Author: Phyrex Source: X, @Phyrex_Ni

Yes, I believe that altcoins are bound to appear. But when they appear should be directly related to liquidity.

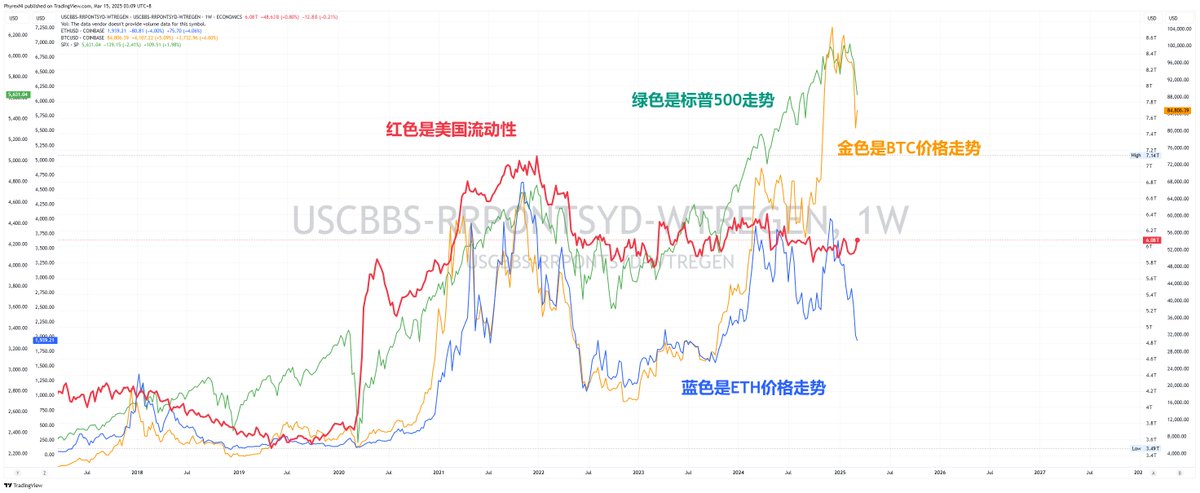

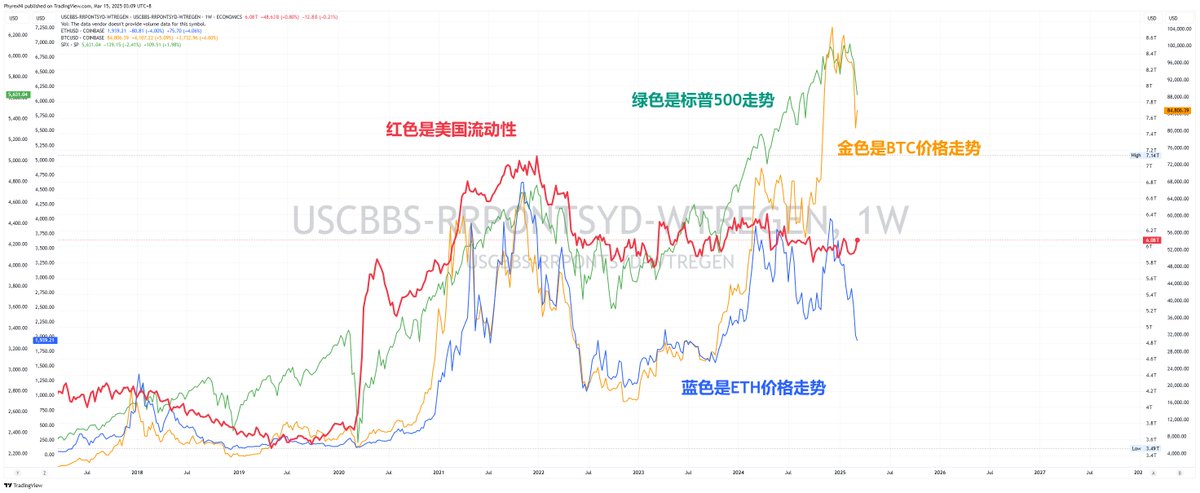

However, the emergence of altcoin season is often accompanied by an increase in liquidity. From the figure, we can see that if ETH is the largest altcoin, the matching degree with US liquidity is very high, but when liquidity increases, it will first be transmitted to large-scale assets, such as S&P 500, and then to medium-sized assets, such as $Bitcoin, and finally to altcoin assets, such as $ETH.

So we can see that when liquidity is missing, large-scale assets are least affected, while small and medium-sized assets are more affected. That is, ETH is the second largest cryptocurrency after BTC, so the data shows that it is closer. If it is changed to other altcoins, the changes affected by liquidity will be more intense.

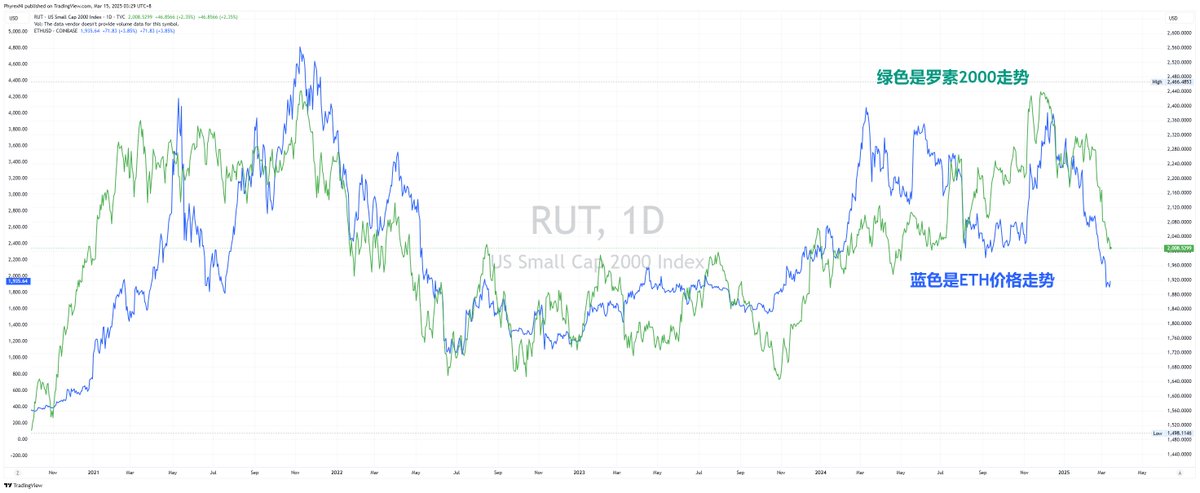

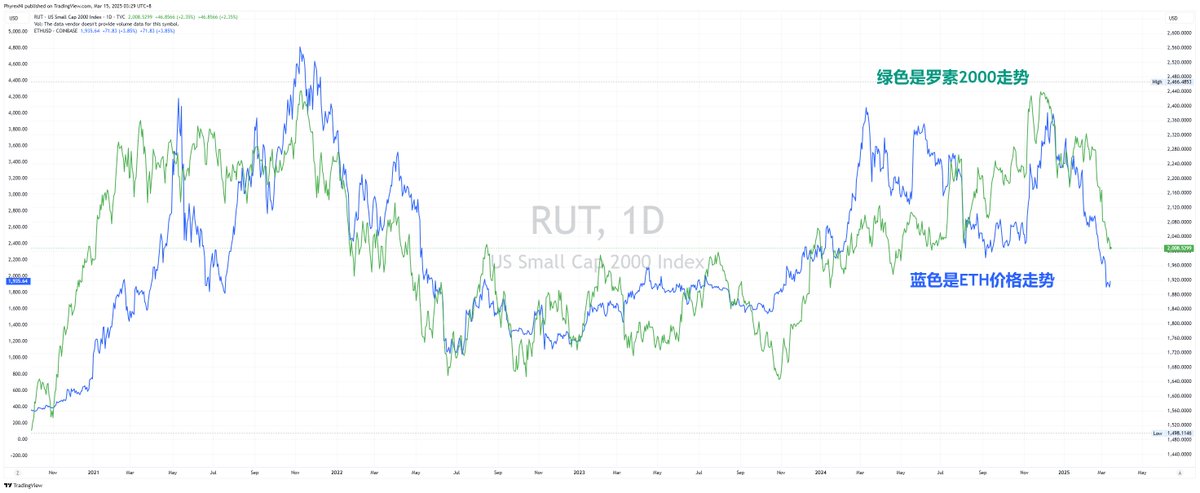

That is, when liquidity is at its peak, the rise will be more fierce, and when liquidity is at its lowest, the fall will be very fierce. Therefore, when the current liquidity has not increased significantly, the altcoin season may indeed be lower. In fact, altcoins are like the Russell 2000 in the US stock market.

As can be seen in the figure, Russell 2000 is seriously affected by liquidity. Even if there is a trend of breaking through liquidity in a short period of time, it is very easy to fall sharply. In fact, this is very different from the main assets with "external forces". For example, the Ai industry in the US stock market has a lot of funds flowing in because it is in the wind, and when the liquidity is poor, it will naturally "draw blood" from small-cap stocks.

The same is true for cryptocurrency, but the difference is that BTC has stimulated the liquidity of both on-site and off-site buying of BTC because of the emergence of spot ETFs, but because the overall liquidity has not improved, it is equivalent to drawing blood from other assets.

From the comparison chart, the trends on both sides are very similar. Both are affected by the liquidity in the United States. Especially when liquidity is insufficient, the rise may be good, but once there is a decline, non-high-quality assets are the first to be cleared, and the last to be bought at the bottom. Therefore, the S&P 500 and BTC often fall the least and rise the fastest in market fluctuations.

In the end, it is true that the alt season will occur, but the alt season must be accompanied by a rebound in liquidity. From now on, the rebound in liquidity is that on the one hand, monetary policy needs to continue to move towards easing and improve investors' risk appetite. On the other hand, there is a direct liquidity stimulus to increase funds in the market, such as stopping balance sheet reduction, canceling SLR or QE.

So if there is no injection of liquidity, then the altcoin situation will at most be a short-term surge and plunge, and it is difficult to last for a longer period of time and form an alt season.

Weiliang

Weiliang