Author: Martin

A silent capital revolution is sweeping through corporate coffers around the world,

reflecting the era of digital assets moving from the fringe to the mainstream

ignoring the high price! Strategy continues to buy Bitcoin,

the company spent $2.46 billion to purchase Bitcoin in the past week

this is the third largest single acquisition in terms of dollar value since the company began increasing its holdings of this cryptocurrency five years ago.

According to documents submitted to the U.S. Securities and Exchange Commission (SEC), the company purchased 21,021 bitcoins between July 28 and August 3,bringing its total holdings to 628,791. Based on the current market price, the value of these digital assets has exceeded U.S. $71 billion.

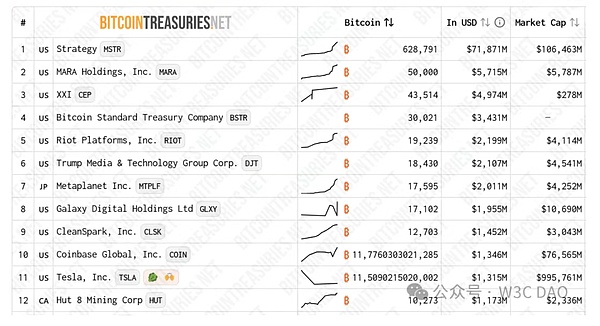

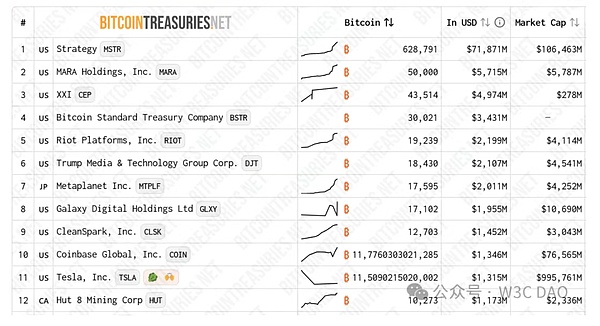

When Bitcoin was first born, it was often denounced by traditional finance as a "geek toy" or a "speculative bubble." But today in 2025,global listed companies are incorporating it into their balance sheets at an unprecedented rate.When Intesa Sanpaolo, Italy's largest bank, quietly bought 11 bitcoins, when Japan's Metaplanet announced in a high-profile manner that it would use Bitcoin as a strategic reserve asset, and when GameStop transformed from a game retailer to a digital asset holder -corporate Bitcoin strategies have gone from fringe experiments to the financial mainstream. According to the latest data, as of July 2025, the number of listed companies worldwide holding Bitcoin has reached 141, a 120% increase over last year. Even more remarkable is that corporate Bitcoin purchases in the first half of the year alone reached a staggering 245,000 units, a 375% increase over the same period in 2024, and even more than twice the amount purchased by ETFs. This silent capital revolution is reshaping the underlying logic of global asset allocation. 1. Panoramic View: Deep Divergence in Corporate Cryptocurrency Holdings 2025 will be a key year for a surge in listed companies' crypto reserves. Data shows that in June alone, 26 new companies added Bitcoin to their balance sheets, bringing the total number of companies globally with crypto assets to over 250. The top 100 publicly listed Bitcoin financial companies hold a combined 959,798 BTC, valued at US$1,094,169,720,000 (RMB 780.14 billion). These companies span multiple industries, including technology, energy, finance, and education, and are geographically distributed across North America, the Middle East, and Asia. Sixty-four companies officially registered with the US SEC hold approximately 688,000 BTC, representing 3-4% of the total Bitcoin supply.

The leading giants have formed a "Bitcoin hegemony":

• Strategy (formerly MicroStrategy): holds 628,791 bitcoins, with a holding value of US$71.871 billion, accounting for more than 70% of the total holdings of listed companies, and can be called a "walking Bitcoin ETF"

• MARA • Bitcoin Standard Treasury: holds 30,021 bitcoins, with a holding value of $3.431 billion • Riota Platforms, Inc: holds 19,239 bitcoins, with a holding value of $2.199 billion • Trump Media & Technology Group Corp: holds 18,430 bitcoins, with a holding value of $2.107 billion •Metaplanet: A Japanese listed company, holding 17,595 bitcoins, with a holding value of US$2.011 billion, making it the largest listed company in Asia in terms of currency holdings, and has achieved remarkable results in replicating the "MicroStrategy model"

•Galaxy Digital Holdings Ltd: Holding 17,102 bitcoins, with a holding value of US$1.955 billion

•CleanSpark, Inc: Holding 12,703 bitcoins, with a holding value of US$1.452 billion

•Coinbase Global, Inc: Holding 11,776 bitcoins, with a holding value of US$1.346 billion

New entrants set off a cross-industry wave

In 2025, corporate Bitcoin investment showed a diversified trend:

• Traditional finance breaks the ice: Intesa Sanpaolo, Italy’s largest bank, purchased 11 Bitcoins, sending a signal for the banking industry to enter the market

• Retail industry transformation: GameStop quickly purchased 4,710 Bitcoins after announcing its Bitcoin strategy, with a record-breaking transformation speed

II. Triple Logic: The Essence of Corporate Bitcoin Strategy

1. Financial Logic: The Noah’s Ark in the Age of Inflation

2. Decentralized trust machine

The distributed ledger technology of the Bitcoin network creates a value transfer channel that does not require an intermediary. Its SHA-256 encryption algorithm ensures that transactions cannot be tampered with. The network composed of thousands of nodes around the world has an attack resistance capability far exceeding that of centralized systems.

When traditional banks are constrained by geopolitics, Bitcoin provides multinational companies with a censorship-resistant value transfer channel. For example, Middle Eastern companies use Bitcoin to circumvent US dollar sanctions and achieve cross-border settlement.

"Bitcoin is not a speculative tool, but a key anchor for rebuilding trust." As industry observers said, "It solves the fundamental proposition of the digital age: when traditional institutions depreciate, what should we believe in?"

3. Frontier carrier of technological innovation

In 2025, the Bitcoin technology ecosystem will usher in key breakthroughs:

• Lightning Network: transaction speed increased to millions of transactions per second, and transaction fees reduced to almost zero

• Quantum-resistant encryption: A defense system to counter the threat of quantum computing is put to the test.

• Cross-chain interoperability: Compatibility with Ethereum smart contracts is achieved through Rootstock

Technological upgrades have enabled Bitcoin to evolve from a simple store of value to a functional asset.

IV. Future Outlook: Three Major Trends in Corporate Currency Holding

Institutional funds are pouring in at an unprecedented scale. In 2024, the net inflow of Bitcoin spot ETFs reached US$32 billion, and

The continued increase in holdings by giants such as BlackRock and Fidelity may cause ETF managed assets to soar to US$190 billion in 2025.This structural change has caused the daily circulating bitcoins to decrease by about 3.5 times, far exceeding the daily output of miners.

The depreciation of currencies in emerging market countries has accelerated its popularity from another dimension. The annual depreciation of local currencies in countries such as Argentina has exceeded 50%, prompting residents to turn to encrypted assets to store value. The related transaction volume in the fourth quarter of 2024 surged by 217% year-on-year.

In the future, corporate currency holdings will show the following three trends:

1. Exponential growth in adoption

Strategy’s executive chairman predicts: “The annual growth rate of corporate Bitcoin investment will reach 30%-60%, and by 2026, the number of companies holding Bitcoin may exceed 700.” This prediction is based on:

• Improved regulatory framework: The US "FIT21" Act is advancing, and the MiCA framework is being implemented in the EU. Optimized accounting standards: New FASB rules allow Bitcoin assets to be measured at market value. Improved infrastructure: CME launches corporate currency hedging contracts, with open interest exceeding US$8 billion. 2. Accelerated entry of sovereign states. In March 2025, Trump signed an executive order to establish a US Bitcoin reserve, signaling a policy shift. If the "Bitcoin Act" passes, the US plans to purchase 1 million Bitcoins (5% of the total supply) over five years, potentially triggering a global race to hoard Bitcoin.

Japan, Switzerland and other countries have explored the synergy between central bank digital currency and Bitcoin ecosystem, and the era of sovereign-level configuration has arrived.

3. Fundamental change in market structure

When corporate holdings account for 16% of the circulating supply of Bitcoin (3.32 million coins), the market mechanism is quietly changing:

• Price discovery mechanism: from retail investor-driven to institutional capital flow-led

• Volatility characteristics: historical volatility has dropped from 100%+ to 40-60%, moving towards a "slow bull" market

• Reconstruction of ecological roles: miners turn from sellers to hoarders, with net positions falling by 90% in 2024

Standard Chartered Bank predicts that with the continued influx of institutions, the price of Bitcoin may approach US$200,000 by the end of 2025. V. Hidden Reefs Behind the Prosperity and the Dawn of a New Treasury Era Despite a bright future, corporate Bitcoin strategies still face challenges: 1. Policy Risk: Regulatory divergence may lead to market fragmentation, such as the coexistence of the EU MiCA framework 2. Financial Risk: Bitcoin’s annualized volatility exceeds 80%, and highly leveraged companies are prone to falling into a “death spiral” 3.

4. Competition risk: CBDC squeezes payment scenarios, and competing currencies such as Ethereum divert funds

As XBIT analysts warn: “Companies trading close to net asset value may face the risk of a ‘death spiral’ - a decline in Bitcoin prices will impact balance sheets, triggering a decline in stock prices.”

When Strategy's Bitcoin reserves exceed the gold reserves of many countries, when Metaplanet uses Bitcoin to hedge against the depreciation of the Japanese yen, and when GameStop transforms its game cartridge warehouses into digital asset vaults—corporate treasury management is undergoing a paradigm shift. Bitcoin is evolving from a "geek toy" to a "standard component of corporate treasuries." This transformation reflects profound contemporary logic: amidst the weakening credibility of fiat currencies and sluggish returns on traditional assets, algorithmically guaranteed scarcity and global liquidity are becoming new anchors of value. Strategy founder Michael Saylor's declaration is coming true: "We're not buying Bitcoin; we're redefining the future of corporate wealth." When 141 publicly listed companies collectively pivot, a new financial era has begun—not just a replacement of assets, but a transformation of the philosophy of value storage.

The ultimate significance of a company's Bitcoin strategy may not lie in short-term gains, but in reflecting on and transcending the traditional financial system.

In this silent capital revolution, pioneers are quietly writing the wealth landscape of the next decade.

The world has never stopped reshaping value, but this time, algorithms have become the writers of the new rules.

Jasper

Jasper