Written by: shaofaye123, Foresight News

Since Moonrock Capital CEO Simon complained about the sky-high listing fees, the controversy over listing fees has intensified. Major KOLs have launched an inspiring discussion - Is the sky-high listing fee really true? What are the invisible listing fees? How do exchanges make a profit? There are so many unknown transactions in the hidden corners of the industry. Let's take a look at them one by one.

Sky-high listing fee controversy

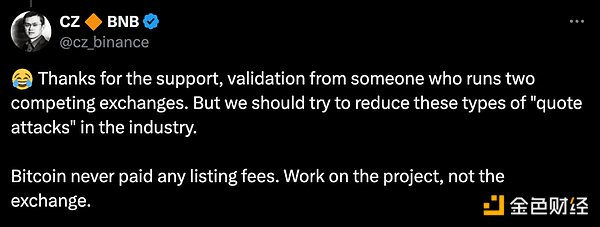

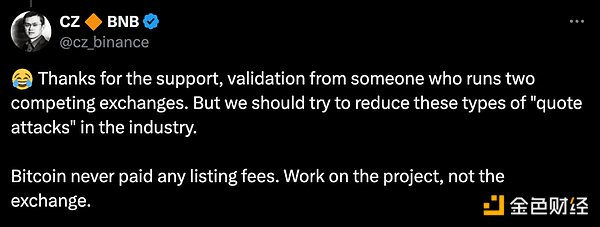

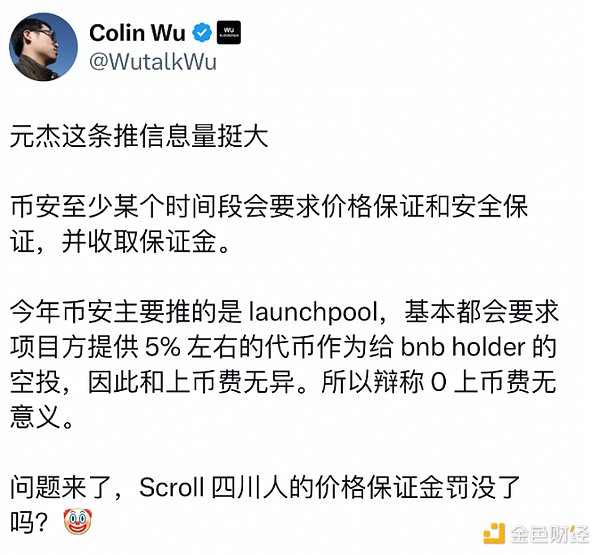

Since its outbreak, the sky-high listing fee incident has attracted great attention. Many well-known people in the industry have given relevant responses. In addition to Sonic Labs co-founder Andre Cronje's quick slap in the face of Coinbase, TRON founder Justin Sun also expressed his support, "Binance did not charge us for listing. Coinbase once asked us to pay 500 million TRX (about 80 million US dollars) and deposit 250 million US dollars of BTC in Coinbase Custody to improve its performance." Conflux COO Zhang Yuanjie then also came out to support, "Binance charged CFX zero listing fee. Due to poor performance of the token, 150kbusd deposits were confiscated. Because the Conflux network had no security vulnerabilities, the deposit of 5 million CFX tokens was eventually refunded. When will CFX Coinbase be listed for free? I can defend you." Binance also responded quickly, in addition to He Yi's tweet. Zhao Changpeng, who was released from prison not long ago, also issued a statement saying, "Bitcoin has never paid any listing fees. Focus on projects, not exchanges."

Event Review Recommended Reading: Rumors are spreading, which of Binance's sky-high listing fees is true or false?

What are the invisible listing fees?

In September this year, He Yi responded to the market's concerns about listing. Binance has a basic framework and strict procedures for listing. The listing process consists of four links: business, research group, committee, and compliance review. There will be no suspicion of information leakage or insider trading.

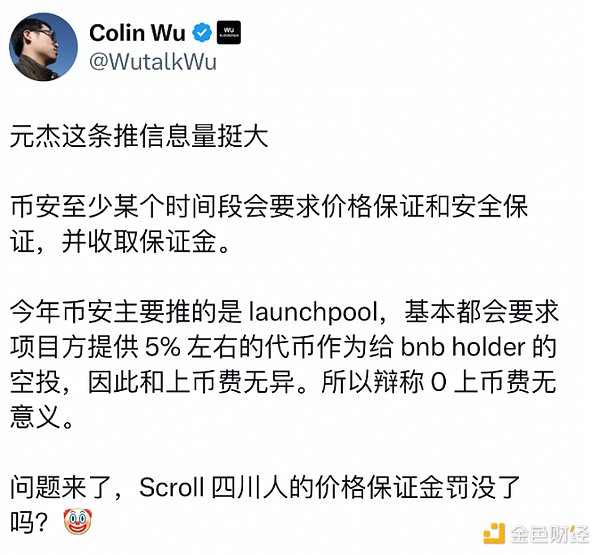

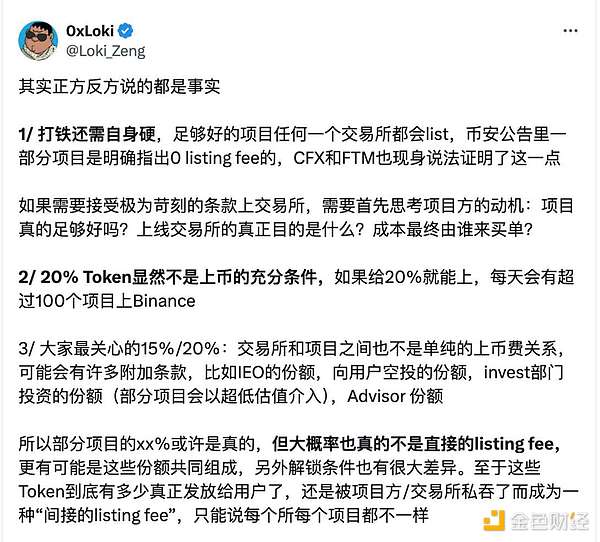

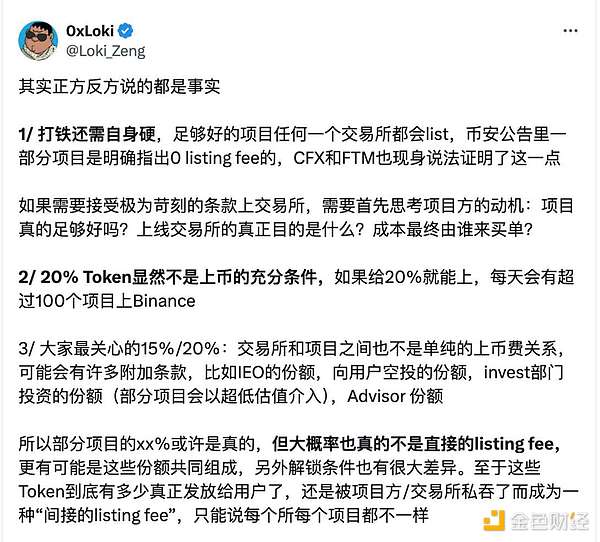

Combined with the relevant information that has been disclosed, there is no direct "bribe" for token shares or stablecoins in the fees required for Binance listing. However, the project party needs to give Binance Launchpool a certain distribution share (about 5%) and reserve airdrop rewards for specific users. In addition to these known fees, judging from the listing of CFX, the project party also needs to pay a large deposit to ensure the stability of the currency price, otherwise it will be fined. In addition, Binance's investment share, activity funds, etc. also require the project party to reach an agreement with Binance.

Regarding the above-mentioned "invisible listing fees". Some people think that margin, airdrops, etc. are just another way of saying the sky-high listing fees, just like the tip of the iceberg hidden under the water, which belongs to the listing fees. Some people think that it is understandable, and these cannot be confused with invisible listing fees, because airdrop shares, etc. are rewards given to users.

The hidden worries of centralized exchanges

The secret corners of the industry are not uncommon. With the extremely considerable income of exchanges, it is difficult to guarantee whether there are opaque transactions.

At present, in addition to transaction fees and capital utilization income, small assets left in users' accounts that cannot be traded, book transaction arbitrage, etc. may also become part of the exchange's income. Compared with the above, many non-compliant exchanges will also gain profits through bad behaviors such as plug-ins, data dumping, and news dumping.

Under the traditional centralized exchange model, similar to the GME incident, it is difficult to avoid the trading platform Robinhood restricting buying and selling to manipulate stock prices. The exchange of interests between project parties, market makers, etc. and exchanges is also not transparent to retail investors. Users do not seem to be in a fair position under the centralized exchange model.

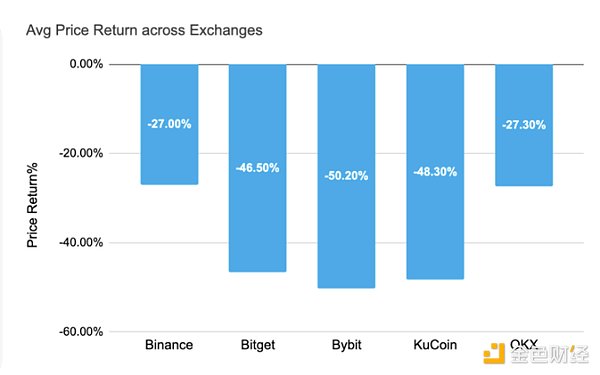

The return rate of listing is negative

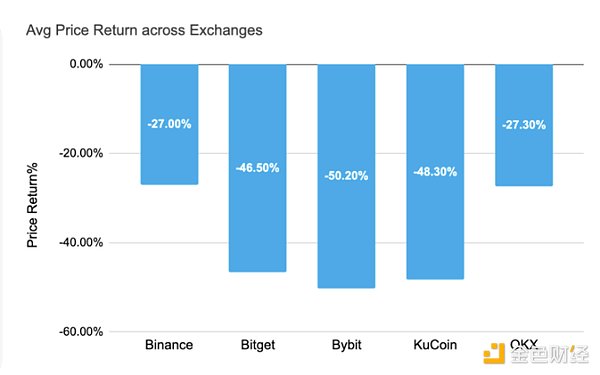

Listing is for profit, whether it is retail investors, exchanges or project parties, they all hope to make a profit. But judging from the current return rate of listing, the discussion of invisible listing fees does not seem to be the focus. The return of currency prices and project development may be more worthy of attention in the industry.

Since the beginning of the year, the average return rate of most exchanges has been negative, and Bybit's average return rate has dropped the most, reaching -50.20%. KuCoin's average return rate reached -48.30%, and Bitget's average return rate reached -46.50%. Binance and OKX's average return rates were also negative, reaching -27.00% and -27.30%. If the hidden corners are not swept, the development of the industry may be restricted.

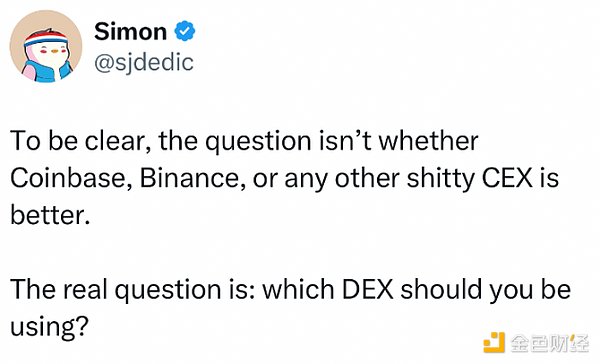

Faced with the dilemma of centralized exchanges, Simon, who broke the news of the sky-high listing fees, gave his opinion. “To be clear, the question is not whether Coinbase, Binance, or any other crappy CEX is better. The real question is: which DEX should you use.”

Weatherly

Weatherly