Author: Tim Craig, dlnews Translation: Shan Ouba, Golden Finance

If Ethereum's validator exit queue becomes congested, Lido may not be able to redeem stETH for Ether during this period.

stETH holders must then rely on existing liquidity to sell their tokens.

The lack of liquidity in Lido’s stETH token could cause it to decouple during periods of extreme market volatility.

Earlier this year, collapsed cryptocurrency lending platform Celsius announced it would withdraw $1.6 billion worth of Ethereum it had previously staked on the chain.

This move instantly blocked Ethereum’s pledge withdrawal queue, causing other Ethereum pledgers to be unable to perform withdrawals.

For most stakers, waiting a few days to withdraw their Ethereum is nothing more than a minor inconvenience.

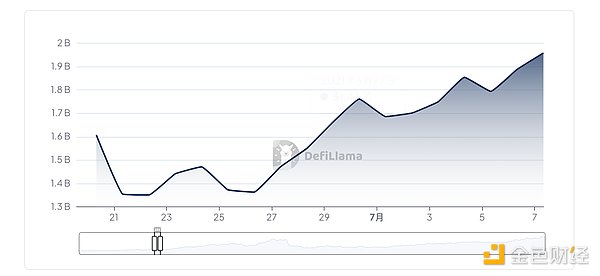

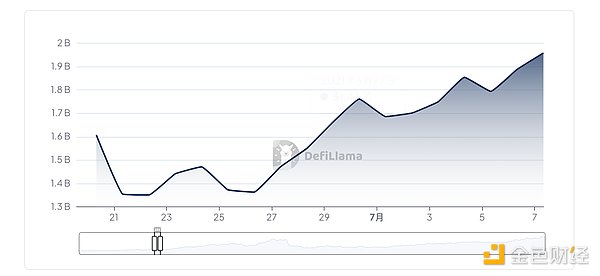

But according to some analysts, this delay could become a major issue for Lido and stETH, the largest Ethereum liquid-staking token with more than $23 billion in circulation.

Riyad Carey, an analyst at cryptocurrency research firm Kaiko, told DL News: "The decline in stETH liquidity is a serious problem."

The concern is that at liquidity levels With low and exit queue congestion, stETH, which is a receipt for collateralized Ethereum deposits, could become decoupled from Ethereum again, leading to mass liquidations for those who leveraged the token on lending protocols.

p>

Although there is no decoupling this time, many are worried that if the cryptocurrency market suddenly drops again, the Ethereum staking queue may collapse as investors rush to unstake and cash out. Extended soon.

Lido believes that stETH has sufficient liquidity and that there are mechanisms in place to prevent another decoupling.

But as stETH becomes increasingly intertwined with the broader DeFi ecosystem, the threat posed by a potential liquidity crisis will only become more apparent.

Insufficient liquidity

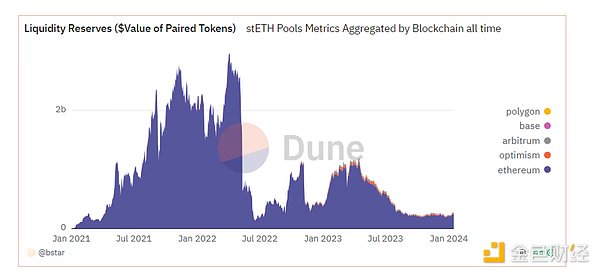

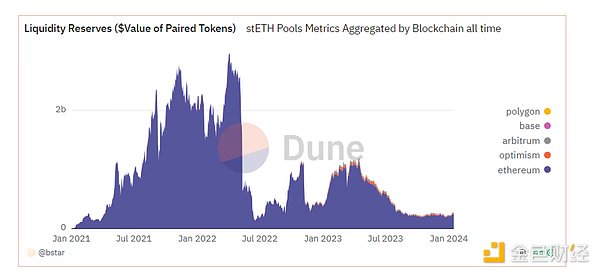

According to data from Lido’s stETH liquidity Dune dashboard, currently The decentralized exchange’s liquidity value is approximately $274 million.

Marin Tvrdić, head of protocol relations at Lido, said in a recent X post that stETH liquidity on centralized cryptocurrency exchanges is in the seven to eight-digit range .

Carey believes that stETH currently has insufficient liquidity.

He said that with the Ethereum validator exit queue becoming congested, there will not be enough liquidity to support DeFi lending if there is a sudden need to close positions. Over $3 billion worth of stETH leveraged bets on protocol Aave.

Lido cannot immediately convert stETH to Ether due to the validator queue being clogged. This means it falls to trading pools that facilitate swaps between stETH and ETH to fill the void.

If stETH begins to diverge from its peg amid demand imbalances, it could trigger a cascade of liquidations on Aave. “If any large stETH holders get impatient and sell, things could get ugly,” Carey said.

Carey isn't the only one worried.

Ariah Klages-Mundt, co-founder of stablecoin protocol Gyrscope, said that stETH decoupling is "very likely" in the future.

"Don't be too surprised if it happens at some point. You have to plan for something like this to happen at some point in finance," Klages -Mundt said in a recent X post. Multiple other Ethereum thought leaders have shared similar sentiments, although not all have explicitly pointed to Lido’s stETH.

p>

Leveraging stETH on lending markets such as Aave is a popular DeFi strategy to increase returns. Investors deposit stETH into Aave and borrow ether, then deposit it into Lido, thereby earning more stETH.

Repeating this cycle will increase stETH's pledge yield income, but if the investor's stETH collateral declines in value relative to the borrowed ether, the investor will also Will face the risk of being liquidated.

Good track record

Still, not everyone thinks Lido is the current Liquidity levels are concerning.

Adcv, an anonymous contributor to Lido DAO, told DL News "based on observable on-chain evidence," said stETH Illiquidity is "inaccurate".

Adcv said: “StETH has institutional-grade liquidity on and off the chain in major trading venues on mainnet, layer 2 AMMs and major CEXs. ”

To back up his claims, Adcv pointed to Lido’s strong track record of fulfilling stETH redemptions.

He said that of the 3 million ether withdrawn by Lido since last year's Shapella upgrade activated withdrawals, less than 30,000 required more than 120 hours to process.

Aave, on the other hand, follows the judgment of DAO service providers such as Chaos Labs and Gauntlet to assess the risks of letting its users exploit stETH.

In November, Chaos Labs proposed that Aave could increase the supply cap for stETH deposits by an additional 1.1 million tokens "without introducing significant risk to the protocol."

But this suggestion is also supported by Gauntlet, but there is a caveat: Chaos Lab's risk calculation assumes no significant price difference between Ether and stETH .

Precautions

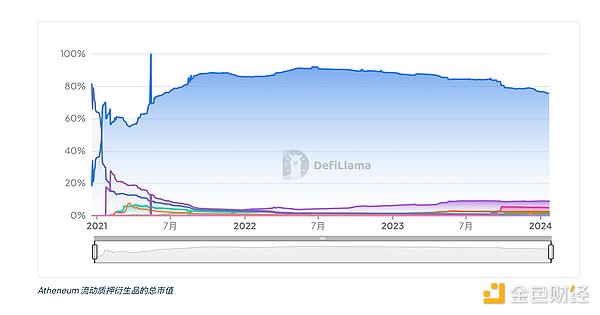

Carey said Lido's liquidity problems began when it stopped sending money to Curve Liquidity providers of the stETH-ETH pool on Finance offer LDO token incentives.

Lido stopped incentivizing liquidity because Ethereum’s April Shapella upgrade allowed stakers to start withdrawing ether from the blockchain’s staking contracts.

This means that if a supply imbalance occurs, Lido can exchange stETH for ether instead of having to rely solely on stETH liquidity on exchanges.

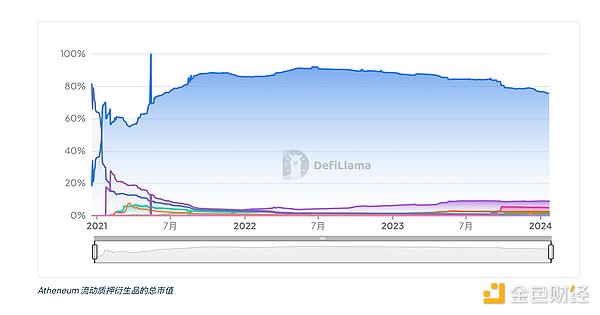

Lido’s own data shows that stETH liquidity on Curve Finance has dropped from approximately $800 million to $274 million since the Shapella upgrade.

p>

Since Ethereum’s Shapella upgrade in April, on-chain stETH liquidity has dropped significantly.

Carey said Lido can take more measures to support liquidity.

"I wrote back in July that I thought Lido should consider partnering with market makers to help increase off-chain liquidity," he said. "While off-chain liquidity has improved since then, I do think this is still worth exploring."

Lido appears to be looking to further secure stETH liquidity Methods.

In August, cryptocurrency analytics platform Glass Markets posted a proposal on the Lido Research Forum, requesting funding to assess stETH liquidity and write a study report outlining the best ways to address its recommendations.

A December post from members of the Lido DAO Operations Workflow confirmed that Glass Markets had received funding to complete the research report.

JinseFinance

JinseFinance