Author: Jake, Messari Analyst; Translation: xz@Jinse Finance

After the hype surrounding the release of the Ethereum Foundation's Kohaku wallet SDK subsided, I conducted some research and reflection on RAIL, which I summarize as follows:

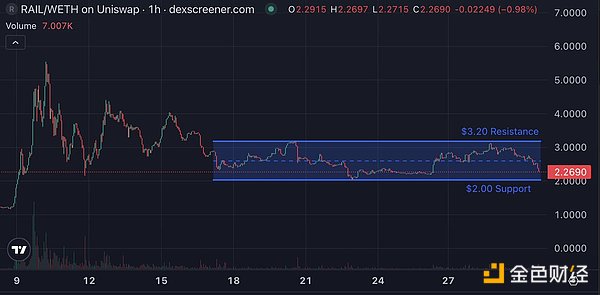

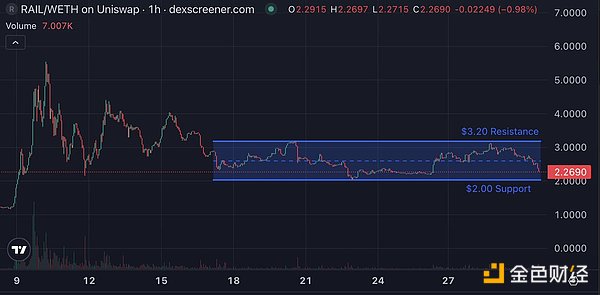

(1) In the past two weeks, RAIL has been fluctuating within a channel between $2.00 and $3.20. I currently hold a large position in RAIL, with an average cost of approximately $1.50. If the price breaks below the support level, I will start adding to my position. If you haven't entered the market yet, the price level near the lower edge of the channel is quite attractive.

(2)The core logic remains unchanged; only the market has changed. After the liquidation event on October 10, RAIL plummeted from approximately $5.00 to $2.20. Since then, its price movement has consistently been highly synchronized with the sideways trading pattern of BTC.

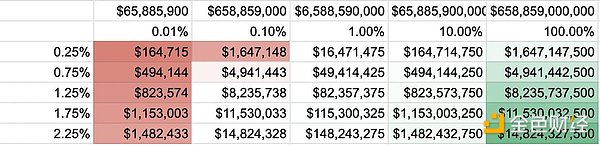

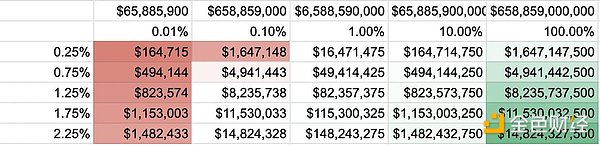

(3)According to the quick calculation model of AJC, Corporate Research Manager at Messari: If 1% of ETH and stablecoins on Ethereum flow through the RAILGUN privacy collection, it will generate approximately $82.4 million in annualized revenue. This calculation is based on a 1.25% revenue capture rate (historical annualized capture rate is 4-10% of TVL) and a 1.0% potential market penetration rate (current market size is $450-500 billion in ETH and approximately $175 billion in stablecoins). At $2.30, its fully diluted valuation (FDV) is $132 million, meaning that in the baseline scenario, annual revenue is equivalent to 62% of its total FDV. Even under pessimistic assumptions (0.1% market penetration + 1.25% revenue capture), it still generates $8.2 million in annual revenue, representing 6.2% of its total FDV (while in a bull market scenario, 10% market penetration would generate $823 million in annualized revenue, equivalent to 624% of FDV). Furthermore, this is only one dimension for evaluating RAIL. Compared to similar valuations (Zcash − FDV $6.46 billion / Monero − FDV $5.95 billion), RAIL's current FDV is less than 3% of its competitors (considering Railgun's quantifiable cash flow potential, a reasonable valuation should be closer to 10-15% of its competitors). Not to mention, ZEC's continued strong performance will further boost the bullish logic for RAIL in the privacy sector.

(4)Potential Catalyst: Continued Growth in Usage. Railgun processed $1.6 billion in privacy transactions this year, slightly less than half of the protocol's total transaction volume since 2021 ($4 billion).

Railgun plans to demonstrate its wallet technology at the Devconnect conference in Argentina in two weeks.

Railgun plans to demonstrate its wallet technology at the Devconnect conference in Argentina in two weeks.

The Ethereum ecosystem continues to increase its investment in privacy, especially Railgun… The Ethereum Foundation continues to increase its investment in institutional-grade solutions, especially institutional-grade privacy solutions like Railgun… (5) With the occurrence of market liquidation events, the window for short-term trading of RAIL has closed, but the window for long-term investment (with at least 3-5 times potential) is fully open. Summary: Hold RAIL firmly.

JinseFinance

JinseFinance