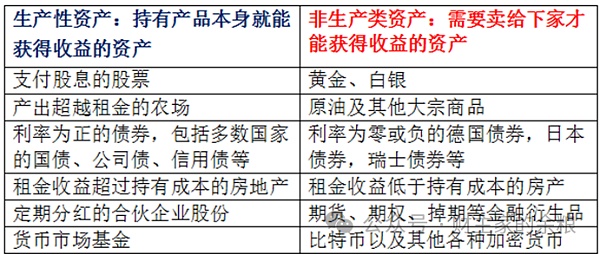

Overall, the current major categories of investable assets are divided into two categories:

Yourself Production assets that can create cash flow;

Commodity assets that cannot create cash flow by themselves.

Obviously, Bitcoin is different from stocks, real estate, bonds, etc. It is not a production asset, but a commodity asset similar to gold.

The valuation of production assets mainly depends on the cash flow generated by them currently or in the future, but for commodity assets, almost every type of commodity has its own unique supply and demand valuation logic.

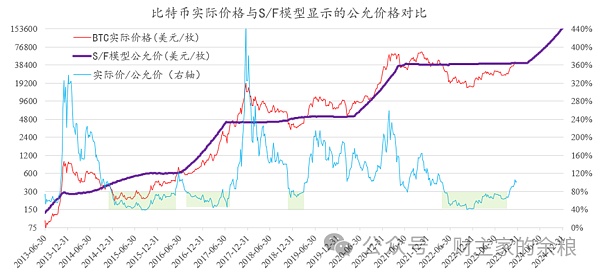

In yesterday's articleIn the article "What should I buy in 2024", I have used stock/ Traffic scarcity valuation ideas, thereby establishing a set of fair price logical models for the price of Bitcoin - of course, all models reflect historical data, but at least, from the pastJudging from the history of Bitcoin price fluctuations in 10 years, this set of models and logic is consistent with reality.

(Explanation: The article has been deleted. In the past two days, I will reorganize the purely theoretical discussion before publishing it).

So, judge the price of Bitcoin. High or low, I follow three steps:

First, you need to understand the price logic of Bitcoin;

Second, judge the macro-financial environment, which may determine the so-called "bull market" or "bear market";

Third, the current short-term market sentiment.

Regardless of the macro-financial environment, it is also Regardless of market sentiment, from the perspective of the Bitcoin price logic model, we can directly use the actual price of Bitcoin to characterize the current Bitcoin price. Is it an overestimation or an underestimation?

In the past 10 years, there have been four stages when the actual price/model fair price of Bitcoin was lower than 80% (the green shaded area in the figure ):

20151< /span>month-2016 year5 month, the currency price is 200-400Fluctuate between US dollars;

2016Year9Month-2017Year7Month, the currency price fluctuated between 600-1600 US dollars;

< strong>2018 year12 month-2019 In March, the currency price fluctuated between 3500-5000 US dollars;

2022 year6 month< span lang="EN-US">-2023October, the currency price is 15000-26000< /span> Fluctuations between US dollars.

Among them, the lowest point appears in September-October 2015 and November-December 2022 In March, the actual price/fair price ratio at that time was only about 40%.

In the comments on yesterday's article, someone asked me why I didn't recommend Bitcoin to everyone when the currency price was the lowest. Now that it has risen, why? Writing articles, isn’t this a trap for everyone?

I don’t know if these people often read my articles——

Read my articles to compare Many people would not say such ignorant words. When I write articles many times saying that I am long on a certain type of asset, it will definitely not be the high point of the price of that asset. On this point, no matter A stocks, U.S. stocks, Hong Kong stocks, gold, Bitcoin and even crude oil, I have been bullish at extremely high levels and short at extremely low levels. I have never done anything like this.

In fact, in 202211- In December, I continuously sorted out the series of bankruptcies of financial institutions in the currency circle and wrote 6 articles to explain why the currency price fell so drastically at that time, and in2023 January At the beginning of the year, I clearly told everyone that the currency price is now at the bottom:

Coin The wave of serial bankruptcies in the currency circle;

The earthquake in the currency circle continues;

Deadly leverage;< /p>

The biggest bankruptcy;

The real big trouble;

Only Bitcoin

The question is, at that time I was desperately recommending it, did you buy it? Do you still think I'm cheating everyone?

Of course, I know that someone must have bought it based on my judgment at that time. At that time, the price of the currency was less than 20,000 US dollars. Now they have made money. Will you tell me?

According to my latest simulated S/F model, the current fair currency price is approximately < span lang="EN-US">41 U.S. dollars, so you can understand that the current actual currency price of 4.4 U.S. dollars is not low, but It is not overestimated and is still within the appropriate range.

Let’s look at the macro financial environment.

2023 can be said to be the most recent 15< /span>The tightest monetary policy in years, even under this circumstance, Bitcoin’s annual increase still reached the level of 140%, which clearly shows that Bitcoin must be at a very low price at the end of 2022.

In 2024, when the Fed is basically unlikely to tighten or release large amounts of water, Theoretically, Bitcoin should be in a bull market, with the price close to the price of its fair model, which may be considered a more appropriate result.

Finally, let’s look at market sentiment.

Since the end of October 2023, a series of Bitcoin ETFs have applied for SEC (U.S. Securities and Exchange Commission) approval, because it is hoped that after the ETF is passed, there will be A large number of takeovers have arrived, so Bitcoin has continued to skyrocket in the past two months. This market sentiment has spread to this day and has not subsided until now, and is still continuing...

From the perspective of market sentiment, the current situation is definitely at the emotional boiling point, which means that the price is likely to be relatively high in the short term.

From the perspective of the fair price of the S/F model, Bitcoin is within a reasonable range;

From the perspective of the macro financial environment, Bitcoin is within a reasonable range;

From the perspective of market sentiment, Bitcoin At an emotional high;

The above three points are my judgments on the current Bitcoin price.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Nulltx

Nulltx Ftftx

Ftftx Cointelegraph

Cointelegraph