Original author: Injective ResearchTranslator: GodRealmX

In the past decade, blockchain, Defi, and on-chain financial system innovations have made great progress, and "liquidity" has always been the cornerstone for promoting the iteration of blockchain-related technologies and user growth. However, to this day, isolated liquidity pools have been formed between different dApp applications under traditional liquidity management solutions, which has extremely low capital utilization efficiency and hindered the iteration of the Defi industry.

In this article, we will introduce a new concept: Liquidity Availability.We will explain and explore the concept of liquidity availability in its context to point out its important position in the crypto ecosystem. We will also discuss the supporting technologies and mechanism designs required for liquidity availability solutions, as well as the problems that it can solve.

What is liquidity availability?

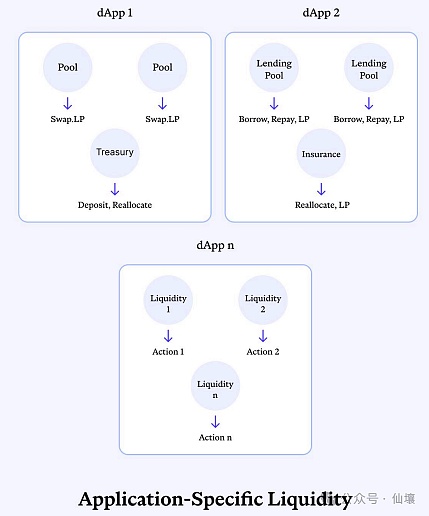

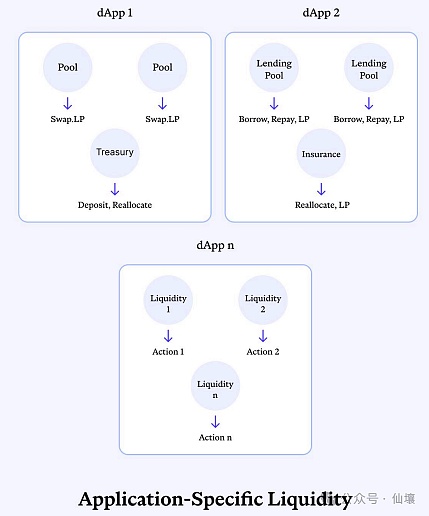

Liquidity Availability refers to the ability to provide sufficient liquidity to ensure the successful execution of a transaction at any time and under certain constraints. Liquidity availability is the ability to provide sufficient liquidity. At the application level, liquidity availability is mainly manifested as Application-Specific Liquidity of dApps. This type of liquidity is limited to a specific dApp and cannot be used for other purposes. Specifically, there are the following constraints:

The liquidity within a dApp cannot be adopted by other applications on the same public chain, and cannot be used in scenarios unrelated to the specific purpose of the dAPP (such as token pairs on DEX), which leads to liquidity fragmentation in the public chain ecosystem. Even within a single dApp, liquidity is usually locked in a specific pool for a single function, such as the liquidity pool for ETH/BTC exchange. This means that the dAPP cannot reallocate this part of liquidity or use it for other use cases in the dAPP, thereby limiting flexibility and reducing the efficiency of capital utilization.

Most of the time, dApps attract liquidity providers (LPs) to deposit their assets into designated repositories, usually in smart contracts, and each repository only supports specific trading use cases. Common scenarios include: liquidity pools for asset exchange, lending protocols that provide overcollateralized loans, insurance pools, and pledge pools for liquidity pledge derivatives (LSD). This is itself a manifestation of liquidity fragmentation, which is becoming more and more serious in today's multi-chain application system, and liquidity is ultimately highly dispersed across multiple public chains.

Therefore, TVL, as a measure of dApp liquidity, does not accurately reflect liquidity availability. TVL aggregates the total amount of liquidity that people deposit into dApps, but this liquidity is severely fragmented across various use cases and cannot fully meet a wider range of trading needs. But within the current system, TVL can be used as a rough indicator to compare the status of different dApps.

Currently, at the public chain level, liquidity availability is still limited to each independent dApp, and a public chain cannot use all the liquidity of the dApps in the ecosystem to improve the liquidity availability of the ecosystem as a whole. Interoperability solutions have ostensibly become the focus of the industry to improve liquidity availability. The industry has explored various technologies, such as cross-chain liquidity aggregators, unified liquidity pools, atomic swaps, liquidity routing, and tokenized liquidity bridges. Although this has improved liquidity availability to a certain extent, the fragmentation problem has not been fundamentally solved.

Why is this important?

Liquidity isolation and fragmentation bring inherent disadvantages, which restricts ecological growth and low capital utilization. For example, The TVL on the Ethereum chain is about $160 billion, of which Uniswap V2 accounts for about $1.6 billion, and this part of liquidity is dispersed in 400,000 token pools. Other applications on the Ethereum chain cannot use the liquidity of Uniswap V2, and even Uniswap itself cannot freely use funds in different token pools, which highlights the importance of the concept of liquidity availability. The crypto industry has never effectively solved the above problems, creating an environment of unsustainable growth. Different dApps and even public chains need to accumulate liquidity for themselves through brutal competition, and the overall net growth requires the continuous introduction of new entry funds. In such an environment, the needs that the project party must first meet are in conflict with the needs to promote the long-term development of the industry. The top priority for the project party is not to quickly release and iterate products, but to compete for liquidity and TVL. This phenomenon is particularly evident during the bear market. The player-versus-player (PvP) ecosystem has developed from this. Which dApp has a higher TVL will have more resources available. In addition, dApp project owners tend to slow down the frequency of product updates in order to retain existing TVL, because each update may require users to migrate funds on the chain.

In general, the above abnormal phenomena have slowed down the overall growth of the crypto industry, and for newly launched projects, they need to find ways to obtain dApp-specific liquidity and cannot directly borrow liquidity from other places, which is a huge obstacle. The above problems have already had a ripple effect in the industry. DApps with larger liquidity scales are growing faster than new projects. This trend has led to a gradual centralization of the market and the emergence of monopoly phenomena that are common in traditional industries. As long as dApp-specific liquidity remains rooted in the current system, this trend will continue and may worsen over time.

After summarizing the above phenomena, we believe that the poor development of liquidity availability has embedded dApp-specific liquidity into the DNA of the Web3 system. The negative effects of this paradigm have permeated the entire industry, and solving this systemic problem requires focusing on its root causes. In this context, liquidity availability is the core concept we need to focus on.

Liquidity Availability in Traditional Finance (TradFi)

Liquidity availability is not only a key concept in blockchain and DeFi, but also in traditional finance (TradFi). The degree of liquidity availability in traditional finance is very different from the situation in Web3, and understanding these differences helps us grasp the practical significance of liquidity availability and understand how much value blockchain can provide to the broader economic system.

The traditional financial system includes banks and non-bank lenders, insurance companies, securities markets, and investment funds. It also includes clearing counterparties, payment providers, central banks, and financial regulators and supervisors. These institutions together form a set of frameworks that allow people to conduct economic transactions, central banks to implement monetary policies, and users or financial institutions to use savings for various investment activities, thereby supporting economic growth. Each component within the framework plays a unique role in promoting liquidity availability within the system, ensuring that the necessary liquidity is provided for any transaction.

In traditional finance, there is often a mature mechanism system to enhance liquidity availability, and the related metrics include the amount of liquid assets, transaction settlement speed and efficiency, and the availability of credit and financial services. The following components play an important role in maintaining and enhancing liquidity availability:

Credit system - is the foundation of liquidity, which can provide loans and agree to let the borrower repay in the future, thereby meeting liquidity needs in a timely manner. For example, credit cards provide revolving credit lines to provide continuous liquidity for consumers and businesses. In addition, the credit system enables borrowers to transfer future consumption behaviors to the present and allows lenders to postpone consumption behaviors to the future. This dynamic adjustment has not yet been realized in the DeFi system. In summary, the credit system can enhance the total amount of liquid assets available in the economy and ensure that there is always liquidity to meet various transaction needs.

Insurance mechanism - By sharing risks and providing financial protection to reduce users' property losses, further improve liquidity availability. The existence of insurance allows individuals and enterprises to effectively hedge against market fluctuations and maintain liquidity even under adverse conditions. The insurance industry stabilizes the amount of liquid assets of different institutions at different times and provides users with necessary funds immediately when needed.

Refinancing - Refinancing refers to the borrower replacing the current loan with a new loan plan, which allows the borrower to borrow at a lower interest rate, more favorable terms, or change the loan term. This can improve the way liquidity is managed, achieve continuous liquidity optimization, and ensure that borrowers can effectively meet their liquidity needs. Overall, refinancing plans can enable debtors to obtain necessary liquidity, improve credit availability, and increase the size of liquid assets in the financial system.

Clearing House - Centralized dealers and market makers play a vital role as intermediaries between buyers and sellers in the financial market. They settle trades, collect margins, and reduce counterparty risk, ensuring that all types of transactions are executed efficiently and securely. For example, the Depository Trust & Clearing Corporation (DTCC) in the United States processes most securities transactions and provides a stable and reliable infrastructure for liquidity availability. Clearing houses share the risk of exchanges, while various DeFi protocols concentrate all funds on a single platform.

Interbank lending markets - such as the federal funds market in the United States, have greatly facilitated the allocation of liquidity within the banking system. Benchmarks such as the Secured Overnight Financing Rate (SOFR) affect the cost of borrowing across financial markets, allowing liquidity to be efficiently allocated to where it is most needed. This infrastructure prevents liquidity from being isolated, increases the amount of liquid assets available throughout the banking system, and improves the availability of credit.

Custody services -Financial institutions enhance liquidity availability by providing asset management services to high-net-worth clients. Custody services can enhance the overall stability of financial markets and reduce the risk of liquidity shortages. Similar to dApp-specific liquidity in Defi, custody services build trust by proving that funds are available, thereby speeding up the completion of various types of transactions. Although custody services have a place in the traditional financial system, they are not suitable for all types of financial transactions due to their inherent limitations.

Centralized dealers and market makers - such as large investment banks, continuously provide buy and sell orders for financial assets to ensure that there is always a counterparty in the market to trade. This practice improves the efficiency of capital utilization and ensures that there is always sufficient liquidity in the market. Such institutions usually reserve various assets in inventory, which enhances liquidity in the market and allows various trading instructions to be completed quickly and efficiently.

By studying the above core components in TradFi, we can clearly see that the infrastructure in traditional finance is designed to meet the liquidity needs at any time to ensure the robustness and efficiency of the financial system. Although the methods of achieving liquidity availability in blockchain are different, its ultimate goal is highly similar to that of the traditional financial system. By borrowing concepts and approaches from the traditional financial system, the Crypto ecosystem can more effectively address the problem of liquidity silos, ultimately contributing to a more efficient and robust financial framework.

Full-chain Liquidity Availability

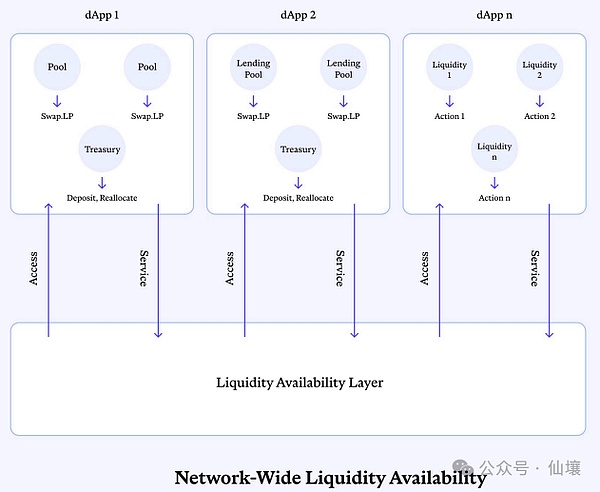

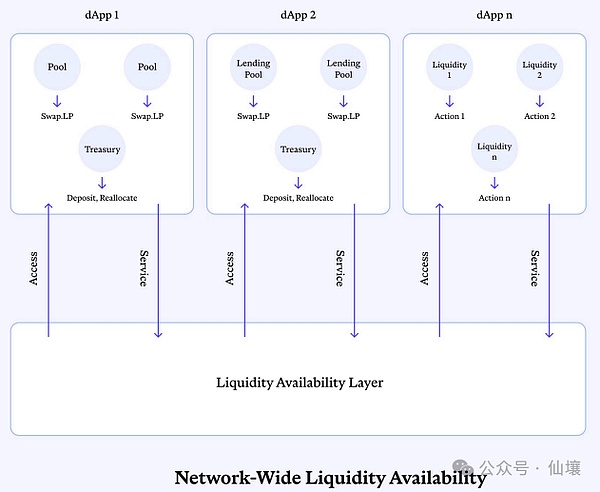

By introducing the concept of liquidity availability and thinking outside the box, we may be able to solve the problems that plague the Web3 industry. Rather than viewing liquidity availability as an application-level problem (where dApp-specific liquidity is the limiting factor), we can view liquidity availability as a public chain-level problem. From this perspective, the success of a transaction has nothing to do with where it was initiated, and the location of liquidity is no longer critical.

In traditional finance, mature systems ensure that liquidity is available when needed, avoiding economic growth or capital inefficiencies. Drawing inspiration from these financial mechanisms, we can apply unique approaches to solve problems in the crypto ecosystem.

From a practical perspective, a public chain should be able to mobilize the liquidity hosted on its chain and use it for indiscriminate trading services at any time. Therefore, the dApps within the network should be fundamentally decoupled from the liquidity behind them, thereby eliminating the reliance on the paradigm of dApp-exclusive liquidity. In such a system, liquidity availability will be considered purely from the public chain level, driven by the overall growth of its ecosystem. Importantly, this will shift the limiting factor from external dependence (the performance of dApps) to internal dependence (the performance of the public chain itself), which is something that the public chain project itself can control and gradually improve.

dApp-specific liquidity framework and full-chain liquidity availability framework

The above charts show the difference between dApp-specific liquidity and full-chain liquidity. Under the full-chain liquidity availability framework, a more efficient and dynamic liquidity system can be formed. In addition, solving the liquidity problem at the public chain/network level can significantly reduce the threshold for launching new projects. Currently, new projects require a large amount of dApp-specific liquidity, which poses a major challenge to startup teams, hindering their launch speed and limiting their iteration capabilities.

By ensuring liquidity is available across the entire public chain, new dApps can launch quickly and innovate freely without having to independently access large-scale liquidity. This will create a more competitive and diverse ecosystem, promote innovation and provide opportunities for small teams.

In essence, applying the concept of "full-chain liquidity availability" at the public chain level transforms liquidity management from isolated competition between dApps to a collaborative and integrated process. This paradigm shift can unlock new possibilities for innovation and ecological growth in the Crypto field, making it more adaptable to changing user needs and more resilient. By drawing on experience in traditional finance, the Crypto ecosystem can develop more complex and efficient liquidity management solutions to solve the problem of liquidity availability.

Key Components of the Full-Chain Liquidity Framework

On the surface, mobilizing all liquidity between dApps on a public chain sounds simple, but in fact it brings many problems and requires innovative solutions to achieve efficient end-to-end services.

First, the LP-related issues are very abrupt. Providing liquidity for a specific dApp or liquidity pool is usually permissionless, and these funds are used in a single scenario. LPs cannot agree that their deposits will be used for other purposes, let alone for a variety of dApps. In addition, LPs who deposit funds into a single dApp can withdraw their deposits at any time. If this model is changed, the funds may be allocated to high-risk platforms at any time and cannot be withdrawn in time. What should we do? Existing large dApps will not be willing to support the idea of full-chain liquidity. More importantly, how can we technically achieve efficient liquidity transfer between dApps?

1. Economic Incentives and Risk Mitigation

First, we must establish an incentive mechanism so that the opportunity cost of not participating in improving the liquidity of the entire chain exceeds the cost of participating. Specifically, dApps that participate in improving the liquidity of the entire chain will have their capital efficiency improved, liquidity availability improved, and potential revenue increased, thereby improving the user experience, increasing trading volume, and increasing revenue through the flywheel effect.

However, we must protect the interests of LPs and need to develop corresponding mechanisms to ensure timely withdrawals and avoid bank runs. Solving this problem involves liquidity reserve strategies, withdrawal plans based on specific time periods, and allowing for phased withdrawal of liquidity. Such a system must be carefully designed to prevent market manipulation or other means of attack to ensure that it is safe and effective. Once the corresponding incentive mechanism is adjusted, the game between dApps, LPs, and users will be basically resolved, which will pave the way for technological development.

2. Just-in-Time (JIT)

Secondly, in order to achieve full-chain liquidity availability, we need to build several core functions: Just-in-Time (JIT), liquidity proof, solver, and routing layer.

Just-in-Time (JIT) refers to the immediate response to specific on-chain state changes when certain trigger conditions are met. These operations are designed to dynamically reallocate resources to optimize configuration effects.

· Trigger mechanism -JIT operations will be initiated based on predefined trigger conditions, such as a surge in resource demand, changes in user activity, fluctuations in network conditions, or input parameters from the coordination layer. These trigger conditions are chain messages that exist in the module state and are stateful.

· Integrable asynchronous interfaces - These interfaces support conditional interaction with the JIT system, allowing dApps to inject or withdraw liquidity based on preset conditions, thereby optimizing the liquidity allocation on the chain. For example, the asynchronous deployment interface allows dApps to contribute liquidity to the full-chain liquidity system when certain conditions are met (such as idle liquidity within the application). This allows dApps to participate in the construction of the full-chain liquidity system without affecting business operations. The asynchronous retrieval interface allows dApps to request liquidity on demand based on predetermined conditions (such as a sudden surge in user demand). Through asynchronous interaction, dApps can access full-chain liquidity on the chain, not just their own proprietary pools, thereby ensuring flexible use of funds.

· Instruction Sets - When the triggering conditions for a specific operation are met, a series of instructions will be triggered. These instructions are linked together in a certain way to specifically generate JIT operation scenarios.

· Smart Contract Automation - The execution of JIT operations will be managed by smart contracts, which will automatically adjust resource allocation based on trigger conditions. Instruction triggers will be monitored by smart contracts, which will first test whether the relevant on-chain instructions can operate normally given a series of JIT operation requests.

· Diversified Resource Allocation - While liquidity is our main focus, JIT operations can be extended to other areas in the public chain. For example, JIT operations can also reallocate computing power or storage resources between two parties.

3. Liquidity Proving

In addition to JIT operations, liquidity proof is critical to ensure that liquidity is mobilized on demand in the network. Liquidity proof requires dApps to provide a verifiable proof scheme that they can meet the necessary conditions to respond to JIT operations or provide liquidity to the outside world. For example, dApps need to publicly announce how much their participation in the full-chain liquidity system can increase overall liquidity, increase revenue, or improve capital efficiency.

Incentivizing Participants - Although liquidity proofs are a necessary component of the entire full-chain liquidity system, the cost of generating proofs and publishing them cannot be underestimated. Therefore, it may be necessary to incentivize dApps to actively participate in generating liquidity proofs through token incentives, subsidies, and reduced fees.

Failsafes and emergency stop devices - In order to prevent systemic risks, failsafe mechanisms and backup plans need to be set up. For example, in the event of a sudden liquidity shortage, the system can mobilize emergency liquidity reserves or temporarily restrict certain operations until liquidity is restored.

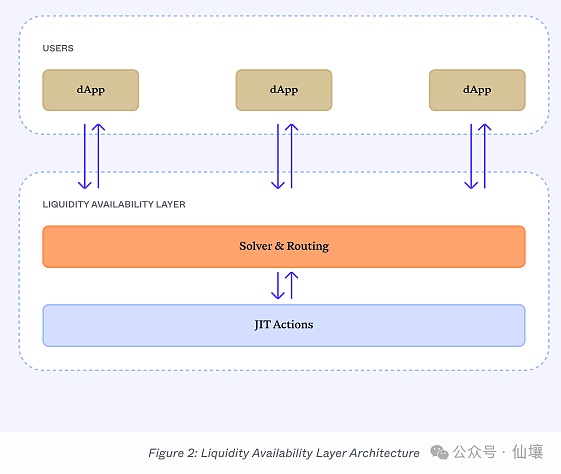

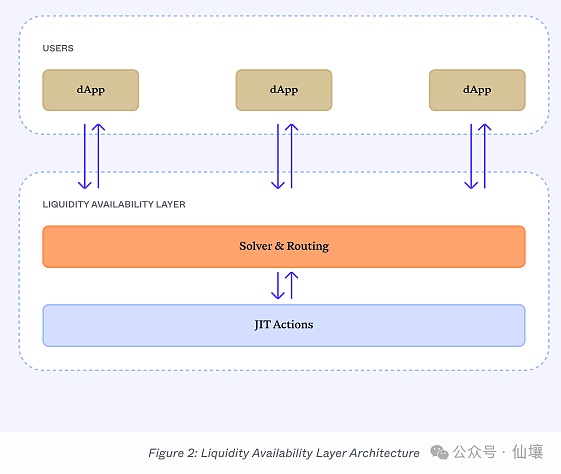

4. Solver & Routing Layer

The concept of JIT solves the problem of real-time liquidity supply, while liquidity proof ensures that there is ample liquidity available in the system. However, an intermediary is also needed to route and allocate liquidity between dApps or chains. This intermediary will act as a decision engine within the liquidity availability framework to optimize and dynamically route liquidity based on real-time network conditions.

Optimization and Decision Engine - Solver will continuously evaluate liquidity paths, optimize transaction costs and capital flow speed, improve capital efficiency, evaluate network conditions (congestion level, gas fees), etc., to transfer liquidity between dApps or chains through the optimal path, ensure real-time allocation of funds to meet the needs of specific users, and maximize capital efficiency.

Constraint Processor - In addition to optimizing the liquidity routing path, the Solver will also consider constraints such as liquidity availability, gas costs, withdrawal time and risk factors. By adhering to predefined parameters/constraints, the solver will ensure that liquidity is allocated safely and efficiently.

Dynamic Behavior - The solution is designed to dynamically adjust the liquidity allocation method based on real-time conditions. For example, if the demand for liquidity in a certain area on the chain suddenly increases, the system will reroute liquidity accordingly to ensure that liquidity allocation is balanced and responsive to special changes.

Abstract Layer Interacts with JIT - The Solver and Routing Layer will act as an abstraction layer between users (applications) and the JIT system, responsible for liquidity tracing and configuration. It will send signals when and where liquidity is needed, triggering JIT behaviors such as borrowing, transferring liquidity, or reallocating related resources. Although users cannot perceive the existence of the Solver and Routing Layer, these components will still make real-time decisions based on network conditions to ensure that JIT behavior meets liquidity needs through the best path.

Initially, the Solver and Routing Layer will focus on simple, direct routing between liquidity sources. However, as the public chain network grows and matures, the Solver will gradually support more complex programmatic routing, which may involve multi-hop liquidity transfers across multiple dApps or multiple chains, dynamically respond to changes in liquidity needs, and maximize capital efficiency.

In a mature state, the end-to-end system will implement the following architecture: JIT operation instructions as the underlying unit, the Solver & Routing Layer is located between the user and the JIT layer, allowing the system to instantly distribute liquidity to the dApps and chains in need.

It is important to note that the Solver and Routing Layer described in the Liquidity Availability Framework is significantly different from existing solutions in the industry. Most existing solutions aim to solve the problem of liquidity fragmentation from the top down, and current cross-chain liquidity routing solutions mainly focus on aggregating liquidity distributed across various dApps in multiple networks.

In contrast, the Liquidity Availability Framework aims to completely eliminate the concept of dApp-specific liquidity and aims to split the liquidity layer from the dApp layer. Part of its technology stack will adopt the Solver and Routing Layer to optimize and simplify liquidity services through JIT operations across applications and chains, turning liquidity into a flexible multi-chain asset.

Modular Full-Chain Liquidity Framework

Implementing JIT operations, liquidity proofs, and solver and routing layers are not only beneficial, but also provide the necessary foundational building blocks to evolve liquidity availability from an isolated, dApp-specific problem to a comprehensive multi-chain network. By establishing these foundational components, the network can better meet liquidity needs dynamically and comprehensively, thereby achieving a more resilient and liquid on-chain environment.

In addition, these foundational components lay the foundation for further innovation. Developers will be able to adopt a modular framework to create new and diverse solutions to solve many complex problems in the industry. With these features, the network can not only achieve immediate and large-scale functional enhancements, but also support the rapid growth that may come in the future.

Notes on Individual Participants

While this article positions the “users” of the liquidity availability framework as dApps, ultimately it is individual users or institutions that act as LPs to inject liquidity into the network.Under the liquidity availability framework, users’ assets will essentially participate in various dApps. In addition, some users may want to deploy liquidity directly to the liquidity availability layer, bypassing specific dApps entirely. To meet such needs, it would be wise to ensure that such functionality is available.

It is fairly simple to achieve this by expressing this part of the business logic in the form of a dApp. However, this “dApp” itself will have a one-way purpose - to provide services for the liquidity availability layer. Here, the liquidity treasury can be used as a tool to receive user deposits, issue liquidity proofs to the outside world, and dynamically deploy and manage liquidity, similar to an integrable dApp. By maintaining specialization, this service party may achieve higher capital efficiency and enable LPs to obtain competitive returns.

The treasury strategy is just one possible way to achieve this scenario. At the current stage of on-chain finance, there are many solutions that can effectively fulfill this role. Regardless of the specific implementation method, it is reasonable to assume that these applications will self-populate under the stimulation of the market, further enhancing the effectiveness and adoption rate of the liquidity availability framework.

Conclusion

The concept of liquidity availability provides a key perspective to solve the problem of inefficient liquidity management in the field of on-chain finance. This paper argues that the shift from dApp-specific liquidity to a multi-chain network-wide liquidity availability framework can unlock huge growth potential, lower the entry barrier for new projects, and cultivate a more innovative and resilient ecosystem.

While JIT actions, liquidity proofs, and solver and routing layer proposals are only theoretical, they are essential components to achieve this transformation. These components can redefine liquidity management from a decentralized fragmented form to a cohesive and integrated form. If implemented effectively, a comprehensive liquidity availability framework will transform liquidity from a static, dApp-specific resource to a flexible, chain-wide, dynamic resource, enabling dApps to scale without being limited by liquidity silos.

However, the ideas explored here are just a start. Further research and experimentation will validate these concepts, explore real-world applications, and refine implementation strategies. Drawing inspiration from traditional financial systems and breaking through their limitations presents a unique opportunity to move the entire on-chain economy forward.

In summary, viewing liquidity availability as available across the entire chain network, rather than dApp-specific, has important implications for the future of decentralized solutions. Embracing this shift can lead to more effective solutions, paving the way for continued growth, technological advancement, and a more equitable and vibrant financial ecosystem. This approach can catalyze the next wave of innovation, driving blockchain and on-chain finance toward a bright future where liquidity is no longer a hindrance, but a driving force.

Weatherly

Weatherly