1. Hello, TN! Pendle was founded in 2020. Could you share your entrepreneurial story? What was your original motivation for founding Pendle? The idea for Pendle was born during the DeFi summer of 2020. At the time, yield farming was at its peak, with triple- and even quadruple-digit annualized returns commonplace, but these returns often lasted only a few days or even hours. This got us thinking: could we lock in these high returns? So we decided to build a protocol that made fixed income in DeFi a reality. This idea became even more significant when we realized that the global fixed income market is actually the world's largest securities market. 2. My impression is that Pendle was initially the primary way to participate in yield farming on Eigenlayer and Ethena last year. Could you explain the essence of Pendle and how users can use it in layman's terms? Pendle is essentially a yield trading protocol. Simply put, we enable users to trade the "right to income" of an asset. This income encompasses all receivables generated by the asset, including regular income and reward points. This is achieved by separating the income and points generated by the asset into independent assets—Yield Tokens (YT), while the remaining principal is represented by Principal Tokens (PT). If you are optimistic about the future income and points generated by an asset, you can purchase YT. If your prediction is correct, the accumulated income from YT exceeds the purchase cost, resulting in a profit. For users seeking stable returns, PT can be purchased at a discount to obtain a fixed annualized return. This is equivalent to buying the asset at a discount and profiting from the price difference. In addition to generating income, Pendle also provides opportunities to participate in various popular DeFi protocols, allowing users to choose the most suitable investment portfolio based on their risk appetite. 3What is Pendle's business model? What value do PENDLE token holders gain?

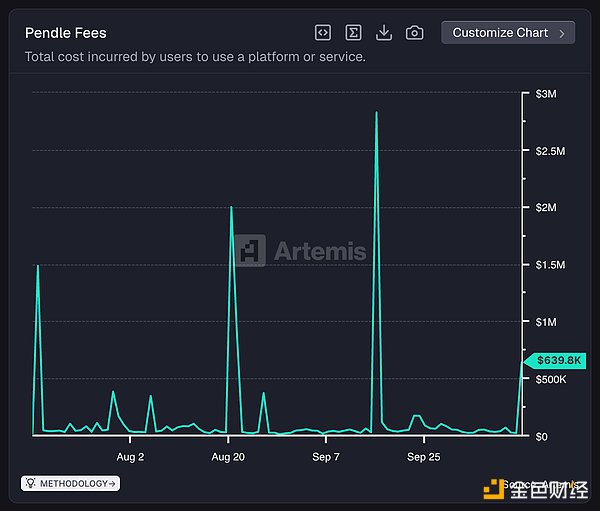

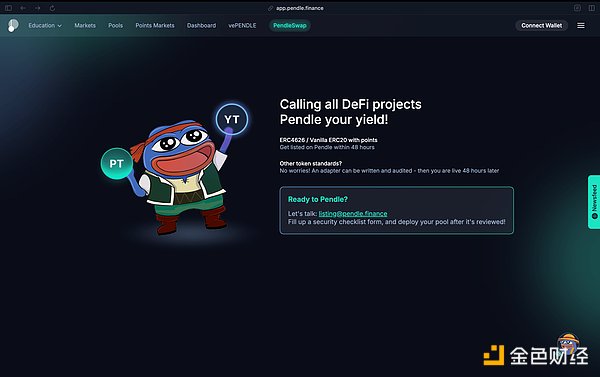

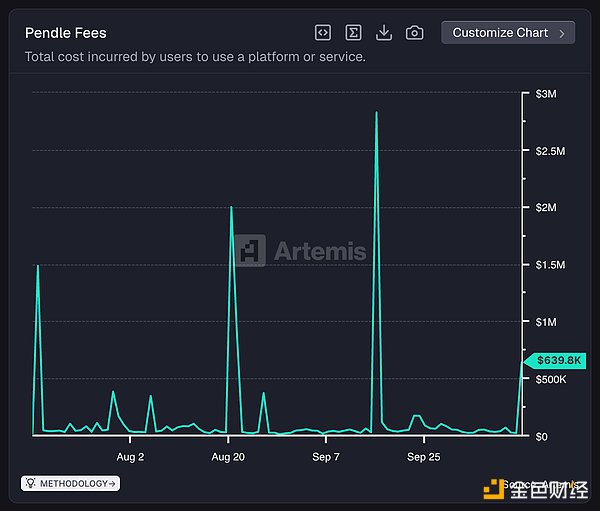

Pendle's revenue comes primarily from two sources: exchange fees and revenue commission. Simply put, the higher the trading volume and total value locked (TVL), the more revenue the protocol earns. A portion of the revenue commission is also distributed to vePENDLE holders in the form of points or airdrops. 4. What's the biggest market misconception about Pendle? I think it's the perception that listing on Pendle is difficult. Actually, listing on Pendle is very simple, especially now that we've established a community-driven pool deployment process. This is also the main reason why so many new markets have recently emerged on Pendle, especially interest-bearing stablecoins like Gaib and USDai. If you're a DeFi project that can generate any form of income/points, listing your assets on Pendle is actually very straightforward.

5, James Ho of Modular Capital, and Jose Sanchez of Spartan Group all see Pendle as the core winner in the stablecoin market. Why do stablecoins account for 78% of Pendle's total locked-in volume? What are your thoughts on Pendle's future opportunities in the stablecoin space? I believe this success is due to the fact that stablecoins are the primary narrative driving the market. Looking back, when Eigenlayer and restaking were the dominant narratives, our TVL was primarily comprised of staking-related assets, mostly denominated in ETH. Then, as the BTCFi narrative emerged, led by Babylon and its derivatives, our TVL naturally followed suit, with a significant increase in the proportion of BTC assets. Now that stablecoins have become a market focus, our TVL is showing the same pattern. Pendle's core advantage lies in its design architecture and infrastructure, which can quickly adapt to various market narratives and trends. As long as an asset can generate returns, it can be restructured through "Pendleization." 6. What metrics are most critical for Pendle? How much weight does fundamental analysis hold when communicating with investors and token funds? TVL and trading volume are core metrics. They directly contribute to protocol revenue and are key considerations when engaging with investors and token funds. Market narratives shift with each cycle, but these fundamentals remain the core metrics for evaluating our performance over the long term. Trust is paramount for large investors and circulating token funds, and these metrics quantify that trust in the protocol. The longer we maintain growth in these metrics, the more trust the protocol accumulates. 7. Please discuss Pendle's future development roadmap. We have three core goals this year: First, Boros, our brand-new leveraged yield trading platform. Boros is designed to handle a wide range of yield sources, encompassing not only DeFi yields but also off-chain traditional financial yields like mortgage rates. Initially, we will focus on a more straightforward and familiar area: perpetual funding rate trading. Just two months after launch, Boros has demonstrated strong growth, with trading volume increasing tenfold compared to V2 and notional trading volume exceeding $1.8 billion. Even at this rate, we currently only cover approximately 0.03% of the total addressable market, leaving significant room for growth in the perpetual funding rate sector alone. Secondly, the Citadels initiative aims to optimize the PT (Protocol Interest) circulation ecosystem and build an independent economic system—especially important after PT lending recently surpassed a record high of $2 billion. Currently, fixed-income PT (Protocol Interest) primarily exists within the EVM ecosystem. Through Citadels, we will expand our reach to institutional investors requiring KYC, Shariah-compliant funds, and even non-EVM chains like HYPE, TON, and Solana. Each of these areas represents a fortress we are building, and this is a crucial step for Pendle in achieving widespread adoption of fixed income. Finally, as we enter a new phase of growth, Pendle V2 will evolve towards a permissionless ecosystem. As mentioned earlier, listing assets on Pendle has never been easier. 8. Looking ahead to the long term, what significant opportunities might Pendle face beyond 2030? Our vision for Pendle is ambitious—we aspire to make all types of yield tradeable on Pendle, encompassing not just DeFi but all types of yield-generating assets globally. Our goal is to create a yield trading marketplace that becomes the go-to platform for top-tier yields, whether from DeFi, CeFi, or traditional finance. We firmly believe that the most impactful blockchain applications are those that solve real-world problems more effectively than traditional financial solutions. This is precisely the standard we are setting for Pendle. From a data perspective, the market opportunity is enormous: the global fixed income market is approximately $140 trillion, making it the world's largest securities market. The demand for fixed-income products isn't hypothetical; it's a mature market that already exists. However, there's currently a lack of a unified platform that seamlessly integrates various on-chain and off-chain yield curves. This is precisely the market gap that Pendle aims to fill. 9. What are the biggest risks and challenges facing Pendle's future success? Our core challenge currently lies in breaking through the limitations of the "on-chain model." Pendle has established solid product-market fit within the crypto-native ecosystem, but to truly scale and become a global yield layer, we must build the infrastructure that can bring Pendle's products beyond the boundaries of Web3. This means establishing the right channels to package and promote these products in a way that traditional finance can understand. This brings with it a host of new challenges—regulatory compliance, KYC verification, legal structures, asset custody, and more. These are crucial building blocks for achieving real-world adoption and attracting external institutions, funds, and clients. We are in active discussions with several potential partners to overcome these obstacles. We are also working closely with the Ethena team to explore specific ways to connect our infrastructure to the broader financial world. While this is a complex, multi-faceted challenge, it's also our most exciting frontier. Once we overcome this, we will unlock a space for development far greater than just DeFi. 10. Why does DeFi need financial products like Pendle? Before Pendle, the DeFi space lacked a reliable way for users to gain fixed income exposure, a significant market gap. Fixed income is a core component of any mature financial system—it allows investors to preserve and increase their wealth in a predictable manner. These products naturally attract a different user base than typical DeFi speculators: sophisticated investors tend to have a more nuanced understanding of risk rather than blindly chasing high annualized returns. We've witnessed this trend firsthand: despite the potential upside from future returns and airdrops, a significant portion of PT trading volume comes from eight- and nine-figure investors who lock in fixed income. From a risk-return perspective, the reliability and predictability of fixed income offer irreplaceable advantages. As a yield trading market, Pendle enables true price discovery for the crypto yield curve. It helps establish the interest rate term structure, similar to the role of Chinese bonds in traditional finance, and has important implications for the broader DeFi financial market. Furthermore, with the rise of points and airdrop mining, Pendle has evolved beyond a simple yield platform. It has become a democratized "early-stage investment" platform, allowing retail investors to gain early access to emerging protocols in a way previously limited to insiders or venture capitalists. This functional layer is extremely attractive and aligns well with our goal of building a more open and inclusive yield market. What sets Pendle apart from earlier attempts at building similar protocols? I believe the key difference lies in our ability to identify and adapt to emerging narratives and market trends. Looking at the evolution of Pendle's TVL composition, you'll see a clear phased shift: early liquidity was heavily concentrated in ETH (especially during the LST and LRT phases), and with the rise of BTCfi, our liquidity allocation naturally shifted. Stablecoins now account for over 78% of TVL, which is actually a healthy sign—unlike speculative assets, demand for stablecoin yields is resilient across cycles. Regardless of bull or bear markets, the market demand for stable, predictable returns remains, especially among users who seek to preserve their wealth. This agility to adapt to market dynamics is our core strength. It's this ability that allows us to maintain relevance and achieve growth across different narrative cycles. What is the typical user profile of 12 and Pendle?

Although it sounds like a cliché, Pendle can indeed provide value to all types of users:

If you prefer conservative and stable returns, the fixed income provided by the principal token PT perfectly meets the needs of wealth preservation and planning;

If you have a higher risk tolerance and hope to leverage the protocols you are optimistic about (especially to maximize airdrop potential or future returns), the income token YT is the ideal tool;

If you are in between or want to take into account both, as a liquidity provider LP, you can obtain fixed income and share the upside potential of income and points.

In-depth analysis of Pendle data

As of September 2025, Pendle's total locked value TVL exceeded a peak of US$13 billion, of which USDDe accounted for the largest proportion (approximately US$8 billion), and the rest was made up of other stablecoins, BTC and ETH. Pendle's liquidity structure is highly narrative-driven. Initially dominated by ETH (during the LST/LRT phase), it subsequently shifted to BTCFi, and now stablecoins account for over 78%. This demonstrates the market's strong demand for predictable, sustainable returns. The peak volatility and pullback in September 2025 reflected a wave of liquidation during the large maturity cycle. Stablecoins are a core pillar of Pendle's growth. With the total stablecoin supply exceeding $300 billion and the proportion of interest-bearing stablecoins rapidly increasing, Pendle has become a key platform for tokenized trading of these yield-earning assets. By capitalizing on the trend of users shifting from passive stablecoin holdings to active yield generation, Pendle is tapping into the largest and most stable liquidity base in the crypto space. This makes stablecoins the backbone of its long-term TVL and revenue expansion. Pendle's collateral base has expanded significantly, with stablecoins leading the way with 28 collateral types (up 27%), underscoring their role as a pillar of the protocol's growth. Ethereum (11 types, +10%) and other assets (23 types, +21%) continue to provide diversified support. This diverse landscape demonstrates Pendle's evolution into a multi-asset yield trading market, nimbly capturing emerging narratives while remaining anchored by the reliability of stablecoins.

Weiliang

Weiliang