

Then the exchange rate of WBERA-iBERA will not fluctuate greatly, so WBERA-iBERA LP will not bear a large impermanent loss, but only the risk of BERA falling. If you have experience in contracts, you can hedge against the risk of falling.

Since iBERA currently has no redemption channel, the exit mechanism will be implemented in Berachain's Bectra upgrade. In the short term, there may be a certain risk of de-anchoring due to liquidity issues, which is a bit similar to the "jail" of Ethereum's Restaking last year. After the exit is opened, it can be redeemed at any time.

Written at the end

Currently, the TVL managed by Infrared has reached 1.7 billion US dollars, and Berachain has 63 active nodes, of which 8 are associated with Infrared. Infrared is in a leading position in the field of liquid staking in the Berachain ecosystem.

Infrared has successfully raised investments from many well-known institutions such as YZi Labs (Binance), Framework, NGC Ventures, Selini Capital and Synergis Capital, with a total amount of up to 18.75 million US dollars. This financing achievement highlights the market's wide recognition of Infrared's potential in the Berachain ecosystem and provides strong financial support for its technology research and development and ecological expansion.

Due to YZi Labs' investment background and position in Berachain. It is expected to be launched in the Alpha zone or even directly on the Binance main board during the TGE in the third quarter.

Infrared's mechanism forms a positive cycle: user staking and increased liquidity improve the security and liquidity of the network, attracting more projects and developers to join the Berachain ecosystem, thereby promoting the development of Infrared. Its liquid pledge service provides users with the dual advantages of flexibility and income, making it the core infrastructure in the Berachain ecosystem.

Joy

Joy