FTX plans to sell Digital Custody for $500,000 to file for bankruptcy protection

FTX’s legal team clarified that since FTX US has not yet restarted, Digital Custody has little value to the asset and will therefore be sold.

JinseFinance

JinseFinance

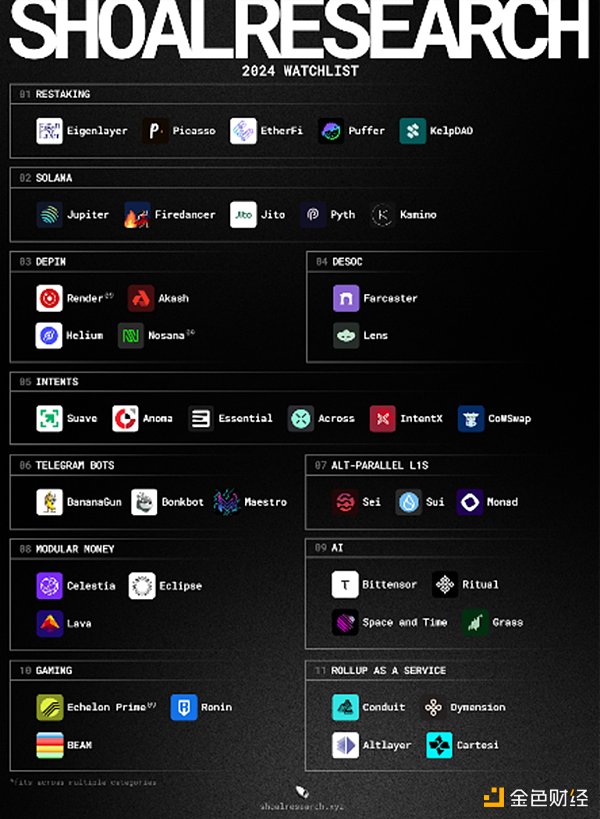

Author: Paul Timofeev & Gabe Tramble, Shoal Research researcher; Translation: Golden Finance xiaozou

Cryptocurrency is the attention economy. Therefore, we believe it is important to focus not only on the fundamentals but also on the trends and narratives that capture attention and generate value.

The Shapella upgrade allows ETH stakers to withdraw money. We have witnessed the rise of the liquidity staking ecosystem, which currently With a value of $48 billion, it is the largest active sector in the cryptocurrency world. Liquidity Staking Tokens offer stakers the opportunity to earn additional income on their native assets, such as ETH, by minting a derivative asset called Liquidity Staking Tokens (LST), which can be deployed across DeFi in the app to earn extra money.

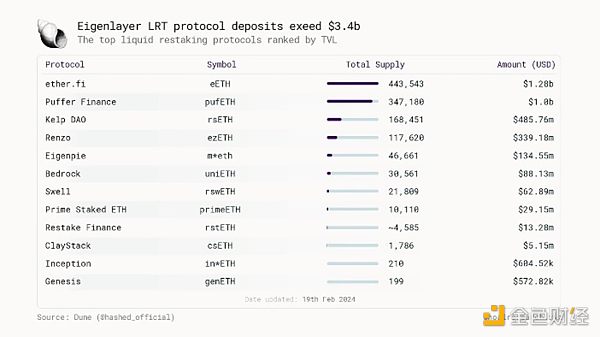

Restaking refers to the process of re-staking the pledged assets. The core idea is to develop the merged security of Ethereum (ETH staking) into a way to guide the security of the new network. It is important to distinguish between native re-staking and liquidity re-staking - native re-staking means staking ETH and generating an "EigenPod" that sets the withdrawal certificate for the EigenLayer smart contract. This allows the EigenLayer system to identify your re-pledge amount, and then you can choose new services to write into the service contract. Liquidity re-staking enables LST holders to “pledge their stake” and accordingly receive a derivative token representing their re-staking position, known as LRT.

In general, re-pledge brings a new layer of income to asset holders. In theory, it brings more security to the underlying network, and of course it may be greater. The risk depends on the specific network. Excitement is growing about this new development, with over $8.9 billion currently deposited on Eigenlayer and over $4.6 billion in liquidity re-hypothecated.

There are some important risks to consider; many liquidity re-pledge platforms do not yet support withdrawals, so be careful when depositing into one-way contracts. Additionally, it is important to ensure that the market for restaking strategies does not converge and lead to new centralization risks at the staking operator level.

We conservatively predict that the re-pledge agreement will perform well in 2024.

EigenLayer——As a pioneer in the field of re-pledge , EigenLayer is the key layer to implement the re-pledge strategy. The protocol has surpassed Uniswap in accumulated deposits (TVL) and is likely to easily overtake Aave and Maker (ranked third and second respectively) by the end of this year or within the next few months. There will be an airdrop coming soon, so it will be interesting to see how user retention and outflow normalize after the token launch. While TVL and user numbers are expected to decline, the key question is to what extent and for how long it will last, as this will provide valuable insights into the formation of long-term beliefs about EigenLayer and the potential of the restaking ecosystem.

Etehrfi - Etherfi supports users to deposit ETH and perform native re-pledge through EigenLayer. The protocol has the highest deposit value ($1.1 billion) of all liquidity re-hypothecation protocols and is one of the few re-hypothecation protocols that supports user withdrawals. Stakeholders retain custody of their ETH while delegating their pledges, and Etherfi generates an NFT for each validator launched through the protocol.

Picasso Network (PICA) —While restaking is native to Ethereum, it is still an underexplored early area and a multi-chain future seems inevitable. As restaking on Ethereum becomes more crowded, the team will begin exploring other ecosystems and blockchains. This is already happening on Solana, which has a liquid staking market worth $1.9 billion and is now mature. Picasso is a new DeFi interoperability layer developed by the Composable Finance team that is native to the Polkadot and Kusama networks and supports cross-ecosystem communication through the Composable IBC module. Solana <> IBC Connect is the first AVS for Picasso’s restaking layer, allowing users to stake SOL or any supported Solana LST. This opens up a new realm of cross-chain applications and use cases between Solana and IBC chains, and other ecosystems will be able to take advantage of Solana’s high speed, low fees, growing user base, and liquidity.

After FTX collapsed, Solana will In the fourth quarter, around the time of the JTO airdrop and the annual Breakpoint conference, all indicators went parabolic. We think this is just the beginning. As excitement grows about the upcoming airdrop (stimulating ecosystem activity, critical infrastructure, and network development) and mainstream media recognition of Solana becomes louder, Solana is well-positioned to thrive in the coming year and beyond. Prepare to perform strong. Simple long-term arguments relying on Moore's Law, along with user-oriented performance specifications such as high throughput and low cost, have put Solana on the path to the consumer chain of the future.

Solana recently experienced a temporary network outage (February 6) after operating normally for more than a year. The root cause of the network outage was that a bug fixed on the testnet was not deployed to the mainnet for testing. While it's clear that network outages can harm Solana's public perception, the fact is that the network eventually returns to normal within an hour and will only become more resilient in these situations, especially as the ecosystem grows Validator clients are increasingly diverse.

JupiterExchange(JUP)

Firedancer - a high-performance validator client developed by Jump Crypto that promises significant improvements in performance and throughput , and more importantly, can enhance the diversity of Solana validator clients.

Kamino Finance - Simply put, Kamino aims to be the liquidity engine for Solana DeFi. Users can perform leveraged borrowing/lending, make money as an LP (liquidity provider) through the CLMM automated vault, and even go long/short on tokens for leveraged trading. A one-stop shop like Jupiter may become a competitor over time. In addition, points are real-time and are expected to be airdropped in the second quarter.

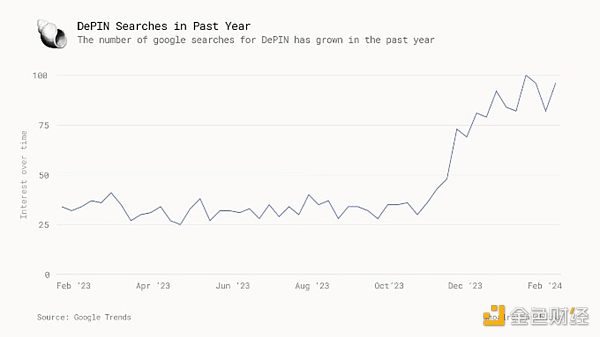

As our world becomes increasingly digital , the amount of data generated continues to grow exponentially, and computing power has become a growing resource demand in this era. With the rise of LLM and consumer/business-focused artificial intelligence, computing power will only accelerate further.

As computing power becomes an increasingly scarce resource, optimizing its distribution and availability becomes more important. The Decentralized Physical Infrastructure Network (DePIN) opens up a more efficient computing market through disintermediation of distribution and value accumulation. DePIN offers an exciting, tangible use case for cryptocurrencies; it treats crypto and blockchain technology as key components of a greater whole, rather than as a separate new technology with a new cheesy buzzword.

DePIN’s growth will continue beyond 2024, with the industry’s popularity surging significantly in recent years. It's important to be able to distinguish between hype and fundamentals, but the combination of the two is exciting.

Render (RNDR) - an OG since 2017 The GPU marketplace connects 3D artists with the resources they need for graphics rendering of virtual scenes for games or movies. The platform recently migrated to Solana, joining some of the leading DePIN platforms such as Helium and Hivemapper.

Akash (AKASH) - GPU as a Service (GPUaaS) expected to reach $25 billion by 2030 scale, which means supply and distribution methods will undoubtedly come under pressure. Akash is a decentralized peer-to-peer GPU rental marketplace launched as a Cosmos chain in September 2020 – think of Akash as the airbnb of GPU computing. Akash uses a hybrid architecture to handle on-chain coordination and settlement, as well as off-chain execution. There's a more critical value proposition here - Akash's speeds on the Nvidia A100 are extremely competitive compared to leading vendors like AWS, Azure, etc.

Helium (HNT) - Helium is a decentralized network for the Internet of Things such as sensors and trackers. The device provides low-power remote communication services. Helium allows individuals to host hotspots (mini towers used to extend network bandwidth) and earn rewards in Helium Tokens (HNT).

Hivemapper (HONEY) Decentralized Google Maps - users buy a webcam and use it to record Driving environment around you, contribute to building Hivemapper’s decentralized map system, and earn HONEY tokens.

Teleport - Teleport is a new decentralized ride-sharing protocol. You remember the huge returns Uber gave its early investors. It can be imagined that the current situation is bringing "Uber" to the blockchain.

With consumer-centric initiatives such as ChatGPT Artificial intelligence has recently experienced its pop culture moment with the rise of AGI applications. These applications have entered many aspects of people's daily lives, and they are expected to eventually change the world for better or worse. OpenAI just launched a new text-generating video AI model, which is a further reminder that there are many capabilities in this new technology of artificial intelligence that we have not yet seen.

As Galaxy Research’s Lucas Tcheyan said: “Innovation in both industries, crypto and artificial intelligence, is opening up new use cases that may accelerate the adoption of both in the coming years.” Blockchain It has brought breakthroughs in settlement, data storage, and system design (back-end), while artificial intelligence is a revolution in computing, analysis, and content delivery (front-end). VanEck AI estimates that revenue from the convergence of crypto and AI will reach $10.2 billion by 2030. However, it is worth noting that directly integrating AI models onto the blockchain is not practical given today’s limited computing power. Things may change 10 years from now, but this is a big bet on blockchain’s scalability.

Benefits of encryption technology for artificial intelligence

Encryption technology Provides a permissionless, trustless, composable settlement layer for AI.

Use cases include decentralized computing markets (which already exist), building agents that can execute a variety of complex financial strategies, and developing identity authentication and privacy solutions to combat artificial intelligence. Negative externalities of intelligence (such as sybil attacks).

Benefits of Artificial Intelligence to the Crypto Industry

Enhanced user experience (UX) for users and developers through large language models, namely specially trained versions of ChatGPT and Copilot.

Has the potential to significantly improve smart contract functionality and automation.

There is a lot of potential to be tapped at the intersection of crypto and artificial intelligence, but as anyone familiar with the history of the dot-com bubble will say, be cautious about new and unproven technologies. trends in innovative technologies and their attendant reversals.

Projects we follow

Bittensor< /strong>(TAO): A decentralized blockchain open source network that supports a machine intelligence peer-to-peer market. Simply put, Bittensor allows participants to submit AI models, which are then purchased by those in need, such as app developers and other researchers. When participants contribute their AI models and training to the Bittensor Network, they are compensated with TAO tokens - given the cost inefficiency of machine learning R&D today, it is conceivable that Google or IBM may use the Bittensor Network in the future. Bittensor has 95,000 accounts, processed 292,000 transfers, and generated 2.3 million blocks. TAO has a market value of approximately US$4 billion, 89% of the supply is pledged, and the maximum supply is 21 million, similar to Bitcoin.

Get Grass - The Get Grass protocol aims to democratize the availability of training data for AI models and establish an "artificial intelligence data layer." Users can download their Chrome extension to start earning points, and the idea is to compensate everyday internet users for collecting and selling data that represents their digital footprint. The team has built a database specifically for training LLMs (which currently is often costly for developers), with the vision that one day even ordinary people will be able to use AI models to develop new applications, and It’s not just the greedy corporate overlords. Additionally, the idea of compensating people for their online data seems inevitable, which is one use case where cryptocurrencies can become a truly perfect digitally native currency. There is no data yet, but it is expected to be available soon.

Nosana (NOS) - Nosana is building a decentralized GPU marketplace for AI applications, bringing users GPU network connectivity to AI developers, similar to Bittensor. Anyone with a spare consumer-grade GPU can become a node on the Nosana network, and anyone can access Nosana's own artificial intelligence models to meet different needs. Since November 2022, Nosana has completed 180,000 inferences on its network, which refer to completed tasks submitted to the network queue. NOS is used to provide collateral for nodes on the Nosana network and is a medium of exchange with a current FDV of $370 million.

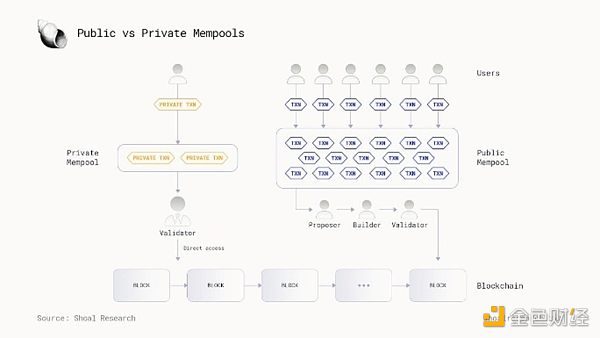

Intents (intentions) have become the encryption field A buzzword, some question the use of the word “intent” itself, but the idea is very simple – intents are signed transactions that outsource transaction execution on behalf of the user in order to have a better settlement price. Whether you want to call this mechanism an intent is entirely up to you, but in the context of our attention economy, we believe "intents" will be more popular.

A key feature of intent-based trading protocols is to outsource transaction execution to a subset of competing searchers (searchers, other names such as solvers, fillers, etc.) who compete in an auction to find the user's transaction. Optimal price path. In addition to various on-chain liquidity sources (liquidity pools on decentralized exchanges), these seekers are often able to leverage off-chain sources like centralized exchange liquidity to fund users’ trades. The benefits of using off-chain liquidity are gas cost savings and higher liquidity. That said, the shift toward increasing reliance on off-chain components has worrying implications on a larger scale.

The private memory pool is It provides users with a "fast track" to connect directly to block builders and is being widely adopted by users and applications integrating various MEV protection services, such as MEV-Blocker, which now has over 600,000 unique address users.

Many teams are working on building the core infrastructure for intent-based applications. The developments we consider most important are:

SUAVE – a sidechain being developed by Flashbots that will serve as a developer toolbox for building auction-based models.

Anoma - The Anoma team is developing a complete network to support intent-based applications while focusing on privacy and security.

Essential - Builds various models and standards for intent applications, including intent-specific DSLs, intent-centric account abstractions, and modular intent layers.

CoWSwap (COW): Not all intent-based protocols are created equal, and Flashbots’ research into the Ethereum order flow market shows that CoWSwap solvers are the only ones competitive in practice model. In comparison, 1inch Fusion’s resolver market and UniswapX’s filler market are obviously centralized. Cow DAO recently voted to start charging fees for CoWSwap, creating an organic revenue stream for the protocol’s growth. There are many other innovative features such as TWAP orders, programmable orders - which can be used to help prevent people's loans from being liquidated, "CoW Hook" transactions - which allow users to combine multiple transactions into one, and the recently released CoW AMM – An LVR capturing AMM that considers LP interests.

Across (ACX): Across is the bridge implementation between Eth L1 <> L2, L2 <> Eth L1 and L2 An intent-based execution model, solvers provide liquidity to complete user transactions and are then compensated for doing so. With over $5 billion in total transaction volume, 357,000 users, and $101 million in TVL, Across is one of the most successful organic third-party cross-chain bridges in the DeFi space today. It inherits the security properties of the UMA optimistic oracle, which allows solvers to assume inherent risk when providing funds to users knowing that they will be repaid, providing users with faster bridge execution.

IntentX: Unlike most other intent-based swap aggregation protocols, IntentX introduces perpetual contract trading to the intent space. Since its launch in Q4 2009, IntentX has taken in $2.5 million in deposits, processed $707 million in transaction volume, and generated $630,000 in revenue on Base. The intent-centric landscape is constantly evolving, and we will be keeping a close eye on IntentX and its novel intent mechanism for perpetual contract trading.

As Chris Dixon emphasizes in his new book "Read, Write, Own":< /p>

“Search and social ranking algorithms can change lives, make or break companies, and even influence elections, yet the code that drives them is controlled by unaccountable corporate management teams that are largely hidden from public scrutiny Out of sight.”

Social networks embody the essence of how people connect and coordinate, yet the vast majority of revenue generated from content created on social networks flows back to the platforms, not to users, entrepreneurs and content creators’ pockets. The creator economy needs an overhaul, and decentralized social media (DeSoc) can help.

DeSoc and crypto-native social networks provide new opportunities for monetizing relationships between creators and fans. The idea is great but has not yet been implemented. There were glimmers of hope, but the real breakthrough moment had not yet arrived. Friendtech died as soon as it became famous. And, Starts Arena, rest in peace.

Friendtech has proven that PVP-style social applications with financial incentives are not a sustainable growth model and will not attract a large number of users beyond crypto-native users.

Logging in remains a major hurdle – switching to a new social network without losing followers/audience is challenging to almost impossible.

To quote former Facebook product manager Antonio Garcia Martinez:

“Web3 needs to enable cool features that were previously impossible with Web2 and make users basically unaware that they are in the zone. On the blockchain.”

That’s why Farcaster is exciting. While Farcaster has recently set new records in terms of users and activity, it's not just the latest hype. Led by Dan Romero and Varun Srinivasan, the former Coinbase team has been working on it for some time. Farcaster is not a specific application, but a platform with a decentralized architecture that enables new applications to be created on top of it. Farcaster uses a hybrid backend architecture where all cryptographic elements/blockchain are abstracted off-chain, while identity management is stored in smart contracts on-chain.

Warpcast, a client developed by the Farcaster core team, provides a smooth web2 social experience. Warpcast has a Twitter-like feed, as well as specific channels similar to subreddits, allowing users to join communities and curate the content they want to see.

Frames are in a league of their own, providing developers with new opportunities to build embedded experiences directly into shared interfaces. In other words, do more cool stuff without leaving the app you're using. In order to pay tribute to Internet culture, a core engineer put Doom into a frame. There are many other exciting possibilities - imagine reading an article about the latest AI tokens and being able to buy the tokens without leaving the article. Or get all the latest news and updates from your favorite research telegram in one interface. Bet on sports directly from your live feed.

Connectivity between experiences, in turn, improves the quality and therefore the value of the experience. This is what Facebook tried to do, but ultimately failed with the Open Graph protocol, mainly due to the technical and multi-party coordination issues that the blockchain needs to solve.

The cool thing about Farcaster is that it only has two clients - anyone can customize the client to suit the needs of the user or business. A16z has a buyback mechanism and a bunch of clients available for anyone to start building today. We look forward to more innovation in this area and are eager to collaborate with development teams in the DeSOC space.

Telegram Bots is another exciting and cryptographic A unique way to interact. They are a classic example of a headless market— Local distribution markets (i.e. wherever the user’s wallet is) face global needs and users.

Today, Telegram bots remove many of the barriers to using cryptocurrencies - wallets are created on behalf of interested users, and funds can be deposited into and withdrawn from a CEX-linked address (i.e. Coinbase). Considering Telegram currently has 800 million monthly active users, this seems like a profitable user base.

The rapid growth and adoption of Telegram bots supports this view – but it’s important to pick a few quality ones out of the hundreds currently launched.

Banana Gun bot(BANANA< /strong>) - Supports Ethereum and Solana. Banana Gun has completed $1.4 billion in total trading volume since launch and has processed over 3 billion trades for 87,000 traders.

BonkBot (TBD) - BonkBot is developed by a team independent of the BONK token. It is the best-performing TG bot on Solana, handling 24 million trades from 158,000 traders and a trading volume of $1.8 billion, more than any other bot. Bonkbot’s transactions are automatically processed through Jupiter, and it has established a synergistic relationship with one of Solana’s head projects.

Unibot (UNIBOT) - supports Ethereum and Solana transactions. Unibot started the TG boom in 2023. Since launch, Unibot has completed 731,000 transactions with a total transaction volume of $479 million and total fees of $4.7 million.

For those who want to invest in trading assets that are only available on-chain, but don’t want to face the hassle of creating a new wallet and traveling through hundreds of trading venues (implied For people who are concerned about smart contract risks), telegram bots are very timely. After all, if you just want to trade memecoins, why bother with the complexities of self-regulation? This may also apply to other use cases beyond trading, such as borrowing/loans on Aave via telegram bot, minting NFTs, payments, etc.

The Solana ecosystem will grow rapidly in the second half of 2023, and will be the first in 2024 Quarterly growth continues, driving greater awareness of the benefits of executing transactions in parallel on the blockchain. While there will always be intrinsic value in the security of Ethereum, which processes transactions sequentially, the reality is that as more users adopt cryptocurrencies and/or more businesses seek to use blockchain technology to handle In the world of business, the need for low-latency and high-throughput infrastructure will naturally be highlighted.

The key idea behind parallel execution is to support simultaneous, conflict-free transactions, resulting in faster execution and higher overall throughput. On Solana, accounts need to declare which specific network state they need to access in each transaction, which is what enables parallel execution. Bob's use of 100 USDC to exchange SOL on Jupiter does not conflict with Alice's borrowing of 1,000 JUP on Kamino.

"Alt-Parallel L1s" are an emerging trend, they are relatively early networks (less than 1 year old) that process transactions in parallel, similar to Solana.

In parallel processing, a key difference is deterministic processing and optimistic processing. In deterministic processing, as seen in Solana, all nodes execute a deterministic set of transactions simultaneously in lockstep. Optimistic processing is, for example, Sei's design, which processes transactions in parallel across multiple nodes and then verifies whether the submitted transaction is valid. Therefore, it is possible for an optimistic parallel processing chain like Sei to execute faster than Solana, but at the cost of possible rollbacks in the event of fraud.

Sei(Sei >) - Sei is L1 built on Cosmos SDK and is dedicated to trading and financial services. Sei V2 will be launched in the first half of 2024 and will introduce upgrades to several key features, including smart contracts, parallel processing and state storage. Sei currently has $23 million in TVL and a market value of nearly $2 billion.

Sui (Sui) - Sui is L1 developed by Mysten Labs based on MoveVM. It uses a parallel processing model. Transactions, you guessed it, have the advantage of high TPS and low fees. Sui currently has $649 million in TVL, ranking tenth among all chains. Interestingly, the Sui token has a market capitalization of nearly $2 billion, which is similar to Sei, even though its TVL is more than 20 times that of Sei.

Monad (to be determined) - Monad is EVM L1, designed to provide more than 10,000 TPS through optimistic parallel execution and "superscalar pipelining". Monad was developed by former Jump Trading employees with extensive high-frequency trading experience and has a very strong community (Gmonad). Monad will also use its own database, MonadDB, for data storage, eliminating the scaling limitations of the previous EVM blockchain.

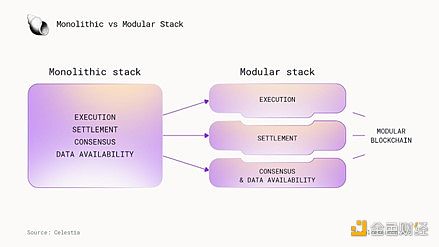

A modular blockchain is a dedicated chain built to meet a specific purpose, while Seamlessly connects with other dedicated chains. Blockchain performs 4 key functions - consensus, execution, settlement and data availability. While monolithic or "integrated" chains run all 4 of these functions on a base layer, modular blockchains take a "plug and play" approach where the network can choose to use specialized infrastructure to perform its key functions.

To match a set Take clothes for example - you can wear the same brand from head to toe (single), or you can wear a Hanes shirt, a pair of Levi jeans and a Carharrt jacket (modular).

Celestia(TIA): Celestia co-founder Mustafa Al-Bassam wrote a research article on Lazy Ledger back in 2019, which laid out the basic concepts about a dedicated system that could help other networks scale - what we would today call Modular blockchain. Celestia, as a specialized data processing layer, provides a low-cost alternative for L2s to publish data.

Eclipse: It is a new L2 that uses SVM for execution, Celestia for data availability, Ethereum for settlement, and RISC ZERO for zk fraud proofs - it doesn't get more modular than this! We are excited to see new use cases for SVM emerging, especially with the rise of modular blockchains. There's some uncertainty about how well Eclipse will actually perform, given its Frankenstein-like experimentation, but the team is strong and expectations for this novel L2 are high.

Developers building dApps have several deployment options, such as existing blockchains, second-layer solutions (L2), custom app chains, rollups, etc. Rollup provides the perfect balance between customization, performance, and development efforts, especially with the simplified setup provided by Rollup-as-a-Service (RaaS) providers. These vendors offer tools and services ranging from rollup management to no-code deployment, making it easy to create and maintain custom rollups.

Imagine running a busy restaurant (traditional blockchain): you handle everything from cooking to delivery. RaaS is like hiring a delivery service (RaaS provider): they manage the delivery so you can focus on cooking (development) and providing a smooth experience to your customers (users).

Conduit: The platform allows anyone to Publish your own rollups quickly and easily, without writing any code. This self-service platform takes care of everything from infrastructure to security, so you can focus on what matters – building your product. Leading companies like Zora and Gitcoin trust Conduit to handle technical complexities.

Dymension (DYM): Dymension adopts a modular blockchain architecture. Users interact with RollApps (front-end), while Dymension (back-end) coordinates the ecosystem and handles communication. Data availability networks (decentralized databases) provide temporary data storage.

Cartesi: Cartesi provides dedicated CPU and rollup for your dApp, enhancing computing scalability while maintaining decentralization and security. and censorship resistance. It uses the Cartesi virtual machine, allowing users to use familiar libraries, languages, and tools for activities beyond the EVM.

Encryption participants have been looking forward to AAA Web3 games for a long time. During the last crypto cycle, Axie Infinity, Sandbox, Decentraland, and Enjin were all the talk of the town, as emerging gaming companies realized that Web3 could be a new place to test ideas. In the last cycle, we found many games similar to “DeFi with lore” that placed more emphasis on the interaction of yield farming/yield generation strategies than on the game itself.

As with many of these games, a lot of the feedback revolves around the genuine fun of the game as a core gaming application. While these games performed well during the bull market, market sentiment faded due to unstable token economics or the collapse of their incentives despite significant price increases.

Ronin(RON >): Ronin developed by Sky Mavis is an EVM-compatible blockchain tailored for games. The most famous thing about Ronin is that it hosts the popular Web3 game "Axie Infinity". Ronin focuses on near-instant transactions and minimal fees, while also standing out by supporting a large number of in-game transactions.

Beam (BEAM): Beam Network is a game-centric ecosystem incubated by Merit Circle DAO. It provides developers with a Beam SDK that supports the integration of blockchain elements into games. BEAM is the network’s gas token and is crucial for transaction payments and smart contract interactions in the BEAM ecosystem.

Echelon Prime (PRIME): Echelon Prime is a gaming platform focused on the development and distribution of games designed to create new Tools for game modes and economic systems. Its token PRIME has been integrated into the sci-fi card game Parallel, its first application. Through PRIME, Echelon Prime is intended to support expansions that promote cutting-edge gaming experiences and economies, such as AI and AR gaming.

We are eager to cooperate with various teams and founders to promote blockchain infrastructure and chain Economic innovation. The field of digital assets is full of opportunities, but also full of noise. If we want to pick a needle in the sea, we must conduct continuous research and constantly improve our ideas.

FTX’s legal team clarified that since FTX US has not yet restarted, Digital Custody has little value to the asset and will therefore be sold.

JinseFinance

JinseFinanceGolden Finance launches the 2208th issue of the cryptocurrency and blockchain industry morning report "Golden Morning 8:00" to provide you with the latest and fastest digital currency and blockchain industry news.

JinseFinance

JinseFinanceMark Cuban criticizes the SEC for ineffective investor protection, highlighting inadequacies in crypto regulation.

Huang Bo

Huang BoHodlnaut is one of the latest companies struggling with insolvency issues. The crypto winter of the year gave a terrible ...

Bitcoinist

BitcoinistHodlnaut, a cryptocurrency lender and borrower based out of Singapore has recently filed an application for judicial management. This shall ...

Bitcoinist

BitcoinistThe DeFi platform known as Gnox sold out its previous presales in record time, with buyers snapping up all of ...

Bitcoinist

BitcoinistEmergency reserve valued at USD 200 million Singapore, 1st August, 2022 – Leading global derivatives exchange - Bitget, is pleased ...

Bitcoinist

BitcoinistEther price is forming a bear pennant pattern whose profit target comes to be near $850.

Cointelegraph

CointelegraphThe crypto exchange, which is backed by Peter Thiel and Coinbase, halted withdrawals in July following an apparent run on its assets.

Cointelegraph

CointelegraphBitcoin has been losing value for months because of, among other market variables, limited liquidity circumstances and targeted dumping of ...

Bitcoinist

Bitcoinist