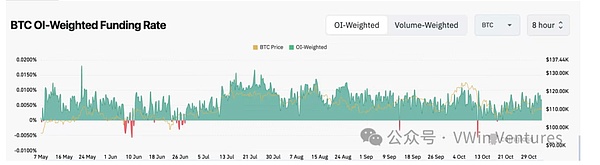

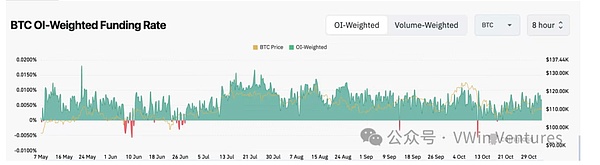

Macroeconomic Overview: While nominal interest rate cuts signal short-term easing, declining reserve requirements and ON RRP, coupled with rising TGA volatility, indicate a structural tightening of liquidity. Market Structure: Institutional funds have partially withdrawn from BTC (BTC ETF saw a net outflow of $607 million) and shifted to ETH (ETH ETF saw a net inflow of $114 million), with holdings continuing to migrate from long-term to short-term holders. On-Chain Data: Funding rates remain moderately positive, and OI has slightly declined, indicating orderly deleveraging and a healthy recovery and consolidation phase in the market. Overall, the current stage is one of "nominal easing but real tightening," with declining interest rates but pressure on the liquidity structure. Risk assets lack sustained drivers and this situation may continue until the balance sheet reduction ends in December. Last week, on the macro level, the Federal Reserve cut interest rates as expected and announced the cessation of balance sheet reduction in December, which initially boosted risk assets. However, Powell's hawkish remarks at the post-meeting press conference emphasized that further rate cuts were not a predetermined path. Strong earnings reports from US tech giants (especially Alphabet and Amazon) initially drove a continued rise in US stocks, but as US Treasury yields and the dollar index rose, market risk appetite clearly declined in the latter half of the week. The Federal Reserve's balance sheet shows that reserves have fallen below $3 trillion and the balance of reverse repos continues to decline, indicating that the liquidity buffer is being depleted. At the same time, the Treasury's TGA account balance has increased, meaning that the government is increasing its fiscal withdrawal efforts. On the surface, the interest rate cut signals short-term easing, but liquidity is actually still tightening. This "structural divergence" determines that capital flows will be more cautious, making it difficult for the market to form a sustained beta rally. It is expected that in the next two weeks, if TGA continues to rise or US Treasury yields remain high, funds will maintain a defensive allocation. Market Structure: Capital Rotation and Share Transfer Go Hand in Hand

Buyers:

1. Short-Term Funds: Total Supply Increases Month-on-MonthThe total holdings of short-term holders have increased marginally, reflecting that some funds are still trying to profit from a rebound at high prices. However, this increase is more due to passive replenishment by small and medium-sized accounts rather than active position building, and the strength of the capital flow is limited. From the derivatives data, the funding rate has fallen back to the neutral to low range, indicating a mild correction in the sentiment of leveraged long positions.The expansion of short-term positions has not formed trend support, but has instead increased the elasticity of short-term volatility. 2. ETF Funds: Bitcoin Outflows, Ethereum Inflows Bitcoin ETFs saw a net outflow of $607 million last week, while Ethereum ETFs recorded a net inflow of $114 million. The inflow volume remains weak, and funds are shifting from BTC, which has higher beta exposure, to ETH, which has more prominent valuation catalysts.

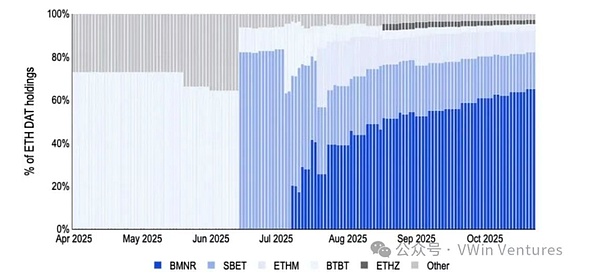

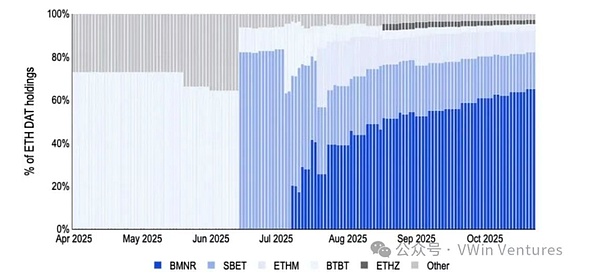

3. DAT Institutions: Accumulation Growth Slows Down

Except for a few institutions such as BMNR that continue to increase their holdings, the net increase in ETHDAT holdings has slowed significantly. Large investors remain cautious after the leverage ratio was broken, even at the current "support" level, and are mostly in a wait-and-see and defensive position rotation phase, waiting for new macroeconomic guidance signals.

Sellers: Mainly long-term holders

Long-term selling continued but moderate, with limited inflows into exchanges. The total holdings of long-term holders (LTH) continued to decline slightly, but at a manageable pace.

Long-term holders' selling continued but moderate, with limited inflows into exchanges. The total holdings of long-term holders (LTH) continued to decline slightly, but at a manageable pace.

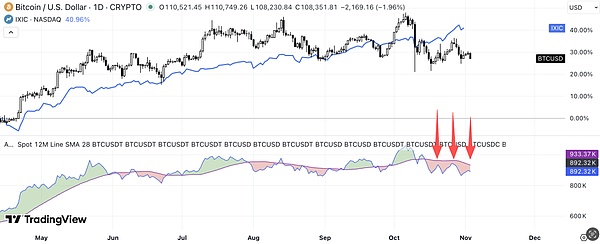

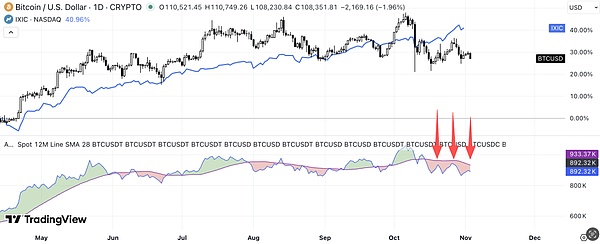

CVD is in a selling phase and has been unable to break through for a long time. The price of 110,000 is a short-term resistance level.

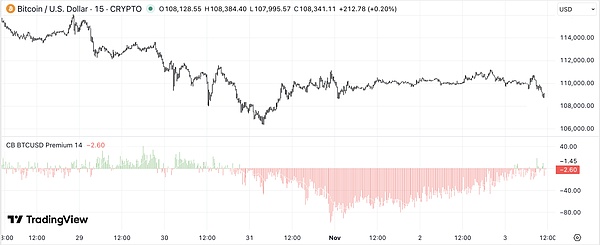

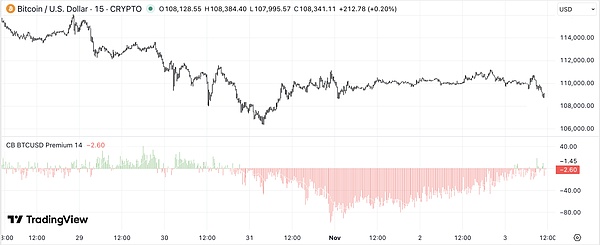

CB Premium indicates that some exchanges are offering discounts, possibly due to concentrated selling pressure from funds in the Americas.

Overall, the market has not experienced systemic deleveraging risks; the sideways consolidation is more like a "breathing period" after a trend-upward movement. Short-term support is in the $107,000–$108,000 range. If ETFs see renewed inflows and the money supply stabilizes, an upward attack is expected to resume.$$107,000–$108,000.

Strategically, we maintain a neutral-to-bullish allocation, focusing on rotation opportunities in ETH and undervalued on-chain assets, while remaining wary of liquidity risks from TGA's liquidity drain and rising US Treasury yields. Alex

Alex