Author: arndxt; Compiler: Block unicorn

I believe we will witness the yield war again. If you have been in the decentralized finance (DeFi) field long enough, you will know that the total locked value (TVL) is just a vanity metric until it is no longer.

In a highly competitive, modular world of automated market makers (AMMs), perpetual contracts, and lending protocols, what really matters is who controls the liquidity routing. Not who owns the protocol, or even who issues the most rewards.

It's who can convince liquidity providers (LPs) to deposit and ensure that TVL is sticky.

This is where the bribe economy starts.

What used to be informal ticket buying (Curve wars, Convex, etc.) has now professionalized into full-fledged liquidity coordination markets, complete with order books, dashboards, incentivized routing layers, and in some cases, even gamified participation mechanisms.

This is becoming one of the most strategically important layers of the entire DeFi stack.

Changes: From issuance to meta-incentives

In 2021-2022, the protocol guided liquidity through traditional means:

Deployment of funding pools

Issuance of tokens

Hope that profit-seeking LPs will still

after the yield declines

text="">Stay

But this model is fundamentally flawed, it is passive. Every new protocol is competing with an invisible cost:the opportunity cost of existing capital flows.

I. The Origins of the Yield Wars: Curve and the Rise of Voting Markets

The concept of yield wars began to become concrete with the Curve Wars in 2021.

The unique design of Curve Finance

Curve introduced the voting lock (ve) token economics, where users can lock $CRV (Curve's native token) for up to 4 years in exchange for veCRV, thereby obtaining:

This creates a meta-game around issuance:

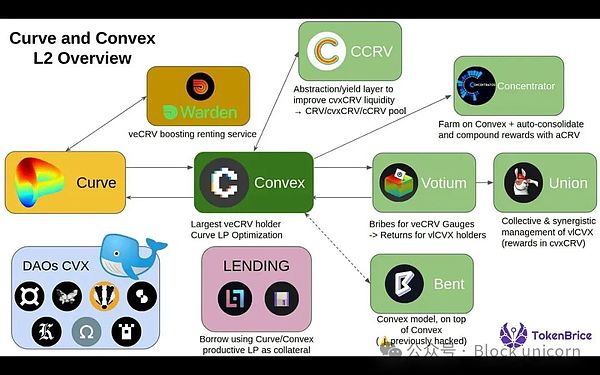

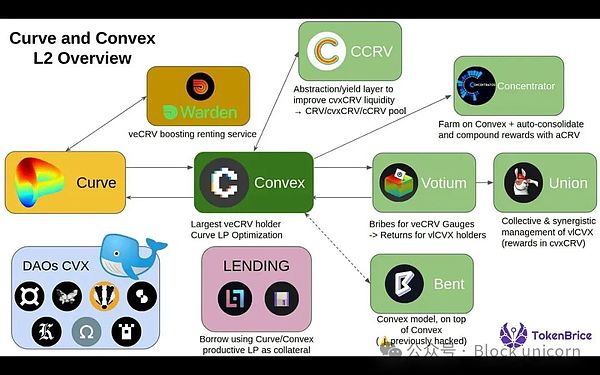

Then came Convex Finance

Convex abstracted the lock-up of veCRV

and gained aggregate voting power from users.

It became the "Kingmaker of Curve" and had a huge influence on the flow of $CRV issuance.

Projects began to bribe Convex/veCRV holders through platforms such as Votium.

Lesson 1: Whoever controls the weight controls the liquidity.

II. Meta-incentives and the Bribery Market

The First Bribery Economy

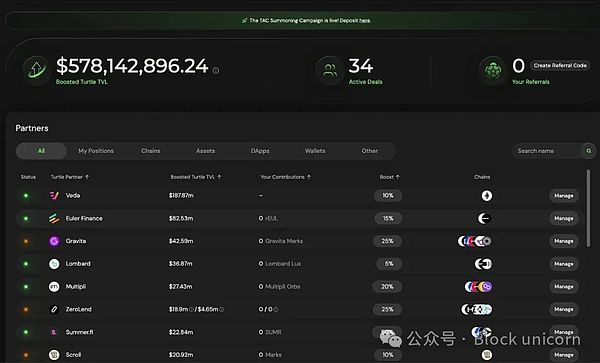

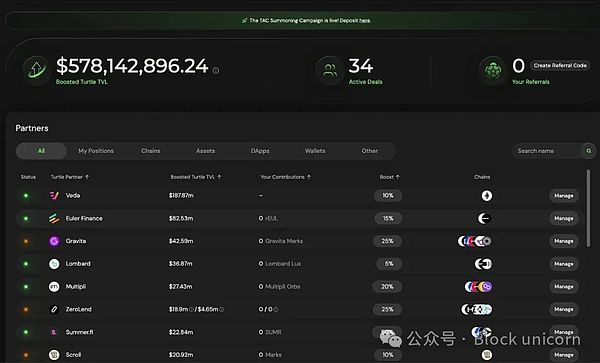

Initially it was just manual influence on issuance, and later developed into a mature marketone. Their pools are often embedded in partnerships, with a total locked value (TVL) of over $580M, using dual token issuance, weighted bribes, and a surprisingly sticky liquidity provider (LP) base.

Their model emphasizes fair value redistribution, meaning issuance is guided by voting and real-time capital velocity indicators.

This is a smarter flywheel: LPs are rewarded for the effectiveness of their capital rather than just size. This time, efficiency is finally incentivized.

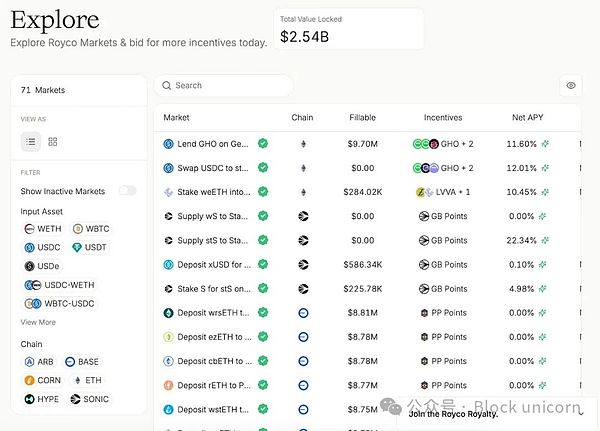

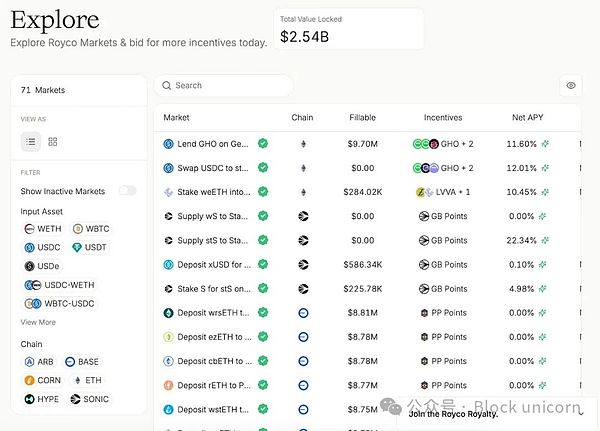

Royco

In one month, its TVL surged to $2.6 billion, up 267,000% month-over-month.

While some of this is "points-driven" capital, what's important is the infrastructure behind it:

Royco is an order book for liquidity preference.

Protocols cannot just offer rewards and hope. They issue requests, and then LPs decide to invest funds, and eventually coordinate to become a market.

This narrative is about more than just the yield game:

Mechanisms for liquidity coordination markets

1. Bribes as market signals

2. Request for Liquidity (RfL) as an Order Book

Projects like Royco allow protocols to list liquidity needs like orders on the market, and LPs fill them based on expected returns.

This becomes a two-way coordination game rather than a one-way bribe.

In the end, if you decide where liquidity flows, you influence who survives the next market cycle.

Alex

Alex