Source: VanEck; Compiled by: Golden Finance

Like most emerging asset classes, allocating to Bitcoin is both an art and a science.

However, three measurable factors consistently explain the majority of BTC price movements over time: global liquidity, leverage, and on-chain activity. Together, these factors provide investors with a practical framework for sizing and timing digital asset investments.

1. Global Liquidity

BTC Price Highly Correlated with Global M2

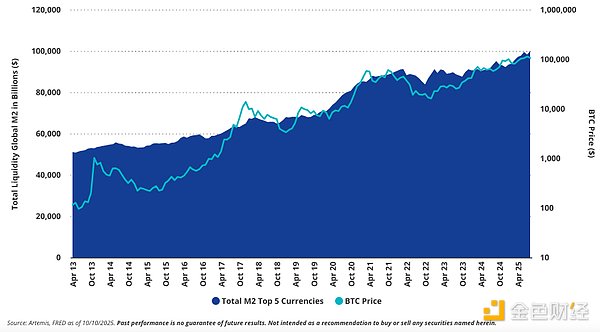

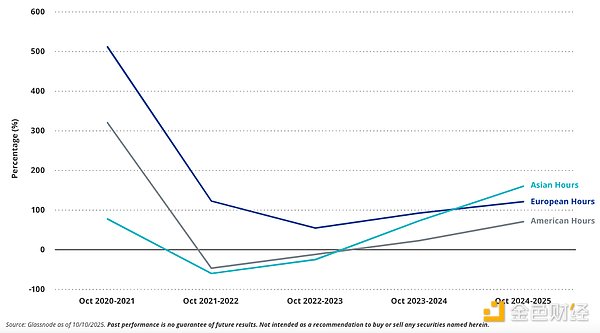

BTC price has long been closely linked to the fluctuations in global money supply. Since 2014, Bitcoin has had a correlation of approximately 0.5 with the growth of global M2 (r² = 0.25), meaning that changes in fiat currency liquidity largely explain its long-term returns. While this relationship tends to weaken during short-term shocks (such as the 2020 COVID-19 pandemic, the 2024 election, or the 2025 "tariff tantrum"), the broader trend of monetary expansion continues to dominate Bitcoin's cycles. A multivariate regression of the supply of the five largest fiat currencies on Bitcoin's price shows that changes in M2 explain more than half of Bitcoin's variance over the past decade (r² = 0.54). Since 2013, liquidity in the five largest global currencies has roughly doubled, from $50 trillion to nearly $100 trillion, during which time the price of Bitcoin has increased more than 700-fold. Among currencies, Euro M2 money supply remains the strongest explanatory variable (r = 0.69, t = 10), highlighting Bitcoin's growing role as a neutral reserve asset in the context of synchronized currency depreciation. VanEck's historical macro view is consistent with this data. In March 2023, VanEck CEO Jan Van Eck stated on CNBC that as the Federal Reserve nears the end of its tightening policy, both gold and Bitcoin appear poised to enter a multi-year bull cycle. Within this framework, VanEck's thesis is that Bitcoin acts as "digital gold," benefiting from weak bank performance, imminent interest rate cuts, and renewed liquidity expansion. Regional market dynamics have shifted significantly over the past two years in terms of Bitcoin price discovery. As shown in the chart below, Bitcoin returns during Asian trading hours lagged those during Western trading hours earlier in this cycle and during the 2020-2022 cycle. Now, Asian trading hours are leading global returns. This year, we've observed that Asia led the recent late summer rally and is now also leading the recent decline. This rotation may reflect tightening liquidity in Asian markets as central banks in India and China are willing to sacrifice domestic monetary growth to defend their currencies. This pattern is consistent with Bitcoin's role as an "anti-money printing" asset in global liquidity cycles.

Annualized average hourly return of BTC trading session

2. Leverage

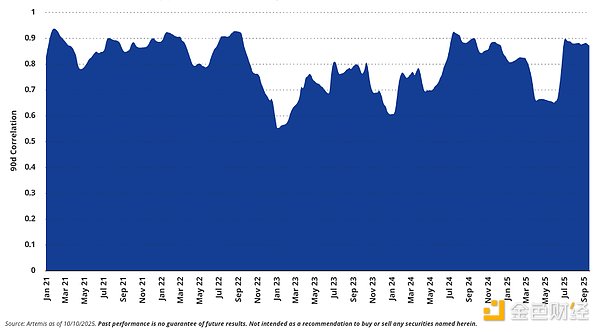

BTC price is closely correlated with BTC futures open interest (OI)

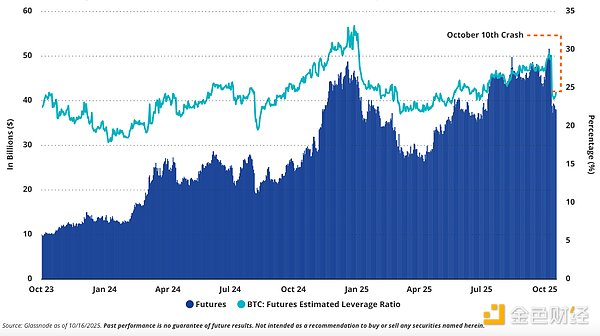

BTC futures open interest (OI) rose 2.5x year-over-year before the October 11th crash

As of early October 2025, futures leverage was close to 95%, and cash collateral for Bitcoin futures reached an all-time high of approximately $145 billion. Open interest peaked at $52 billion on October 6th, then fell back to $39 billion on October 10th after BTC dropped 20% within 8 hours, a reminder of how margin calls are cascaded through the system. Notably, leverage has never remained above 30% for more than 75 days, suggesting limited sustained risk appetite. As of mid-October, Bitcoin futures leverage was at the 61st percentile of its historical range over the past 5.25 years. Meanwhile, the composition of leverage is maturing. Growing participation from institutions, miners, and ETF market makers has shifted trading activity to regulated venues such as the Chicago Mercantile Exchange (CME), where longer-dated, hedging-oriented contracts dominate. Leverage remains a double-edged sword, amplifying drawdowns while also reflecting growing confidence in Bitcoin as a financial asset. Against the backdrop of the deleveraging event on October 11 and the price of Bitcoin reaching its lowest level relative to gold since October 2024, we believe the current market is a buying opportunity.

3. On-Chain Activity

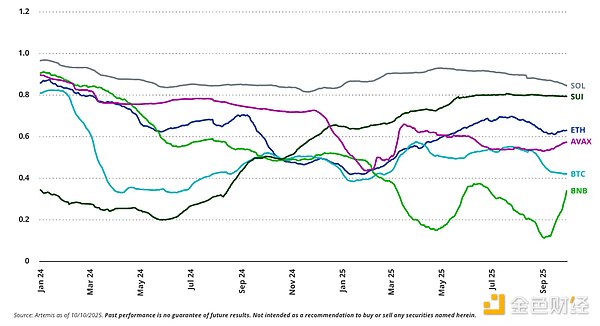

1-Year Correlation between Blockchain Revenue and Token Price

While macro liquidity and market structure are indicators of Bitcoin's short-term cycles, and these indicators often influence risk appetite across the cryptocurrency market, on-chain fundamentals offer the clearest window into the actual adoption of cryptocurrencies. Across major networks, token prices show a significant statistical correlation with blockchain-generated revenue, demonstrating that usage and value are intertwined. Among the major blockchains, Solana's network revenue has the strongest correlation with token performance (r²=0.71, t²=30), while Binance Chain's BNB has the weakest correlation (r²=0.13). The causal relationship between the two is complex: higher token prices catalyze more revenue-generating user activity, while sustained fee revenue strengthens long-term valuations. As major blockchain application ecosystems mature, they provide new channels for activity, which can improve the relationship between price and on-chain revenue. As the newest of the six blockchains in the chart above, Sui's network growth in DeFi and consumer gaming/NFT applications over the past two years clearly demonstrates this relationship. For Bitcoin, on-chain metrics such as transaction volume and network fees remain less predictive of daily price movements than liquidity or leverage. However, they remain strong evidence of network health. We believe that Bitcoin (and, to a lesser extent, Ethereum) are relatively less disconnected from these fundamentals than other blockchain networks due to their increasing adoption as store-of-value monetary assets in off-chain treasuries and exchange-traded products (ETPs). While these factors favor BTC and ETH, the continued growth of on-chain revenue and user activity is the strongest evidence that a blockchain network's value proposition transcends speculation. Setting aside on-chain metrics, Bitcoin still resembles an "eight-year-old" on its adoption curve, as Jan van Eck described it in 2023, but its growing correlation with global liquidity and leverage suggests that BTC is evolving from a speculative asset to a macro hedge against fiat currency debasement. Today, BTC is more like a teenager; despite BTC's growth, we expect market sentiment to remain volatile in the coming years.

Aaron

Aaron

Aaron

Aaron Catherine

Catherine Hui Xin

Hui Xin Aaron

Aaron Davin

Davin Davin

Davin Brian

Brian Hui Xin

Hui Xin Jasper

Jasper Davin

Davin