Source: IGNAS | DEFI RESEARCH; Compiled by: Golden Finance

Federal Reserve Rate Cut

The biggest short-term uncertainty for cryptocurrencies recently is the direction of interest rates.

What signals will Federal Reserve Chairman Powell send at the Jackson Hole symposium (Thursday, August 22nd, US time), and how will the Fed determine interest rates at the FOMC meeting on September 16th and 17th?

Dovish tone → 2-year yield and US dollar index fall → BTC/ETH surges

Hawk rate cuts may keep interest rates high for a longer period of time → Risk dissipates, alternative investments are the first to sell

This is the result of ChatGPT 5 Thinking and Deepseek's Deepthink model. But many people on X also agree with this view, which explains the recent decline in altcoins. Source: Jake | Wintermute Trader | OTC Crypto Crypto's dependence on macro factors is frustrating, but the end of the last global rate hike cycle suggests we can't ignore them. However, as Jake from Wintermute mentioned above, my AI model also paints an optimistic picture: rate cuts are coming. The uncertainty lies in the timing, frequency, and magnitude of these cuts.

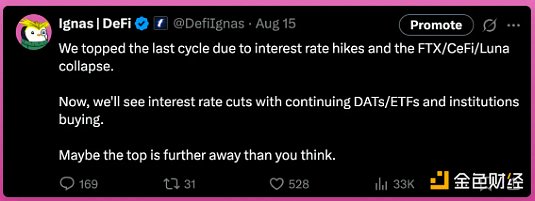

So, we are in the exact opposite situation of how the last cycle ended: with rate cuts on the horizon, is the bull market top further and higher than we thought?

I hope so, but everyone I talk to is planning to sell and take profits.

I hope so, but everyone I talk to is planning to sell and take profits.

Who is buying to offset the selling?

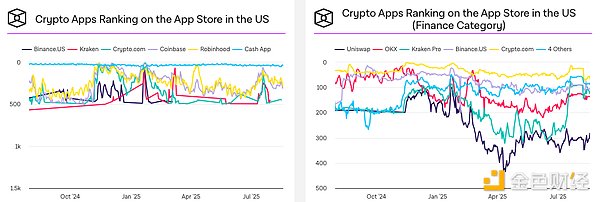

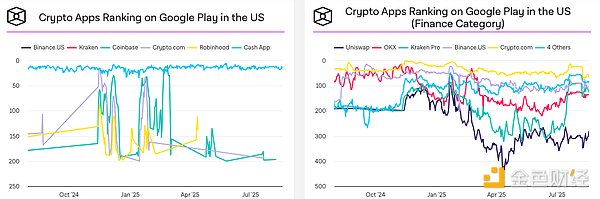

1. Retail investors haven't shown up yet

The retail investor base we relied on last cycle hasn't shown up yet.

Tracking cryptocurrency applications in app stores, source: TheBlock

2, ETFs and DATs

On the contrary, the largest buyers are:

My concern is: can the buying power of institutional investors, DAT investors, and other "whales" offset the retail sell-offs of cycles 3 and 4? Or will they run out of steam?

Ideally, this is a multi-year process where steadily rising prices gradually break out of weakness.

The most interesting outcome would be if the cryptocurrency continues to rise even after most of the cryptocurrency's native users sell, leading to further gains.

Anyway, DAT is the most significant risk and bullish factor I want to briefly touch upon.

Now it's all about DAT

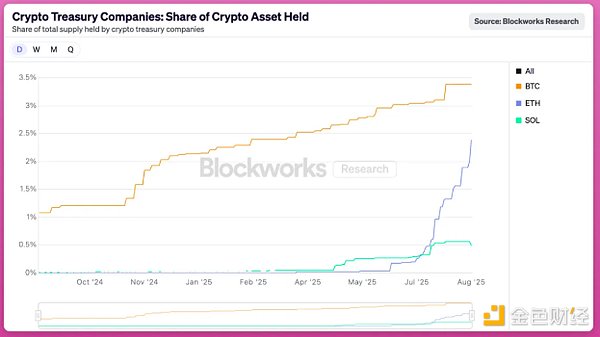

1. Amount of ETH held by DAT

Look at how quickly DAT acquires ETH.

It took ETH DAT less than 3 months to capture 2.4% of the total ETH supply.

Look at it from another angle, So what is BTCS doing?

To attract more stock buyers, BTCS announced its first “double dividend”: a one-time blockchain dividend of $0.05 per share in ETH and a $0.35 per share in USD.

On top of that, they’re offering… read this carefully… “We will offer a one-time $0.35 per share in Ethereum loyalty payment to shareholders who transfer their shares to our transfer agent for registration and hold them until January 26, 2026.”

For crypto native users, BTCS appears to be building a TradFi staking mechanism to prevent them from selling their shares. Their motivation for offering double yield is that their mNAV is below 1 and it "prevents market manipulation" by preventing shares from being lent to short sellers.

Also, where do these dividends come from? They give away the ETH they earn.

Also, where do these dividends come from? They give away the ETH they earn.

Doesn't look good. Right?

At least they haven't publicly sold off the ETH. I suspect the first DATs to capitulate and sell off their crypto will be smaller companies that can't attract buyers for their equity.

3. DAT Dashboard

So, keep an eye on the dashboard below to identify DATs and study what they're doing with their crypto holdings.

Crypto Twitter may ignore smaller DATs, but they'll give us an idea of what the larger, systemically important DATs will do.

Here are some dashboards to keep an eye on:

To make things difficult, you'll notice that each dashboard reports slightly different data.

We'll need to keep an eye on the other DATs.

4. Record ETH Redemption Queue

But I wouldn't be surprised if the ETH rally slows down in a few days or weeks due to the current low premium to mNAV and the record ETH redemption queue. Before moving on to another topic, I'd like to add that I'm increasingly optimistic about the creation of DATs for altcoins. The case for altcoin DATs: This cycle has seen a record number of new tokens issued. While most are worthless meme coins, the cost of issuing tokens has essentially dropped to zero. Compared to previous cycles, proof-of-work forks require hardware (such as Litecoin and Dogecoin) or the establishment of staking infrastructure (such as EOS, SOL, and ETH). Even in previous cycles, token issuance required some technical expertise.

Before this cycle, the number of tokens to watch was "manageable." This included some lending protocols, DEX tokens, some L1 tokens, infrastructure tokens, and so on.

With token issuance costs dropping to zero and more projects launching tokens, especially due to the rise of pump fun, altcoins have struggled to attract sufficient attention and capital inflows.

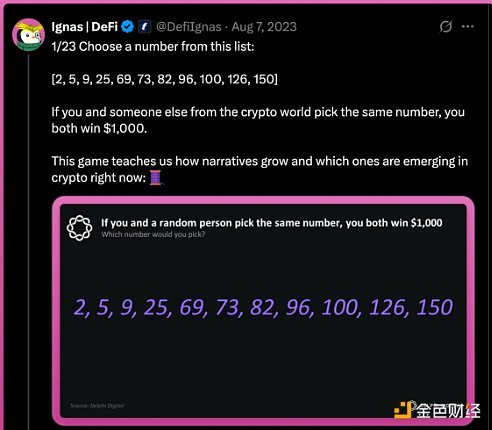

In the example below, I shared 11 numbers. But what if there were thousands? There are no Schelling points to watch.

Just Bitcoin and other currencies. Combined with Microstrategy's continued buying, only BTC managed to rise. Altcoin DATs changed this dynamic. First, few altcoin projects can orchestrate a DAT purchase plan. This requires a specific set of knowledge and skills that most projects don't possess. Second, only a limited number of altcoins are "worthy" of having a DAT. Examples include Aave, Ethena, Chainlink, Hype, or a DeFi token index. Third, and perhaps most importantly, DATs give ICO projects the opportunity to IPO, thereby attracting institutional capital that they would otherwise not have. As I wrote on X: I think altcoin DATs are just a crazy Ponzi scheme. But if you think about it, DATs allow altcoins to go public: from ICO to IPO. BNB's DAT is like Binance's IPO, something they might not have been able to achieve otherwise. Alternatively, the AAVE DAT could allow TradFi to invest in future lending operations. This could lead to the creation of more DATs like this. — Defi Ignas Finally, unlike BTC and ETH, altcoins don't have ETFs to attract institutional investors. Therefore, I'll focus on the altcoin DAT space, as they present different dynamics in terms of absorbing VC sales (over-the-counter) or acquiring tokens at a discount. Ethena is an early example, but I'd like to see what happens when altcoins with a significant portion of circulating supply acquire DATs. Is it time to take profits: Looking at market indicators? As I wrote above, many people I've spoken with plan to sell. But they don't want to sell at current prices. Why? Because all indicators look surprisingly healthy.

Just Bitcoin and other currencies. Combined with Microstrategy's continued buying, only BTC managed to rise. Altcoin DATs changed this dynamic. First, few altcoin projects can orchestrate a DAT purchase plan. This requires a specific set of knowledge and skills that most projects don't possess. Second, only a limited number of altcoins are "worthy" of having a DAT. Examples include Aave, Ethena, Chainlink, Hype, or a DeFi token index. Third, and perhaps most importantly, DATs give ICO projects the opportunity to IPO, thereby attracting institutional capital that they would otherwise not have. As I wrote on X: I think altcoin DATs are just a crazy Ponzi scheme. But if you think about it, DATs allow altcoins to go public: from ICO to IPO. BNB's DAT is like Binance's IPO, something they might not have been able to achieve otherwise. Alternatively, the AAVE DAT could allow TradFi to invest in future lending operations. This could lead to the creation of more DATs like this. — Defi Ignas Finally, unlike BTC and ETH, altcoins don't have ETFs to attract institutional investors. Therefore, I'll focus on the altcoin DAT space, as they present different dynamics in terms of absorbing VC sales (over-the-counter) or acquiring tokens at a discount. Ethena is an early example, but I'd like to see what happens when altcoins with a significant portion of circulating supply acquire DATs. Is it time to take profits: Looking at market indicators? As I wrote above, many people I've spoken with plan to sell. But they don't want to sell at current prices. Why? Because all indicators look surprisingly healthy.

1. Profit and Loss Index

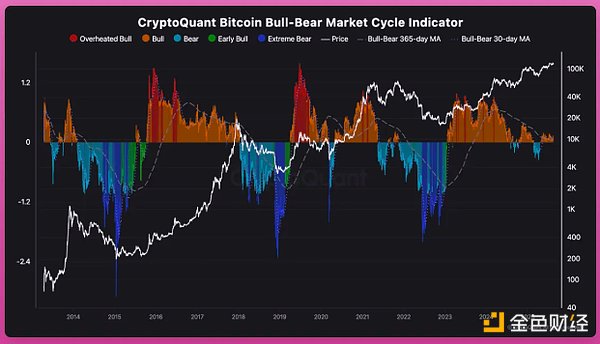

This CryptoQuant all-in-one momentum indicator uses the Profit and Loss Index to track bull and bear cycles.

TL;DR (Not much has changed since a few months ago.

Bitcoin is in the middle of a bull market.

Holders are taking profits, but extreme euphoria has not yet set in.

Prices can still rise before becoming overvalued.

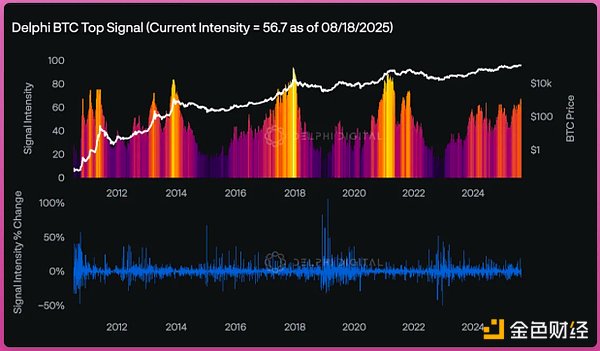

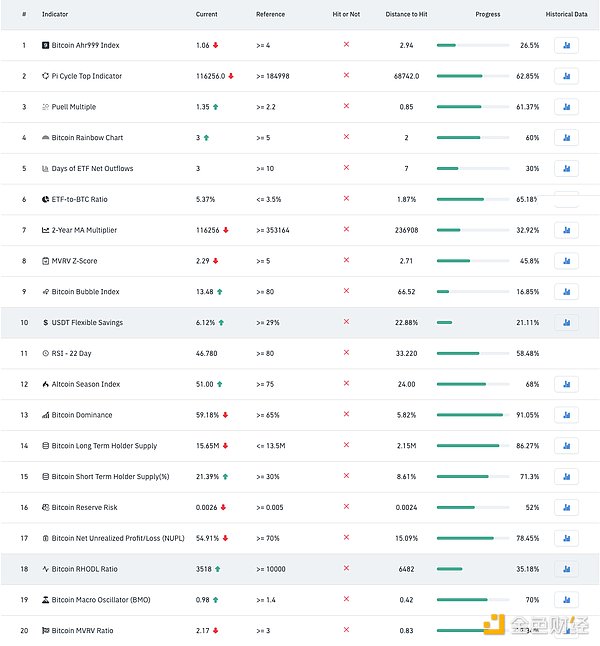

2. Delphi BTC Top Signal

That being said, the Delphi BTC Top Signal dashboard shows that it is close to overheating, but the strength score is still around an acceptable 56.7. The highest value hovers around 80.

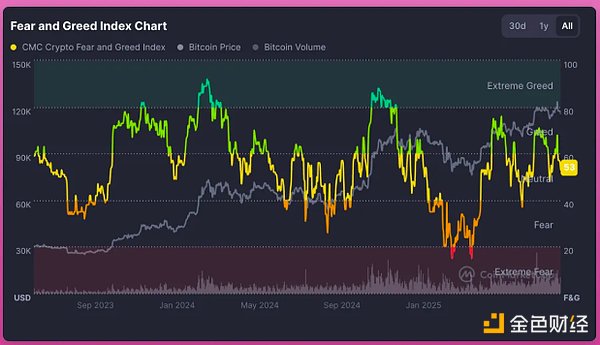

3. Fear and Greed Index returned to neutral

4. Coinglass Bull Top Indicator, tracking 30 data

Source: Coinglass

Neither indicates a potential market top.

5. Funding Rate

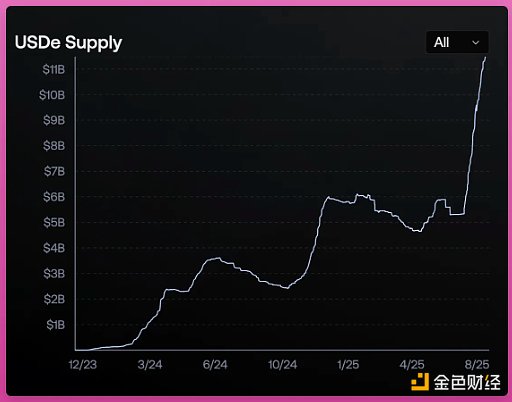

I used to track funding rate spikes at market tops, but I wonder if this metric is being distorted by Ethena.

High interest rates indicate an excess of longs, which typically precedes a surge. But Ethena's USDe broke this signal.

The Ethena stablecoin converts funds into yield by going long on spot and shorting perpetual contracts. When interest rates rise, more USDe is minted, more shorts pour in, and funds gradually cool down. It's a cycle.

Thus, high funding no longer indicates an overheated market. It may simply mean that Ethereum is printing more dollars.

So, instead of tracking funding rates, what happens if we track the supply of USDe instead of the funding rate? In this case, the market looks hot. USDe The supply of ETH doubled in a month.

6. The market outlook is good, but there is potential leverage

Overall, I think the market outlook is good. However, due to the large number of crypto investors in the third and fourth cycles sitting on unrealized profits, every big rise will be sold.

I hope DAT and ETH Able to absorb sell-offs.

It’s also quite possible that a bear market could once again arrive unexpectedly due to macroeconomic shocks. Such macro shocks could ultimately reveal hidden leverage in crypto that has yet to be discovered.

In my first post in the “State of the Market” series, I shared several potential areas of leverage:

Ethena: The majority of USDe’s backing shifted from ETH to BTC and now to liquid stablecoins.

Rehypothecation: The narrative is dormant, but LRT is integrating into OG DeFi infrastructure.

Circulation: Degens chase higher yields and leverage mining through circular holdings. Recently, Justing Sun withdrew his ETH holdings, causing the ETH collateralization ratio to spike, triggering a wave of ETH redemptions.

Ethena was the primary focus, but now DAT is the main target.What if there's hidden leverage we don't even know about?

This keeps me up at night.

What do you do with your profits?

Shifting my tax residency to Portugal has changed my perspective on crypto.

Capital gains are taxed at 0% if held for more than 365 days. Additionally, there's no tax on crypto-to-crypto transactions.

This means I can convert to a stablecoin, hold it for a year, and reap the tax-free gains.

The question is: where do you hold your stablecoins to maximize returns without having to rotate them while getting a good night's sleep?

Surprisingly, few protocols are up to the task. The pursuit of high returns forces you to switch from one protocol to another. You also need to be wary of "vault migration" when contracts are upgraded, as well as the risk of hacker attacks.

The most mentioned are Aave, Sky (Maker), Fluid, Tokemak, and Etherfi Vault, but there are many more options such as Harvest Finance, Resolv, Morpho, Maple, etc.

Question: Which protocol do you think is worth keeping your stablecoin in for a year?

Personally,

However, USDe's growth and the first ETH/ETH cycle make me a little worried about a large liquidation event (although the new Aave Umbrella mechanism helps).

Sky is the second.

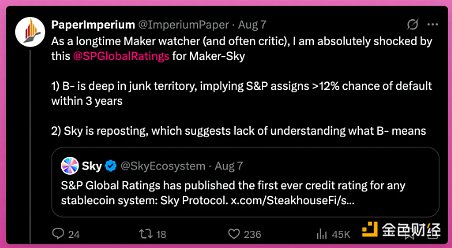

What worries me is that S&P Global Ratings' B- rating for Sky is the first credit rating for any stablecoin system.

A B- rating puts it in the risky but not yet collapsed category.

Weaknesses:

This means Sky’s stablecoins (USDS, DAI) are seen as credible but fragile.

They work well in normal times, but stress events like large withdrawals or loan losses could deal a severe blow.

As PaperImperium commented, “This is a catastrophic rating for a major stablecoin.”

That said, TradFi's risk tolerance is far lower than what crypto natives are accustomed to, but putting all stablecoins in one protocol is not feasible.

This also shows that the cryptocurrency market is still in its early stages, and there are no true passive investments yet. Except for BTC and ETH (staking on Lido meets my criteria).

That's all for now. Hope to see you soon!

Alex

Alex

Alex

Alex Alex

Alex Catherine

Catherine Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Anais

Anais Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine