Author: Yue Xiaoyu

Future big opportunities are all on the chain, and the exchange is just the last stop.

On-chain transactions have greater opportunities for small funds, and on-chain transactions can help us see the latest trends in the industry.

So how do you participate in on-chain transactions?

It has been mentioned in the Meme Coin Beginner's Guide: The specific methodology is divided into three steps:

Step 1: Discover potential new coins (chain sweep)

Step 2: Discover the trend of smart money (follow orders)

Step 3: Final buy and sell (trading)

Learning how to sweep chains is the first and most critical step. Choosing the right asset is half the battle, so this article will share some sweep chain tips in depth.

Regarding sweep chain tools, GMGN is the main recommendation here. It has a lot of data indicators, and the examples below mainly use GMGN.

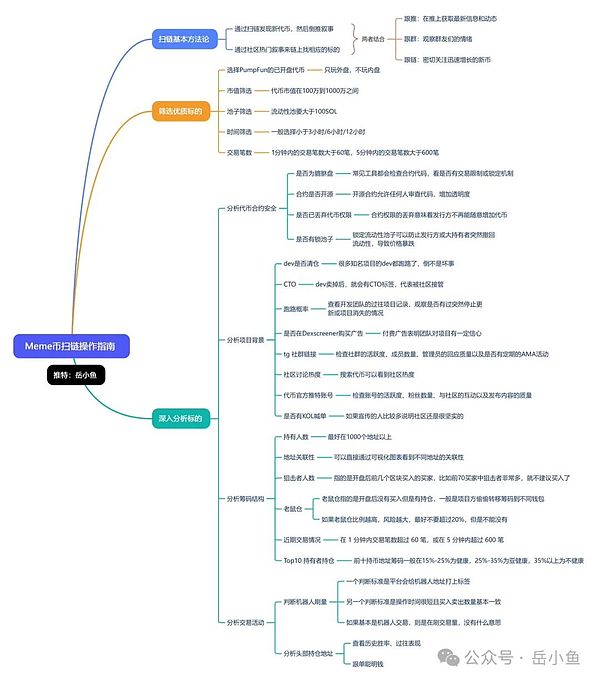

1. Basic methodology of chain sweeping

The basic methodology of chain sweeping is mainly divided into two types:

The first is to discover new tokens through chain sweeping and then reverse the narrative;

The second is to find the corresponding target on the chain through popular narratives in the community;

Take $PNUT as an example: PNUT originated from a popular squirrel named Peanut. The New York State Environmental Protection Department entered Longo's home based on a search warrant, confiscated Peanut, and was euthanized on November 1, 2024.

Peanut's tragic fate sparked widespread anger and mourning on social media, and Elon Musk also posted a series of tweets to join the debate.

Against this backdrop, the PNUT meme coin was launched on the Solana blockchain in early November 2024 to pay tribute to Peanut.

In this scenario, if we see this news on Twitter for the first time and scan the chain at the same time, we can easily find the golden dog $PNUT.

This is a combination of the two methods: on the one hand, we need to scan the chain, and on the other hand, we will pay attention to the topics discussed in the community.

Therefore, the daily routine of Meme coin players is to discover community information and chain dynamics as early as possible, mainly three things to follow:

Follow the push: follow a large number of Chinese and English KOL accounts related to Meme coins on Twitter to obtain the latest information and dynamics;

Follow the group: join various discussion groups and observe the emotions of group members;

Follow the chain: pay close attention to new coins with rapidly growing numbers of coin holders, transaction volume, and market value;

2. Preliminary screening of tokens

The Meme coin market is mixed, with tens of thousands and hundreds of thousands of Meme coins appearing every day, so we need to conduct a round of effective screening first.

First, you need to select the opened tokens of PumpFun.

Anyone can issue tokens on PumpFun, but the market value must reach $69,000 to automatically add liquidity to Raydium, the largest DEX on Solana.

Therefore, before $69,000, it was the internal market, and after it was added to DEX, it became the external market.

Although the internal market is earlier and the returns are greater, the volatility is also very large, and 99.99% of the tokens in the internal market are directly returned to zero, which is very difficult to operate. Therefore, it is not recommended to play the internal market, only the external market.

Let's take a look at some specific screening items:

(1) Market value screening: Generally, choose a market value between 1 million and 10 million US dollars. If the market value of the token exceeds 10 million, generally do not FOMO chase it;

(2) Pool screening: The liquidity pool must be greater than 100SOL to ensure sufficient liquidity;

(3) Time screening: generally choose less than 3 hours/6 hours/12 hours. The shorter the token creation time, the greater the early opportunity. (4) Number of transactions: the number of transactions within 1 minute is greater than 60, and the number of transactions within 5 minutes is greater than 600. After completing the above screening, you can actually stare at the list of tokens after screening. Generally, there will not be many, about 10 tokens.

3. In-depth analysis of tokens

For the list of tokens filtered out in the previous step, we can further analyze these tokens.

On the token details page, there are several major modules. Different modules carry different information and play different roles:

(1) Analyze the security of token contracts: it is best to have no risk items

Generally, trading platforms use third-party contract testing service providers, such as GoPlus.

There are several main dimensions:

Mint authority: If there is mint authority, it means that the project party can issue more tokens, print money unlimitedly, and eventually smash the market;

Blacklist: If there is, any wallet address can be blacklisted, resulting in only buying but not selling. This is the Pixiu plate;

Burning the pool: The proportion of burning the pool represents the proportion that the project party can smash the market. The higher the better, and the best is 100%, which means that the project party cannot withdraw the pool, that is, it cannot rug, and cannot withdraw liquidity;

left;">In addition to the common ones mentioned above, of course the more dimensions of detection the better. In this regard, OKX DEX has done relatively well.

(2) Analyze project background: Project background determines long-term trend

Dev liquidation: The devs of many well-known projects have run away. This is not a bad thing, but a good thing. This means that the project no longer has selling pressure from the project party, and there are enough coin holders;

CTO: After the dev is sold, a new team will participate, and there will be a CTO label, which means that it is taken over by the community. This information is not particularly meaningful;

Small trumpet: The project party spends money on publicity on DEX Screener, which means that the project is doing something, which is also a positive indicator;

Official social media: Check the account's activity, number of followers, interaction with the community, and the quality of content posted; if no one follows the official account and there are no posts discussing it, then it is most likely a batch of spam.

(3)Analyze the chip structure: the chip structure determines the trading strategy

Number of holders: at least 1,000 addresses;

Top 10 holdings: the lower the ratio, the healthier it is, preferably below 30%;

Number of snipers: refers to the buyers who bought in the first few blocks after the opening. For example, if there are many snipers among the first 70 buyers, it is not recommended to buy;

Blue chip index: refers to the address holding the blue chip token of the chain. The higher the blue chip index ratio, the more blue chip holders are optimistic about the coin, but it is not very referenceable;

Runaway probability: refers to the more addresses that buy runaway tokens, the higher the possibility that the token will become a scam. If the runaway risk is 100%, it is not recommended to buy;

Rat warehouse: Rat warehouse refers to not buying after the opening but holding positions. Generally, the project party secretly transfers chips to different wallets. The higher the rat warehouse ratio, the greater the risk. It is best not to exceed 20%, but it cannot be zero;

(4) Analyze trading activities: exclude robot brushing and find smart money

If it is basically a robot transaction, it is just brushing the transaction volume, which is meaningless.

The way to judge the robot is: One criterion is that the platform will label the robot address, and the other criterion is that the operation time is very short and the buying and selling quantities are basically the same.

More importantly, you can view the details of the top holding addresses, see their historical winning rate and past performance, and thus find smart money, and follow orders later.

Through the activity information of smart money, we can help improve the efficiency of chain scanning and the success rate of finding golden dogs.

However, copy trading deserves to be discussed separately in detail, so I will not expand on it here.

4. To summarize

The above are the basic skills of sweep chain. We can find that the core of sweep chain is: Discover information in time, quickly filter information, and then effectively guide your own decision-making.

The most important thing next is to apply these skills in practice, establish your own trading logic, and constantly polish your own trading model.

Trading is a skill that can be continuously improved through hard work.

On-chain is not just PVP, and Meme coin speculation is not just buying lottery tickets. You can improve your winning rate by honing your trading model in the market.

High returns are a reward for your efforts and cognitive level.

Participate in the market, learn the market, and respect the market!

(This article is only for communication and learning, and does not constitute any investment advice!)

Davin

Davin

Davin

Davin Clement

Clement YouQuan

YouQuan Catherine

Catherine Joy

Joy Jasper

Jasper Jixu

Jixu Hui Xin

Hui Xin Kikyo

Kikyo Jasper

Jasper