Author: Ignas Translator: Shan Ouba, Jinse Finance

In the previous article, I called this phenomenon a major shift, but little detailed information clearly explains its impact. As Ray Dalio might say, this phenomenon is common in other industries, but it has never happened before in the history of cryptocurrency.

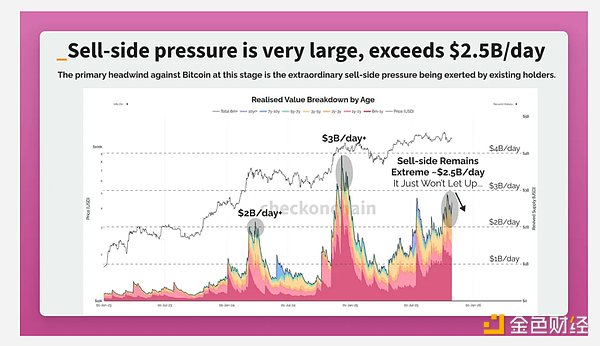

Traditional finance practitioner Jordi Visser provides the best explanation: BTC wins, and early BTC believers are cashing in their profits.

This is not a panic sell-off, but a natural transition of ownership from centralized to decentralized. Among all traceable on-chain metrics, whale selling is a key signal.

This is not a panic sell-off, but a natural transition of ownership from centralized to decentralized. Among all traceable on-chain metrics, whale selling is a key signal.

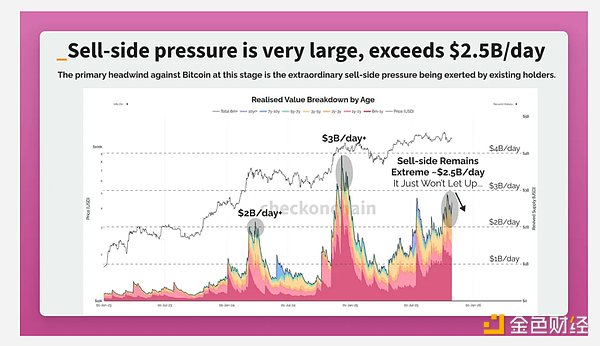

Long-term holders sold 405,000 BTC in just 30 days, representing 1.9% of the total circulating supply.

Take Owen Gunden as an example.

Owen Gunden is one of the early Bitcoin whales. He made large transactions on Mt. Gox, accumulating a huge holding, and also served as a board member of LedgerX. His associated wallet holds more than 11,000 BTC, ranking him among the largest individual holders on the chain.

Recently, his wallet began transferring large amounts of BTC to the Kraken exchange. He transferred thousands of tokens in several batches, which usually indicates a sell-off.

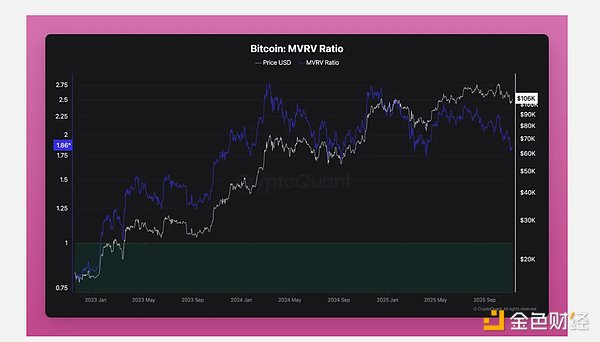

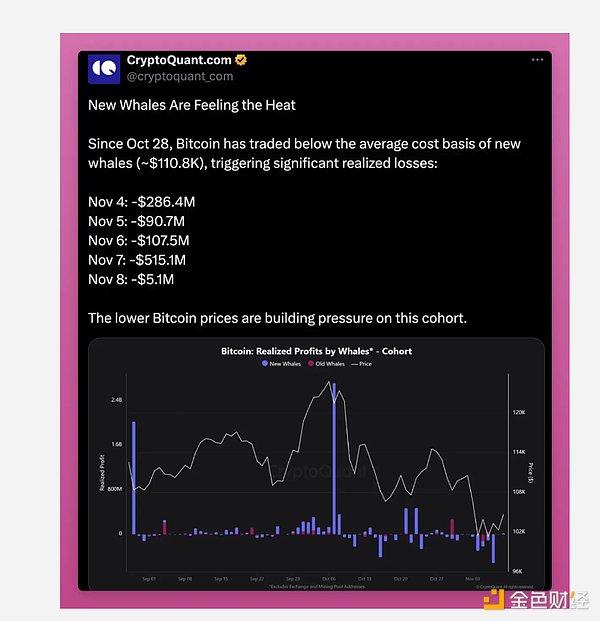

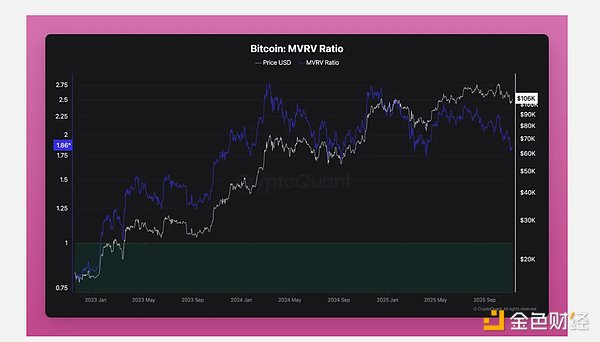

On-chain analysts believe he may be preparing to liquidate most of his holdings, worth over $1 billion. He hasn't tweeted since 2018, but this move aligns with my argument for a major rotation. Some whales are moving to ETFs for tax benefits or selling BTC to diversify their portfolios, perhaps by buying ZEC? As supply shifts from early whales to new buyers, unrealized profit prices continue to rise. New whales are gradually taking control of the market. The rise of MVRV offers a glimpse into how the average cost benchmark has shifted from early miners to ETF buyers and new institutions.

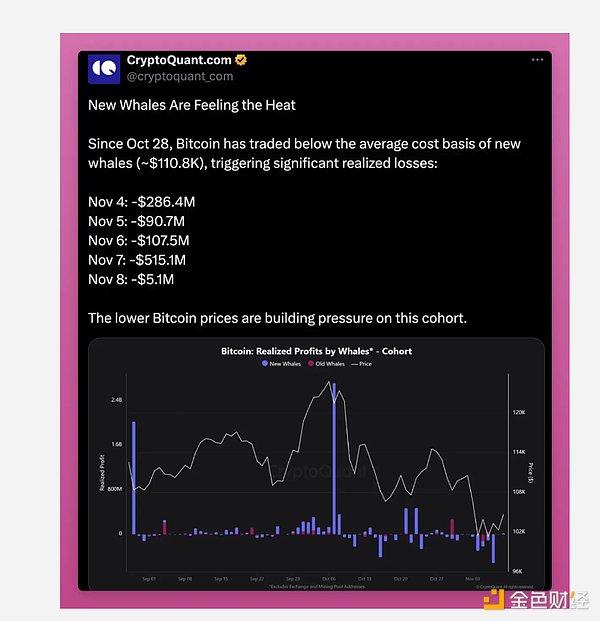

Some might think this looks bearish because early whales have profited handsomely from holding their positions for years, while new whales are currently at a loss. The average cost benchmark is close to $110,800, raising market concerns. If BTC continues to perform weakly, new whales may sell off.

But the rise of MVRV indicates that ownership is diversifying and the market is maturing. Bitcoin is shifting from a few low-cost holders to a group of decentralized holders with higher cost benchmarks. This is a bullish signal. So, what about altcoins?

Ethereum

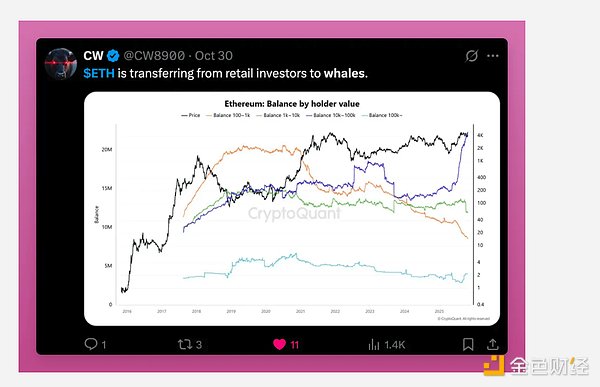

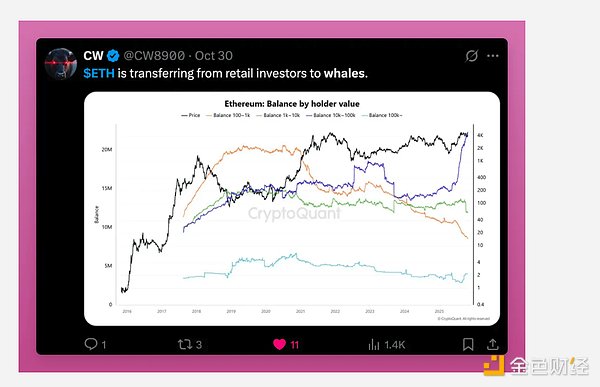

BTC has won, but what about ETH? Is ETH also exhibiting the same large rotation pattern? Similar to BTC, this phenomenon may partially explain the price lag of ETH.

BTC

BTC

BTC has won, but what about ETH?

In any case, the main difference between the two seems to be that ownership of ETH is shifting from retail investors to whales, while the core shift in BTC is from early whales to new whales.

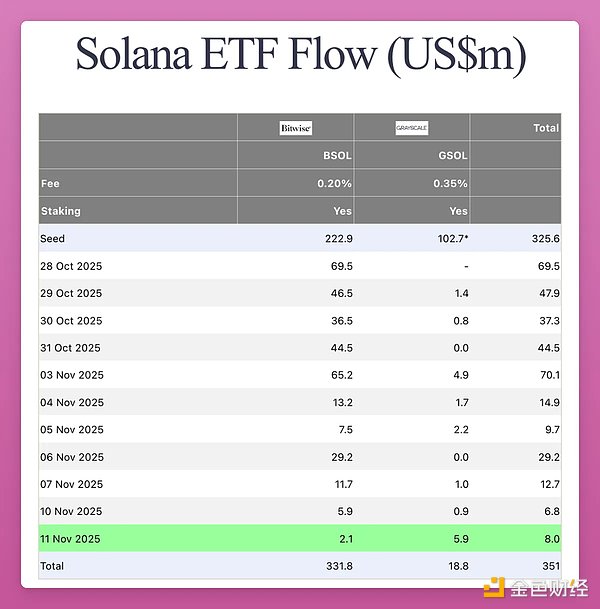

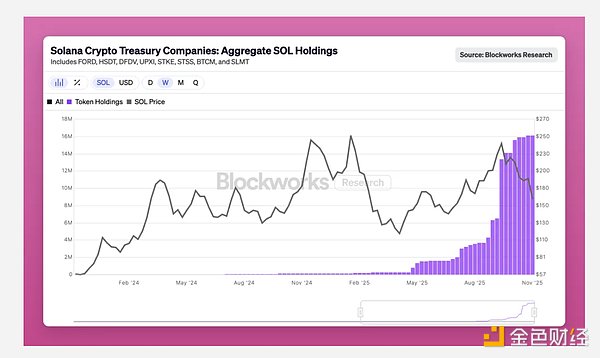

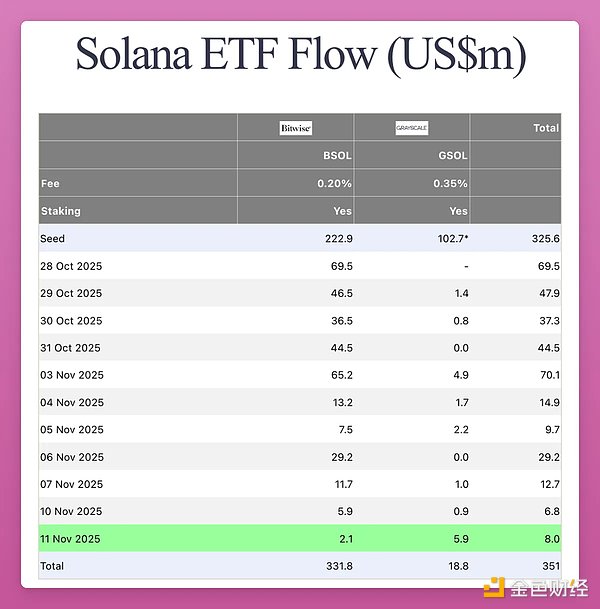

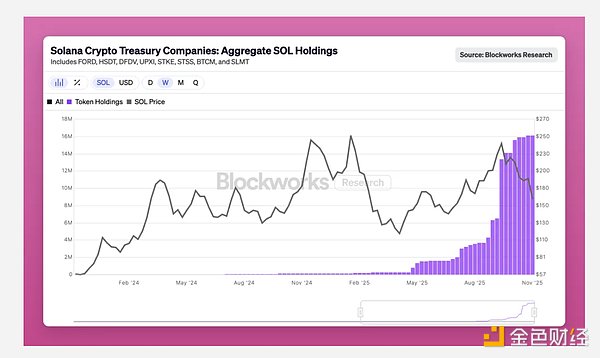

Some early DATs have also begun buying Solana, on a considerable scale:

Currently, 2.9% of the circulating Solana is held by DATs.

Held, valued at approximately $2.5 billion. For more information on the structure of Solana DAT, please read Helius's related article. Therefore, Solana now possesses the same traditional financial investment infrastructure as Bitcoin and Ethereum, held by regulated funds and corporate treasuries, only on a smaller scale. While the on-chain data is somewhat chaotic, the supply remains concentrated in the hands of early insiders and VC wallets. These tokens are slowly transferring to new institutional buyers through ETFs and treasuries. The major rotation has already impacted Solana, just one cycle later than Bitcoin and Ethereum. Therefore, while the rotation of Bitcoin and Ethereum is nearing its end, with prices potentially surging at any time, Solana's trajectory is more unpredictable. Where will it go next? Bitcoin matured first, followed closely by Ethereum but slightly lagging, while Solana will take even longer. So, which stage is this cycle currently in? In previous cycles, the script was simple: BTC surged, followed by ETH, and the wealth effect gradually spread. Native cryptocurrency users profited from mainstream coins and then invested in smaller-cap altcoins, driving the entire market up. But this time is different. The cycle is stuck in the BTC stage. Even with BTC rising, early whales either moved to ETFs or cashed out, completely leaving the cryptocurrency casino to improve their real lives. There's no wealth effect, no capital spillover, only the PTSD left by the FTX crash, and the market continues to struggle. Altcoins are no longer competing with Bitcoin as currencies; instead, they are vying for dominance in utility, yield, and speculation. Most altcoins will fail these tests. Only a few categories will survive: Public chains with real-world use cases: Ethereum, Solana, and perhaps one or two other projects. Products with cash flow or real-world value accumulation. Assets with unique needs that Bitcoin cannot replace, such as ZEC. Infrastructure that can capture transaction fees and attention. Stablecoins and RWA will continue to emerge, so I don't want to miss out on new hot targets. But all other projects will become noise. Uniswap's fee switch was a key turning point. While not the first project to do so, it was the most prominent DeFi protocol. This move put pressure on all other protocols, forcing them to follow suit and start sharing fees with token holders. Of the top 10 lending protocols, 5 have already started sharing revenue with holders. Therefore, DAOs are transforming into on-chain companies, where token value will depend on the revenue they generate and distribute. This will be a core area of the next wave of change.

Kikyo

Kikyo