Author: Marcin Kazmierczak, Sarah Morton, CoinDesk; Translated by Wuzhu, Golden Finance

Marcin Kaźmierczak of Redstone Oracles explains how Bitcoin Layer 2 can enhance the performance of the protocol by deploying enhanced features on a separate blockchain while maintaining its integrity.

Last week, many advisors attended the Consensus 2024 conference in Austin, Texas. I highlighted the key themes that emerged from the event in my "Expert Q&A". I look forward to the conference in Toronto, Canada next year.

Bitcoin Layer 2

Bitcoin has revolutionized the financial world with its decentralized, secure, and transparent features. Although it was the first cryptocurrency, Ethereum (ETH) pioneered the development of the entire decentralized finance, or DeFi ecosystem. Now, Bitcoin is following suit and ushering in an era of development for its own ecosystem. As Bitcoin has become more popular, challenges related to its scalability and transaction speed have also increased. To address these issues, the Bitcoin community has developed various Layer 2 blockchains that can improve the efficiency and functionality of the network without changing Bitcoin itself.

This article dives into the concept of Bitcoin Layer 2, exploring their classification, advantages, and expected advancements. By understanding these innovative protocols, users can understand how Bitcoin can continue to evolve and maintain its relevance in an increasingly competitive digital environment. At the end of the day, Bitcoin is digital gold, and an entire economy has been created around it, similar to gold in the physical world.

Q: What are Bitcoin Layer 2s and how are they classified?

A: They are built on top of the Bitcoin blockchain. They address performance issues and limitations of the Bitcoin blockchain and add programmable features. There are three types of Bitcoin Layer 2:

1. State Channels

Function: Create external channels for transactions, which are recorded off-chain and updated as a single transaction on the main network at the end. You can compare it to a dedicated mailing route between houses to optimize the cost of sending letters between houses.

Example: Bitcoin Lightning Network.

2. Sidechains

Function:A semi-autonomous network that maintains communication with the main network and can define its own architecture. Imagine an optimized city mail system that periodically syncs with a central office.

Examples:Stacks Network, Rootstock Infrastructure Framework (RIF).

3. Rollups

Function:Serves as an execution layer that batches transactions and submits them to the main network's consensus layer for final settlement. Imagine a full-state mail system that updates a central authority on its delivery status every 10 minutes. In the Ethereum ecosystem, examples include Arbitrum, Optimism, zkSync, and Starknet.

Types:Optimistic Rollups and ZK Rollups.

Examples:Merlin Network, Build On Bitcoiin, B^2, Bitlayer.

Q: What problems does Bitcoin L2 solve and why are they important?

A: Bitcoin Layer 2 solves key problems to increase the efficiency and functionality of the network. First, they improve scalability by reducing congestion. As a result, transactions are cheaper and executed faster, making Bitcoin more suitable for everyday use. L2 also increases the utility of Bitcoin holdings and introduces complex smart contract capabilities, thereby supporting DeFi, NFTs and other Web3 applications. This enhanced programmability helps Bitcoin maintain market relevance. They expand Bitcoin's use cases and ensure smoother and more affordable transactions. Ultimately, Bitcoin L2s are important to users because they provide BTC holders with new features, such as using lending platforms, yield solutions or decentralized exchanges (DEX). For participants who hold a significant part of their Bitcoin portfolio, they are an alternative to Ethereum-based solutions.

Q: Comparison of existing Bitcoin L2s and what to expect in the field this year.

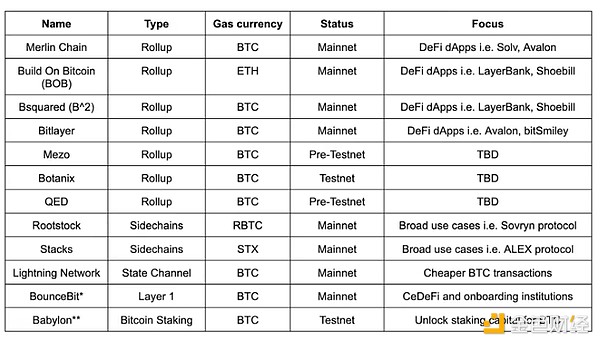

A: Comparing Bitcoin Layer 2s requires evaluating their technical classification. It should be determined whether it is a state channel, a Rollup, or a sidechain. In addition, indicators such as transaction fees, security guarantees, and decentralized applications (dApps) available on the network are also crucial. The following table represents the main Bitcoin Layer 2 as of June 2024.

* BounceBit is not a Layer 2, but a Layer 1 Proof of Stake chain with BTC as the main currency.

** Babylon is a BTC staking platform that implements a novel method to allow BTC staking.

Looking to the future, we can undoubtedly expect further expansion of Bitcoin Layer 2. Due to the scarcity of Bitcoin and the fact that there will only be about 21 million Bitcoins, it fundamentally makes sense to expand the programmability and functionality of digital gold. Upcoming developments will include reducing transaction costs for the aforementioned Layer 2, adding more compatibility layers, and implementing well-known primitives on top of Ethereum, such as automating dApps or supporting popular wallets.

There is no floor or ceiling to the value of Bitcoin, with the cumulative market cap currently approaching $1.4 trillion. In its current form, the Bitcoin blockchain plays the role of a foundational layer on top of which innovation can flourish. And today, this is achieved through Layer 2. Looking at the success of Arbitrum, Optimism, Base, and zkSync, we can say that we will have at least a few thriving ecosystems in this category. It is therefore crucial to track its development and accept the use of BTC as one of the fastest growing narratives in 2024.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Sanya

Sanya JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance