Source: Barron's Chinese

The dollar has typically strengthened when the U.S. has imposed tariffs on its trading partners in the past, and one reason for the weakness this time may be that the dollar is losing its safe-haven status.

Global stock markets generally fell on Tuesday (March 4) after a new round of U.S. tariffs on Canada, Mexico and China took effect, but some analysts pointed out that what is more disturbing is the reaction of the U.S. dollar.

The dollar has typically strengthened when the U.S. has imposed tariffs on its trading partners in the past. Stephen Miran, Trump's nominee for chairman of the White House Council of Economic Advisers, once said that Trump's tariffs on China during his first term were one of the reasons for the weakening of the yuan, which in turn offset the impact of tariffs on U.S. consumer prices.

One of the reasons for the dollar's rise after the 2024 U.S. presidential election is the expectation of a dollar appreciation brought about by Trump's tariff plan. Now some analysts believe that the weakness of the dollar so far this week should be a cause for concern.

Lily Francus, chief investment officer of Novi Loren and former head of quantitative strategy at Moody's, wrote on social media earlier this year: "It's not terrible that the dollar rises because of tariff-related news, but it's terrible that the dollar falls because of tariff-related news." Francus recently shared her article again on social media X.

George Saravelos, global head of foreign exchange research at Deutsche Bank, pointed out that there may be several reasons for the dollar's downward reaction, and he thinks one of the reasons is particularly disturbing: the dollar may be losing its status as a safe-haven asset.

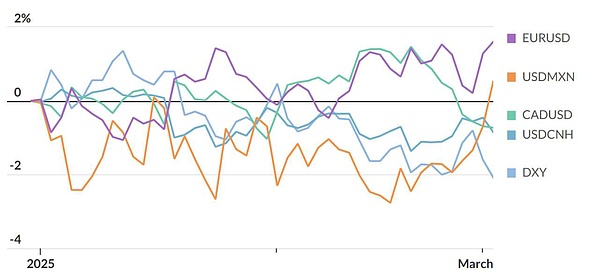

The dollar weakened after a new round of tariffs took effect

Source: FactSet; Deli Wanbang

"Sometimes investors can ignore a certain reaction in the market, but this time it is different," Saravelos commented.

There are other reasons for the decline in the dollar, such as the outflow of funds from the US stock market to European and Chinese stocks, which may have weakened investors' demand for the dollar.

In addition, according to recent data, the US current account deficit accounted for more than 4% of GDP at the end of last year. Saravelos said that in the past, when this ratio reached such extreme levels, it was also the peak of the dollar's overvaluation.

However, Saravelos tried to highlight some of the reasons why he believes the dollar is falling because it is losing its safe-haven status.

The long-standing negative correlation between the dollar and risk assets such as U.S. stocks has broken, Saravelos said, with both falling in tandem. In addition, the dollar weakened against both high-beta and low-beta currencies, another sign of pressure on the dollar.

Another reason for the dollar's weakness is that expectations of increased defense spending have boosted the euro against the dollar, which has supported European bond yields, a key driver of exchange rate movements.

The expectation of a higher European defense budget pushed European defense stocks to a record high on Monday. But ING's foreign exchange strategists said they are skeptical that the euro's recent gains can be sustained.

One potential consequence of the dollar's recent weakness is that the impact of Trump's tariffs on U.S. inflation could be amplified as a result.

On Tuesday, the dollar fell against the Canadian dollar and also weakened against the euro and the Chinese yuan. Meanwhile, the dollar continued to climb against the Mexican peso.

The dollar index, which measures the greenback against a basket of major currencies, fell 0.5% to 106 on Monday, its lowest level since December, according to FactSet.

Jasper

Jasper

Jasper

Jasper Clement

Clement Catherine

Catherine Hui Xin

Hui Xin Clement

Clement Brian

Brian Aaron

Aaron Jixu

Jixu Jasper

Jasper Clement

Clement