Author: Yohan Yun Source: cointelegraph Translation: Shan Ouba, Golden Finance

Ethereum is at one of the most critical moments since its creation. The usage of the underlying network is falling sharply, with core data close to multi-year lows, and even co-founder Vitalik Buterin has made radical proposals for a complete overhaul of Ethereum's architecture.

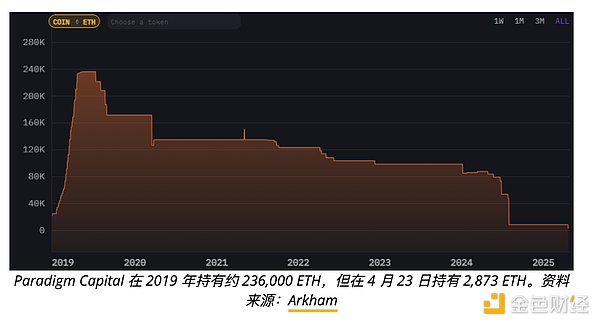

And institutional investors are no longer waiting for results. On-chain data shows that long-term supporters like Galaxy Digital and Paradigm have cut their Ethereum (ETH) holdings significantly in recent weeks.

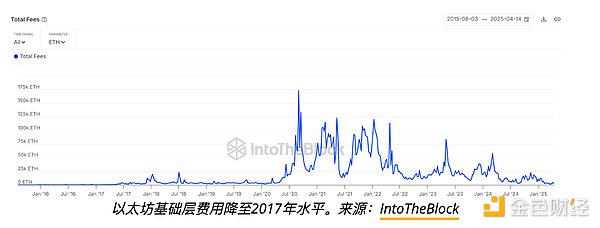

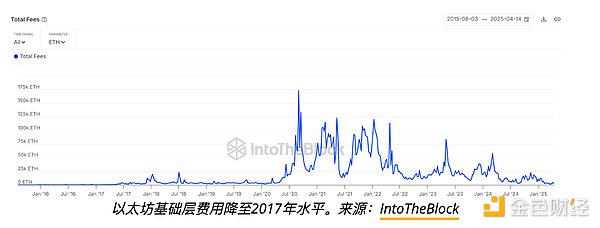

So far, throughout April, activity on the Ethereum mainnet has continued to decline: network fees are decreasing, but inflation is rising. Although second-layer networks are still thriving, they are eroding the value-carrying capacity of the mainnet.

However, it’s not just Ethereum that’s “crashing”. Some whales see this downturn as a rare opportunity to buy at the bottom. Even those institutions that are selling ETH haven’t completely given up on it.

Institutions “abandon” Ethereum, but are they really parting ways?

These institutions are like “breaking up”, but they can’t let go of their “ex”. Instead of completely blacklisting ETH, they “cold-stored” it and tried “new objects” like Solana.

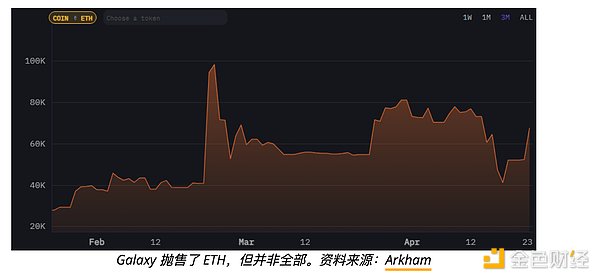

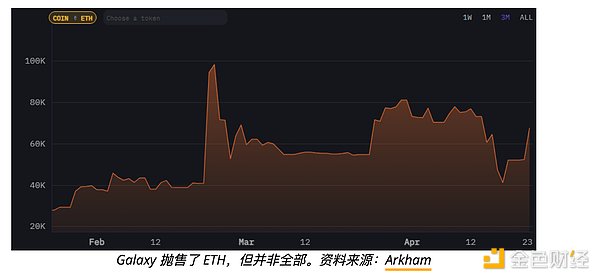

In recent weeks, on-chain analysts have found that multiple institutions have transferred large amounts of ETH from their marked wallets, most likely for sale. Lookonchain reported that Galaxy Digital transferred 65,600 ETH (worth about $105.5 million) to Binance. Previously, the company held about 98,000 ETH in February, which has now dropped to around 68,000 (data from Arkham).

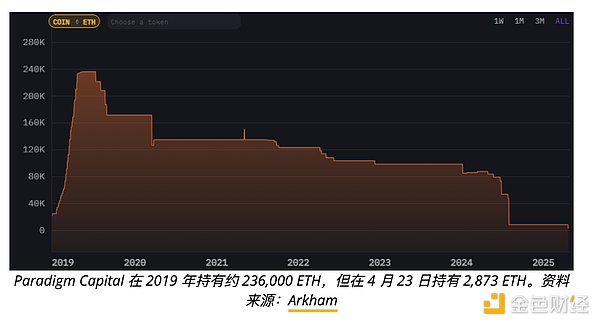

Although Galaxy's ETH holdings have declined recently, they are still at a high level compared to the beginning of the year. This also reflects the overall trend of Ethereum investment products. According to CoinShares data, ETH investment funds have seen an outflow of $26.7 million in the past week, and the cumulative outflow in the past eight weeks has reached $772 million. However, net inflows from the year to date are still $215 million. Meanwhile, Galaxy also withdrew 752,240 SOL (worth about $98.37 million). Solana has taken some of the heat off Ethereum, especially during the memecoin craze of 2024 and early 2025, when Solana became the main battleground. Although the craze eventually cooled due to scams, bots and shoddy projects, it also demonstrated Solana's technical strength - it can maintain low fees and no major downtime under high transaction volume. Paradigm is another investment institution that has reduced its ETH holdings. On April 21, the company transferred 5,500 ETH (about $8.66 million) to Anchorage Digital. According to on-chain analyst EmberCN, since January 2024, Paradigm has transferred approximately 97,000 ETH (worth approximately US$301.57 million) to Anchorage, which then flowed to centralized exchanges.

Sei Labs co-founder Jayendra Jog told Cointelegraph: "While institutional investors initially bought into ETH based on the narrative of 'supersonic currency', they are now faced with the reality of declining protocol revenues and deteriorating token economic models."

Ethereum Returns to "Inflation"

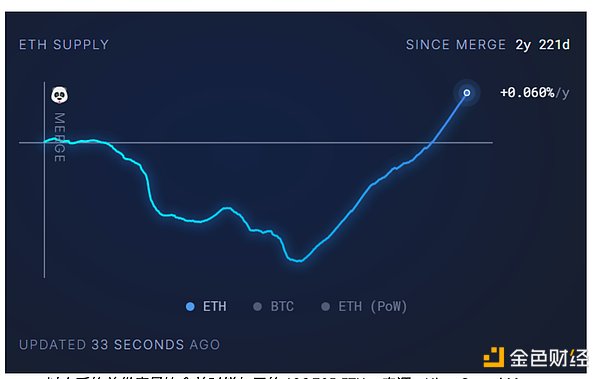

ETH's deflationary nature was once an important selling point to attract investors. This mechanism was introduced to the Ethereum network through two major upgrades. First, there was the London hard fork in August 2021, which introduced the EIP-1559 proposal, which burned part of the transaction fees; followed by the Merge upgrade in September 2022, when Ethereum officially switched to a proof-of-stake (PoS) mechanism, which significantly reduced the issuance of new coins.

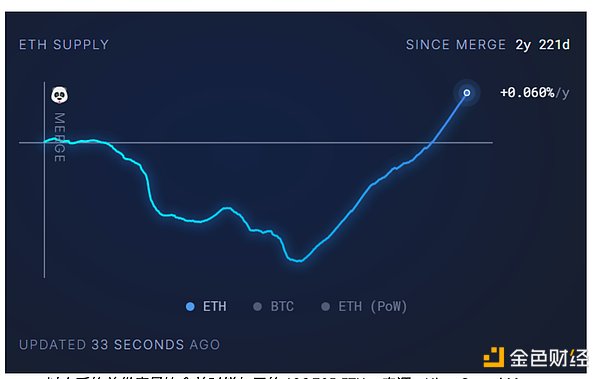

After the Merge upgrade, the total supply of ETH continued to decline until April 2024, when ETH began to re-enter inflation. By early February 2025, the total supply of ETH had exceeded the level at the time of the Merge.

ETH inflation is partly due to a sharp drop in network fees, resulting in a decrease in the number of ETH destroyed. According to data from IntoTheBlock, between April 14 and 21, 2024, the Ethereum network collected 1,873.52 ETH in fees. This is slightly higher than the 1,697.61 ETH in the week ending March 17, which was the lowest week in terms of fees since July 31, 2017 (in ETH terms).

Vitalik proposed a radical proposal: replacing EVM with RISC-V

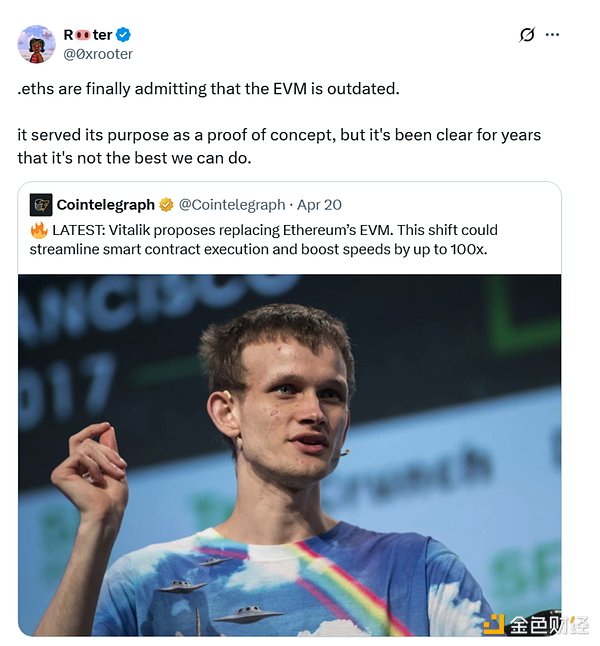

On April 20, Vitalik Buterin proposed to replace the current Ethereum Virtual Machine (EVM) instruction set with the RISC-V architecture to improve the speed and efficiency of the network execution layer. Some people see this as a signal of "surrender" to the existing architecture.

Sei Labs co-founder Jayendra Jog commented: Vitalik's RISC-V proposal is essentially an admission that the underlying architecture of EVM has reached its limit. When the founder of Ethereum personally proposed to replace the core virtual machine that supports the entire ecosystem, this is not evolution, but a recognition of a design bottleneck that cannot be improved in an incremental way.

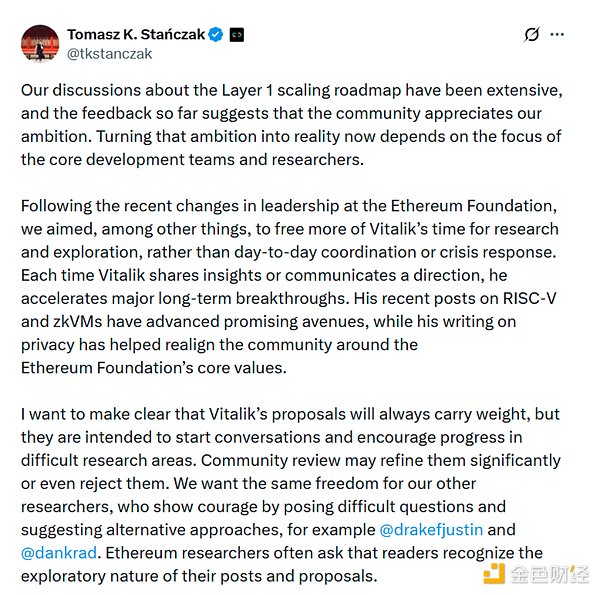

The background of the release of this proposal is that the Ethereum Foundation has recently undergone a round of leadership adjustments, and the controversy and criticism in the community about the future direction of Ethereum is also heating up.

Will Ethereum be that "missed opportunity"?

Ethereum's current predicament stems in part from its Rrollup centralized expansion strategy. The core idea of this strategy is to move transactions off the main chain by building a Layer 2 expansion network, but still use the security of the Ethereum main chain. This does alleviate congestion problems during network peaks, but it also brings new challenges, such as reduced ETH destruction and ecosystem fragmentation.

However, according to Tomasz Stańczak, the new co-executive director of the Ethereum Foundation, the community's attention to Layer 1 expansion is increasing. Stańczak posted on the X platform that the Ethereum Foundation will refocus on its near-term goals, mainly including the expansion of Layer 1 and support for the expansion of Layer 2.

At the same time, some whales began to buy low when the Ethereum price fell back. On April 23, the blockchain monitoring platform Lookonchain found that two addresses were accumulating millions of dollars worth of ETH. On April 22, Lookonchain also found that another wallet had purchased more than $100 million in ETH since February 15. ETH's current price has fallen from a high of more than $4,000 in December last year, but it rose by more than 10% on April 23, returning to more than $1,800. Standard Chartered Bank recently lowered its ETH price forecast for 2025 from $10,000 in a letter to clients. However, for whales who are currently buying at a low point, ETH still has upward potential - the bank still maintains its target price of $4,000 by the end of the year.

Geoff Kendrick, head of digital asset research at Standard Chartered Bank, said that this more conservative outlook is mainly due to the structural weakness of Ethereum. He pointed out that the fee income that should have been obtained by the main chain has now been "diverted" by a large number of Layer 2 networks, which also weakened the economic model of the main chain.

Weatherly

Weatherly