Author: HYPHIN, THOR Source: onchaintimes Translation: Shan Ouba, Golden Finance

Exchanging and creating custom tokens has become easier than ever before, thanks to the convenience and low entry barriers brought by the convenient methods used by many blockchain developers. Coupled with social media and the growing number of retail investors, this has greatly accelerated the expansion of tokens that do not provide any utility and rely solely on loyal communities and ruthless, aggressive marketing to maintain their growth.

Introduction

Internet culture and emoticons (memes) have long occupied an important position in the crypto space. Proof of this is that at the time of writing, the total market value of Memecoin is as high as approximately $66.65 billion. Dogecoin accounts for approximately 43.81% of the entire category, and its value is higher than some well-known companies (such as Vodafone, Pinterest and Logitech).

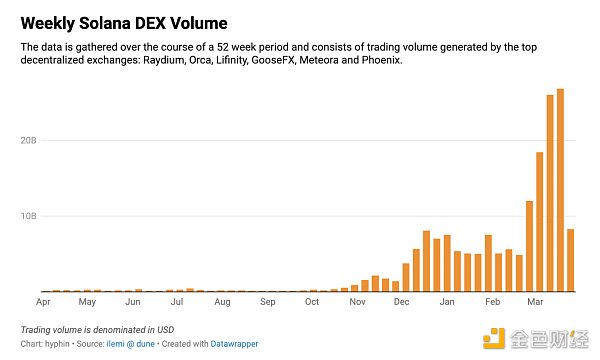

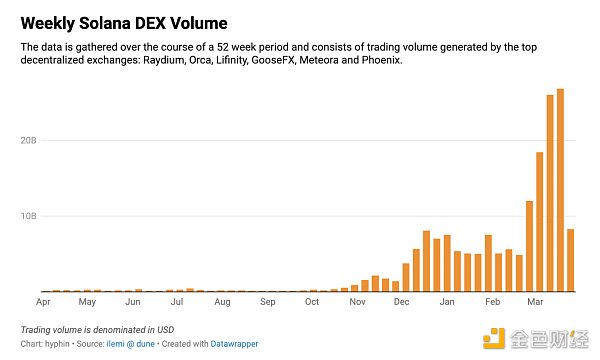

Ethereum has long been the central hub for Memecoin, with little competition until recently. There has been a shift in activity around these tokens, which is happening on the Solana chain, becoming the primary platform for projects to enter the market and speculators to seek entry opportunities.

A big factor in Solana’s expansion and surge in trading volume is its vibrant on-chain Memecoin ecosystem, which has generated a lot of interest this year, with names such as “dog wif hat” and “Bonk” entering the mainstream and soaring to extremely high valuations.

While we do not endorse trading Memecoin, it is still instructive to understand what, why, and how is happening in this market that is finding its footing and gaining visibility.

At first glance, it may seem impossible to distinguish the reasons behind the seemingly meaningless token price increases, but if you look closely, you may find some clues. Therefore, in this article, we will give a broad overview of the entire Memecoin space by examining every nook and cranny to try to figure out what is going on.

Overview

Before analyzing, it is best to understand the environment in which Memecoin operates and its characteristics, because the entire market lacks rationality and needs to be observed with an open mind.

Each niche market has developed its own unique culture, and on-chain activities on the Solana chain are no exception. Since the beginning of the Solana bull run, stories of missed life-changing opportunities and overnight fortunes have been common on Twitter. Realizing that a potential wealth-making transaction was about to take place, many people from different backgrounds were attracted to the liquidity pool in the hope of getting lucky and making a fortune.

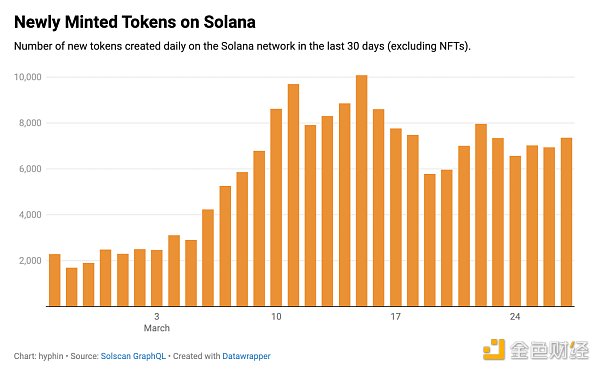

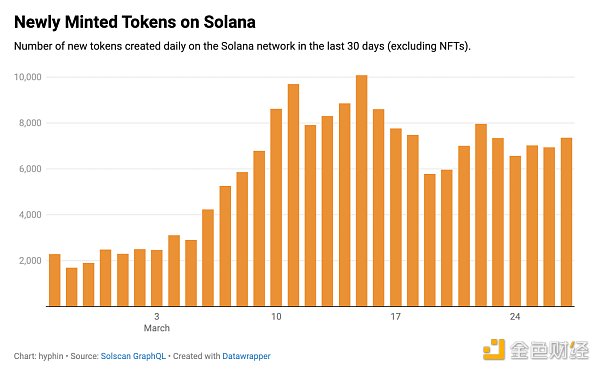

A key feature of Memecoin on the Solana chain is the large number of tokens created every day.

Due to the extremely low cost required to launch a Memecoin, a large number of new trading pairs are listed on decentralized exchanges every day. This makes it a fast-paced environment where frequent rotations, trends, and meta-strategy shifts are commonplace. Most, if not all, of the new trading pairs lack liquidity, resulting in large price impacts and wild volatility. The average lifespan of a project tends to be around 24 hours or less, mainly due to malicious actors trying to exploit the frenzy through carpet scams and deceptive marketing to deceive ambitious, unsuspecting investors.

If you spend enough time looking at charts in Telegram groups and sifting through hashtags on Twitter, you’ll notice a pattern that allows you to map most of the players to specific roles that are critical to the space.

Roles:

Developers: Worshipped as gods, developers are seen as shepherds who can guide the community toward financial freedom. Their decisions often shape early price action and determine the lifespan of a project, since as creators they have full control over fundamentals and may hold a large portion of the token supply.

Influencers: Using their influence on social media, influencers share their personal investments to raise awareness of a project for different motivations. Depending on their intentions, some are looking to strengthen the community by increasing social proof, others are simply looking for exit liquidity to profit.

Community Members: Loyal to the end, willing to follow a project to the promised land or to zero without reservation. These people frequently appear in chat groups to interact with others, tirelessly promoting their investments under posts from prominent people whose attention can make or break a trade.

Snipers: By automating on-chain interactions and indiscriminately buying tokens as soon as liquidity is added to the pool and trading is open, these wallet operators hope to profit from the upward momentum generated after ordinary traders intervene. In most cases, they are not optimistic about the long-term prospects and will sell early because the opportunities are plentiful.

Remember, all of this takes place in a brutal and unforgiving player-versus-player environment. In order to stay competitive and have a fighting chance, many trading tools with useful analytical features have been developed to speed up decision-making and execution. Services such as Photon and BonkBot are favored by most traders and provide a significant quality of life improvement compared to traditional options.

Characteristics of Successful Memecoins

In the vast sea of tokens, only a few have been able to sustain high valuations for an extended period of time and have a tight-knit, relevant community. This means that success must be inseparable from some quantifiable factors.

Having a robust due diligence framework will make the process of sifting through a lengthy watch list much easier and save time. This begs the question - what valuable information can we use to effectively analyze these unpredictable tokens?

We can use historical data to try to identify some common patterns and indicators to assess project potential to a certain extent. For example, by analyzing the top 50 memecoins, we can get a general idea of the attributes of outperformers.

Trends

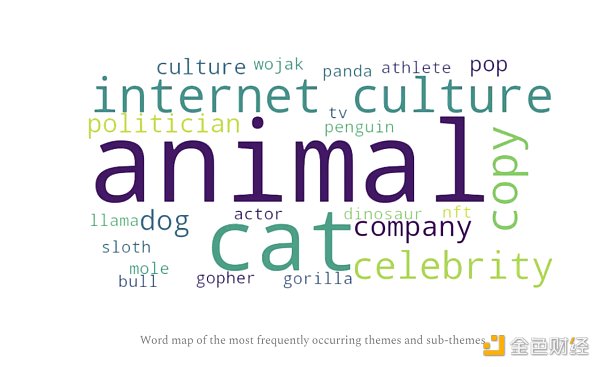

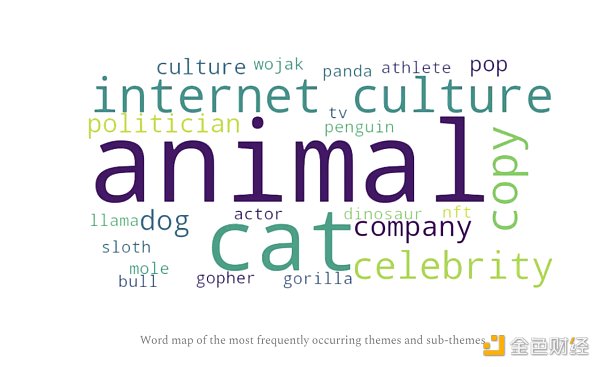

Since the entire memecoin space is mainly driven by trends and narratives, it is worth paying attention to the categories or themes that are currently popular to avoid betting on the wrong ones.

By visualizing the hot topics using a word cloud, it is relatively easy to see the current main trends and sub-trends.

In this example, animal-themed tokens are the most relevant, with cats being the most popular sub-theme. The second largest cluster in this visualization is "Internet culture," which generally covers crypto Twitter and mainstream memes.

An interesting detail in this visualization is the use of the "copy" keyword, which includes projects that have spun off from the original concept and incorporated their own unique elements. These projects continue to emerge, providing a second chance for those who missed out on the pioneer project.

Indicators

After narrowing down the promising categories, there are some technical details that should be evaluated before moving forward.

To avoid unlimited selling pressure, every project should prohibit minting additional tokens. All projects we observed have disabled this setting.

The liquidity pool tokens received by deployers when adding initial liquidity are destroyed, which can reduce the risk of liquidity being extracted by creators. The median value here shows that usually most of the initial liquidity is destroyed.

In most cases, the top token holders are distributed within the 20% range and vary from project to project. The lower the percentage, the lower the likelihood that a few individuals will disrupt the market order by selling in large quantities.

Since most memecoins have a lifespan of no more than a few days, having volume (i.e. a sign of activity) 100 hours after trading started is usually a good indicator. The median lifespan of the top 50 memecoins is less than a week, which shows how quickly the market can change. However, the top memecoins tend to remain relatively stable and hold their place on the leaderboard.

Community

Community is the cornerstone of every Memecoin and the most difficult but critical aspect to evaluate. An active, outspoken community with its own unique culture is essential to spread the message and attract new members to achieve growth in a competitive market.

To promote communication and market early, projects need to have a presence on media platforms such as websites, Twitter, Telegram, and Discord to ensure credibility and maximum reach.

More than two-thirds of the Memecoins we observed had at least 3 channels, so the absence of Telegram and Twitter chatrooms should immediately raise red flags.

We can use these channels to survey the community and look for positive indicators, which generally include (but are not limited to):

No infighting: People constantly bickering in group chats or on Twitter is not good for the project's image and may discourage speculators interested in the project. Positive sentiment and active, healthy discussions are more attractive. * Strong Twitter presence: Having a solid brand and recognizable characteristics on Twitter (e.g., inside jokes, common themes of memes) is critical to maximizing the project's ability to be remembered, recognized, and viral to attract as much attention as possible.

Respected KOLs: Having well-known social media personalities supporting and frequently mentioning the Memecoin would be a huge positive, while working with KOLs who are known for pumping and dumping should be avoided.

Final Assessment

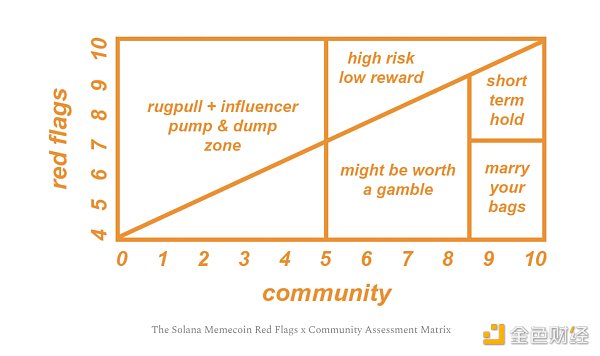

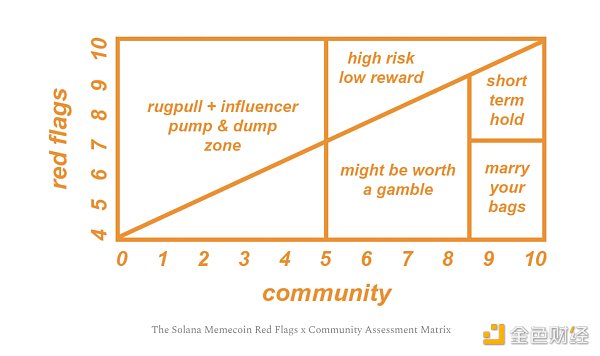

Finding long-term potential in the vast sea of Memecoins is no easy task and requires multi-dimensional analysis such as quantitative indicators and community observation. This document outlines a method for evaluating the evaluation matrix based on indicators and community engagement for investors to refer to.

If you are wondering why the "red flag" axis starts at 4, the answer is: there are no Memecoins on Solana without red flags. By establishing a ratio between the community ranking and the number of negative factors present, we can loosely assign each coin to a category.

The goal should always be to identify and interact with Memecoins with high community ratings and the fewest warning signs, because they have a greater chance of success.

However, there are some common phenomena that should be considered when trying to categorize projects:

Community takeover: In some cases, the developers of a promising and well-received concept decide to exit the project by selling all of their tokens, and in response, the community creates new communication channels, essentially restarting the project without the risk of developer shenanigans.

Influencer resurgence: This is hard to predict, but there are extreme cases where a dead project gets a second chance and receives widespread attention due to the involvement of a popular creator.

Sniper exit: Early exits by snipers usually leave a stain on the leaderboard for the project, and they can increase their chances of marketing on social media, as they are less likely to offset the community's efforts through huge selling pressure, which can easily scare people away.

Finding gems is a difficult task, but as history has proven, they do exist and occasionally appear on our radar.

Conclusion

The Memecoin wave has swept in and has become an indispensable part of the cryptocurrency market. Even if you have no intention of participating, understanding the Memecoin market is essential knowledge for any qualified cryptocurrency investor. Through the analysis method provided in this article, investors can more rationally evaluate the potential of the Memecoin project.

Cheng Yuan

Cheng Yuan