With the implementation of stablecoin regulatory frameworks in major countries and economies around the world, the global digital asset market is also undergoing historic changes. On the one hand, the wild growth period of stablecoins may come to an end; on the other hand, the pattern of the stablecoin market may also usher in a change, that is, will USDC usher in a golden age under the "escort" of US regulators, and where will Tether go under the new regulatory system? At the same time, can the internationalization of the RMB achieve breakthrough development with the help of offshore RMB stablecoin opportunities?

The compliance of US stablecoins poses a severe challenge to Tether, especially in the mainstream financial system and institutional markets. Its market share and influence will inevitably be eroded by compliant stablecoins. However, in the regulatory vacuum zone, the fiat currency failure zone, and the core liquidity layer of the crypto-native ecosystem, Tether will still retain a considerable "offshore living space" with its network effect and first-mover advantage, but the growth momentum may slow down significantly and face continued trust and compliance pressure.

It should be pointed out that the market strategy of Tether is essentially "technologically neutral". It does not challenge the US dollar system, but acts as a "digital plumber" for the US dollar system. The development history of Tether provides experience for non-US dollar stablecoins. Developing non-US dollar stablecoins through the "digital path" is a feasible path. After years of development, non-US dollar stablecoins have already had a foundation for expansion, and the "de-dollarization" trend since this year has also provided new opportunities for non-US stablecoins.

From the existing regulatory framework and development status of the stablecoin market, the future stablecoin market is likely to present the characteristics of "dual-track parallel" development. On the one hand, the US domestic compliant stablecoin is the leading one, serving the traditional financial and institutional markets that are subject to strong supervision, emphasizing security, transparency and legal protection. On the other hand, Tether may continue to play an important role in specific regions and crypto-native ecosystems; at the same time, compliant offshore stablecoins based on different sovereign currencies will accelerate development and serve specific geo-economic circles and diversified needs.

With the implementation of stablecoin regulatory frameworks in major countries and economies around the world, the global digital asset market is also undergoing historic changes. On the one hand, the wild growth period of stablecoins may come to an end; on the other hand, the pattern of the stablecoin market may also usher in a change, that is, will USDC usher in a golden age under the "escort" of US regulators, and where will Tether (USDT) go under the new regulatory system? At the same time, is there a possibility of a breakthrough for non-US dollar stablecoins?

Regulation becomes stricter, where will Tether go?

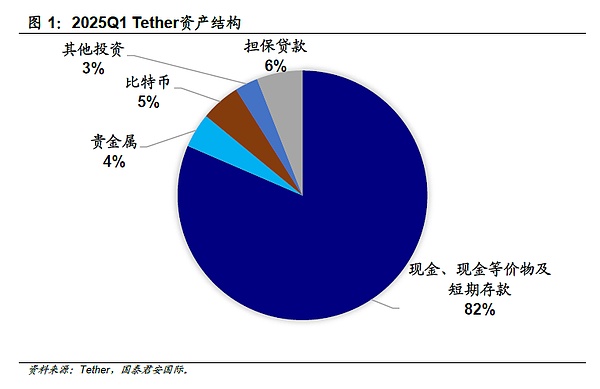

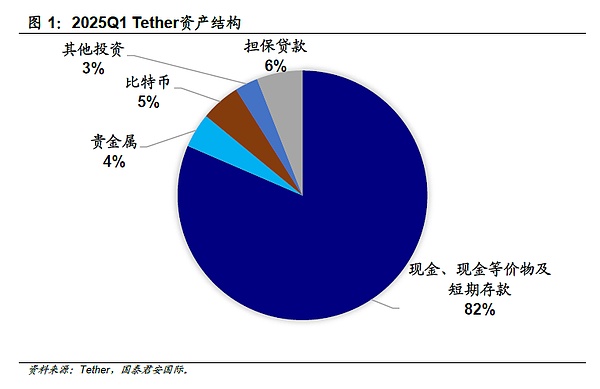

Investors generally believe that the compliance of the US domestic stablecoin market will affect the favor of institutional funds for Tether, thus bringing a negative impact on its operations. It is foreseeable that, in the context of wider application of USTD, once the United States launches a fully compliant, audited, transparent and federally regulated stablecoin, such as PayPalPYUSD leaf="">Or the possible future bank-issued stablecoins, traditional financial institutions, hedge funds and even national sovereign funds and other "big funds" will be more inclined to choose these more secure products. In addition, the strict control of the US regulators on the access channels of fiat currency may further restrict the business transactions related to "non-compliant" stablecoins, which will increase the difficulty and cost of users to obtain and redeem Tether, weakening its liquidity advantage. Therefore, given the long-term consideration of Tether's lack of transparency in the composition of reserve assets and audit reports, its share in the institutional market may be significantly eroded.

However, demand from regulatory vacuums and fiat currency failure regions means that Tether still has a place in the stablecoin market. First, in regions facing high inflation, capital controls, and sharp fluctuations in local currencies (such as some Latin American, African, and Southeast Asian countries), the demand for Tether as a convenient dollar value storage and cross-border payment tool remains strong. As long as these regions lack effective local stablecoin alternatives or strict supervision, Tether will remain the best choice. Secondly, in the field of centralized exchanges (CEX) and decentralized finance (DeFi), trading pairs, liquidity pools, lending collateral and other scenarios are highly dependent on Tether. With its first-mover advantage, huge circulation and deeply embedded liquidity network, it is difficult to be completely replaced in the short term. Finally, even if Tether still cannot meet the domestic regulatory requirements of the United States in the end, it can further transfer its operational focus and main user groups to jurisdictions with relatively loose regulation or no clear regulation, forming an "offshore stablecoin center."

Take Nigeria as an example. As the largest economy in Africa, it has long faced the problem of exchange rate instability. 2023In 2023, the US dollar to naira exchange rate increased from approximately1,500, and inflation as high as 17.4%, seriously eroding residents' purchasing power. This economic environment has prompted Nigerians to seek more stable value storage and transaction tools.The inefficiency of the traditional financial system and the high cost of cross-border remittances have further driven the adoption of cryptocurrencies and stablecoins. Tether is an ideal choice due to its 1:1 peg to the US dollar. Nigerian users initially used Tether mainly to avoid the risk of naira depreciation, especially in cross-border payments and international transfers. For example, Nigerian expatriates who remitted 200 US dollars to China in the past would have to pay 16-24 US dollar handling fees and US dollar fees. In addition, some companies have begun to use Tether to pay wages to avoid employee salaries being reduced due to monthly inflation. Supermarket chains Pick n Pay support scanning code payment with Tether and give 10% cashback, promoting "crypto cashless". Through the financial technology platform SureRemit, users can directly use Tether to pay tuition, water and electricity bills. Its network covers more than 1,000 merchants worldwide, providing financial access for the unbanked. (According to the United Nations Development Programme, as of 2021, approximately 60% of the population aged 15 and above in sub-Saharan Africa do not have a bank account, while the global average is 2. lang="EN-US">26%. The proportion of women without bank accounts is 12% higher than that of men. In terms of the density of financial infrastructure, Africa has only 100,000 peoplea bank account per 100,000 people. commercial banks, which is far below the global average of 10.8. )

. At present, although it is a general trend for the United States to strengthen its supervision on stablecoins, there is still uncertainty about the attitude of regulators towards Tether. Specifically, if severe measures are taken to restrict transactions between US entities and Tether, the survival space of Tether will inevitably be greatly compressed. If only mild measures are taken to restrict circulation in the United States, it will leave room for it to maneuver. In addition, the regulatory regulations of other countries and economies will also jointly determine the future of Tether.

In summary, the compliance of US stablecoins poses a severe challenge to Tether, especially in the mainstream financial system and institutional markets. Its market share and influence will inevitably be eroded by compliant stablecoins. However, in the regulatory vacuum zone, the fiat currency failure zone, and the core liquidity layer of the crypto-native ecosystem, Tether will still retain a considerable "offshore survival space" with its network effect and first-mover advantage, but the growth momentum may slow down significantly and face continued trust and compliance pressure.

How can non-US stablecoins "break through"?

It should be pointed out that the market strategy of Tether is essentially "technologically neutral". It does not challenge the US dollar system, but acts as a "digital plumber" for the US dollar system. The development history of Tether provides experience for non-US dollar stablecoins. Developing non-US dollar stablecoins through the "digital path" is a feasible path. "Market-driven and demand-driven" is the key to Tether's success. It has seized the global demand for the US dollar as a stable value medium, expanded rapidly during the regulatory vacuum, and established a huge user network and liquidity ecosystem.

After years of development, non-US dollar stablecoins have already had a foundation for expansion, and the "de-dollarization" trend since the beginning of this year has also provided new opportunities for non-US stablecoins. From the experience of Tether, its booming development is related to the currency instability in some countries and regions, and these regions also have rich foreign trade relations, which has become a realistic scenario for the implementation of non-US stablecoins.

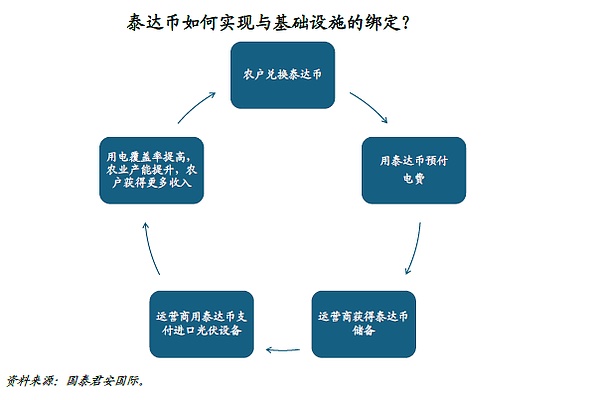

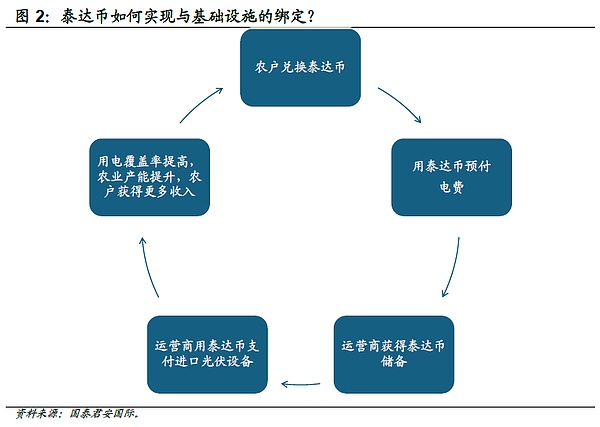

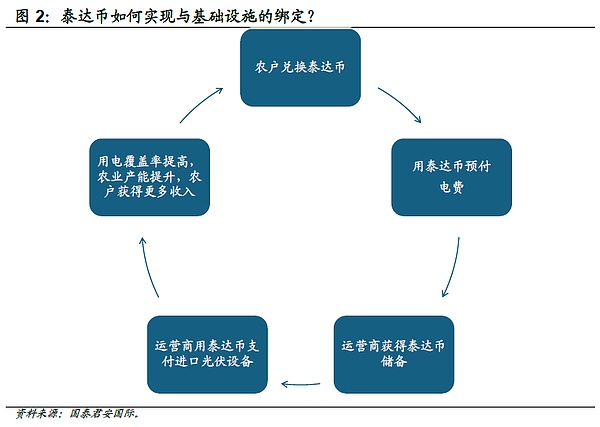

At the same time, the development of Tether is inseparable from its deep binding with infrastructure. On the African continent, 600 million people are suffering from power shortages, and Tether has entered this market in an unexpected way - through deep binding with solar charging station operators, converting US dollar stablecoins into "energy passes" for off-grid communities. Specifically, local operators deploy off-grid photovoltaic charging stations in villages, users prepay electricity bills with Tether through mobile wallets, and operators purchase photovoltaic panels from international suppliers with Tether (avoiding the risk of local currency depreciation). This strategy not only expands the real economy scenarios of Tether, but also opens up a "infrastructure-bundled" breakthrough path for non-US dollar stablecoins.

To sum up, judging from the regulatory framework and development status of the existing stablecoin market, the future stablecoin market is likely to present the characteristics of "dual-track parallel" development. On the one hand, it is dominated by US domestic compliant stablecoins, serving the traditional financial and institutional markets that are subject to strong supervision, and emphasizing security, transparency and legal protection. On the other hand, Tether may continue to play an important role in specific regions and crypto-native ecosystems; at the same time, compliant offshore stablecoins based on different sovereign currencies will accelerate development to serve specific geo-economic circles and diversified needs. From the perspective of market composition, for Tether, the wave of compliance of US stablecoins is both a challenge to market share and an opportunity for it to deepen its presence in a specific "offshore" ecosystem. At the same time, non-US dollar stablecoins can also find their own potential to break out of the circle from Tether.

Anais

Anais