Lu Xun never said: "No matter what sins you committed in your previous life, you have paid them off by holding Ethereum." This round of Ethereum Holders never expected that Ethereum would be so lagging, and once ranked last among mainstream projects. However, it is too early to draw a conclusion now, and the big market does not seem to be over. If Bitcoin adoption has just begun, then Crypto and Web3 as a whole are in the early stages. In 2025, can Ethereum still be "rescued"? What "events" and "breakthroughs" are worth looking forward to?

01 Inflow of spot ETFs

At present, Ethereum spot ETFs have been approved for listing in the US stock market for some time. Compared with the Bitcoin spot ETF, there is a certain gap in the speed and volume of capital inflow. However, in addition to the fact that Ethereum does not have the same "out-of-circle" and broad consensus as Bitcoin, there is another very important reason. Compared with the staking and other benefits brought by directly holding Ethereum itself, spot ETFs that have no additional benefits and need to pay management fees and other fees have no advantages.

However, the good news coming in 2025 is that people from relevant financial institutions are actively promoting the listing of Ethereum spot ETFs that allow additional benefits from staking operations. There is still a lot of motivation to promote this matter, because financial giants are the main stakeholders in the "hot" trading demand for crypto asset spot ETFs. There is not only potential demand for staking Ethereum spot ETFs, but also a friendly regulatory environment brought about by Trump's coming to power, which makes it easier to get approval.

02 Ethereum Strategic Reserve

The current Bitcoin strategic reserve being promoted by the United States is one of the main driving forces of the Bitcoin and crypto markets. It should be noted that in addition to gold, the United States also has oil in its important strategic reserve assets. Therefore, "digital gold" Bitcoin has certain feasibility and significance as a strategic reserve. At the same time, Ethereum, once known as "digital oil", also has the hope of being listed as a strategic reserve asset.

Compared to Bitcoin, in fact, the Trump family WLFI project supported by Trump is an ecological project deployed on the Ethereum mainnet. Its main business is based on the support brought by Ethereum DeFi ecology AAVE and Chainlink. At the same time, the project treasury has begun to reserve a large number of ETH and Ethereum ecological project tokens, and recently a large number of WBTC have been exchanged for ETH. According to the analysis of the 7 multi-signature wallets in the treasury of the project, some wallet addresses are already "old guns" on the Ethereum DeFi ecological chain. Therefore, the project team has a high degree of understanding of Ethereum and its ecology, and the operation is relatively professional.

Given that the team behind Trump took the lead in launching the adoption project of the Ethereum ecology, we can think that it has a high degree of recognition for the subsequent development of Ethereum and its ecology, supports the development of high-tech industries such as Web3, and is also in line with Trump's "America First" concept. Therefore, it is very likely that Ethereum will be mentioned as a strategic reserve asset in 2025.

03 Ethereum's next major upgrade

Due to Ethereum's unsatisfactory performance, its next major upgrade named "Pectra" has not received much attention. It is reported that 10 EIP improvement protocols have been added to this upgrade plan, mainly involving user experience and support optimization for Layer2. The main highlights are as follows:

1) Optimization of account abstraction

This upgrade will optimize the wallet experience, so that ordinary wallet addresses can also have the complex functions and flexible operations of "contract wallets", such as "gas payment, social recovery, multi-signature", etc. These optimizations will further lower the user's usage threshold. When users use Web3 applications, they can have the same operating experience as Web2 applications. Lay the foundation for the large-scale adoption of Web3 applications in the future.

2) Layer2 support optimization

Provide more data space (blob) for Layer 2 solutions to enhance Ethereum's scalability. Re-evaluate and adjust the cost of calldata, and optimize block throughput and storage. Simply put, it is to expand the capacity of Layer data space and optimize the cost, so that the supported Layer2 capacity is large and the cost is lower.

3) Improve the security and flexibility of validators

Optimize the voting processing, extraction and other operations of validators to improve security and efficiency, and at the same time increase the staking limit of 32ETH, which is equivalent to merging the running verification nodes, reducing the operation and maintenance pressure and improving efficiency, while also alleviating the pressure of point-to-point messaging and data storage between a large number of node networks.

In short, Ethereum's Pectra upgrade will provide support for the Ethereum ecosystem with a more user-friendly experience, higher scalability, and more stable node network at the technical bottom layer.

04 Ecological Application Explosion and Technological Progress

At this stage, more and more major institutions such as the Trump family's DeFi project, Sony's Layer2, and Deutsche Bank's Layer2 are building Web3 applications and infrastructure solutions on Ethereum, and the Ethereum ecosystem is the first choice.

The Ethereum ecosystem is mature, rich, diverse and leading in terms of technical resource reserves, development history, development team support, on-chain capital volume, client security and wallet user experience. By the same token, in the next stage of the big market in 2025, whether it is the strong recovery of DeFi or the popularity of tracks such as AI Agent, Ethereum as the underlying infrastructure will benefit greatly from the adoption of these ecological applications and the prosperity of on-chain activities, and its benefits include but are not limited to the inflow of funds, the consumption of Gas, the deflation of Token supply, etc.

With the launch of Unichain, the OP super chain family has added a heavyweight player. The cross-chain liquidity of Layer2 is expected to make progress in 2025. By then, combined with the upgrade and optimization support of Ethereum itself, the potential energy formed by the major Layer2 groups will combine to form unprecedented competitive pressure on some high-performance new public chains.

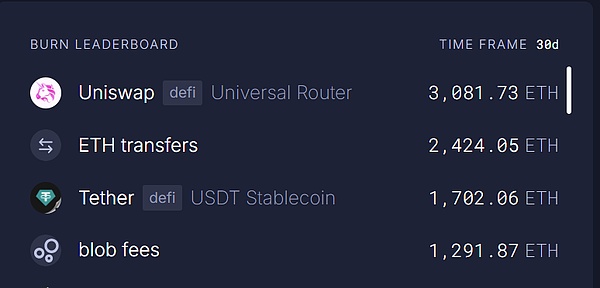

In the past, some people always said that Ethereum's Layer2 was a failure, sucking blood from the main network and not bringing any benefits to the main network, but recently we have also seen the prosperity of Layer2. Data from ultra sound money shows that Layer2's Blob fee has become one of the major gas burners on the Ethereum main network, which also shows the success of the Layer2 expansion plan.

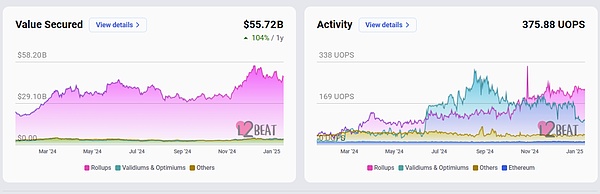

L2Beat's real-time statistical data chart also shows that the funds flowing into Layer2 exceed 55 billion US dollars. Calculated by transaction volume, the total expansion is more than 2,500% of the original main network.

For large companies and institutions outside the circle such as Sony and Deutsche Bank, Layer2 is an excellent entry point for Web3 business. It does not require a lot of technical reserves and resource investment to start, and it is natively supported by the Ethereum ecological community. Therefore, under the successful leadership of these institutions, the real institutional adoption of Layer2 will soon come.

05 Summary

In fact, many people know that the advantages of Ethereum and its ecology are quite obvious, but they did not expect that the current size of Ethereum can no longer be quickly driven by funds like in the first two rounds of market conditions. Obviously, this is not an easy task. Just like the size of Bitcoin, it has been able to rise rapidly due to the large inflow of institutional funds from spot ETFs and the strong expectations of US strategic reserve assets. However, compared with Bitcoin, Ethereum also has the additional support of technological upgrades and the development of the Web3 ecology. There are still many highlights in 2025. Let's wait and see.

Brian

Brian

Brian

Brian Joy

Joy Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Davin

Davin Brian

Brian