Author: YettaS, Primitive Ventures Investment Partner; Translation: Golden Finance xiaozou

True native innovation is a product that has never existed before and can only be born under the emerging technology paradigm. In the field of Web3, we are always asking: What kind of innovation is truly native to the encryption technology stack?

Fred Wilson proposed a timeless framework in his 2009 article "The Challenge of Mobile":

The so-callednative refers to those opportunities that did not exist before and could not exist without a mobile phone. For example, we wouldn’t consider delivering breaking news to mobile devices a native opportunity, because there are few startups with a better chance of becoming “CNN for mobile” than CNN. This is a powerful insight: true nativeness emerges only when a new interface completely reshapes how we interact with a system. Applying this principle to Web3, I believe stablecoins are one of the most native innovations in crypto, especially from a payments and banking perspective. 1. Interface shifts give rise to aggregate opportunities Every revolution in finance started with a new user interface. These interfaces will initially bring friction, but will also open up aggregation opportunities by redefining how value is initiated, verified, and settled.

Card era: Credit cards become the new interface for cash.

Digital era: Digital wallets become the new interface for e-commerce.

Web3 era: Stablecoins are becoming the new interface for banks.

Card Era:Visaand the Birth of the Global Payment Network

The United States after World War II ushered in income growth and consumption prosperity. When consumers' demand for seamless payments increased, credit cards came into being. Diners Club took the lead in breaking through in 1950, followed by American Express and MasterCard.

But the early systems were separated from each other. A card issued by one bank might not work at a merchant on another payment network; true interoperability had yet to be achieved.

In 1958, Bank of America launched BankAmericard, a scalable system that connected banks and merchants through a licensing mechanism. By 1976, it had morphed into Visa, a global network that aggregated fragmented markets into a unified layer.

Digital Age: PayPal and the e-commerce interface

In the late 1990s, with the rise of eBay and the explosion of cross-border P2P trade, business was redefined. But the payment system lagged far behind. Buyers needed a way to transact without sharing card information and avoiding foreign exchange and remittance friction.

PayPal quickly transformed to dominate online payments. With email-based transfers and instant account opening, it greatly reduces friction and is deeply embedded in the native economic system of the Internet.

Web3era: Stablecoins as aninterface

So, what is the real native innovation of Web3? In this paradigm, data is money and money is data.

The traditional system separates information from value. SWIFT sends payment instructions, and settlement is completed later through a complex network of correspondent banks and clearing houses - a process that is slow, expensive and opaque.

Blockchain merges information and value into a single layer. Now, the flow of value can be as efficient as information. This opens up a design space for programmable, composable finance:

•Trustless: Every transaction is verifiable on-chain.

•Permissionless: Anyone can build and use financial services.

•Interoperable: Assets can flow across protocols and chains.

Stablecoins are at the heart of this system. They have become the native interface in the cryptoeconomy for deposits, earning yields, lending, and spending, essentially functioning as a new type of banking interface.

2, frominterfacetonetwork: stablecoins become the new liquidity layer

Just like the credit card era before Visa, today's stablecoins are also fragmented - issued by different issuers with different strategies and underlying architectures. But they are all competing to become the default liquidity layer in the crypto financial stack.

We can see that giants have entered the market:

• Ripple acquired Hidden Road for $1.25 billion to push RLUSD into the institutional market.

• Circle launched a B2B settlement layer through the Circle Payments Network.

• Mastercard and OKX work together to build an end-to-end stablecoin channel.

• Visa works with Bridge to provide support for stablecoin-linked card infrastructure.

• Stripe launches native stablecoin-enabled accounts for global developers and merchants.

No one wants to miss the next big convergence moment.

3Towards narrow banking and deposit outflows

The GENIUS Act passed by the U.S. Senate clears the way for traditional financial institutions to issue stablecoins, which will prompt more traditional financial institutions to enter the stablecoin field. But in the long run, this also lays the groundwork for the outflow of traditional bank deposits. If users can earn, store and spend through on-chain assets that earn interest and settle instantly, why should they keep their funds in banks?

Traditional banks may evolve into simple ATMs, serving only as deposit and withdrawal channels for programmable dollars. Frax Finance is a case worth watching, as the protocol is actively building frxUSD into a universal, interoperable base layer across regulated fiat currencies.

Just as PayPal diverted transaction volume from payment processors, stablecoins may begin to pull deposits from banks. In the future, a narrow banking system may be formed, where banks only assume custody functions and operate channels, while credit creation will move to other areas.

4The Golden Triangle of Stablecoins

As stablecoins evolve from trading chips to the native storage, earning, lending and spending interface in the crypto economy, they are gradually becoming a new type of digital liquidity layer - inherently programmable, composable and global.

But becoming the default money layer is not just about trust or speed. It requires solving three major problems that traditional banks have already overcome through infrastructure, regulation and scale.

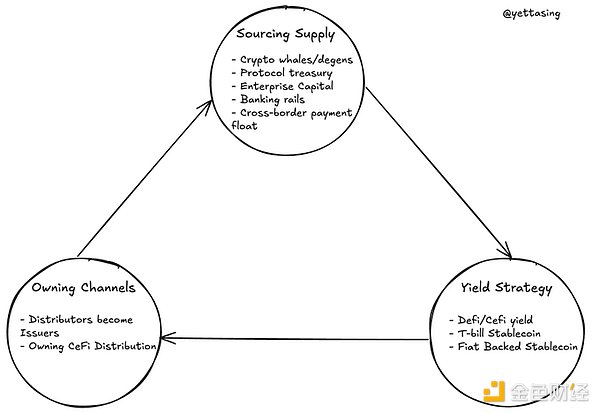

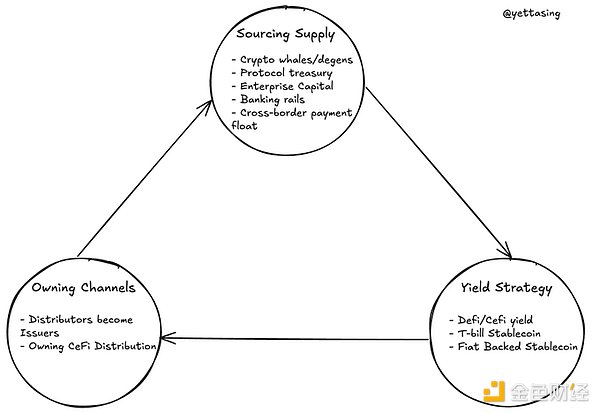

In crypto, this comes down to mastering the golden triangle of stablecoin strategy:

Liquidity Supply - Where does the liquidity of the stablecoin come from? Can it quickly and reliably reach deep idle capital pools?

Channel Control - How will the stablecoin be used? Do you control key distribution nodes such as CEX, brokers, or Web2 use cases?

Yield Design - Can you create a scalable and modular yield strategy that matches users, partners, and regulatory requirements?

Most stablecoin projects can only do one of these, and only a few can do two. The ultimate winners will be those that can balance all three.

(1)Liquidity Supply: The Battle for Idle Capital

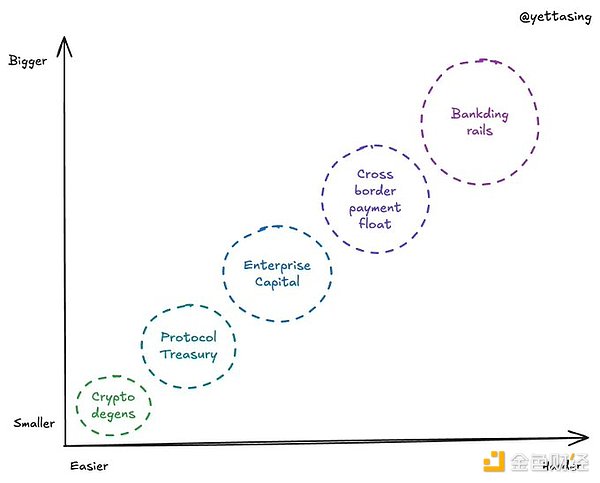

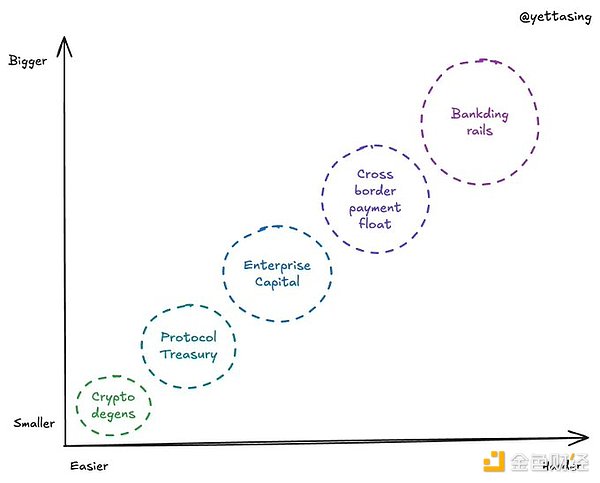

The winners in the stablecoin space will be those who are the first to release idle USD liquidity. Supply is not infinite, it is a speed race to grab the largest and most underutilized pool of deposits. Here are the major competitive areas, arranged from low to high difficulty and small to large scale:

Crypto Whales/Speculators:Still the fastest source of liquidity for the crypto-native model, driven by whales, speculators, and margin traders in CEX and DeFi.

Protocol Treasury:Large and sticky. BuidlFi.io holds $2.8 billion TVL with just 69 wallets, with the top two vaults coming from Ethena Labs and Sky. Stablecoins are becoming reserve assets for crypto-native institutions.

Enterprise Capital:From RWA projects to regional fintechs, everyone is chasing corporate vaults and remittance networks to issue or integrate stablecoins. USDX has made early progress in this regard.

Cross-border Payment Float:Stablecoins are now the second largest payment channel in the world. Idle liquidity in the crypto interoperable settlement layer is a natural source of float. I am optimistic about the development of codex in this area.

Bank Track:After the passage of the GENIUS Act, banks can interact directly with stablecoin infrastructure. Frax Finance is one of the first projects to enter this track.

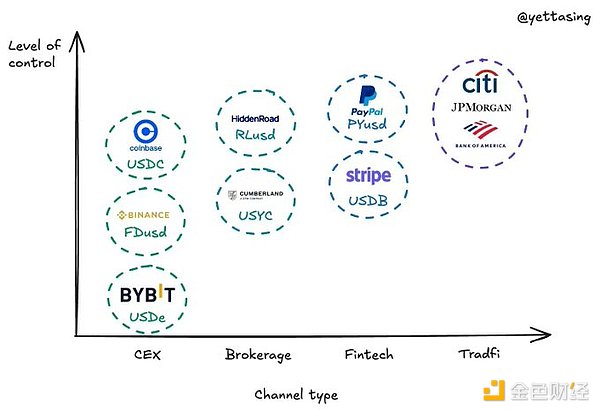

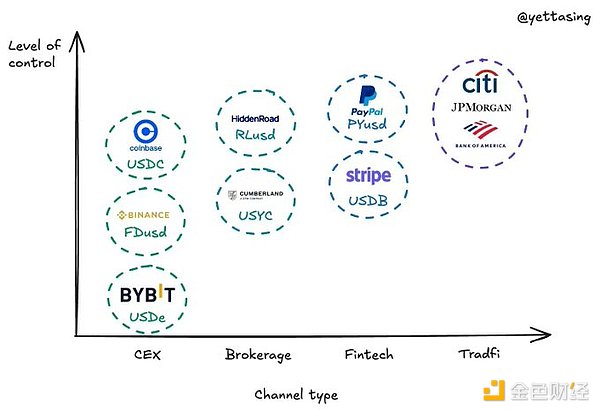

(2) Channel Control: Distribution Determines Destiny

Distribution channels are moats. Whether it is controlling the end-user experience, wallets, CEX, brokers or merchant networks, whoever controls these channels can lock in user use and establish defensive barriers.

Two dominant strategies are currently taking shape:

Distributors transform into issuers

• PayPal launches PYUSD to natively monetize its payment ecosystem.

• Stripe launches stablecoin financial accounts that support USDB issued by Bridge.

• Cumberland affiliate Hashnote launches USYC, an interest-bearing stablecoin backed by U.S. Treasuries.

• JPMorgan Chase, Bank of America, Citigroup and Wells Fargo are exploring joint issuance of stablecoins.

Control of CeFi distribution channels

• Coinbase is the key distribution engine of Circle's USDC.

• Binance promotes FDUSD to replace BUSD and has now become its internal settlement token.

• Ethena Labs promotes the adoption of USDe through direct access to Bybit.

• Ripple acquires Hidden Road to deepen its institutional brokerage infrastructure.

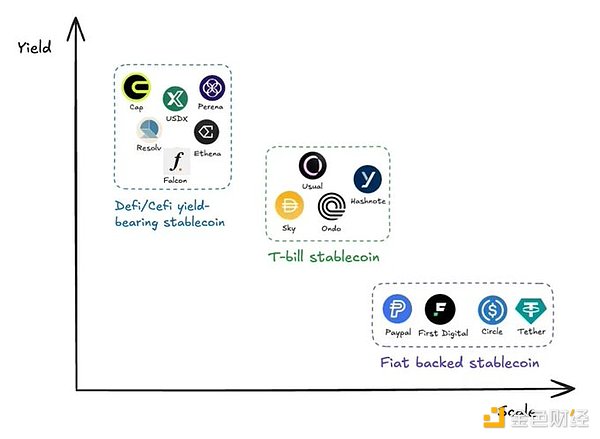

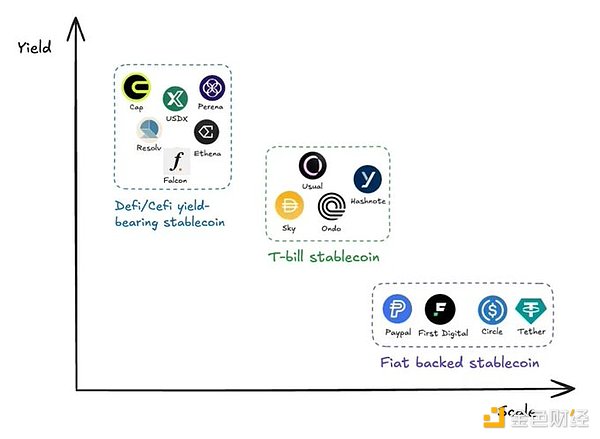

(3)Yield strategy: designing a stablecoin yield curve

In addition to trust and liquidity, the competition among stablecoins is also reflected in the monetization ability of floating gold. However, yield design faces a classic trade-off: high returns will limit scalability.

The current landscape can be divided into three strategic areas:

DeFi/CeFiInterest-bearing stablecoins:

These protocols attract capital through high yields, often using innovative financial engineering methods. However, their ability to scale is constrained by two core challenges: risk management and regulatory complexity.

• Ethena initially used a delta-neutral strategy to generate yield for its synthetic USDe, and has now expanded to asset management and payment solutions, providing a comprehensive DeFi platform.

• Perena is a stable bank based on Solana, working with external vault managers to diversify the sources of income for users.

• CAP secures the ecosystem by incorporating re-hypothecation, while introducing Franklin Templeton as a key asset manager to generate returns for stablecoin holders.

• Resolv expands from its original delta-neutral strategy to exploit a wide range of crypto yield opportunities, ensuring stability and institutional adoption through a risk isolation mechanism (RLP token).

• Falcon, backed by DWF Labs, is a synthetic dollar protocol with a unique inverse delta-neutral strategy.

• StableLabs’s USDX is a synthetic USD stablecoin backed by a multi-currency arbitrage strategy that maintains a near delta-neutral USD position through balanced trading of multiple digital assets.

Treasury Stablecoins:

Medium yield, institutional-grade structure. Players such as Ondo and Hashnote tokenize US Treasuries through money market funds, balancing compliance and composability.

Fiat-collateralized Stablecoins:

Zero yield, largest scale. USDC, USDT, FDUSD, and PYUSD are distributed through CEX and payment channels, mainly monetizing off-chain float, with very low user incentives.

Just as Visa abstracted merchant bank relationships into a universal settlement layer, stablecoins are now abstracting banks’ deposit layers—turning currencies into open APIs.

This changes the interface form of the banking industry itself.

And there is a major opportunity in this interface migration: rebuilding the currency technology stack from scratch with stablecoins as the core operating system.

Catherine

Catherine