Author: Yohan Yun, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Jump Trading's recent transfer of hundreds of millions of dollars worth of Ethereum has sparked debate and market speculation.

This massive asset sell-off preceded Japan's historic stock market crash on August 5, when the Nikkei 225 index plunged 12.4%, falling 4,451 points - the largest point drop in history.

Jump Trading recently moved about $315 million in staked Ethereum to cryptocurrency exchanges, with a large number of transfers occurring over the weekend.

There are rumors that these transactions may be part of a liquidation process as the proprietary trading firm prepares to wind down its cryptocurrency business after its former CEO resigned amid an investigation by the U.S. Commodity Futures Trading Commission.

Jump Trading's Ethereum balance history. Source: Arkham Intelligence

Instead, some analysts believe that the company may have foreseen the market downturn and moved quickly to convert its risk assets into stablecoins.

The Japanese stock market crash came after the Bank of Japan decided to raise its benchmark interest rate for the second time since March and to its highest level in 15 years. This has led to a sharp strengthening of the yen after it hit a 38-year low against the dollar in June.

“In my opinion, the most plausible reason is that Jump Trading has been borrowing yen to finance its high-frequency trading business, perhaps to have sufficient liquidity or to acquire crypto assets, in other words, as a leveraged position,” noted Mads Eberhardt, senior crypto analyst at Steno Research.

“Now, with the yen surging against the dollar, the cost of repaying the loan denominated in dollars has increased significantly, and their underlying collateral may have also been hit, [and] Jump Trading may have received a margin call on its loan.”

Meanwhile, on-chain data shows that other companies such as Grayscale have also recently sold large amounts of Ethereum, suggesting that the sell-off of Ethereum is not unique to Jump Trading.

Japan's 21st Century 'Black Monday' and Global Recession Fears

Japan's historic stock market crash on Aug. 5, following disappointing U.S. jobs data last week, heightened fears of a global recession, analysts said. Concerns that the yen carry trade may be coming to an end, a popular investment strategy as interest rates in Japan are at historic lows, are growing.

The carry trade involves borrowing money from a country with a low interest rate and converting it into another currency to invest in assets with higher returns.

“Most funds borrow yen, convert it into dollars and then use it to buy dollar-denominated assets,” said Justin d’Anethan, head of business development for Asia Pacific at market maker Keyrock.

A stronger yen could be bad news for cryptocurrency investors as institutional funds are tied to traditional markets. Source: Google Finance

The economic instability has led some experts to believe that companies involved in the yen carry trade are now in trouble. According to Eberhardt, this could be the reason why firms like Jump Trading are liquidating assets. “This could lead them to raise as much fiat as possible to pay back their loans. To do this, they have to liquidate the most liquid bets, which could lead them to quickly liquidate hundreds of millions of dollars worth of Ethereum,” he said. “I can’t see any other explanation why a well-respected trading firm would sell so much Ethereum in such a low liquidity environment, when it should be clear that weekend liquidity is extremely poor for cryptocurrencies.” Is the Jump Trading sell-off part of a trend? A check of its token balance history on Arkham Intelligence shows that the firm has been selling its Ethereum holdings since July 20, not on weekends.

The company first moved more than 120,000 Wrapped Staked Ether (wstETH) from its Wormhole Counter-Exploit Funds address. The staked Ethereum in the wallet was reportedly recovered from the Wormhole bridge hack in February 2022, when $325 million was lost.

Activity at the address suggests that most of these funds have been withdrawn from Ethereum staking protocol Lido. According to data from Arkham Intelligence, one related address still holds about 37,600 wstETH.

Jump Trading is not the only company to see this trend. Other major investment firms, such as Grayscale and Paradigm, have also been liquidating their Ethereum positions.

“This disappearance of ETH is primarily caused by capitulation by large funds,” commented DeFi Mochi X on X. Grayscale’s Ether balance. Source: Arkham Intelligence Grayscale has sold nearly 600,000 ETH since July 24, when the Ethereum exchange-traded fund (ETF) launched, according to Arkham Intelligence. Against this backdrop, some see Jump Trading’s move as part of a broader strategy to reduce risk from Japan’s market crash on Monday.

Mikko Ohtamaa, co-founder of algorithmic trading firm Trading Strategy, told Cointelegraph: “They could just be savvy sellers.”

Ohtamaa noted that signs of instability in the Japanese market have been building for weeks, giving macro traders plenty of time to prepare.

Jump Crypto Could Be Shutting Down

Jump Trading’s recent Ethereum sales could be a sign of the firm’s exit from the cryptocurrency market, following reports last month that the U.S. Commodity Futures Trading Commission (CFTC) had launched an investigation into the firm.

Ohtamaa said the theory is that “they want to exit the cryptocurrency business, which is tiny compared to their main business in the stock market.”

“For them, it’s not worth the regulatory risk,” he continued.

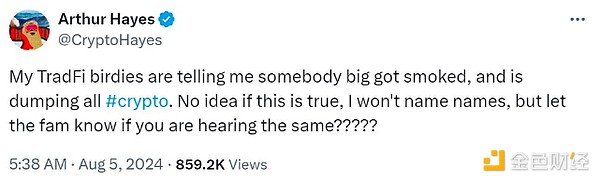

Source: Arthur Hayes

Even before the investigation, Jump Trading had faced a number of challenges in the cryptocurrency space.

In February 2022, the company's Solana bridge Wormhole project was hacked and lost $325 million, which put the company in a difficult market situation.

In addition, the company has been linked to the Terra crash, where it was allegedly involved in key trading activities that led to the crash, and the subsequent FTX crash, where the company had a large exposure to the FTX exchange.

The controversies have fueled speculation that Jump Trading is strategically exiting the volatile and increasingly regulated cryptocurrency market.

Conclusion

There are two main theories about Jump Trading’s recent selling of Ethereum. Some analysts believe it is more likely a response to margin calls triggered by economic conditions in Japan, while others claim it is the beginning of the end for the company’s crypto division.

But analysts believe it is not necessarily one or the other.

“But given Jump’s expertise in the traditional space, they are very aware of FX moves and it makes sense that they may have to preemptively protect or correct carry trades against the yen, or simply anticipate a market pullback,” said Keyrock’s d’Anethan.

“This could work out well, especially if they are looking to reduce crypto activity – killing two birds with one stone,” he added.

Eberhardt pointed to this week’s flow data for U.S. bitcoin and ethereum spot ETFs, which will reveal how traditional investors are responding to the plunging markets.

“If there are strong inflows into ETFs this week, it could lead to a general sense of calm among crypto market participants, while the opposite would be true if there were outflows from ETFs.”

The macroeconomic environment in the U.S. is also being closely watched amid concerns about an impending recession.

Bernice

Bernice

Bernice

Bernice JinseFinance

JinseFinance Davin

Davin TheBlock

TheBlock Coinlive

Coinlive  Bitcoinist

Bitcoinist Coindesk

Coindesk Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph