Source: Liu Jiaolian

It’s February in the blink of an eye.

After the Federal Reserve’s January interest rate meeting ended and the Fed issued remarks to counter the March interest rate cut, BTC plunged slightly and once broke through 42k. It was repaired overnight to over 43k.

In January 2024, which just ended, BTC opened at 42.5k and closed at 43.35k. January continued to close higher. This is already the fifth consecutive month that BTC has closed higher since September 2023.

In the past, there were cases where the monthly line closed up for 5 consecutive months or more. During the start-up stage of the bull market from the end of 2020 to the beginning of 2021, it closed up for six consecutive months, going from $10,000 to $60,000.

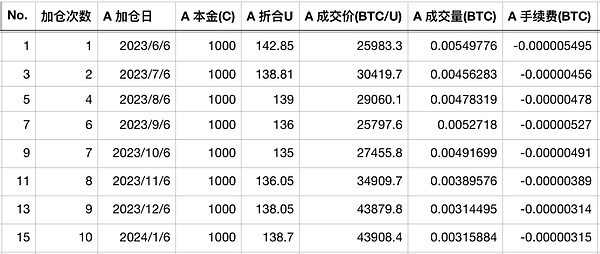

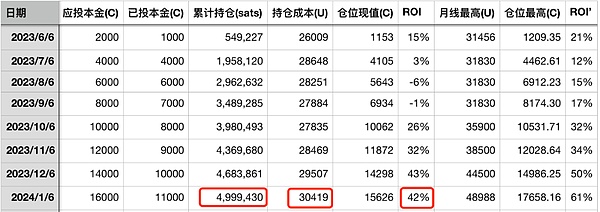

It has closed higher for five consecutive months, which means that the "ten-year agreement" has failed to increase positions on dips for five consecutive times. As I watched, the cost of adding a position increased from 27k in September to 43k now.

So far, in the past six months or so, we have accumulated "real Satoshi" (compared to the currently hyped "fake Satoshi" meme coins) is about 5 million sats. The holding cost is about 30k, and the return on investment is 42%. The highest floating profit reached over 61%.

Careful readers may have noticed that adding positions on dips often leads to "petrification" in the face of continuous rises and the loss of opportunities to add positions at low cost. So, if fixed investing is used together with dips, that is, DCA (Dollar-Cost Averaging) and the so-called BTFD (Buy The Fxxking Dip) are mixed in the English circle, will the final effect really be better than mindless fixed investing?

Jiaolian then spent a little time and pulled out the BTC monthly data for the past five years, from January 2019 to December 2023. Then I wrote a script to backtest the effects of several strategies as follows:

Set a monthly principal of $2,000.

Strategy 1: Brainless fixed investment. Use the monthly closing price to add positions without any thought.

Strategy 2: Add positions on dips. Split the principal into two parts. One is used to add positions at the monthly closing price, and the other is reserved for adding positions at the monthly closing price when the monthly closing price is lower than the opening price (that is, it falls this month).

Strategy 3: Add positions in the next month when prices fall. The principal is also divided into two parts, one part is added to the position at the end of the month without thinking, and the other part is reserved for the closing of the next month of the falling month to add positions.

The backtest results are as follows: (excluding transaction fees and currency withdrawal fees)

- Strategy: no-brainer fixed investment. Total investment: 120,000 USD. Total position: 8.4378 BTC. Average cost: 14221 USD.

- Strategy: Add to positions on dips. Total investment: 116,000 USD. Total position: 8.0342 BTC. Average cost: 14438 USD.

- Strategy: Increase positions in the next month when prices fall. Total investment: 117,000 USD. Total position: 7.9910 BTC. Average cost: 14641 USD.

The conclusion is obvious: first, the final cost of adding positions when there is a dip is higher than mindless fixed investment. Second, the longer you delay adding a position, the higher the final cost will be.

So we can draw the inference: if you have money, add it all, which is better than adding positions in batches. The only reason for fixed investment is that the funds available for investment are obtained month by month.

In other words, if you have 120,000 cash on hand now, then all the positions will be added at one time, and the ratio will be divided into 12 parts. If you add 10,000 positions every month in the next 12 months, there will be a greater probability of obtaining more optimized results.

But if the 120,000 is not in hand immediately, but will only be credited with 10,000 every month in the next 12 months, then it can only be obtained when 10,000 is received every month. Add to your position immediately. In this way, it becomes a fixed investment.

But, for most people, even if they have 120,000 cash on hand, they still split it into 12 parts and pretend that they will be paid each month in the next 12 months. There are 10,000 available, so if you invest in batches, the process and outcome will be better.

Even further, split the 120,000 into 24 parts, 12 of which are used to invest 5,000 per month in the next 12 months, and the other 12 parts of 5,000 each are used for flexible investment every month. It will be better if you invest. This is the reason why Bazi Jue insists on making fixed investments and adding positions whenever there is a dip.

Although, the final result is likely to be that a stud is better than mindless fixed betting than adding positions on dips, but from the perspective of human process psychology, the long wait and tragic fluctuations after a stud may be It will torture an untrained person until he has a nervous breakdown and leaves the market, and good things turn into bad things; even if he is a mindless fixed-term investment, he will encounter a drop after each fixed-term investment, and he will add positions at high positions again and again, which will torture people psychologically. The ground is unbearable, making it impossible to persevere. The whole process is boring and no fun at all.

Only holding coins in one hand and money in the other, applauding when the price rises and adding positions when the price falls, makes this torturous process relatively easy. What Bazi Jue pursues is the optimal solution to the balance between psychology and income, rather than simply maximizing income. No matter how great the potential profit expectations are, if you cannot hold on to them and persist, they will instantly return to zero and turn into losses.

Due to the flexibility of adding positions on dips, it actually gives investors a sense of control over their own destiny. A sense of control brings psychological security, but in reality it brings higher risks. In other words, the originally undifferentiated income situation has been transformed into a distribution that has a certain relationship with the investor's personal market feeling and operating level. Someone did a good job, won the fixed shot, and cast alpha. If someone doesn't do a good job and can't beat the fixed bet, he will cast a negative alpha.

Writing this, Jiaolian took a look at the average holding cost of BTC in his main position, which was 13783.45 USD, barely beating the fixed investment by a little. However, due to diversified investments in 2021 and expanded holdings of some altcoins, the overall position cost has soared to 15953.89 USD after being converted into BTC, underperforming the fixed investment of BTC. It is obvious that diversification and investing in altcoins have brought negative alpha to me.

Brian

Brian

Brian

Brian Bitcoinist

Bitcoinist Beincrypto

Beincrypto Beincrypto

Beincrypto Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Nell

Nell Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph