USDC surpasses USDT: Compliance is key to stablecoin dominance

As institutional investors enter the cryptocurrency market, Tether's USDT dominance in the stablecoin market may change.

JinseFinance

JinseFinance

Author: OKX Ventures Jeff Ren, Peiqi Xu, Wei Zhao and Bingcheng Zhong Translation: Shan Oppa, Golden Finance

From the bull market in 2021 to the bear market in 2023, crypto The currency market has undergone significant changes. The total market value dropped from US$3 trillion to US$1 trillion, but the market value of stablecoins only dropped by 30%.

As of December 2023, CoinGecko data shows thatthe total market value of the stablecoin market is approximately $130 billion. Tether (USDT) dominates with a 70% share, USDC holds about 20%,the rest is scattered among various other stablecoins. Against the current backdrop of higher government bond yields (>5%), Tether's net profit in the first quarter of 2023 was $1.48 billion, and quarterly returns on investments in cash and cash equivalents again approached $1 billion in the third quarter of 2023 , highlighting the profitability of the market.

In addition to Tether and USDC, we have also seen the emergence of many on-chain stablecoins, reflecting the demand for different types of stablecoins in the DeFi field, both Centralized and permissionless. Innovations in these emerging stablecoins include collateral diversification, collateral liquidation mechanisms, and profit-sharing mechanisms that give back to the community. Their success depends on maintaining liquidity and attracting major DeFi protocols.

Although new on-chain stablecoin protocols continue to emerge, more than 90% of market value is still concentrated in centralized stablecoins. *Some startups are trying to challenge the dominance of Tether and Circle by leveraging the yield on payments generated by U.S. government bonds, but I believe the long-term development of centralized stablecoins will require more cooperation with traditional financial institutions and regulators. This includes working with a compliant custodian, adequate capital injection, and obtaining relevant licenses.

To create the next "super stable currency" similar to USDC and USDT, we believe that at least the following four key conditions need to be met in order to give full play to centralization and decentralization. Advantages of centralized stablecoins:

USD-based stablecoins: US dollar in the world It has broad acceptance within the scope and its supporting assets have broad applicability.

Global regulatory recognition and licenses: Super stablecoins need to be positioned globally from the beginning and gain recognition from US regulatory agencies and global license.

Innovative financial attributes: Super stablecoins should have innovative financial attributes, such as profit sharing mechanisms, to build community support and sustainability Continued growth.

Seamless integration into the DeFi ecosystem: Super stablecoins need to become an integral part of DeFi Lego to achieve widespread adoption in the DeFi field use.

The stablecoin market plays a vital role in the cryptocurrency ecosystem and is expected to continue to develop and expand. To successfully create the next super stablecoin, we believe that a series of DeFi gameplay advantages may need to be met and partnerships established.

In order to solve the problems of centralized stablecoins, decentralized stablecoins have introduced innovative solutions. These new stablecoins are built on blockchain protocols, making them more transparent. For example, Curve's crvUSD, AAVE's GHO, and Dopex's dpxUSDSD are all stablecoins based on on-chain protocols, reducing centralization factors. Decentralized stablecoins can be divided into two major categories:

Over-collateralized stablecoins:

Collateralized stablecoins are the most common type of decentralized stablecoins. Their asset backing typically comes from other cryptocurrencies, such as Ethereum or Bitcoin, to maintain their relative value stability. For example, MakerDAO’s DAI is backed by Ethereum as collateral. The latest trend is to shift collateral from traditional centralized stablecoins and major traditional digital currencies to broader digital currencies or multi-layer nesting to increase liquidity and provide more application scenarios. For example, the largest collateral in Curve’s crvUSD is stETH, while Ethena’s stablecoin is also based on Ethereum and Liquid Staked Tokens (LST).

PotentialAdvantages: Collateralized stablecoins may be able to surpass simple payment tools role, evolving into a more comprehensive digital asset management tool that provides users with a wide range of choices and flexibility.

Potential Disadvantages: A major problem with collateralized stablecoins is asset utilization due to excessive collateral Reduced risk, especially when backed by volatile assets like Ethereum. This volatility creates the possibility of forced liquidation, creating significant challenges.

Algorithmic stablecoin:

Algorithmic stablecoins are one of the most decentralized stablecoin types. The idea is to use market demand and supply to maintain a fixed price without the need for actual collateral to back it up. These stablecoins use algorithms and smart contracts to automatically manage supply to maintain price stability. For example, Ampleforth is an algorithm-based stablecoin designed to keep its price close to $1. It aims to adopt an elastic supply mechanism to automatically adjust supply according to market demand to balance prices. When the price is above $1, supply increases, and when the price is below $1, supply decreases.

In addition, there are some hybrid algorithmic stablecoins that attempt to combine algorithms and fiat reserves. Frax, for example, is an algorithm-based stablecoin designed to maintain prices close to $1. It uses a hybrid stablecoin mechanism, partially backed by fiat currency reserves and partially managed by algorithms to maintain price stability.

Potential Advantages: Algorithmic stablecoins aim to be decentralized. We believe stablecoins may have advantages in scalability compared to other solutions. Algorithm-based stablecoins use transparent and verifiable code, which makes them attractive.

Potential Disadvantages: Algorithmic stablecoins, like all digital assets, are susceptible to market sensitivities . When market demand for an algorithmic stablecoin declines, its price may fall below the target value. In addition, the operation of algorithmic stablecoins relies on smart contracts and community consensus, which may bring governance risks such as code flaws, hacker attacks, human manipulation, or conflicts of interest.

Centralized Stablecoin Fiat currency is usually used as collateral and is stored in an off-chain bank account as a reserve for on-chain tokens. They solve the value anchoring problem of virtual assets, linking digital assets with physical assets (such as U.S. dollars or gold) to stabilize their value. At the same time, it solves the access problem of virtual assets under the regulatory environment and provides users with a more reliable way to store and trade digital assets. Centralized stablecoins still account for over 90% of the market share. *

Currently, in addition to the U.S. dollar and British pound, many centralized stablecoin projects have U.S. Treasury bonds as collateral. U.S. Treasuries are typically held in institutional custody, providing callability, while tokenization increases the liquidity of the underlying financial asset. Additionally, they provide interaction opportunities for DeFi components, such as leveraged trading and lending. This allows projects to obtain dollars from crypto users to purchase U.S. Treasury bonds at zero cost and directly benefit from the bond yields.

However, centralized stablecoins also have certain potential limitations. One of them is limited production opportunities. Because centralized stablecoins rely on reserves held by trusted entities to ensure stability and value, users may not receive native returns. This limitation stems from the centralized control and management of collateral.

1. U.S. bond yields have risen more than DeFi protocol yields

The surge in government bond yields has led to significantly higher returns on TradFi compared to DeFi. Currently, the total market value of stablecoins has reached $130 billion, making it the 16th largest holder of U.S. Treasury bonds, with annualized returns of 5% or more. Lending stablecoins to others for interest yields a loan yield of about 3%, while decentralized exchanges such as Uniswap offer returns of around 2% through automated market makers (AMMs)**. This situation reflects that falling bond prices and rising yields may prompt some investors to seek higher returns in traditional financial markets, which may lead to lower yields in DeFi.

2. The emergence of stable currency projects with profit sharing mechanisms

Currently, most of the profits from centralized stablecoins go to their issuers and related investors. USDC, for example, shares some of its profits with investors like Coinbase. Coinbase then allows users to store USDC on the platform to earn rewards, thereby attracting more users. However, there are some innovations in the market where revenue sharing goes beyond investors and ecosystem participants.

3. TradFi gradually enters the stablecoin market

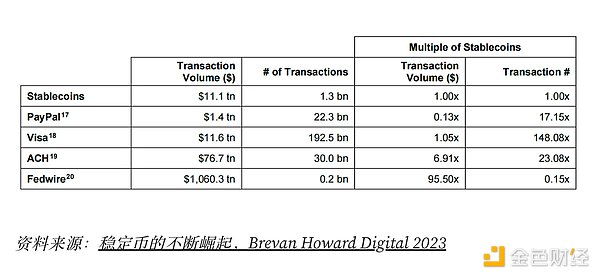

According to a research report by Brevan Howard, the on-chain settlement volume of stablecoins will reach US$11.1 trillion in 2022, exceeding PayPal's US$1.4 trillion and equivalent to Visa's US$11.6 trillion. This highlights the huge potential of stablecoins in the payments sector, especially in providing efficient on-chain settlement systems. Moreover, in developing countries with underdeveloped payment and banking systems, the application of stablecoins is particularly critical, meeting the need for efficient, low-cost payment solutions. As a result, stablecoins play an increasingly important role in the global financial ecosystem, especially in promoting financial inclusion and economic growth.

Several companies including PayPal and Visa are entering the stablecoin market. PayPal has partnered with Paxos to launch PYUSD, a stablecoin backed by U.S. dollar deposits, short-term government bonds and cash equivalents. PYUSD can be redeemed within the PayPal app and is interoperable with Venmo and other cryptocurrencies. It's designed to provide PayPal's 431 million users an entry point into the Web3 world. Currently, PYUSD has a circulating supply of approximately $114.46 million, ranking 14th, accounting for 0.1% of the total stablecoin market. The launch of PayPal could significantly impact the widespread adoption of cryptocurrencies, bridging traditional financial convenience with digital currency innovation.

In the first half of 2023, USDC accounted for nearly half of Coinbase’s revenue , totaling approximately US$399 million.

Source: Coinbase

A. Cooperation between exchanges and stablecoins brings revenue growth

In the first half of 2023, part of Coinbase's revenue came from a profit-sharing agreement with Circle. USDC balances on Coinbase reached $2.5 billion at the end of the third quarter of 2023, up from $1.8 billion at the end of the second quarter. Circle and Coinbase jointly manage USDC through a central alliance and distribute returns based on USDC holdings. In August 2023, Coinbase Ventures acquired a minority stake in Circle, strengthening their partnership.

Source: Coinbase

In addition, Circle also announced that it is expanding its Web2 business by using USDC for cross-border settlement. In September 2023, Visa expanded USDC stablecoin settlement using Circle to the Solana blockchain to increase cross-border payment speeds, becoming one of the first major companies to use Solana for settlement, and pushing up the Solana token price in the short term. Coin price.

The market shows that USDT is mainly used for derivatives trading on centralized exchanges, while USDC is more commonly used in Web3 DApps. Choosing a trustworthy stablecoin issuer is crucial for an exchange. Traditional institutions such as Bank of New York Mellon have higher credibility, while major cryptocurrency issuers such as Tether and Circle have relatively strong financial positions. Factors such as escrow services, auditing firms, and licensing are also important. In the case of BUSD and TUSD, using multiple custodians can reduce counterparty risk.

B. The potential of stablecoin payments drives increased traffic to exchanges and issuers

Stablecoin payments, especially cross-border transactions, have huge potential to drive exchanges and Issuer traffic. Issuers can integrate stablecoins into payment processes by partnering with Web2 payments companies. For example, as of the fourth quarter of 2023, PayPal had 433 million active retail accounts and 35 million active merchant accounts worldwide. PayPal allows settlement of PYUSD, which can be purchased, held, and sent by merchants on PayPal, Venmo, and Xoom. Venmo has about 80 million users in the U.S. and contributes to PayPal's 320 million global users. *Currently, PYUSD is only supported by PayPal US accounts due to licensing restrictions, but it has the potential to grow given PayPal's broad user base. However, PYUSD faces risks from its issuer, Paxos,

Source: PayPal< /p>

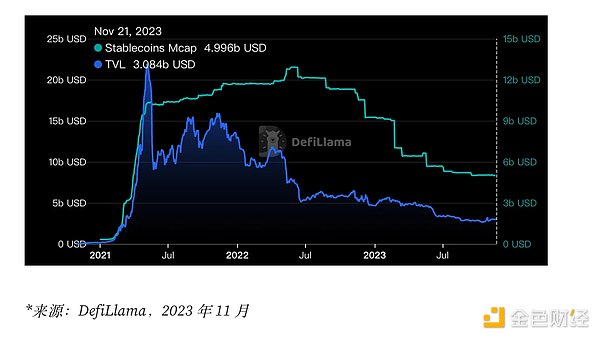

A. The impact of BUSD on the total locked value (TVL) of BSC

BUSD, which supports 6 public chains and is mainly active on Ethereum and BSC, has declined in market value, causing its market value to fall to US$2 billion. This drop had a significant impact on the Binance Smart Chain (BSC) ecosystem, as the decline in BUSD value caused the stablecoin value to drop by 44% and the total value locked (TVL) in the BSC protocol dropped by 66%, highlighting the impact of Binance Smart Chain (BSC) The critical role of ecosystems. Stablecoins in the health of the blockchain ecosystem.

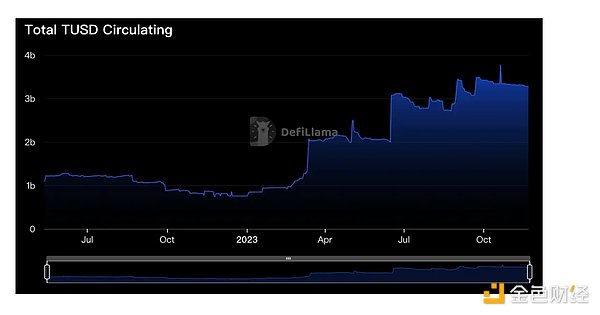

B. The impact of TUSD on Tron ecology

After a series of operations after February 2023, the market value of TrueUSD (TUSD) increased from around US$1 billion to US$2 to US$3 billion between.

February 2023: TUSD implements the Chainlink proof-of-reserve mechanism to ensure the security of its minting process and further guarantee transparency and reliability.

March 2023: TUSD hires The Network Firm LLP, a U.S. independent accounting firm specializing in the blockchain industry, for its USD Reserve coverage provides real-time verification.

April 2023: TUSD introduces native support on the BNB chain.

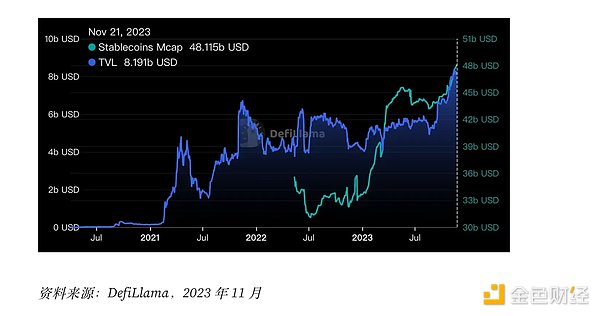

The market value of stablecoins on public blockchains and the area There is also a positive correlation between the total value locked (TVL) on a blockchain, as shown below for the TRON blockchain.

C. USDC on different blockchains

USDC has been issued on more than 15 public blockchains, with the highest rankings in total value locked (TVL) being Ethereum, Solana, and Polygon. USDC is actively seeking to expand its application scenarios, mainly focusing on payments, especially cross-border payments.

Table: Distribution of USDC’s TVL on different blockchains

USDC and Solana: Visa partners with Circle to use USDC for on-chain settlement on the Solana blockchain, aiming to take advantage of Solana’s high throughput and low transactions Cost enables faster and cheaper cross-border payments.

USDC and Polygon: In October 2023, Circle will support native USDC on the Polygon PoS mainnet. Major Polygon protocols such as AAVE, Compound, Curve, QuickSwap, and Uniswap have announced development support for native USDC, with plans to enable cross-chain interoperability by the end of 2023.

USDC and Sei Network: In November 2023, Circle invested in Sei Network to support native USDC on-chain and noted Sei's performance advantage, the transaction finalization time is 0.25 seconds, surpassing Sui, Solana and Aptos.

D. Stable currency issued by Dapp

Stablecoins issued by top DeFi protocols such as MakerDAO, Curve, and Aave have a huge impact on the public chain. Here we take the rise of stablecoins crvUSD and GHO as examples for reference.

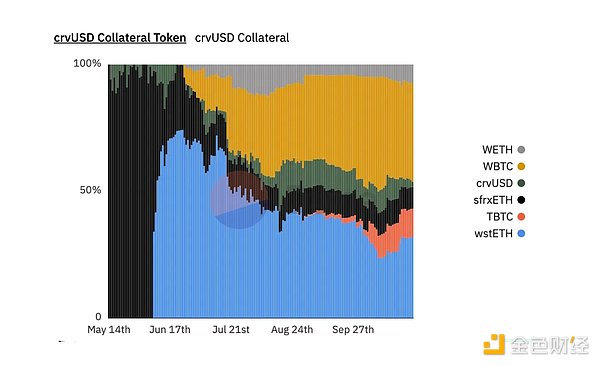

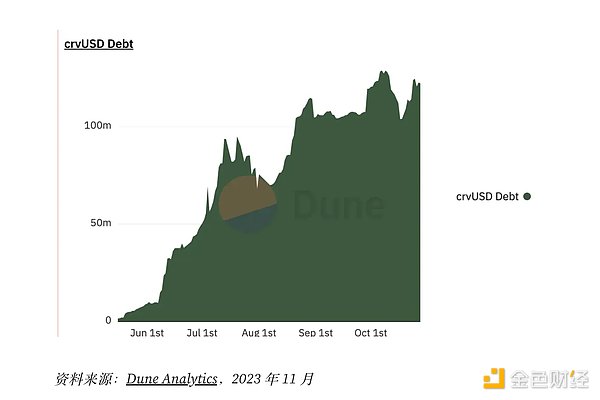

Curve’s crvUSD, launched in May 2023, allows users to mint stablecoins using a variety of crypto assets as collateral, with WBTC significantly contributing to its growth. The protocol quickly gained market dominance by adding collateral such as Lido’s wstETH and BitGo’s WBTC, demonstrating Curve’s influence in the DeFi space. These developments not only enhance Curve’s DeFi influence, but also impact asset liquidity and stablecoin usage on public blockchains. This trend highlights the innovation and importance of the leading DeFi protocols in the crypto ecosystem and suggests that their evolving role may bring new dynamics and challenges to blockchain usage and market stability.

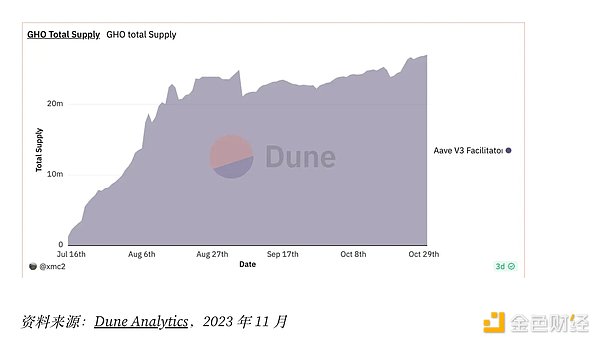

Aave, the largest lending protocol* with a total locked value (TVL) of US$5.64 billion, launched the over-collateralized stablecoin GHO. Therefore, all tokens supported by the Aave v3 protocol can be used as collateral for GHO, and this collateral will continue to generate revenue within the lending protocol. Since its launch in July, GHO’s cumulative TVL has exceeded $20 million.

*Source: DefiLlama

Currently, most stablecoin supply is backed by highly liquid short-term assets such as U.S. dollars and Treasury bills, and the risk of default is very low. The primary risk for centralized stablecoin issuers is ensuring smooth user purchase and exit channels; if the issuer fails to redeem during user exit, the ecosystem may collapse.

Finding trustworthy stablecoin issuers is critical for ecosystem participants. Analyzing the cryptocurrency ecosystem and the traditional financial market system, crypto-native custodians, traditional financial custodians, banks, and asset management platforms all have absolute credibility. For example, institutions such as Fireblocks, BitGo, Bank of New York Mellon and BlackRock are more suitable as stablecoin issuers.

ETF asset management can be used as a model in which multiple parties ensure the openness and transparency of fund storage and liquidity through the "monitoring sharing agreement" and enhance credibility. In addition, third-party on-chain auditing and on-chain data tracking platforms such as OKLink can jointly supervise the security of funds.

USDC was briefly decoupled due to the bankruptcy of SVP in 2023 Highlights the importance of balance sheet risk management. Some stablecoin projects, such as PYUSD, entrust asset management to Paxos, a custody service provider that holds a New York BitLicense and is regulated by the New York State Department of Financial Services (NYDFS), to reduce certain risks by handing over assets to third-party compliance agencies custodian.

In addition, Circle has partnered with BlackRock, one of the world's largest asset managers, to create the Circle Reserve Fund, which is registered and regulated by the SEC. The main goal is to manage USDC’s reserves, of which the institution currently holds approximately 94%.

M^ZERO Labs provides the blockchain foundation Examples of facilities. M^ZERO Labs is committed to building decentralized infrastructure that allows institutional participants to allocate and manage assets on the blockchain. The platform is open source and connects financial institutions with other decentralized applications, facilitating on-chain value transfer and collaboration among participants.

As the cryptocurrency landscape evolves from a peak in 2021 to a bear market in 2023, stablecoins uniquely emphasize their resilience and critical role in the broader crypto ecosystem. Despite the market contraction from $3 trillion to $1 trillion, the relative stability of stablecoin market caps highlights their potential to serve as a safe haven amid cryptocurrency volatility. Mainstream stablecoins such as USDT and USDC have solidified their position in the market.

The rapid growth and diversification of the stablecoin industry is a testament to continued innovation in the cryptocurrency space. The evolution of the market, from overcollateralization to algorithmic stablecoins, demonstrates dynamic responses to diverse financial needs. The ingenuity inherent in these emerging stablecoins, including their different collateral types, liquidation processes, and revenue sharing mechanisms, not only enhances the resilience of the DeFi ecosystem but also creates a laboratory for potential market evolution.

In the foreseeable future, stablecoins are expected to significantly expand their influence in the crypto ecosystem. As technology advances, we expect the application of stablecoins in financial services to continue to expand, especially in areas such as cross-border payments and settlements. Realizing this potential requires the industry to increase its efforts to improve transparency, security and integration with existing financial infrastructure.

All in all, stablecoins are not just a subset of the cryptocurrency market. They are crucial for bridging the traditional financial and digital currency worlds. Their journey is one of continuous evolution that requires constant innovation, adaptation and collaboration to navigate the dynamic currents of market and regulatory change. For market participants, capturing and adapting to these changes is critical to ensuring long-term success in this ever-changing environment.

As institutional investors enter the cryptocurrency market, Tether's USDT dominance in the stablecoin market may change.

JinseFinance

JinseFinanceExplore the strategic integration of USDC into Celo's blockchain, revolutionizing the digital finance landscape.

Weiliang

WeiliangCircle, a prominent stablecoin issuer, has made a strategic investment in Sei Network, a layer-1 blockchain

Aaron

AaronRevenue drawn away from ETH could result in lower staking yields.

Beincrypto

BeincryptoVitalik Buterin said at the BUIDL Asia conference in South Korea that centralized stablecoins like USDC and USDT will become an important determinant of future hard forks.

Cointelegraph

CointelegraphSpeaking at the BUIDL Asia event in Korea, Vitalik Buterin said that centralized stablecoins like USDC & USDT will become significant deciders in future hard forks.

Cointelegraph

CointelegraphThe entire crypto space felt a negative impact from the failure of the algorithmic stablecoin UST and Terra’s native token, ...

Bitcoinist

BitcoinistThe issue of stablecoins not being stable enough has been mentioned by regulators many times. Regulators worry that the mushrooming of stablecoins, most of which are pegged to the U.S. dollar, may sow the seeds of instability in the overall financial market.

Ftftx

Ftftx Cointelegraph

CointelegraphOn-chain liquidity was the catalyst of DeFi Summer 2020, but what will lead the DeFi markets to hit a trillion dollars within another year or two?

Cointelegraph

Cointelegraph