Author: Jiawei @IOSG

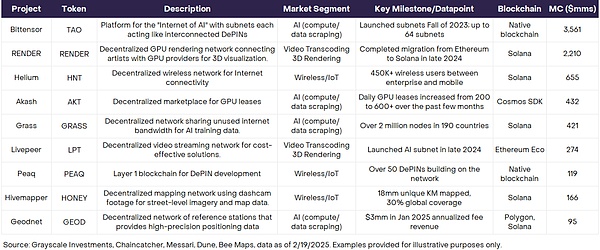

▲ Source: Grayscale

Grayscale wrote a research report on DePIN at the beginning of this year. The above table shows the top DePIN projects and their market value. Since 2022, DePIN and AI have been mentioned as two new directions of Crypto investment. However, there seems to be no iconic project in the DePIN field. (Helium is considered a leading project, but Helium even appeared before the concept of DePIN; Bittensor, Render and Akash in the table are more classified as AI tracks)

It seems that DePIN does not have a strong enough leading project to open the ceiling of this track. The DePIN track may still have some Alpha in the next 1-3 years.

This article attempts to sort out the investment logic of DePIN from scratch, including why DePIN is an investment track worthy of our attention, and proposes a simple analysis framework. Since DePIN is a comprehensive concept covering many diverse sub-tracks, this article will zoom out a little and explain the concept from an abstract perspective, but will still give some specific examples.

Why pay attention to DePIN investment

DePIN is not a buzz word

First of all, it needs to be made clear that decentralizing the infrastructure of the physical world is not a fancy idea, nor is it just a simple "narrative play", but it can be implemented. In DePIN, there are indeed scenarios where decentralization can "enable" something or "optimize" something.

Here are two simple examples:

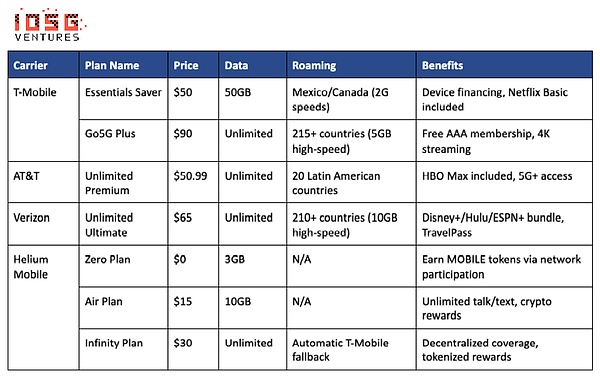

▲ Source: IOSG

In the telecommunications field, a major track in DePIN, taking the US market as an example, traditional communication operators (such as AT&T and T-Mobile) often need to invest billions of dollars in spectrum license auctions and base station deployment, and then pay $200,000 to $500,000 in deployment costs for each macro base station with a coverage radius of 1-3 kilometers. In an auction of 5G spectrum in the 3.45GHz band by the Federal Communications Commission (FCC) in 2022, AT&T invested $9 billion, becoming the operator with the highest investment. This centralized infrastructure model leads to high prices for communication services.

Helium Mobile distributes this early cost to each user through community crowdsourcing. Individuals only need to purchase hotspot devices for $249 or $499 to access the network and become "micro-operators". Through token incentives, the community is driven to spontaneously form networks, thereby reducing overall investment. The cost of deploying a macro base station for Verizon is about $200,000, while Helium can achieve similar coverage by deploying about 100 hotspot devices (total cost of about $50,000), reducing costs by about 75%.

In addition, in the field of AI data, traditional AI companies need to pay up to $300 million per year in API fees to platforms such as Reddit and Twitter to obtain training data, and crawl data with the help of Bright Data (residential agent) and Oxylabs (data center agent). Not only that, they are increasingly facing more and more copyright and technical restrictions, and the compliance and diversity of data sources are difficult to guarantee.

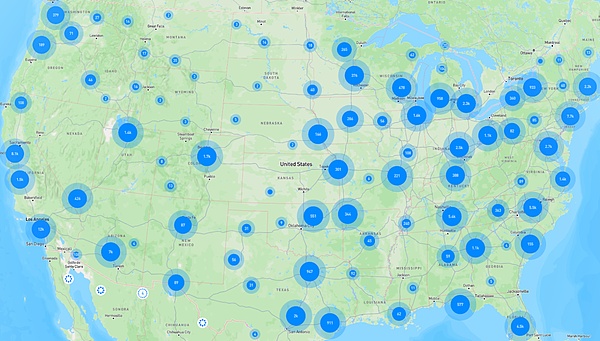

Grass solves this dilemma through distributed Web Scraping, allowing users to share idle bandwidth by downloading browser extensions, helping to crawl public web page data and obtain token rewards from it. This model greatly reduces the data acquisition cost of AI companies, while achieving data diversity and geographical distribution. According to Grass statistics, there are currently 109,755,404 IP addresses from 190 countries participating in the network, contributing an average of 1,000 TB of Internet data per day.

To sum up, a basic starting point for investing in DePIN is that decentralized physical infrastructure has the opportunity to do better than traditional physical infrastructure, and even do things that traditional methods cannot do.

As the intersection of Infra and Consumer

As the two main lines of Crypto investment, Infra and Consumer each face some problems.

Infra projects generally have two characteristics: First, the technical attributes are very strong. For example, technologies such as ZK, FHE, and MPC have very high thresholds, and there is a certain disconnect in market cognition. Second, in addition to the familiar Layer1/2, cross-chain bridges, pledges and other projects that can directly reach end users, most Infra is actually toB. For example, developer tools, data availability layers, oracles, coprocessors, etc. are relatively far away from users.

These two points make it difficult for Infra projects to promote users' mindshare and have poor dissemination. Although high-quality Infra has a certain amount of PMF and income, and can be self-sufficient through the cycle, in the market conditions where attention is scarce, the lack of mindshare makes it difficult to list in the later stage.

On the other hand, Consumer is directly facing end users and has a natural advantage in capturing mindshare. But new concepts are easily falsified by the market, and may even fall into a slump after the hotspot switches. Such projects often fall into a cycle from narrative drive to short-term outbreak, and then to falsification and decline, and have a short life cycle. Examples include friend.tech and Farcaster, etc.

Growth, mindshare, and listing are all issues that have been discussed a lot in this cycle. In general, DePIN can better solve the above two dilemmas and find a balance.

DePIN is based on the real needs of the physical world, such as energy, wireless networks, etc. High-quality DePIN projects have solid PMF and income, are not easy to be falsified, and are easy to be understood by the market. For example, Helium's unlimited data package of $30 per month is obviously cheaper than the plans provided by traditional operators.

DePIN also has user-side usage needs and can capture mindshare. For example, users can download Grass's browser plug-in to contribute their idle bandwidth. At present, Grass has reached 2.5 million users of terminals, and many of them are non-encrypted native users. The same is true for other tracks such as eSIM, WiFi, in-vehicle data, etc., which are very close to users.

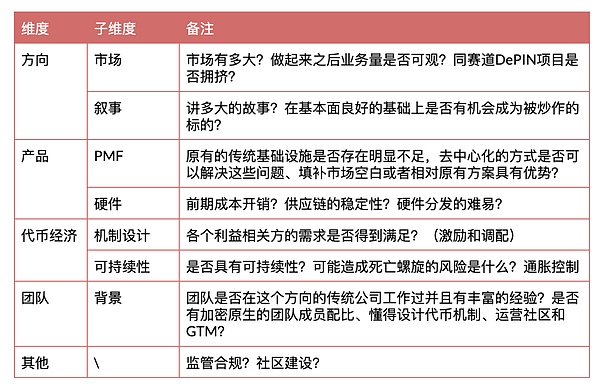

DePIN Investment Framework

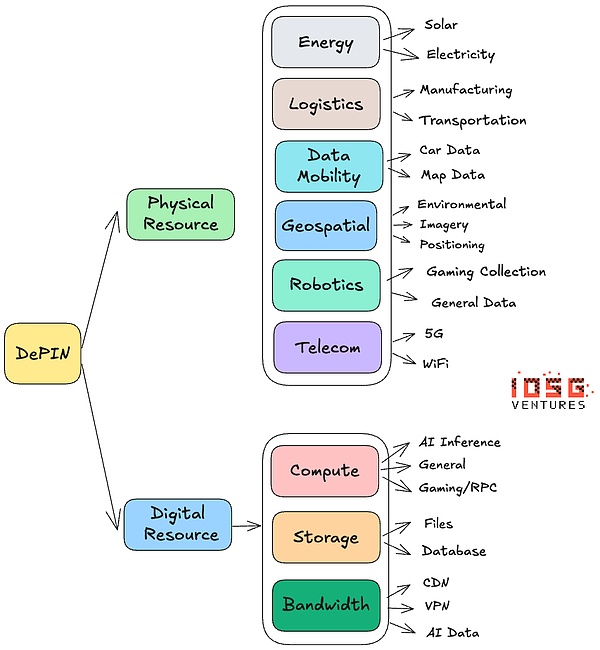

▲ Source: Messari, IOSG

Direction

Just from intuition, 5G and wireless networks are large markets, while in-vehicle data and weather data are small markets. From the demand side, see whether it is a rigid demand (5G) or a strong demand. Moreover, since 5G and other similar technologies have a very large share in the traditional market, even if DePIN can capture a small part of it, the market capacity is considerable given the size of Crypto.

Products

According to Grayscale's report, the DePIN model is particularly suitable for industries with high capital requirements, high entry barriers, obvious monopoly patterns, and insufficient resource utilization. To answer PMF's question, there are essentially two points.

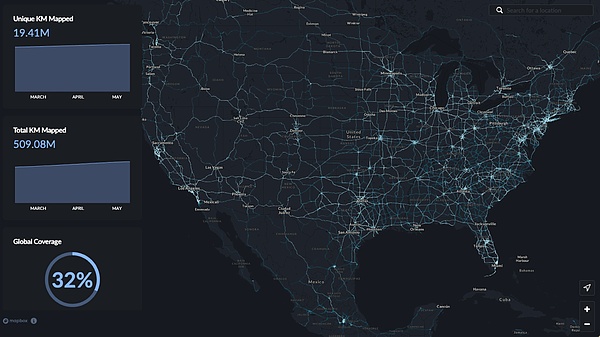

▲ Source: Hivemapper

On the supply side, has DePIN accomplished something that was not possible before, or has it achieved outstanding advantages over existing solutions (cost, efficiency, etc.). For example, in the map collection track where Hivemapper is located, there are at least three major problems with traditional map collection:

Traditional reliance on professional fleets and manual annotation is costly and has poor scalability

Google Street View has a long update cycle and low coverage in remote areas

Centralized map service providers monopolize the data pricing power

Hivemapper allows users to collect data by selling dashcams, and uses the crowdsourcing model to turn data collection into something that users do in their daily driving. Through token incentives to guide users, resources are prioritized in high-demand areas.

On the demand side, there must be real market demand for the products provided by DePIN, and it is best to have a strong willingness to pay. In the same example, Hivemapper can sell map data to companies such as autonomous driving, logistics, insurance, and municipalities, and key needs are verified.

Regarding hardware, Multicoin talked about hardware at the beginning of its 2023 article "Exploring The Design Space Of DePIN Networks". The author combines and supplements a few points of view here.

The timeline of hardware can be summarized as "manufacturing-sales-distribution-maintenance".

#Manufacturing

Does the project party design and manufacture the hardware by itself, or use existing hardware? For example, Helium provides two types of its own hotspots and also supports integration with existing WiFi networks. Or DePIN projects in the computing and storage categories can directly use existing graphics cards and hard drives, etc.

#Sales

The clear price of sales means that users will calculate the payback period based on potential revenue. Helium's home mobile hotspot costs $249, and DIMO's vehicle-mounted data collector costs $1,331.

#Distribution

How to distribute? Distribution involves many uncertainties: logistics timeliness, transportation costs, and delivery cycles from pre-sales, etc. For projects targeting global scale, inappropriate distribution design and means may greatly slow down the progress of the project.

#Maintenance

What do users need to do to maintain hardware? Some equipment may be depreciated or worn out. The simplest maintenance example is Grass, where users only need to download a browser extension and no other operations are required; or Helium's hotspot, which can be continuously run with a simple installation. If solar power generation and so on are involved, it may be more complicated.

Combining the above points, the simplest model is Grass's model - directly using the existing network bandwidth, no need for manufacturing and distribution, no threshold for users to start, and no need for sales, which helps to quickly expand the network in the early stages of the project.

Admittedly, each direction of the project has different requirements for hardware. But hardware is related to the friction of initial adoption. The smaller the friction in the early stages of the project, the better. As the project matures, some friction can bring retention and a certain degree of binding relationship. For start-up teams, it is necessary to control the path selection and resource investment in hardware, step by step rather than all at once.

Imagine, if it is not easy to go from "manufacturing-selling-distribution-maintenance", then why should users participate unless there is a very strong and highly deterministic incentive?

Token Economy

Token mechanism design is the most challenging part of the DePIN project. Unlike projects in other fields, DePIN needs to incentivize various participants in the network in the early stage, so it is necessary to launch tokens in the very early stage of the project. This topic is suitable for a new article to do some case studies, so this article will not expand on it.

Team

In the team ratio, the founder needs at least one of the following backgrounds: one is to have worked in a traditional company in this field and has rich experience, responsible for the actual implementation of technology and products, and the other is to be crypto-native, understand token economy and community building, and distinguish between the preferences and mental models of crypto users and non-crypto users.

Other

Regulatory issues, such as collecting road images and data in China, are obviously very sensitive.

Summary

Crypto has no real "breakthrough" applications in this cycle, and it seems that we are still a long way from the adoption of users outside the circle. The short-term incentives provided by some Crypto applications are the reason why users use them, but they cannot last. The economic benefits derived from DePIN from the bottom layer have the potential to replace traditional infrastructure on the user side, thereby achieving sustainability of applications and large-scale adoption.

▲ Source: Helium

Although the combination of DePIN and reality makes the development cycle longer, we have seen some hope from the development of Helium Mobile: Helium Mobile cooperates with T-Mobile, and user devices can seamlessly switch to T-Mobile's national 5G network. For example, when users leave the range of Helium community hotspots, they automatically connect to T-Mobile base stations to avoid signal interruption. Earlier this year, Helium announced a partnership with global telecommunications giant Telefónica to deploy Helium Mobile 5G hotspots in Mexico City and Oaxaca, starting its expansion in South America. Telefónica’s subsidiary in Mexico, Movistar, has approximately 2.3 million subscribers, and this partnership will directly connect these subscribers to Helium’s 5G network.

In addition to what has been discussed above, we believe DePIN has two unique advantages:

Compared to traditional monopolistic large enterprises, DePIN has more flexible deployment methods and means, and can align incentives within the ecosystem through a token model.For example, the traditional telecommunications industry is usually dominated by a few giants and lacks the motivation to innovate. For example, in rural areas, due to the dispersed population in the area, traditional operators have low return on investment and long time, so traditional operators have no motivation to promote deployment. Through proper token economic design, networks can be encouraged to be deployed in places where hotspots are scarce. The same is true for Hivermapper to set higher incentives in places where map resources are scarce.

DePIN has the opportunity to bring positive externalities. From AI companies purchasing Internet data collected by Grass, autonomous driving companies purchasing street-level map data from Hivemapper, and Helium Mobile providing low-cost traffic packages, it can be seen that DePIN can actually jump out of the scope of Crypto, bring value to real life and other industries, and feed back to the entire ecosystem through the token economy. In other words, there is real value behind the DePIN token, not a Ponzi model.

Of course, DePIN also faces many uncertainties: for example, the uncertainty of the time cycle due to operating hardware, regulatory risks, due diligence risks, etc.

In summary, DePIN is the track we focus on in 2025, and we will also output more DePIN-related research in the future.

Brian

Brian

Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Brian

Brian Alex

Alex Brian

Brian