Author: Michael Nadeau, founder of The DeFi Report; Translation: Jinse Finance xiaozou

Standard Chartered Bank released a report titled "Ethereum's Midlife Crisis" last month, which sparked heated discussions. The report estimated that Base caused Ethereum's market value to evaporate by $50 billion and "took away GDP", so it lowered ETH's year-end target price from $10,000 to $4,000. This raises a core question: Did Standard Chartered misjudge ETH at the bottom of the L2 "J curve"? Or will the structural recession continue?

In this article, we will re-examine Standard Chartered's conclusions and put forward our own insights.

1、Base's"partnership"

Suppose you are Ethereum and I am Base. We are both building critical infrastructure for web3. One day I proposed to you: Instead of building another L1 to compete, why not work together?

As aBase, my cooperation requirements are:

Share Ethereum security and settlement layer (the cost of building a validator is too high)

Build a native cross-chain bridge to access Ethereum users and assets

Share liquidity and developer ecology

Reduce operating costs

CompatibleEVMand surrounding infrastructure

As an Ethereum, you hope to:

Acquire new users throughCoinbase

IncreaseETHDemand (transactions and on-chain services)

Obtain enterprise-level customer feedback

Create fee income for validators

Increase throughput and user experience

Both parties form a 1+1>3 synergy. Now two years have passed, let's use on-chain data to verify the results.

2、BaseEconomy and On-chain Data

User Fees

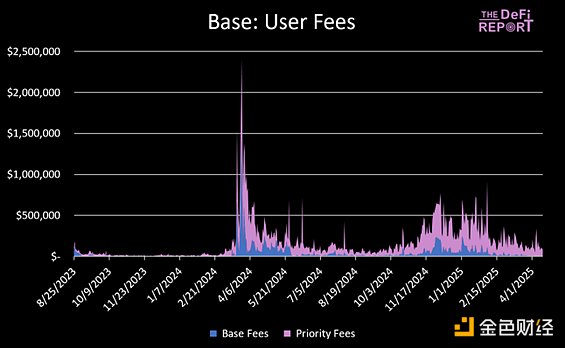

Since its inception, Base has accumulated $24.8 million in basic fees and $81.9 million in priority fees. In 2024, Base revenue ($74 million) accounted for 1.1% of Coinbase's total annual revenue.

Base is currently the fastest growing and most profitable Ethereum L2, launched two years later than its biggest competitor Arbitrum.

Base GDP

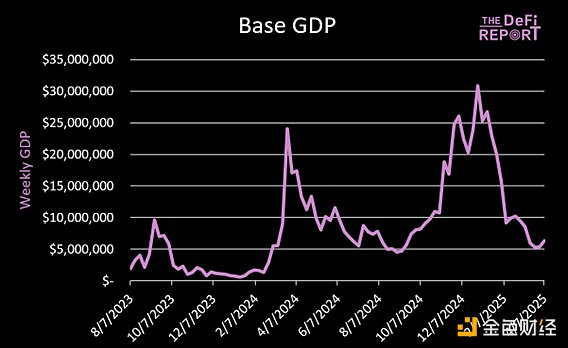

Base's on-chain applications have generated a total of $768 million in fees (cumulative "GDP"), with major contributors including DeFi protocols such as Uniswap and Aerodrome.

"GDP" measures the fees paid by end users for using on-chain applications (excluding gas fees).

Daily average new addresses

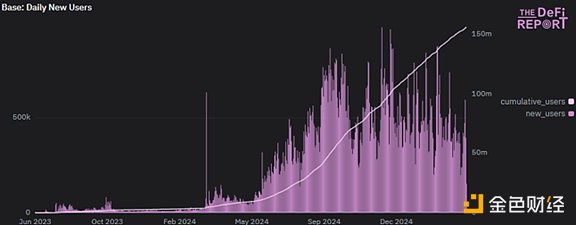

In the past 30 days, Base has added an average of 412,000 new addresses per day. Since its launch in August 2023, Base has attracted a total of 155 million address interactions. Base is attracting new users to the Ethereum ecosystem.

BasebridgesETH

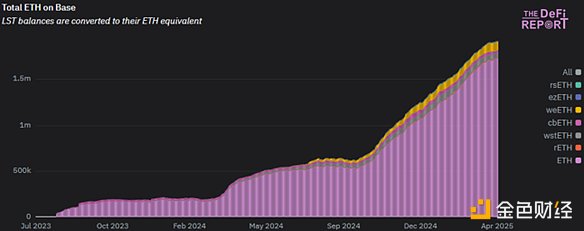

Currently, there are 1.917 million ETH (including LST) on the Base chain, accounting for 1.6% of the circulation, creating new demand for ETH.

Daily average bridged assets

Through the native cross-chain bridge, $500 million to $200 million of assets flow between L1/L2 every day (ETH accounts for 80%). In the past 30 days, $503 million of assets have flowed back from Base to Ethereum. In the past 90 days, $3 billion of assets have flowed back from Base to Ethereum, proving that Ethereum is still a cross-chain hub.

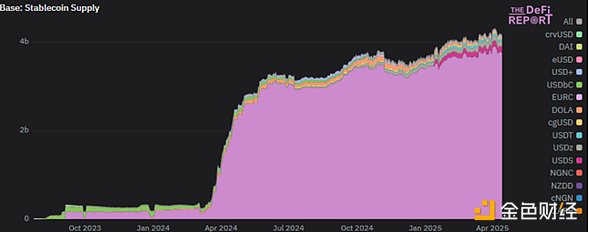

Stablecoin supply

The stablecoin stock on the Base chain reached 4.2 billion US dollars (USDC accounted for 91%), with a total locked value of 9.9 billion US dollars, of which 6 billion were native assets and 3.3 billion came from Ethereum cross-chain. This creates more application scenarios for Ethereum.

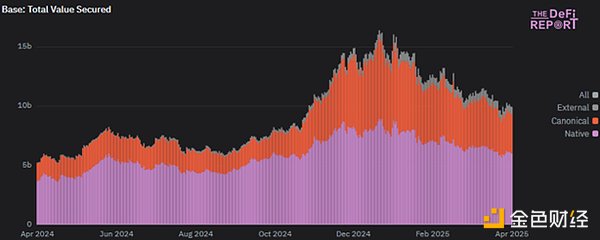

Base is currently valued at $9.9 billion. $6 billion of this is “native” assets, meaning they are issued on Base. $3.3 billion is “canonical” assets, meaning they are bridged from Ethereum. $600 million is considered “external” assets, meaning they are bridged from other chains.

Similarly, Base has created net new demand for ETH through its native tokenized assets.

In summary, in less than two years, Base has used Ethereum to:

• Become the largest and fastest growing L2, earning $106 million in user fees.

• Introduced 157 million new addresses for Ethereum (including some L1 user migration).

• Build an application ecosystem that generates $768 million in fees.

• Cross-chain 1.91 million ETH, creating additional on-chain service demand.

• Increased $4 billion in stablecoin value (Coinbase holds approximately 50% of USDC).

• Issued $6 billion in native assets and introduced $3.3 billion in Ethereum assets.

We believe that Ethereum has achieved the cooperative value of 1+1=3 here. But how does Ethereum itself benefit?

3、Base’s contribution to Ethereum’s “security franchise”

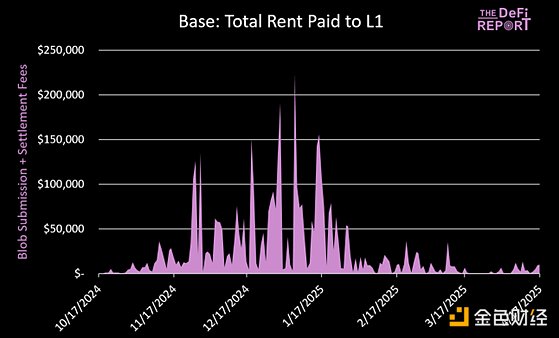

Base has paid a total of $4.5 million in blobs and settlement fees to L1 (destroyed), with an on-chain profit margin of 91% in the last six months (excluding off-chain costs).

Note that Base paid a total of $24 million in L1 fees, 80% of which occurred before the implementation of EIP4844 (cheaper blobs), and our analysis does not include the previous call data stage.

Base currently processes an average of 93 TPS, effectively expanding Ethereum's capacity.

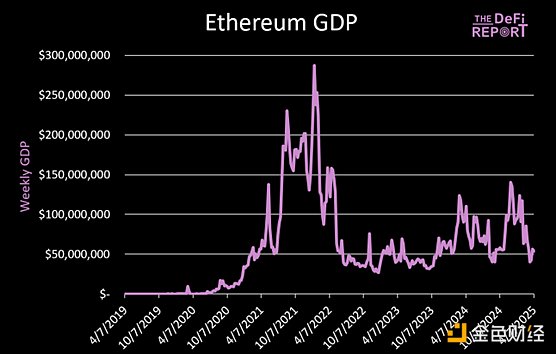

Since Base went online in August 2023, Ethereum's weekly GDP has increased by 75%, but it is still 80% lower than its peak in early 2022. Currently, the daily GDP of L1 applications is $57 million, while the average weekly GDP of Base applications is $6.8 million.

Back to the core question: Does Base "steal" Ethereum GDP?

The answer is yes!

This is exactly what the L2 roadmap is all about. Top applications (such as Uniswap, Aave) are expanding to Base, and new projects (such as Aerodrome) are directly choosing Base instead of L1. Users' migration to L2 has led to a decrease in L1 fees and ETH burn, and Ethereum is moving towards a more enterprise/B2B business model.

This will only constitute an Ethereum "bug" if L2 cannot make up the gap with blob fees in the future.

4、BaseGrowth Forecast andETHValue Capture

Based on current data, we believe that Ethereum is investing in the long-term future through the L2 roadmap, sacrificing GDP, handling fees and ETH burn in the short term, and expecting Base to expand its scale, establish a replicable template (traditional finance?), and promote the positive development of the ecosystem.

Current situation analysis:

• L2 currently processes about 165 TPS in total and needs to compete for blob space.

• 3-4 L2s continue to occupy the current target of 3 blobs per block (maximum 6), and every time this happens, L2s bid against each other, raising fees.

• The target blobs/block is currently 3 (maximum 6), but will be increased to 6 (maximum 9 blobs/block) through the Pectra upgrade next month. Therefore, in the initial scenario analysis, we assume a target of 6 blobs and a maximum of 9 blobs.

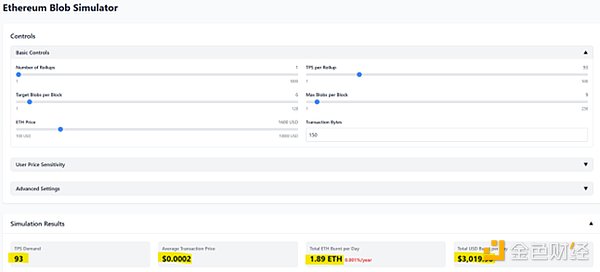

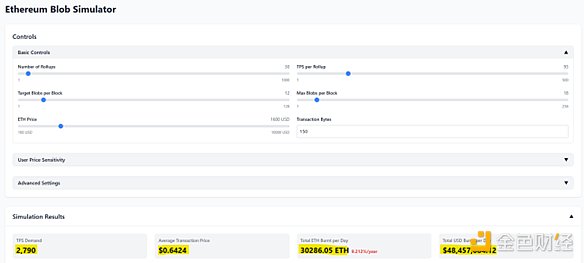

• We use the Blob simulator created by Tim Robinson.

As can be seen from the above figure, the current state has little impact on the Ethereum economy, with an average L2 fee of $0.0002.

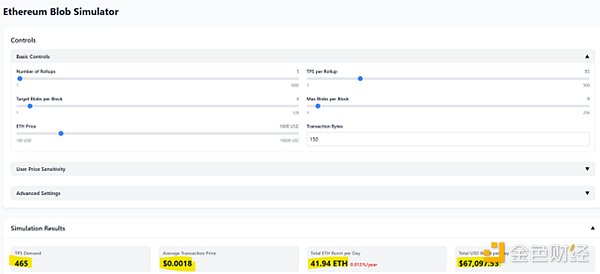

A 5x increase in Base TPS will result in slightly higher L2 fees, while bringing more value to Ethereum L1 (annualized $24.5 million).

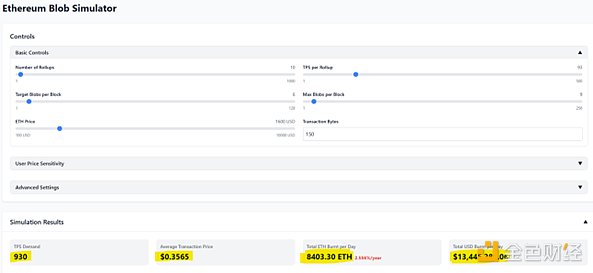

A 10x increase in Base TPS will cause L1 annualized revenue to surge 200x to $4.9 billion (validators will be happy to see this).

But we also created another problem: the average L2 fee will rise to $0.35 (unacceptable).

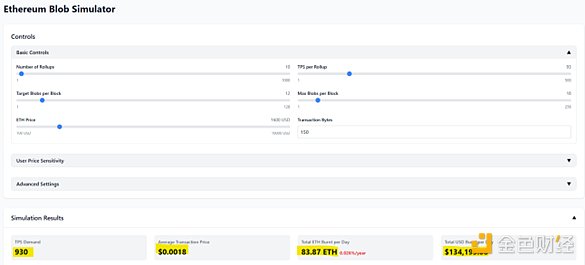

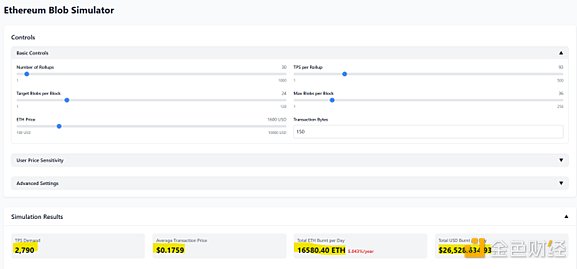

PeerDAS and Fusaka upgrades (expected in Q3/Q4 this year) will increase blobs/blocks to 12 (the final goal is 48, with a maximum limit of 72). Assuming that Base TPS increases 10 times and the initial Fusaka upgrade is completed:

• The average L2 fee can be controlled at $0.0018

• L1 annualized revenue of $48.9 million

If Arbitrum and Optimism also achieve 10x expansion during the same period:

• But once again, we’ve created a bottleneck, with average L2 cost/transaction rising to $0.64. This doesn’t work.

Let’s optimistically estimate that the target blob will increase to 24 in one year:

• L1 annualized revenue dropped to $9.6 billion

• L2 average fee is still $0.17

To control the L2 average fee below $0.02, 33 target blobs/block are required. At this time, L1 annualized revenue is only $1.4 billion, which is exactly the same as the actual revenue in the past 365 days.

Summary:

We try to simplify the analysis model to clarify two core mechanisms: 1) the impact of L2 transactions per second (TPS) on blob pricing; 2) the transmission effect of the increase in the number of L1 target blobs/blocks on the Ethereum economic model and L2 user fees. In fact, we fully recognize the dynamic and unpredictable nature of the market environment - in the near future, there may be hundreds of L2s competing for blob space at the same time.

We are sure that L1 will continue to carry a large amount of on-chain activities, continue to generate fee income and promote ETH destruction. However, the specific application scenarios and transaction scale are still unclear.

According to the simulator deduction results (assuming that the three major L2s all reach 10 times the current Base TPS), when the total L2 TPS reaches 2,790, even if the Pectra technology upgrade is completed, the Ethereum network will still face overload pressure (at this time, the cost of a single L2 transaction is $0.35).

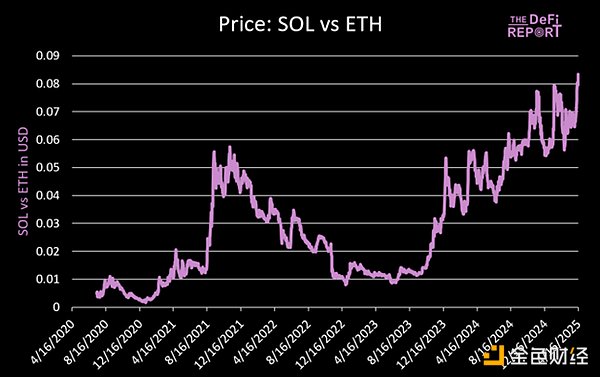

In contrast, Solana has been processing 1,078 TPS steadily over the past 90 days, with an average fee of only $0.016 (including base fee + priority fee), and the actual user fee is lower - because its network adopts a dynamic pricing mechanism based on transaction type, and its performance upgrade solution Firedancer has not yet been officially launched.

5Conclusion

"There is no perfect solution, only trade-offs" is particularly applicable here. Base started quickly through the L2 model and currently has ideal returns, but it also binds itself to the uncontrollable Ethereum expansion route and may face "vendor lock-in" and technical debt risks.

Ethereum seems to have gained enterprise-level customers by sacrificing L1 fees, creating new demand for ETH and a better user experience. However, it is questionable whether the long-term economic relationship is sustainable - scenario analysis shows that expansion bottlenecks may continue to exist. If L2 cannot expand rapidly, it may be necessary to issue additional ETH to maintain validator income (after EIP4844, ETH supply has changed from deflation to possible excess of BTC).

We believe that Base is satisfied with the current status quo, but if Ethereum blob expansion is ineffective, it may seek alternatives such as Celestia. Ethereum urgently needs to shift its culture from "value identification" to a "security as a service" business model for enterprises.

Back to the original question: Did Standard Chartered Bank misjudge the bottom of the "L2 J-curve"? We believe that the structural decline of Ethereum's fundamentals will continue in the short term. Although market sentiment may improve as traditional finance goes online, there is a lack of fundamental catalysts for improvement. The figure below shows that there is still a long way to go.

YouQuan

YouQuan

YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy Brian

Brian Hui Xin

Hui Xin Joy

Joy YouQuan

YouQuan Brian

Brian Hui Xin

Hui Xin